Trend Following Trading Strategy Based on Granville and MACD Multiple Signal Confirmation

EMA MACD GC(Golden Cross) SL(Stop Loss) TP(Take Profit)

Overview

This strategy combines Granville’s trend reversal theory with MACD indicator for multiple signal confirmation. The core concept involves identifying potential trend reversals through price-moving average relationships and validating trades using multiple MACD signals. This approach effectively identifies trend initiation points while reducing false signal risks through multiple confirmation mechanisms.

Strategy Principles

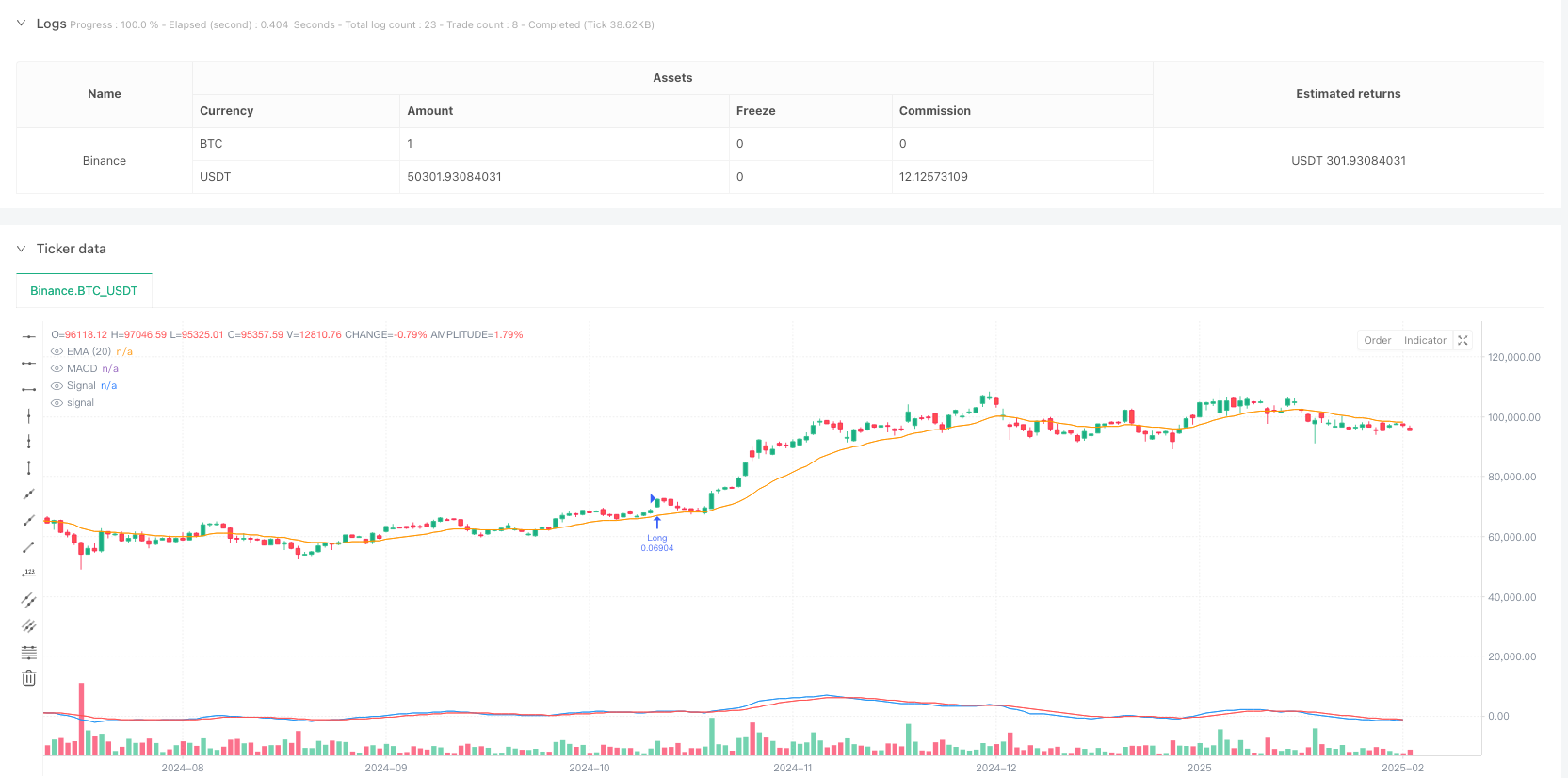

The strategy execution follows four key steps: 1. Granville Reversal Signal: Monitors price crossing above EMA from below, indicating potential trend reversal. 2. Initial MACD Golden Cross: Waits for MACD golden cross after Granville reversal signal as secondary trend confirmation. 3. MACD Breakout Verification: Confirms MACD line breaks above initial golden cross level, indicating continued momentum. 4. MACD Retest: Waits for MACD to retest and cross signal line again for final entry signal.

