Overview

This strategy is a trend following system based on ATR (Average True Range) dynamic trailing stop. It combines EMA as trend filter and controls signal generation through adjustable sensitivity parameters and ATR period. The system supports both long and short trades with comprehensive profit management mechanism.

Strategy Principle

- Uses ATR indicator to calculate price volatility and determines trailing stop distance based on set sensitivity coefficient (Key Value)

- Uses EMA to judge market trend direction, only opening long positions above EMA and short positions below EMA

- Triggers trading signals when price breaks through trailing stop line and aligns with trend direction

- System employs staged profit management:

- At 20%-50% profit, raises stop loss to breakeven

- At 50%-80% profit, takes partial profit and tightens stop loss

- At 80%-100% profit, further tightens stop loss to protect profits

- Above 100% profit, closes entire position

Strategy Advantages

- Dynamic trailing stop effectively follows trends while preventing premature exits

- EMA trend filtering effectively reduces false breakout risks

- Staged profit mechanism ensures profit realization while giving trends room to develop

- Supports both long and short trading, fully capturing market opportunities

- Strong parameter adjustability, adapting to different market environments

Strategy Risks

- May result in losses from frequent trading in ranging markets

- Potentially large drawdowns during trend reversal initiation

- Improper parameter settings may affect strategy performance Risk control suggestions:

- Recommended use in clear trending markets

- Careful parameter selection through backtesting

- Set maximum drawdown limits

- Consider adding market condition filters

Strategy Optimization Directions

- Add market environment recognition mechanism to use different parameters under different market conditions

- Introduce volume and other auxiliary indicators to enhance signal reliability

- Optimize profit management mechanism with dynamic profit targets based on volatility

- Add time filters to avoid trading during unfavorable periods

- Consider adding volatility filters to reduce trading frequency during excessive volatility

Summary

This is a well-structured trend following system with clear logic. Through the combination of ATR dynamic tracking and EMA trend filtering, it captures trends while maintaining good risk control. The staged profit mechanism design reflects mature trading thinking. The strategy has strong practicality and extensibility, with potential for better trading results through continuous optimization and improvement.

