Overview

This strategy is a short-selling mean reversion trading system based on ATR (Average True Range), which identifies overextended price opportunities through dynamic ATR thresholds. The strategy integrates multiple technical indicators, including ATR, EMA, and SMA, forming a comprehensive trading decision framework. When price breaks through the ATR dynamic threshold and meets EMA filter conditions, the system looks for shorting opportunities, aiming to capture mean reversion price movements.

Strategy Principles

The core logic of the strategy is based on the following key steps: 1. Calculate ATR value over a set period (default 20) to reflect market volatility 2. Multiply ATR by a custom multiplier and add to closing price to construct raw threshold 3. Apply Simple Moving Average (SMA) to smooth the raw threshold and reduce noise 4. Generate short signal when closing price breaks above smoothed ATR signal trigger within specified trading window 5. If EMA filter is enabled, closing price must be below 200-period EMA to execute short 6. Trigger position closure when closing price falls below previous bar’s low

Strategy Advantages

- High Adaptability - Dynamically adjusts thresholds through ATR to adapt to volatility changes in different market environments

- Comprehensive Risk Control - Integrates multiple risk control mechanisms including time windows, trend filters, and dynamic thresholds

- Parameter Flexibility - Provides multiple adjustable parameters including ATR period, multiplier, and smoothing period for strategy optimization

- Clear Execution - Clear entry and exit conditions reduce uncertainty from subjective judgment

- High Systematization - Built on quantitative indicators, enabling fully automated trading

Strategy Risks

- Market Reversal Risk - Short reversal strategy may face continuous losses in strong upward markets

- Parameter Sensitivity - ATR period and multiplier choices significantly impact strategy performance, requiring continuous optimization

- Slippage Impact - May face execution price deviation risks in markets with insufficient liquidity

- Trend Dependency - EMA filter conditions may cause missing some profitable opportunities

- Capital Management Risk - Requires reasonable position sizing to avoid excessive single trade risk

Strategy Optimization Directions

- Introduce Multi-Timeframe Analysis - Improve trading signal reliability through trend confirmation across different timeframes

- Optimize Exit Mechanism - Consider adding trailing stops or ATR-based dynamic stops

- Add Volume Indicators - Enhance entry timing accuracy by incorporating volume analysis

- Improve Risk Control - Add daily stop loss and maximum drawdown limits

- Dynamic Parameter Adjustment - Adaptively adjust ATR parameters and multipliers based on market conditions

Summary

This is a well-designed short strategy that establishes a reliable trading system through ATR dynamic thresholds and EMA trend filtering. The strategy’s strengths lie in its strong adaptability and comprehensive risk control, while attention needs to be paid to risks from changing market environments. Through continuous optimization and improved risk management, the strategy has the potential to maintain stable performance across different market conditions.