Stop loss and take profit levels are dynamically adjusted based on reversal candlestick range, with stop loss at reversal bar low and take profit at 1.618 times the reversal bar range, following Fibonacci extension principles.

Strategy Advantages

- Multiple Confirmation Mechanism: Combines price action, trend indicators, and momentum indicators to significantly reduce false signals.

- Dynamic Risk Management: Sets stop loss and take profit based on actual market volatility for adaptive risk management.

- Trend Continuation Verification: Improves accuracy in capturing sustained trends through multiple MACD confirmations.

- High Adaptability: Strategy parameters can be optimized for different market conditions and timeframes.

Strategy Risks

- Signal Lag: Multiple confirmation requirements may delay entry points, affecting potential returns.

- Range-bound Market Performance: Frequent false breakouts in sideways markets may lead to consecutive losses.

- Over-reliance on Technical Indicators: Pure technical analysis may fail during extreme market sentiment shifts.

- Parameter Sensitivity: Different market environments may require frequent parameter adjustments to maintain strategy effectiveness.

Strategy Optimization Directions

- Market Environment Classification: Introduce volatility indicators for different parameter configurations in various market conditions.

- Entry Timing Optimization: Consider adding volume confirmation during MACD retest to improve signal reliability.

- Dynamic Stop Loss/Take Profit Adjustment: Adjust multipliers based on market volatility.

- Market Sentiment Integration: Incorporate sentiment indicators to adjust strategy aggressiveness during extreme sentiment periods.

Summary

This strategy builds a comprehensive trading system by combining classical technical analysis theories with modern quantitative trading methods. The multiple signal confirmation mechanism provides reliable trade signals, while dynamic risk management methods ensure strategy adaptability. Despite some lag issues, continuous optimization and parameter adjustment give the strategy practical value and development potential.

