Overview

This strategy is an advanced trading system based on multiple technical pattern recognition, combining candlestick pattern analysis with breakout trading principles. The strategy identifies and trades multiple classic candlestick patterns, including Doji, Hammer, and Pin Bar formations, while incorporating a dual-candle confirmation system to enhance signal reliability.

Strategy Principles

The core logic of the strategy is built on several key elements: 1. Pattern Recognition System - Uses precise mathematical calculations to identify three key candlestick patterns: Doji, Hammer, and Pin Bar. Each pattern has its unique identification criteria, such as the relationship between body and shadow ratios. 2. Breakout Confirmation Mechanism - Employs a dual-candle confirmation system, requiring the second candle to break above the high (for longs) or below the low (for shorts) of the previous candle to reduce false signals. 3. Target Price Determination - Uses an adjustable lookback period (default 20 periods) to determine recent highs or lows as target prices, giving the strategy dynamic adaptability.

Strategy Advantages

- Multiple Pattern Recognition - Significantly increases potential trading opportunities by monitoring multiple technical patterns simultaneously.

- Signal Confirmation Mechanism - The dual-candle confirmation system effectively reduces the risk of false signals.

- Visual Trading Ranges - Uses colored boxes to mark trading ranges, making trading targets more intuitive.

- Flexible Parameter Adjustment - Parameters like lookback period can be adjusted according to different market conditions.

Strategy Risks

- Market Volatility Risk - May generate false breakout signals during high volatility periods.

- Slippage Risk - Actual execution prices may significantly deviate from signal prices in less liquid markets.

- Trend Reversal Risk - Reversal signals in strong trend markets may lead to substantial losses.

Optimization Directions

- Volume Confirmation Integration - Recommend incorporating volume analysis into the pattern recognition system to improve signal reliability.

- Dynamic Stop-Loss Mechanism - Can implement dynamic stop-loss levels based on ATR or volatility.

- Market Environment Filtering - Add trend strength indicators to filter out reversal signals during strong trends.

- Timeframe Optimization - Consider signal confirmation across multiple timeframes.

Summary

The strategy establishes a comprehensive trading system by combining multiple technical pattern analysis with breakout trading principles. Its strengths lie in multi-dimensional signal confirmation and flexible parameter adjustment, while attention must be paid to market volatility and liquidity risks. Through the suggested optimization directions, the strategy’s stability and reliability can be further enhanced.

