Overview

This strategy is a comprehensive trend-following system that combines multiple indicators to capture market trend opportunities through price breakouts, volume confirmation, and EMA alignment. The strategy monitors price breakouts of recent highs/lows, significant volume increases, and the arrangement of multiple Exponential Moving Averages (EMAs). It also includes an innovative narrow consolidation detection mechanism for capturing potential short opportunities.

Strategy Principles

The core logic of the strategy is based on the following key elements: 1. Price Breakout System: Monitors price breakouts above/below the highs/lows of the past 20 periods 2. Volume Confirmation: Requires breakout volume to be at least 2x the 20-period average volume 3. EMA System: Uses 30/50/200 period EMAs to build a trend confirmation framework 4. Long Conditions: Price breaks new high, volume increases, price above 200EMA, short-term EMA above medium-term EMA, and medium-term EMA above long-term EMA 5. Short Conditions: Includes two entry mechanisms: - Traditional Breakout Short: Price breaks new low, volume increases, bearish EMA alignment with downward sloping 200EMA - Narrow Consolidation Short: Price forms a narrow consolidation below medium-term EMA, with range less than 0.5x ATR

Strategy Advantages

- Multiple Confirmation Mechanism: Enhances signal reliability through price breakout, volume, and EMA triple confirmation

- Flexible Short Entry: Provides two independent short entry methods, increasing trading opportunities

- Strong Adaptability: Uses ATR to define narrow consolidation, allowing adaptation to different market volatility environments

- Robust Risk Control: Uses 200EMA as stop-loss reference, providing clear exit mechanisms

- Parameter Adjustability: Key parameters can be optimized for different market characteristics

Strategy Risks

- False Breakout Risk: Markets may exhibit false breakouts leading to incorrect signals

- Slippage Risk: Significant slippage may occur during high-volume breakout moments

- Trend Reversal Risk: Using EMA-based stops may lead to premature exits in strong trend markets

- Parameter Sensitivity: Strategy performance is sensitive to parameter settings, requiring careful optimization

- Market Environment Dependency: May generate frequent false signals in ranging markets

Strategy Optimization Directions

- Introduce Trend Strength Filtering: Add indicators like ADX to filter signals in weak trend environments

- Optimize Stop-Loss Mechanism: Implement ATR-based dynamic stops for more flexible risk management

- Improve Position Management: Dynamically adjust position sizes based on breakout strength and market volatility

- Add Time Filtering: Implement intraday time filters to avoid trading during volatile opening and closing periods

- Incorporate Market Environment Classification: Dynamically adjust strategy parameters based on different market conditions (trending/ranging)

Summary

The Multi-Trend Breakout Momentum Trading Strategy is a comprehensive trend-following system that ensures signal reliability while providing flexible trading opportunities through the combination of multiple technical indicators. The strategy innovates by combining traditional breakout trading methods with a new narrow consolidation detection mechanism, making it adaptable to different market environments. While certain risks exist, the strategy has the potential to achieve stable performance in trending markets through proper parameter optimization and risk management measures.