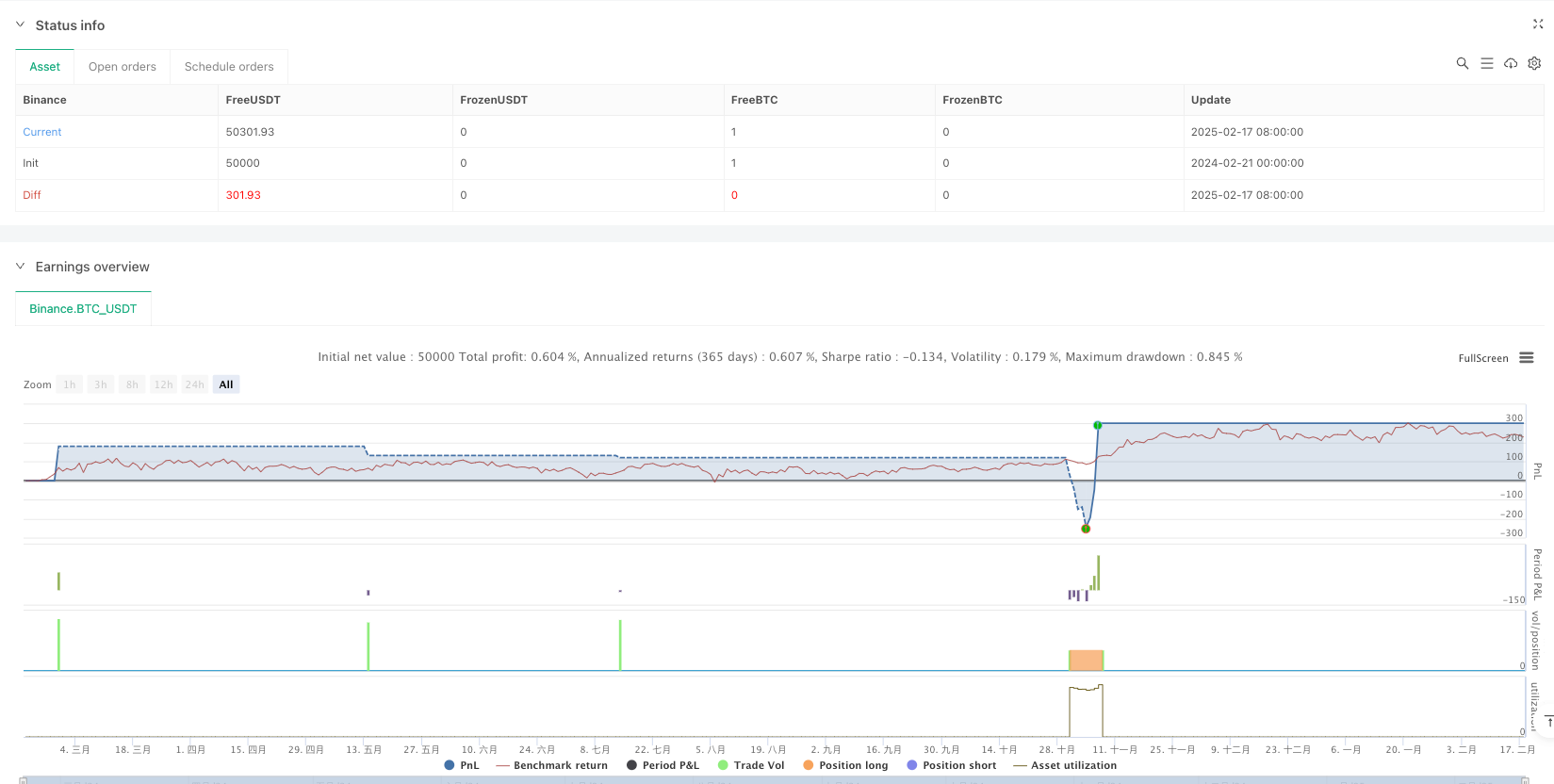

/*backtest

start: 2024-02-21 00:00:00

end: 2025-02-18 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Granville + MACD Strategy", overlay=true, initial_capital=100000, default_qty_type=strategy.percent_of_equity, default_qty_value=10)

// ■ Parameter Settings

emaPeriod = input.int(20, "EMA Period for Granville", minval=1)

fastLen = input.int(12, "MACD Fast Period", minval=1)

slowLen = input.int(26, "MACD Slow Period", minval=1)

signalLen = input.int(9, "MACD Signal Period", minval=1)

// ■ Calculate EMA (for Granville reversal detection)

ema_val = ta.ema(close, emaPeriod)

// ■ Granville Reversal Detection (e.g., price crosses above EMA from below)

granvilleReversal = ta.crossover(close, ema_val)

// ■ Calculate MACD

[macdLine, signalLine, _] = ta.macd(close, fastLen, slowLen, signalLen)

// ■ State management variables (to manage state transitions)

var bool granvilleDone = false // Reversal bar confirmed flag

var float granvilleLow = na // Low of the reversal bar (used for SL)

var float granvilleRange = na // Range of the reversal bar (used for TP calculation)

var bool macdGC_done = false // First MACD Golden Cross confirmed

var int goldenCrossBar = na // Bar index of the first MACD Golden Cross

var float initialMacdHigh = na // MACD value at the Golden Cross (used for break detection)

var bool breakoutDone = false // MACD line breaks the initial Golden Cross MACD value

// ■ (1) Granville Reversal Detection

if granvilleReversal

granvilleDone := true

granvilleLow := low // Low of the reversal bar (SL)

granvilleRange := high - low // Range of the reversal bar (used for TP calculation)

// Reset MACD-related states

macdGC_done := false

breakoutDone := false

initialMacdHigh := na

goldenCrossBar := na

// ■ (2) MACD Golden Cross (first signal) detection

if granvilleDone and (not macdGC_done) and ta.crossover(macdLine, signalLine)

macdGC_done := true

goldenCrossBar := bar_index

initialMacdHigh:= macdLine

// ■ (3) Check if MACD line breaks the initial MACD value at the Golden Cross

if macdGC_done and (not breakoutDone) and (macdLine > initialMacdHigh)

breakoutDone := true

// ■ (4) When MACD retests and crosses above the signal line again, it's the entry timing

// ※ Check for a crossover after the first Golden Cross bar

entryCondition = granvilleDone and macdGC_done and breakoutDone and (bar_index > goldenCrossBar) and ta.crossover(macdLine, signalLine)

// ■ TP and SL settings at entry

if entryCondition

entryPrice = close

tpPrice = entryPrice + granvilleRange * 1.618

slPrice = granvilleLow

strategy.entry("Long", strategy.long)

strategy.exit("Exit Long", from_entry="Long", stop=slPrice, limit=tpPrice)

// Reset states after entry (for the next entry)

granvilleDone := false

macdGC_done := false

breakoutDone := false

initialMacdHigh := na

goldenCrossBar := na

// ■ Plotting (for reference)

// Display the EMA on the price chart (with fixed title)

plot(ema_val, color=color.orange, title="EMA (20)")

// Plot MACD and Signal in a separate window (with fixed titles)

plot(macdLine, color=color.blue, title="MACD")

plot(signalLine, color=color.red, title="Signal")