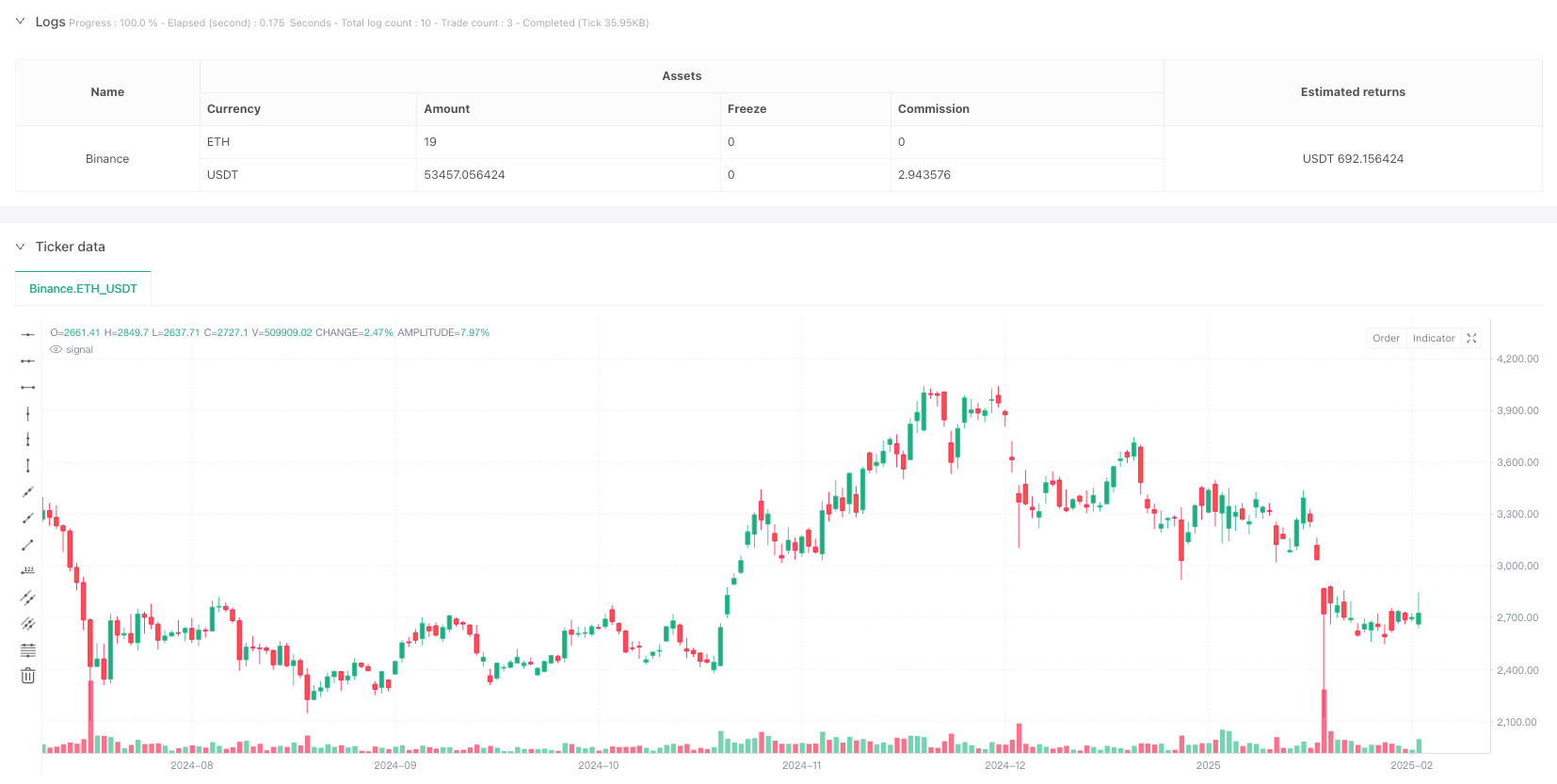

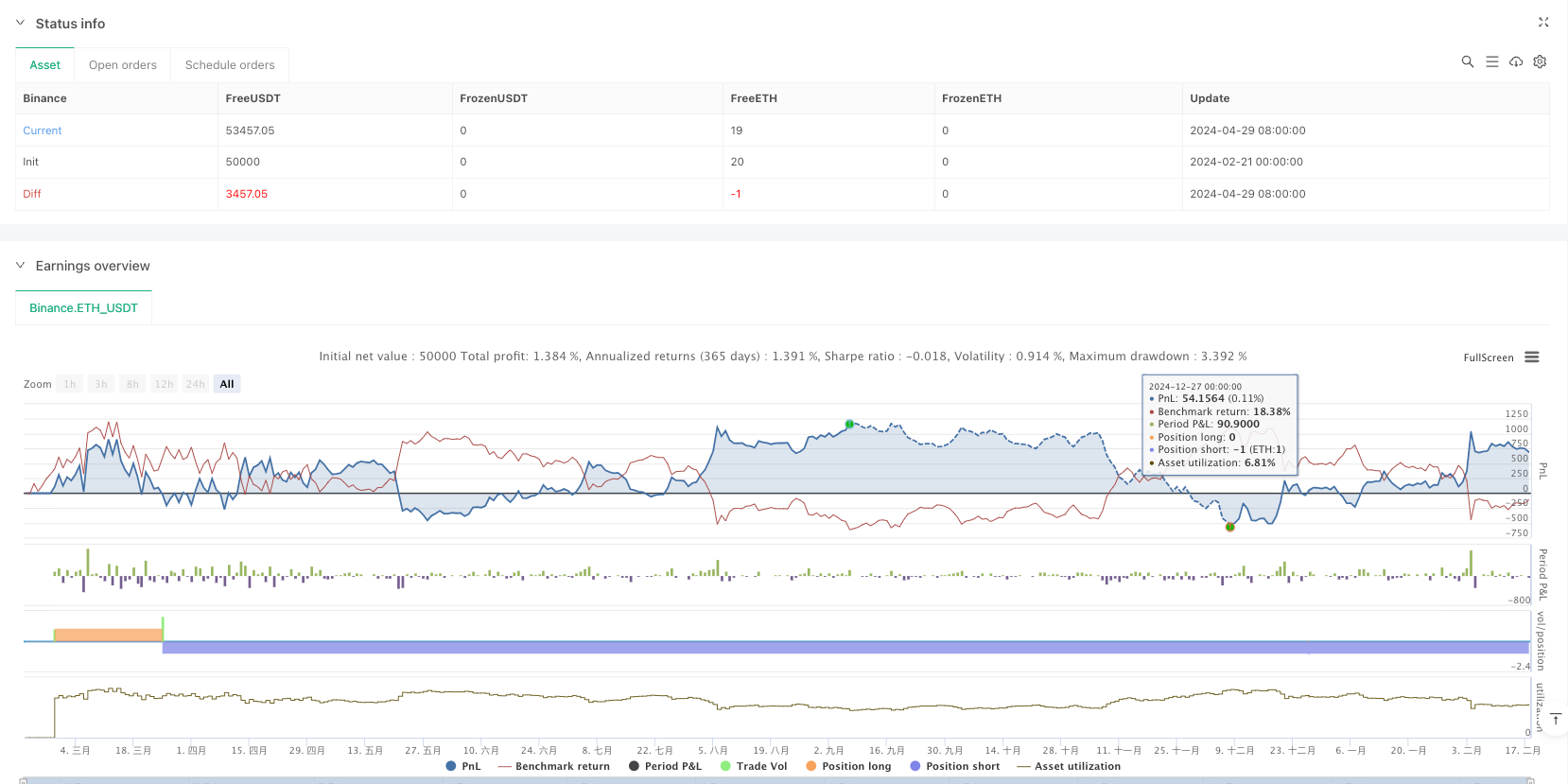

/*backtest

start: 2024-02-21 00:00:00

end: 2025-02-18 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Binance","currency":"ETH_USDT"}]

*/

//@version=5

strategy("Target(Made by Karan)", overlay=true)

// Input for lookback period

lookbackPeriod = input.int(20, title="Lookback Period for Recent High/Low", minval=1)

// --- Pattern Identification Functions ---

// Identify Doji pattern

isDoji(open, high, low, close) =>

bodySize = math.abs(close - open)

rangeSize = high - low

bodySize <= rangeSize * 0.1 // Small body compared to total range

// Identify Hammer pattern

isHammer(open, high, low, close) =>

bodySize = math.abs(close - open)

lowerShadow = open - low

upperShadow = high - close

bodySize <= (high - low) * 0.3 and lowerShadow > 2 * bodySize and upperShadow <= bodySize * 0.3 // Long lower shadow, small upper shadow

// Identify Pin Bar pattern

isPinBar(open, high, low, close) =>

bodySize = math.abs(close - open)

rangeSize = high - low

upperShadow = high - math.max(open, close)

lowerShadow = math.min(open, close) - low

(upperShadow > bodySize * 2 and lowerShadow < bodySize) or (lowerShadow > bodySize * 2 and upperShadow < bodySize) // Long shadow on one side

// --- Candle Breakout Logic ---

// Identify the first green candle (Bullish)

is_first_green_candle = close > open

// Identify the breakout above the high of the first green candle

breakout_green_candle = ta.crossover(close, high[1]) and is_first_green_candle[1]

// Identify the second green candle confirming the breakout

second_green_candle = close > open and breakout_green_candle[1]

// Find the recent high (for the target)

recent_high = ta.highest(high, lookbackPeriod) // Use adjustable lookback period

// Plot the green rectangle box if the conditions are met and generate buy signal

var float start_price_green = na

var float end_price_green = na

if second_green_candle

start_price_green := low[1] // Low of the breakout green candle

end_price_green := recent_high // The most recent high in the lookback period

strategy.entry("Buy", strategy.long) // Buy signal

// --- Red Candle Logic ---

// Identify the first red candle (Bearish)

is_first_red_candle = close < open

// Identify the breakdown below the low of the first red candle

breakdown_red_candle = ta.crossunder(close, low[1]) and is_first_red_candle[1]

// Identify the second red candle confirming the breakdown

second_red_candle = close < open and breakdown_red_candle[1]