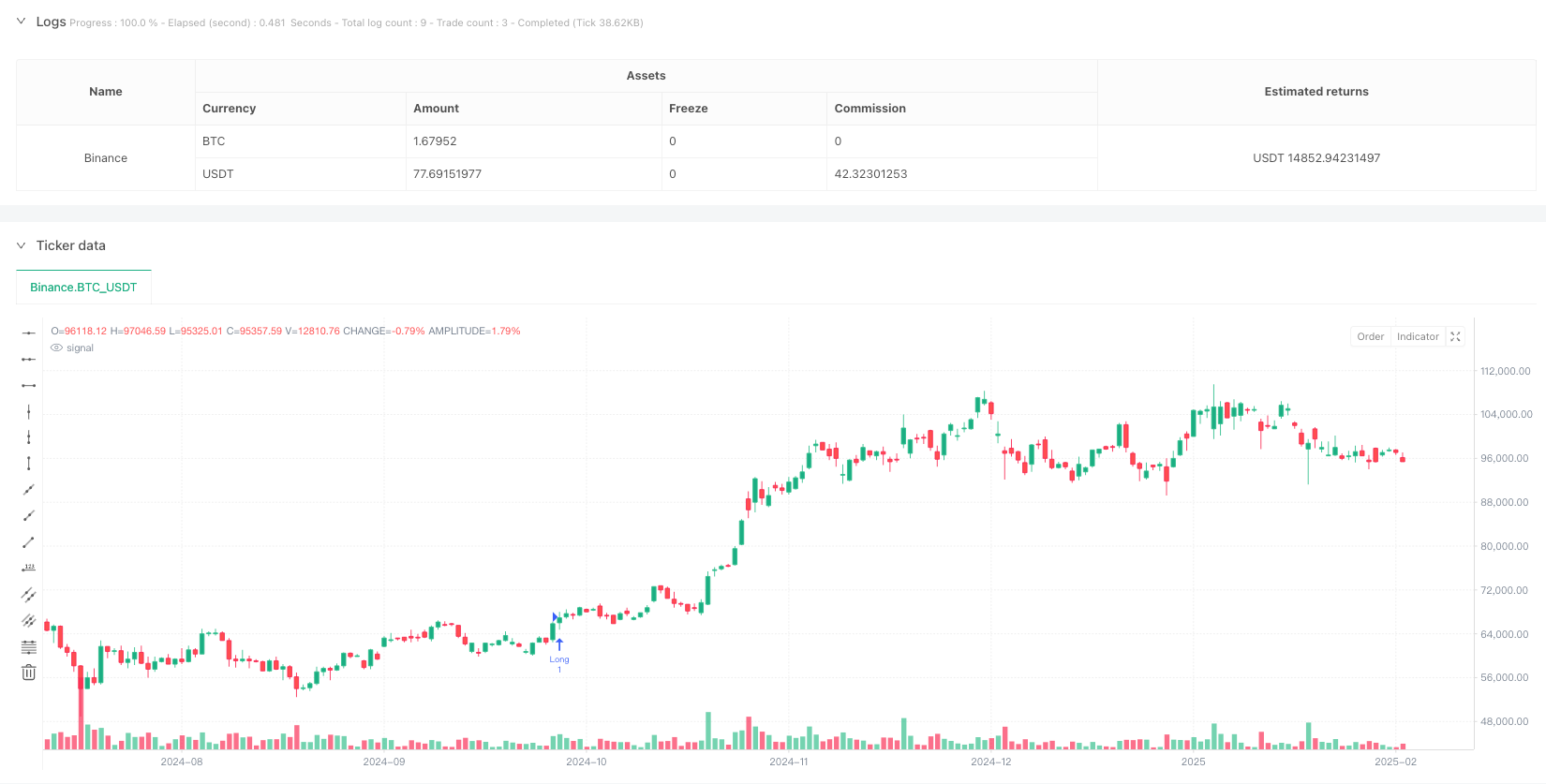

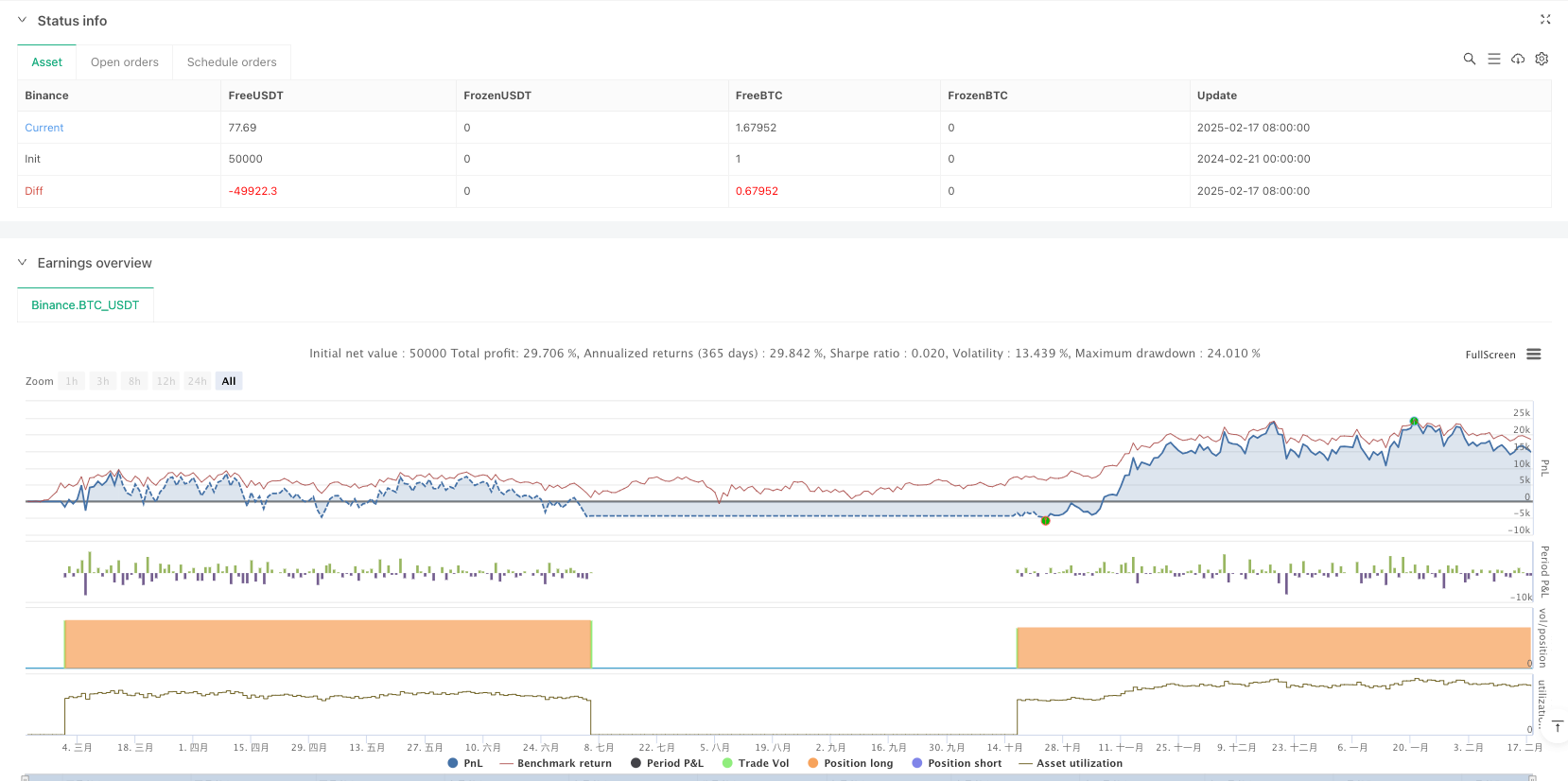

/*backtest

start: 2024-02-21 00:00:00

end: 2025-02-18 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Breakout Strategy (Long & Short) + Slope of 200 EMA", overlay=true)

// -------------------

// 1. Settings

// -------------------

breakout_candles = input.int(20, title="Number of Candles for Breakout")

range_candles = input.int(10, title="Number of Candles for Previous Range")

ema_long_period = input.int(200, title="Long EMA Period")

ema_medium_period = input.int(50, title="Medium EMA Period")

ema_short_period = input.int(30, title="Short EMA Period")

// Checkbox to allow/disallow short positions

allowShort = input.bool(true, title="Allow Short Positions")

// Inputs for the new Narrow Consolidation Short setup

consolidationBars = input.int(10, "Consolidation Bars", minval=1)

narrowThreshInAtr = input.float(0.5,"Narrowness (ATR Mult.)",minval=0.0)

atrLength = input.int(14, "ATR Length for Range")

// -------------------

// 2. Calculations

// -------------------

breakout_up = close > ta.highest(high, breakout_candles)[1]

breakout_down = close < ta.lowest(low, breakout_candles)[1]

prev_range_high = ta.highest(high, range_candles)[1]

prev_range_low = ta.lowest(low, range_candles)[1]

ema_long = ta.ema(close, ema_long_period)

ema_medium = ta.ema(close, ema_medium_period)

ema_short = ta.ema(close, ema_short_period)

average_vol = ta.sma(volume, breakout_candles)

volume_condition = volume > 2 * average_vol

// 200 EMA sloping down?

ema_long_slope_down = ema_long < ema_long[1]

// For the Narrow Consolidation Short

rangeHigh = ta.highest(high, consolidationBars)

rangeLow = ta.lowest(low, consolidationBars)

rangeSize = rangeHigh - rangeLow

atrValue = ta.atr(atrLength)

// Condition: Price range is "narrow" if it's less than (ATR * threshold)

narrowConsolidation = rangeSize < (atrValue * narrowThreshInAtr)

// Condition: All bars under Medium EMA if the highest difference (high - ema_medium) in last N bars is < 0

