Overview

This strategy is a trading system that combines the RSI2 indicator with a moving average. It primarily captures potential long opportunities by monitoring RSI reversal signals in oversold territories while using moving averages as trend filters to improve trading accuracy. The strategy employs a fixed exit mechanism that automatically closes positions after reaching a preset period.

Strategy Principle

The core logic includes several key elements: 1. Uses RSI with period 2 to identify oversold conditions, entering observation mode when RSI falls below the set buy threshold (default 25) 2. Confirms entry signals when the RSI indicator breaks upward 3. Optionally incorporates moving average filtering, requiring price to be above the moving average for entry 4. Adopts a fixed holding period exit mechanism (default 5 candles) 5. Draws trade lines on the chart connecting buy and sell points, with different colors indicating profit/loss status

Strategy Advantages

- Flexible Parameters: Supports customization of RSI period, buy threshold, holding period, and moving average period

- Simple and Reliable Mechanism: Uses classic RSI oversold reversal signals combined with trend filtering

- Proper Risk Control: Employs fixed-period exit mechanism to avoid over-holding

- Good Visualization: Directly displays trade profit/loss through trade lines

- Controllable Backtesting: Supports setting specific backtest start and end times

Strategy Risks

- False Breakout Risk: RSI indicator may generate false reversal signals leading to incorrect trades

- Fixed Period Risk: Preset holding period may be too short causing premature exits or too long leading to profit giveback

- Trend Dependency: Moving average filtering may excessively limit trading opportunities in ranging markets

- Parameter Sensitivity: Strategy performance is sensitive to parameter settings, requiring frequent adjustments in different market environments

Strategy Optimization Directions

- Dynamic Holding Period: Adapt holding time based on market volatility

- Multiple Confirmation Mechanism: Add volume, volatility, and other auxiliary indicators to improve signal reliability

- Smart Stop Loss: Introduce ATR and other indicators for dynamic stop loss placement

- Gradual Position Building: Implement progressive position building to spread risk

- Market Environment Recognition: Add trend strength judgment to use different parameter combinations under different market conditions

Summary

This is a well-structured trading strategy with clear logic, capturing market opportunities through RSI oversold reversal signals combined with moving average trend filtering. The strategy’s strengths lie in its flexible parameters and reasonable risk control, but attention must be paid to false breakout risks and parameter sensitivity issues. Through the suggested optimization directions, the strategy has significant room for improvement to enhance its adaptability in different market environments.

