双均线交叉结合RSI强弱过滤交易策略 | Dual Moving Average Crossover with RSI Strength Filter Trading Strategy

Overview

This strategy is a trading system that combines dual moving average crossover with RSI indicator filtering. It uses a 5-period Exponential Moving Average (EMA5) and a 10-period Simple Moving Average (SMA10) as primary trend identification tools, while incorporating a 14-period Relative Strength Index (RSI14) as a trade signal filter to enhance trading accuracy through strict entry and exit conditions.

Strategy Principles

The strategy’s core logic is based on the combination of two key technical indicators: 1. Dual Moving Average System: EMA5 and SMA10 crossovers for trend change detection - Buy signal when EMA5 crosses above SMA10 - Sell signal when EMA5 crosses below SMA10 2. RSI Filtering System: - Long positions require RSI14 value above 60 - Short positions require RSI14 value below 50 - Price must break through corresponding RSI levels to confirm trading signals

Strategy Advantages

Comprehensive Signal Confirmation

- Initial signals provided by moving average crossovers

- Secondary confirmation through RSI filter

- Final confirmation requires price breakthrough of RSI key levels

Effective Risk Control

- Clear entry and exit conditions

- Automatic position closure on reverse signals

- RSI indicator filters out potential false signals

Clear Strategy Logic

- Simple and understandable indicator combination

- Specific trading rules

- Easy to adjust and optimize

Strategy Risks

Sideways Market Risk

- Frequent moving average crossovers may lead to overtrading

- Misleading signals in ranging markets

- Recommended for use in clear trends

Lag Risk

- Moving averages have inherent lag

- RSI confirmation may miss part of price movements

- Need to balance timeliness and accuracy

Parameter Sensitivity

- Moving average periods affect signal frequency

- RSI threshold settings impact filtering effectiveness

- Different market conditions may require different parameters

Strategy Optimization Directions

Introduce Trend Strength Filtering

- Add ADX indicator for trend strength assessment

- Use looser RSI filtering conditions in strong trends

- Increase filtering stringency in weak trends

Optimize Parameter Adaptability

- Dynamically adjust moving average periods based on market volatility

- Automatically adjust RSI thresholds based on market conditions

- Implement adaptive algorithms for parameter selection

Enhance Risk Management

- Add stop-loss and take-profit mechanisms

- Implement position sizing functionality

- Include trading cost considerations

Summary

This strategy constructs a relatively complete trading system by combining dual moving average crossover with RSI filtering. Its main advantages lie in its signal confirmation mechanism and risk control measures, though it does have some inherent limitations. Through the suggested optimization directions, the strategy has the potential to achieve better performance in actual trading. It may perform particularly well in markets with clear trends.