allBelowMedium = ta.highest(high - ema_medium, consolidationBars) < 0

// -------------------

// 3. Long Entry

// -------------------

breakout_candle_confirmed_long = ta.barssince(breakout_up) <= 3

long_condition = breakout_candle_confirmed_long

and volume_condition

and close > prev_range_high

and close > ema_long

and ema_short > ema_medium

and ema_medium > ema_long

and strategy.opentrades == 0

if long_condition

strategy.entry("Long", strategy.long)

// -------------------

// 4. Short Entries

// -------------------

// (A) Original breakout-based short logic

breakout_candle_confirmed_short = ta.barssince(breakout_down) <= 3

short_condition_breakout = breakout_candle_confirmed_short

and volume_condition

and close < prev_range_low

and close < ema_long

and ema_short < ema_medium

and ema_medium < ema_long

and ema_long_slope_down

and strategy.opentrades == 0

// (B) NEW: Narrow Consolidation Short

short_condition_consolidation = narrowConsolidation

and allBelowMedium

and strategy.opentrades == 0

// Combine them: if either short scenario is valid, go short

short_condition = (short_condition_breakout or short_condition_consolidation) and allowShort

if short_condition

// Use a different order ID if you want to distinguish them

// but "Short" is fine for a single position

strategy.entry("Short", strategy.short)

// -------------------

// 5. Exits

// -------------------

if strategy.position_size > 0 and close < ema_long

strategy.close("Long", qty_percent=100)

if strategy.position_size < 0 and close > ema_long

strategy.close("Short", qty_percent=100)

// ======================================================================

// 5. ADDITIONAL PARTIAL EXITS / STOPS

// ======================================================================

// You can add partial exits for shorts or longs similarly.

// For example:

// if strategy.position_size < 0 and close > stop_level_for_short

// strategy.close("Short", qty_percent=50)