Price Range and Breakout Based Efficient Quantitative Trading Strategy

Pivot CONSOLIDATION ZONE BREAKOUT

Overview

This is an efficient quantitative trading strategy based on price range and breakout. The strategy primarily identifies consolidation zones in the market and executes trades when prices break out of these zones. It uses the ZigZag indicator to identify key price points, combines highs and lows to define consolidation areas, and generates trading signals when prices break through these areas.

Strategy Principles

The core logic includes the following key steps: 1. Identify important turning points through highest and lowest prices within the Loopback Period 2. Use ZigZag algorithm to track price movements and determine key support and resistance levels 3. Confirm valid consolidation zones by setting minimum consolidation length 4. Dynamically update upper and lower boundaries to track changes in consolidation areas 5. Trigger trading signals when price breaks out of consolidation zones

Strategy Advantages

- High Adaptability - Strategy can dynamically identify and update consolidation zones, adapting to different market environments

- Controlled Risk - Provides clear stop-loss positions through well-defined consolidation zones

- Visual Support - Offers visualization of consolidation areas, helping traders understand market conditions

- Bi-directional Trading - Supports both upward and downward breakout opportunities, maximizing market opportunities

- Adjustable Parameters - Provides multiple adjustable parameters for optimization based on different market characteristics

Strategy Risks

- False Breakout Risk - Market may exhibit false breakouts leading to failed trades

- Slippage Risk - May face significant slippage in fast-moving markets

- Market Environment Dependency - Strategy performs well in ranging markets but may underperform in trending markets

- Parameter Sensitivity - Improper parameter settings may affect strategy performance

- Money Management Risk - Requires proper control of position sizing for each trade

Strategy Optimization Directions

- Incorporate Volume Indicators - Confirm breakout validity through volume analysis

- Optimize Entry Timing - Add pullback confirmation mechanism to improve entry quality

- Enhance Stop-Loss Mechanism - Design more flexible stop-loss strategies

- Add Market Environment Filters - Include trend assessment to operate in suitable market conditions

- Optimize Parameter Adaptation - Automatically adjust parameters based on market volatility

Summary

This is a well-designed quantitative trading strategy with clear logic. Through the identification of consolidation zones and capture of breakout signals, it provides traders with a reliable trading system. The strategy’s visualization capabilities and parameter flexibility make it highly practical. Through continuous optimization and risk control, this strategy has the potential to achieve stable returns in actual trading.