// Find the recent low (for the target)

recent_low = ta.lowest(low, lookbackPeriod) // Use adjustable lookback period

// Plot the red rectangle box if the conditions are met and generate sell signal

var float start_price_red = na

var float end_price_red = na

if second_red_candle

start_price_red := high[1] // High of the breakout red candle

end_price_red := recent_low // The most recent low in the lookback period

strategy.entry("Sell", strategy.short) // Sell signal

// --- Pattern Breakout Logic for Doji, Hammer, Pin Bar ---

// Detect breakout of Doji, Hammer, or Pin Bar patterns

var float start_price_pattern = na

var float end_price_pattern = na

// Check for Doji breakout

if isDoji(open, high, low, close) and ta.crossover(close, high[1])

start_price_pattern := low[1] // Low of the breakout Doji

end_price_pattern := recent_high // The most recent high in the lookback period

box.new(left = bar_index[1], right = bar_index, top = end_price_pattern, bottom = start_price_pattern, border_color = color.new(color.blue, 0), bgcolor = color.new(color.blue, 80))

strategy.entry("Buy Doji", strategy.long) // Buy signal for Doji breakout

// Check for Hammer breakout

if isHammer(open, high, low, close) and ta.crossover(close, high[1])

start_price_pattern := low[1] // Low of the breakout Hammer

end_price_pattern := recent_high // The most recent high in the lookback period

box.new(left = bar_index[1], right = bar_index, top = end_price_pattern, bottom = start_price_pattern, border_color = color.new(color.blue, 0), bgcolor = color.new(color.blue, 80))

strategy.entry("Buy Hammer", strategy.long) // Buy signal for Hammer breakout

// Check for Pin Bar breakout

if isPinBar(open, high, low, close) and ta.crossover(close, high[1])

start_price_pattern := low[1] // Low of the breakout Pin Bar

end_price_pattern := recent_high // The most recent high in the lookback period

box.new(left = bar_index[1], right = bar_index, top = end_price_pattern, bottom = start_price_pattern, border_color = color.new(color.blue, 0), bgcolor = color.new(color.blue, 80))

strategy.entry("Buy Pin Bar", strategy.long) // Buy signal for Pin Bar breakout

// Check for bearish Doji breakout

if isDoji(open, high, low, close) and ta.crossunder(close, low[1])

start_price_pattern := high[1] // High of the breakdown Doji

end_price_pattern := recent_low // The most recent low in the lookback period

box.new(left = bar_index[1], right = bar_index, top = start_price_pattern, bottom = end_price_pattern, border_color = color.new(color.orange, 0), bgcolor = color.new(color.orange, 80))

strategy.entry("Sell Doji", strategy.short) // Sell signal for Doji breakdown

// Check for bearish Hammer breakout

if isHammer(open, high, low, close) and ta.crossunder(close, low[1])

start_price_pattern := high[1] // High of the breakdown Hammer

end_price_pattern := recent_low // The most recent low in the lookback period

box.new(left = bar_index[1], right = bar_index, top = start_price_pattern, bottom = end_price_pattern, border_color = color.new(color.orange, 0), bgcolor = color.new(color.orange, 80))

strategy.entry("Sell Hammer", strategy.short) // Sell signal for Hammer breakdown

// Check for bearish Pin Bar breakout

if isPinBar(open, high, low, close) and ta.crossunder(close, low[1])

start_price_pattern := high[1] // High of the breakdown Pin Bar

end_price_pattern := recent_low // The most recent low in the lookback period

box.new(left = bar_index[1], right = bar_index, top = start_price_pattern, bottom = end_price_pattern, border_color = color.new(color.orange, 0), bgcolor = color.new(color.orange, 80))

strategy.entry("Sell Pin Bar", strategy.short) // Sell signal for Pin Bar breakdown

// Optional: Plot shapes for the green sequence of candles

plotshape(series=is_first_green_candle, location=location.belowbar, color=color.green, style=shape.labelup, text="1st Green")

plotshape(series=breakout_green_candle, location=location.belowbar, color=color.blue, style=shape.labelup, text="Breakout")

plotshape(series=second_green_candle, location=location.belowbar, color=color.orange, style=shape.labelup, text="2nd Green")

// Optional: Plot shapes for the red sequence of candles

plotshape(series=is_first_red_candle, location=location.abovebar, color=color.red, style=shape.labeldown, text="1st Red")

plotshape(series=breakdown_red_candle, location=location.abovebar, color=color.blue, style=shape.labeldown, text="Breakdown")

plotshape(series=second_red_candle, location=location.abovebar, color=color.orange, style=shape.labeldown, text="2nd Red")