Overview

This strategy is a multi-timeframe swing trading system based on the Stochastic Oscillator. It identifies trading opportunities by combining stochastic signals from current and higher timeframes, using dynamic take-profit and stop-loss levels for risk management. The strategy is designed for volatile markets, aiming to capture short-term price movements for profit.

Strategy Principles

The core logic is based on several key elements: 1. Using Stochastic Oscillator confirmation on two timeframes (current and higher) 2. Looking for crossover signals in overbought/oversold zones 3. Buy conditions: K line crosses above D line in current timeframe with K<20; higher timeframe K<20 and K>D 4. Sell conditions: K line crosses below D line in current timeframe with K>80; higher timeframe K>80 and K 5. Dynamic take-profit and stop-loss system based on entry price, with adjustable multipliers

Strategy Advantages

- Multi-timeframe signal confirmation improves reliability and reduces false signals

- Trading in overbought/oversold zones increases probability of trend reversal

- Dynamic TP/SL system automatically adjusts to market volatility, enhancing money management flexibility

- Visual interface clearly displays trading signals and TP/SL levels for better understanding

- Adjustable parameters allow adaptation to different market conditions

Strategy Risks

- Frequent stop-losses may occur in highly volatile markets

- Dual timeframe confirmation might cause missed trading opportunities

- Fixed multiplier TP/SL may not suit all market conditions

- Potential early profit taking in strong trends

- Requires careful parameter optimization to balance reward and risk

Optimization Directions

- Implement adaptive TP/SL mechanism based on market volatility

- Add trend filter for adjusting trade direction in strong trends

- Incorporate volume indicators as confirmation signals

- Develop more sophisticated position sizing system

- Consider adding market sentiment indicators for entry timing optimization

Summary

This is a comprehensive trading system combining technical analysis and risk management. Through multi-timeframe signal confirmation and dynamic TP/SL, the strategy maintains stability while offering good profit potential. However, users need to optimize parameters according to their trading style and market conditions, always maintaining strict risk control.