Strategy source code

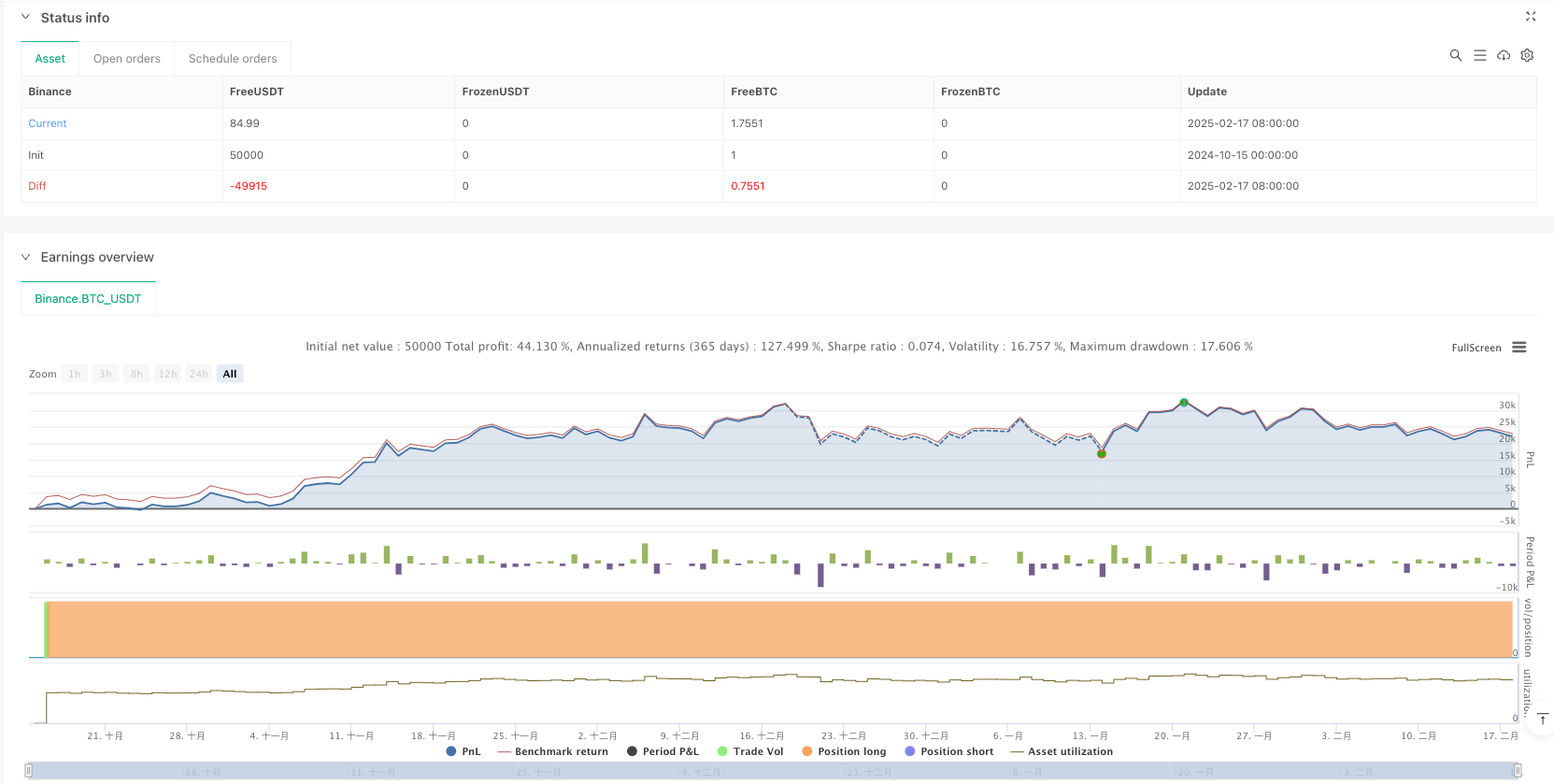

/*backtest

start: 2024-10-15 00:00:00

end: 2025-02-18 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Enhanced UT Bot with Long & Short Trades", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=100)

// Input Parameters

keyvalue = input.float(1.1, title="Key Value (Sensitivity)", step=0.1)

atrperiod = input.int(200, title="ATR Period")

emaPeriod = input.int(50, title="EMA Period")

roi_close = input.float(100, title="Close Trade at ROI (%)", step=1)

// ATR Calculation

src = close

xATR = ta.atr(atrperiod)

nLoss = keyvalue * xATR

// EMA for Trend Filtering

ema = ta.ema(src, emaPeriod)

// Trailing Stop Logic

var float xATRTrailingStop = na

if na(xATRTrailingStop)

xATRTrailingStop := src - nLoss

if src > nz(xATRTrailingStop[1]) and src[1] > nz(xATRTrailingStop[1])

xATRTrailingStop := math.max(nz(xATRTrailingStop[1]), src - nLoss)

else if src < nz(xATRTrailingStop[1]) and src[1] < nz(xATRTrailingStop[1])

xATRTrailingStop := math.min(nz(xATRTrailingStop[1]), src + nLoss)

else

xATRTrailingStop := src > nz(xATRTrailingStop[1]) ? src - nLoss : src + nLoss

// Buy/Sell Signal with Trend Filter

buySignal = ta.crossover(src, xATRTrailingStop) and src > ema

sellSignal = ta.crossunder(src, xATRTrailingStop) and src < ema

// Strategy Logic: Long Trades

if buySignal and strategy.position_size <= 0

strategy.entry("Buy", strategy.long)

if sellSignal and strategy.position_size > 0

strategy.close("Buy")

// Strategy Logic: Short Trades

if sellSignal and strategy.position_size >= 0

strategy.entry("Sell", strategy.short)

if buySignal and strategy.position_size < 0

strategy.close("Sell")

// ROI Calculation for Both Long and Short Trades

var float entryPrice = na

var bool isLong = na

if strategy.position_size > 0

entryPrice := strategy.opentrades.entry_price(0)

isLong := true

if strategy.position_size < 0

entryPrice := strategy.opentrades.entry_price(0)

isLong := false

// Calculate current profit

currentProfit = isLong ? (close - entryPrice) / entryPrice * 100 : (entryPrice - close) / entryPrice * 100

// Enhanced ROI Management

if strategy.position_size > 0 // Long Position

if currentProfit >= 20 and currentProfit < 50

stopLevel = entryPrice // Breakeven

strategy.exit("TSL Breakeven", from_entry="Buy", stop=stopLevel)

if currentProfit >= 50 and currentProfit < 80

stopLevel = entryPrice * 1.30 // 30% ROI

strategy.exit("TSL 30%", from_entry="Buy", stop=stopLevel)

strategy.close("Partial Profit", qty_percent=50) // Take 50% profit

if currentProfit >= 80 and currentProfit < roi_close

stopLevel = entryPrice * 1.60 // 60% ROI

strategy.exit("TSL 60%", from_entry="Buy", stop=stopLevel)

if currentProfit >= roi_close

strategy.close("Full Exit at 100% ROI")

if strategy.position_size < 0 // Short Position

if currentProfit >= 20 and currentProfit < 50

stopLevel = entryPrice // Breakeven

strategy.exit("TSL Breakeven", from_entry="Sell", stop=stopLevel)

if currentProfit >= 50 and currentProfit < 80

stopLevel = entryPrice * 0.70 // 30% ROI (Short stop)

strategy.exit("TSL 30%", from_entry="Sell", stop=stopLevel)

strategy.close("Partial Profit", qty_percent=50) // Take 50% profit

if currentProfit >= 80 and currentProfit < roi_close

stopLevel = entryPrice * 0.40 // 60% ROI (Short stop)

strategy.exit("TSL 60%", from_entry="Sell", stop=stopLevel)

if currentProfit >= roi_close

strategy.close("Full Exit at 100% ROI")

// Plotting

plot(xATRTrailingStop, color=buySignal ? color.green : sellSignal ? color.red : color.gray, title="Trailing Stop")

plot(ema, color=color.blue, title="EMA Trend Filter")

plotshape(buySignal, title="Buy Signal", style=shape.labelup, location=location.belowbar, color=color.green, text="Buy")

plotshape(sellSignal, title="Sell Signal", style=shape.labeldown, location=location.abovebar, color=color.red, text="Sell")