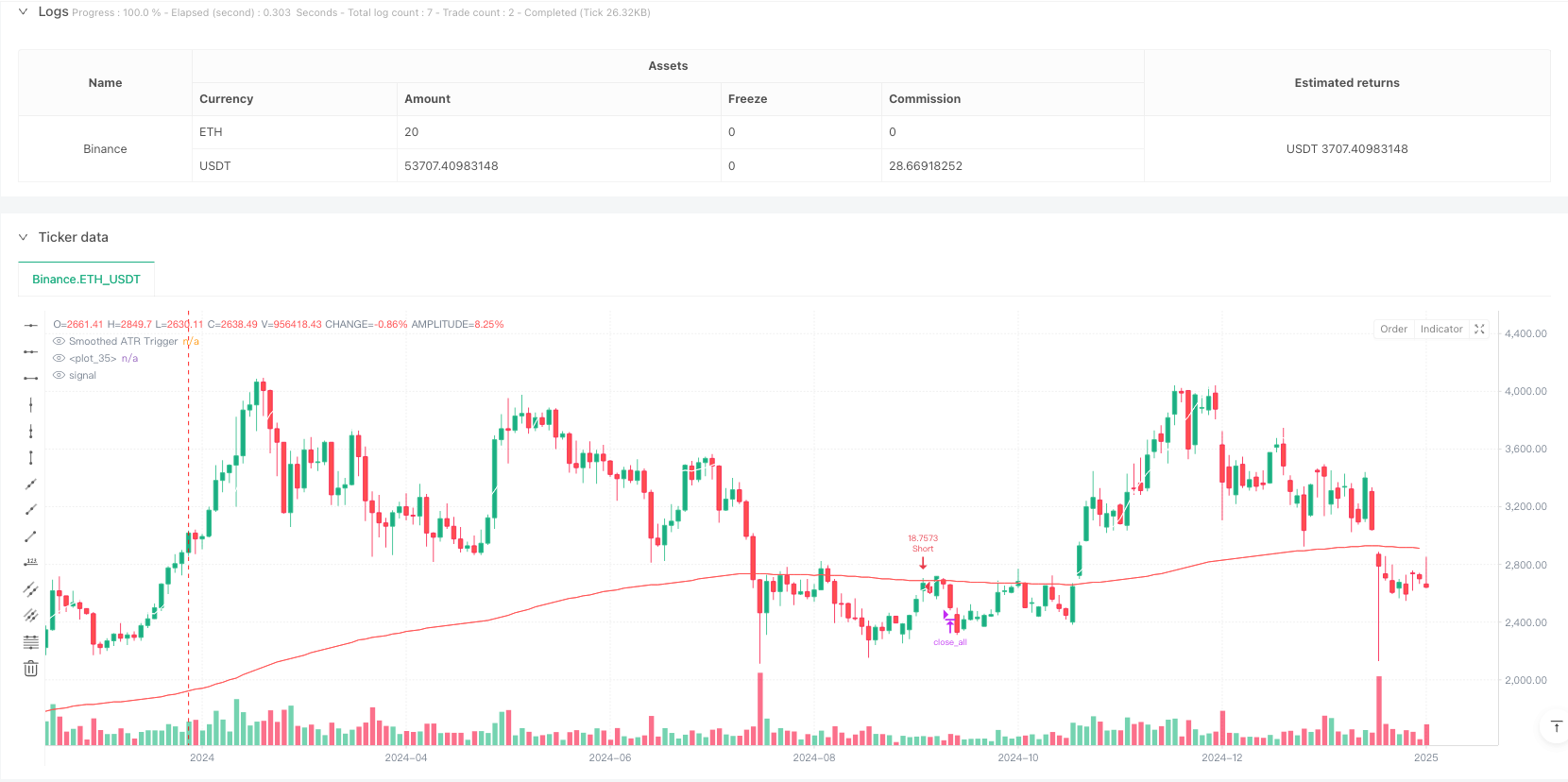

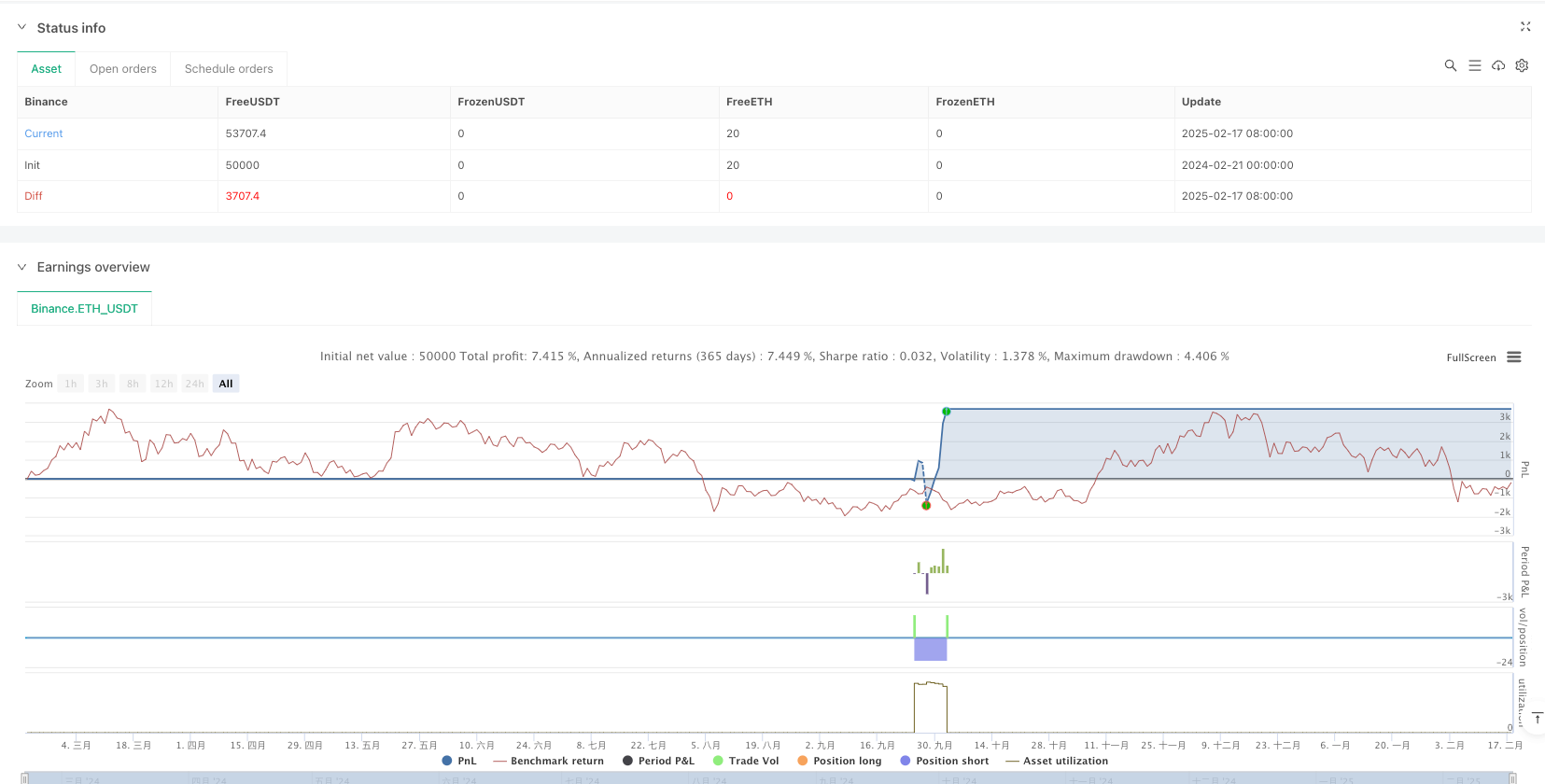

/*backtest

start: 2024-02-21 00:00:00

end: 2025-02-18 08:00:00

period: 2d

basePeriod: 2d

exchanges: [{"eid":"Binance","currency":"ETH_USDT"}]

*/

//@version=6

strategy("[SHORT ONLY] ATR Sell the Rip Mean Reversion Strategy", overlay=true, initial_capital = 1000000, default_qty_value = 100, default_qty_type = strategy.percent_of_equity, process_orders_on_close = true, margin_long = 5, margin_short = 5, calc_on_every_tick = true, fill_orders_on_standard_ohlc = true)

//#region INPUTS SECTION

// ============================================

// ============================================

// Strategy Settings

// ============================================

atrPeriod = input.int(title="ATR Period", defval=20, minval=1, group="Strategy Settings")

atrMultInput = input.float(title='ATR Multiplier', defval=1.0, step=0.25, group="Strategy Settings")

smoothPeriodInput = input.int(title='Smoothing Period', defval=10, minval=1, group="Strategy Settings")

//#endregion

// ============================================

// EMA Filter Settings

// ============================================

useEmaFilter = input.bool(true, "Use EMA Filter", group="Trend Filter")

emaPeriodInput = input.int(200, "EMA Period", minval=1, group="Trend Filter")

//#region INDICATOR CALCULATIONS

// ============================================

// Calculate ATR Signal Trigger

// ============================================

atrValue = ta.atr(atrPeriod)

atrThreshold = close + atrValue * atrMultInput

signalTrigger = ta.sma(atrThreshold, smoothPeriodInput)

plot(signalTrigger, title="Smoothed ATR Trigger", color=color.white)

// ============================================

// Trend Filter

// ============================================

ma200 = ta.ema(close, emaPeriodInput)

plot(ma200, color=color.red, force_overlay=true)

//#region TRADING CONDITIONS

// ============================================

// Entry/Exit Logic

// ============================================

shortCondition = close>signalTrigger

exitCondition = close<low[1]

// Apply EMA Filter if enabled

if useEmaFilter

shortCondition := shortCondition and close < ma200

//#endregion

if shortCondition

strategy.entry("Short", strategy.short)

if exitCondition

strategy.close_all()