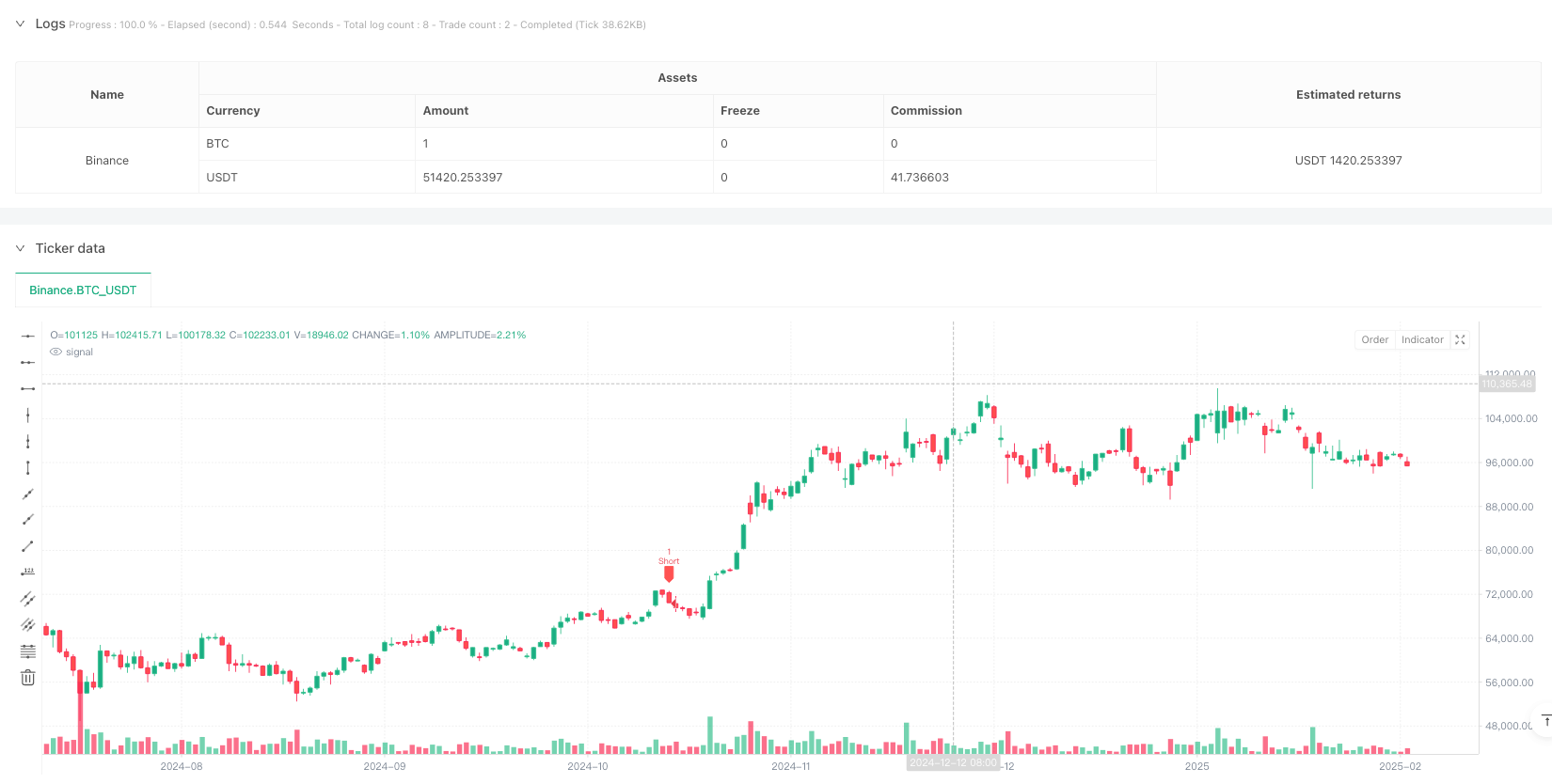

/*backtest

start: 2024-02-21 00:00:00

end: 2025-02-18 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Swing Fairas Oil", overlay=true)

// Input parameters

kLength = input(14, title="Stochastic K Length")

dLength = input(3, title="Stochastic D Length")

smoothK = input(3, title="Smooth K")

tfHigher = input.timeframe("30", title="Higher Timeframe")

takeProfit = input(1.7, title="Take Profit Multiplier")

stopLoss = input(1.7, title="Stop Loss Multiplier")

// Calculate Stochastic Oscillator for current timeframe

k = ta.sma(ta.stoch(close, high, low, kLength), smoothK)

d = ta.sma(k, dLength)

// Calculate Stochastic Oscillator for higher timeframe

kHTF = request.security(syminfo.tickerid, tfHigher, ta.sma(ta.stoch(close, high, low, kLength), smoothK))

dHTF = request.security(syminfo.tickerid, tfHigher, ta.sma(kHTF, dLength))

// Buy and sell conditions (confirmation from two timeframes)

buyCondition = ta.crossover(k, d) and k < 20 and kHTF < 20 and kHTF > dHTF

sellCondition = ta.crossunder(k, d) and k > 80 and kHTF > 80 and kHTF < dHTF

// Define Take Profit and Stop Loss levels

longStopLoss = close * (1 - stopLoss / 100)

longTakeProfit = close * (1 + takeProfit / 100)

shortStopLoss = close * (1 + stopLoss / 100)

shortTakeProfit = close * (1 - takeProfit / 100)

// Execute Trades

if buyCondition

strategy.entry("Long", strategy.long)

strategy.exit("Long Exit", from_entry="Long", limit=longTakeProfit, stop=longStopLoss)

if sellCondition

strategy.entry("Short", strategy.short)

strategy.exit("Short Exit", from_entry="Short", limit=shortTakeProfit, stop=shortStopLoss)

// Plot buy/sell signals on candlestick chart

plotshape(series=buyCondition, location=location.belowbar, color=color.green, style=shape.labelup, size=size.small, title="Buy Signal")

plotshape(series=sellCondition, location=location.abovebar, color=color.red, style=shape.labeldown, size=size.small, title="Sell Signal")

// Highlight candles for buy and sell conditions

barcolor(buyCondition ? color.green : sellCondition ? color.red : na)

// Draw Take Profit and Stop Loss levels dynamically with labels

var float tpLevel = na

var float slLevel = na

if buyCondition

tpLevel := longTakeProfit

slLevel := longStopLoss

if sellCondition

tpLevel := shortTakeProfit

slLevel := shortStopLoss