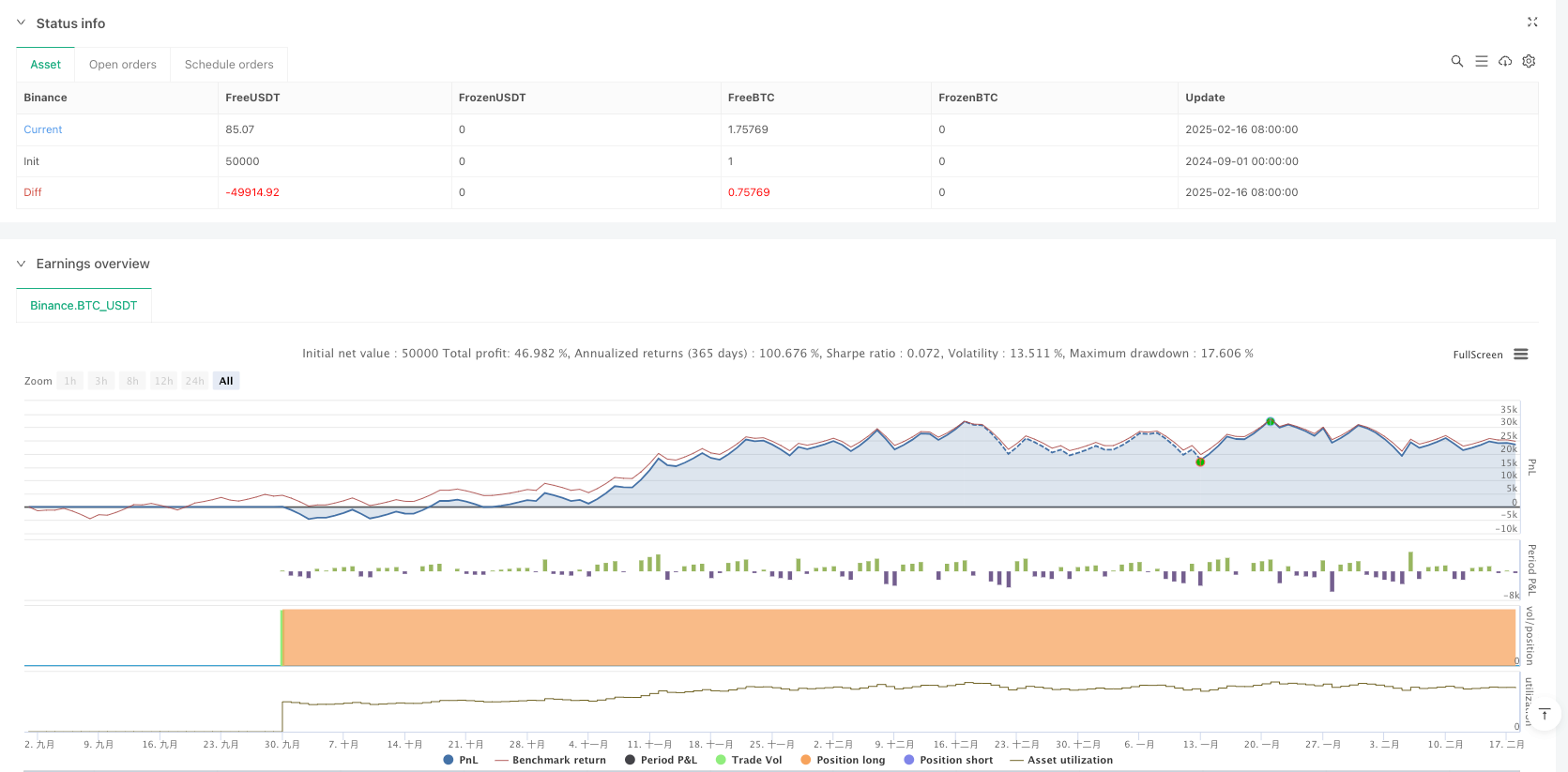

/*backtest

start: 2024-09-01 00:00:00

end: 2025-02-18 08:00:00

period: 5d

basePeriod: 5d

exchanges: [{"eid":"Binance","currency":"BTC_USDT"}]

*/

// This code is released under the Mozilla Public License 2.0

// More details at: https://mozilla.org/MPL/2.0/

// © LonesomeTheBlue

//@version=5

strategy("Consolidation Zones - Live [Strategy]", overlay=true, max_bars_back=1100)

//-----------------------------------------------------------------------//

// Input Variables

//-----------------------------------------------------------------------//

prd = input.int(defval=10, title="Loopback Period", minval=2, maxval=50)

conslen = input.int(defval=5, title="Min. Consolidation Length", minval=2, maxval=20)

paintcons = input.bool(defval=true, title="Color Consolidation Zone?")

zonecol = input.color(defval=color.new(color.blue, 70), title="Zone Color")

//-----------------------------------------------------------------------//

// Variables and Calculations for ZZ (ZigZag) Detection

//-----------------------------------------------------------------------//

// Check if the bar has the highest High or lowest Low in the last prd bars

float hb_ = ta.highestbars(prd) == 0 ? high : na

float lb_ = ta.lowestbars(prd) == 0 ? low : na

// Convert to bool to check if hb_ and lb_ are valid (not na)

bool hasHb = not na(hb_)

bool hasLb = not na(lb_)

// Direction variable to determine the trend, based on the last high or low pivot

var int dir = 0

// ZigZag value and last pivot

float zz = na

float pp = na

// 1) Determine direction based on whether a high or low pivot occurred

dir := if hasHb and not hasLb

1

else if hasLb and not hasHb

-1

else

dir // unchanged direction

// 2) If both a high and low pivot occurred in the same bar

bool sameBar = hasHb and hasLb

if sameBar

if dir == 1

zz := hb_

else

zz := lb_

else

zz := hasHb ? hb_ : (hasLb ? lb_ : na)

// 3) Storing last pivots (pp) - iterate over older bars

for x = 0 to 1000

if na(close) or dir != dir[x]

break

if not na(zz[x]) // if zz[x] is a valid value

if na(pp)

pp := zz[x]

else

if dir[x] == 1 and zz[x] > pp

pp := zz[x]

if dir[x] == -1 and zz[x] < pp

pp := zz[x]

//-----------------------------------------------------------------------//

// Logic for Consolidation Zone Detection

//-----------------------------------------------------------------------//

var int conscnt = 0

var float condhigh = na

var float condlow = na

float H_ = ta.highest(conslen)

float L_ = ta.lowest(conslen)

var line upline = na

var line dnline = na

bool breakoutup = false

bool breakoutdown = false

// Check if pp has changed

bool changedPP = ta.change(pp) != 0

if changedPP

// If enough candles are in consolidation, check for breakout

if conscnt > conslen and not na(condhigh) and not na(condlow) and not na(pp)

if pp > condhigh

breakoutup := true

if pp < condlow

breakoutdown := true

// Check if we are still "in the zone"

bool inZone = conscnt > 0 and not na(pp) and not na(condhigh) and not na(condlow) and (pp <= condhigh) and (pp >= condlow)

if inZone

conscnt += 1

else

conscnt := 0

else

// No change in pivot -> continue consolidation

conscnt += 1

if conscnt >= conslen

// At the first "touch" of the required number of candles

if conscnt == conslen

condhigh := H_

condlow := L_

else

condhigh := math.max(condhigh, high)

condlow := math.min(condlow, low)

//-----------------------------------------------------------------------//

// Drawing Fill

//-----------------------------------------------------------------------//

// Declare two plot variables (just ordinary assignment)

condHighPlot = plot(condhigh, color=na, style=plot.style_stepline)

condLowPlot = plot(condlow, color=na, style=plot.style_stepline)

// bool to check if we want to color the zone

bool doFill = paintcons and (conscnt > conslen)

// Calling fill

fill(condHighPlot, condLowPlot, color= doFill ? zonecol : color.new(color.white, 100))

//-----------------------------------------------------------------------//

// Alerts & STRATEGY

//-----------------------------------------------------------------------//

alertcondition(breakoutup, title="Breakout Up", message="Breakout Up")

alertcondition(breakoutdown, title="Breakout Down", message="Breakout Down")

if breakoutup

// Close short first

if strategy.position_size < 0

strategy.close("Breakout Short")

// Open LONG

strategy.entry("Breakout Long", strategy.long)

if breakoutdown

// Close long first

if strategy.position_size > 0

strategy.close("Breakout Long")

// Open SHORT

strategy.entry("Breakout Short", strategy.short)