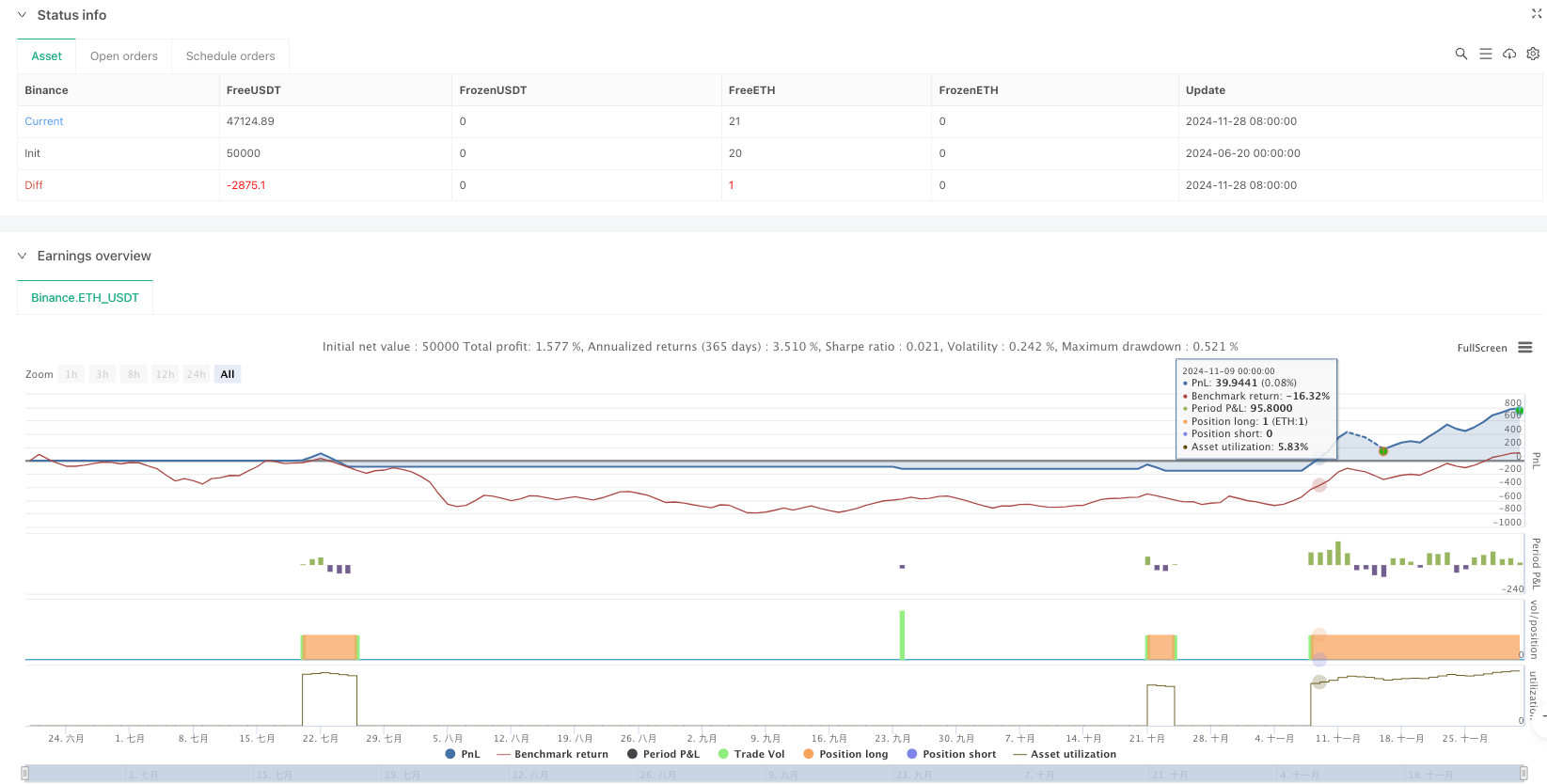

/*backtest

start: 2024-06-20 00:00:00

end: 2024-12-01 00:00:00

period: 3d

basePeriod: 3d

exchanges: [{"eid":"Binance","currency":"ETH_USDT"}]

*/

//@version=5

strategy("EMA and SMA Crossover with RSI14 Filtering", overlay=true)

// Define parameters for EMA, SMA, and RSI

ema5_length = 5

sma10_length = 10

rsi14_length = 14

rsi60_level = 60

rsi50_level = 50

// Calculate EMAs, SMAs, and RSI

ema5 = ta.ema(close, ema5_length)

sma10 = ta.sma(close, sma10_length)

rsi14 = ta.rsi(close, rsi14_length)

// Define Crossover Conditions

positive_crossover = ta.crossover(ema5, sma10)

negative_crossover = ta.crossunder(ema5, sma10)

// Define RSI filter conditions

rsi_above_60 = rsi14 > rsi60_level

rsi_below_50 = rsi14 < rsi50_level

// Condition: price below 60 on RSI 14 and later crosses above for Buy

price_below_rsi60 = close < rsi14

price_above_rsi60 = close > rsi14

// Condition: price above 50 on RSI 14 and later crosses below for Sell

price_above_rsi50 = close > rsi14

price_below_rsi50 = close < rsi14

// Trading logic

var bool active_buy_trade = false

var bool active_sell_trade = false

// Buy Condition: EMA 5 crosses above SMA 10 and RSI 14 crosses above 60

if (positive_crossover and not active_buy_trade)

if (price_below_rsi60)

// Wait for price to cross above RSI 60

if (price_above_rsi60)

strategy.entry("Buy", strategy.long)

active_buy_trade := true

else

strategy.entry("Buy", strategy.long)

active_buy_trade := true

// Sell Condition: EMA 5 crosses below SMA 10 and RSI 14 crosses below 50

if (negative_crossover and not active_sell_trade)

if (price_above_rsi50)

// Wait for price to cross below RSI 50

if (price_below_rsi50)

strategy.entry("Sell", strategy.short)

active_sell_trade := true

else

strategy.entry("Sell", strategy.short)

active_sell_trade := true

// Exit Buy Condition: Reverse Signal (EMA crosses below SMA or RSI crosses below 50)

if (active_buy_trade and (negative_crossover or rsi14 < rsi50_level))

strategy.close("Buy")

active_buy_trade := false

// Exit Sell Condition: Reverse Signal (EMA crosses above SMA or RSI crosses above 60)

if (active_sell_trade and (positive_crossover or rsi14 > rsi60_level))

strategy.close("Sell")

active_sell_trade := false

// Plotting EMAs, SMAs, and RSI 14 on the chart

plot(ema5, color=color.blue, linewidth=2, title="EMA 5")

plot(sma10, color=color.red, linewidth=2, title="SMA 10")

hline(rsi60_level, "RSI 60", color=color.gray, linestyle=hline.style_dotted)

hline(rsi50_level, "RSI 50", color=color.gray, linestyle=hline.style_dotted)

plot(rsi14, color=color.green, linewidth=1, title="RSI 14")