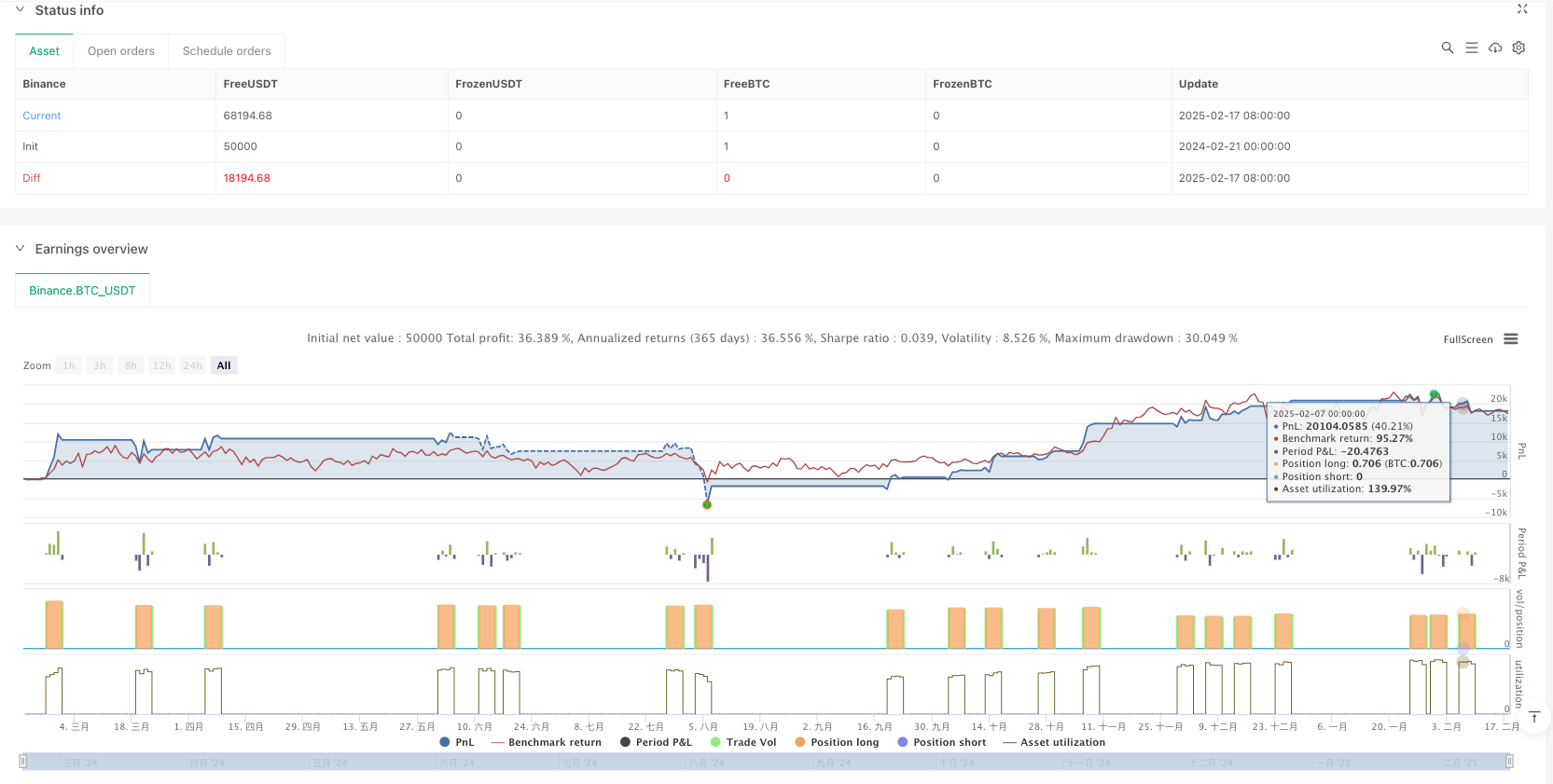

/*backtest

start: 2024-02-21 00:00:00

end: 2025-02-18 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Binance","currency":"BTC_USDT"}]

*/

//@version=6

strategy("RSI 2 Strategy with Fixed Lines and Moving Average Filter", overlay=true)

// Input parameters

rsiPeriod = input.int(2, title="RSI Period", minval=1)

rsiBuyLevel = input.float(25, title="RSI Buy Level", minval=0, maxval=100)

maxBarsToHold = input.int(5, title="Max Candles to Hold", minval=1)

maPeriod = input.int(50, title="Moving Average Period", minval=1) // Moving Average Period

useMAFilter = input.bool(true, title="Use Moving Average Filter") // Enable/Disable MA Filter

// RSI and Moving Average calculation

rsi = ta.rsi(close, rsiPeriod)

ma = ta.sma(close, maPeriod)

// Moving Average filter conditions

maFilterCondition = useMAFilter ? close > ma : true // Condition: price above MA

// Buy conditions

rsiIncreasing = rsi > rsi[1] // Current RSI greater than previous RSI

buyCondition = rsi[1] < rsiBuyLevel and rsiIncreasing and strategy.position_size == 0 and maFilterCondition

// Variables for management

var int barsHeld = na // Counter for candles after purchase

var float buyPrice = na // Purchase price

// Buy action

if buyCondition and na(barsHeld)

strategy.entry("Buy", strategy.long)

barsHeld := 0

buyPrice := close

// Increment the candle counter after purchase

if not na(barsHeld)

barsHeld += 1

// Sell condition after the configured number of candles

sellCondition = barsHeld >= maxBarsToHold

if sellCondition

strategy.close("Buy")

// Reset variables after selling

barsHeld := na

buyPrice := na