Overview

This strategy is a quantitative trading system that combines volatility breakout, trend following, and momentum confirmation. It identifies trading opportunities by calculating ATR-based dynamic breakthrough levels combined with EMA trend filtering and RSI momentum indicators. The strategy employs strict risk control measures, including fixed percentage risk management and dynamic stop-loss settings.

Strategy Principles

The strategy consists of three core components: 1. Volatility Breakout Calculation: Uses highest and lowest prices within the lookback period, combined with ATR multiplier to calculate dynamic breakthrough thresholds, avoiding look-ahead bias. 2. Trend Filtering: Uses short-term EMA to determine current trend direction, only taking long positions above EMA and short positions below EMA. 3. Momentum Confirmation: Uses RSI indicator to confirm market momentum, requiring RSI above 50 for long entries and below 50 for short entries.

Strategy Advantages

- Dynamic Adaptability: Breakthrough levels automatically adjust based on market volatility, allowing the strategy to adapt to different market environments.

- Multiple Filters: Combines trend and momentum indicators to reduce false signals.

- Strict Risk Control: Uses fixed risk percentage for position management and dynamic stop-loss protection.

- High Customizability: Key parameters such as ATR period, breakthrough multiplier, EMA period can be adjusted according to specific needs.

Strategy Risks

- Lag Risk: Using moving averages may lead to delayed entry points.

- Sideways Market Risk: May generate frequent false breakthrough signals in ranging markets.

- Parameter Sensitivity: Strategy performance is sensitive to parameter settings, requiring thorough testing. Solutions:

- Recommend backtesting and optimization under different market conditions

- Can add market environment recognition module

- Suggest adopting more conservative money management approach

Optimization Directions

- Market Environment Adaptation: Add volatility range judgment, using different parameter settings in different volatility environments.

- Signal Optimization: Consider adding volume confirmation to improve breakthrough signal reliability.

- Stop Profit/Loss Optimization: Implement dynamically adjusting risk-reward ratio based on market volatility.

- Time Filtering: Add trading time window filters to avoid trading during unfavorable periods.

Summary

This is a well-structured quantitative trading strategy with clear logic. By combining volatility breakout, trend following, and momentum confirmation, it captures significant price movements while controlling risk. The strategy’s high customizability makes it suitable for further optimization to adapt to different trading instruments and market environments. It is recommended to conduct thorough parameter optimization and backtesting before live trading.

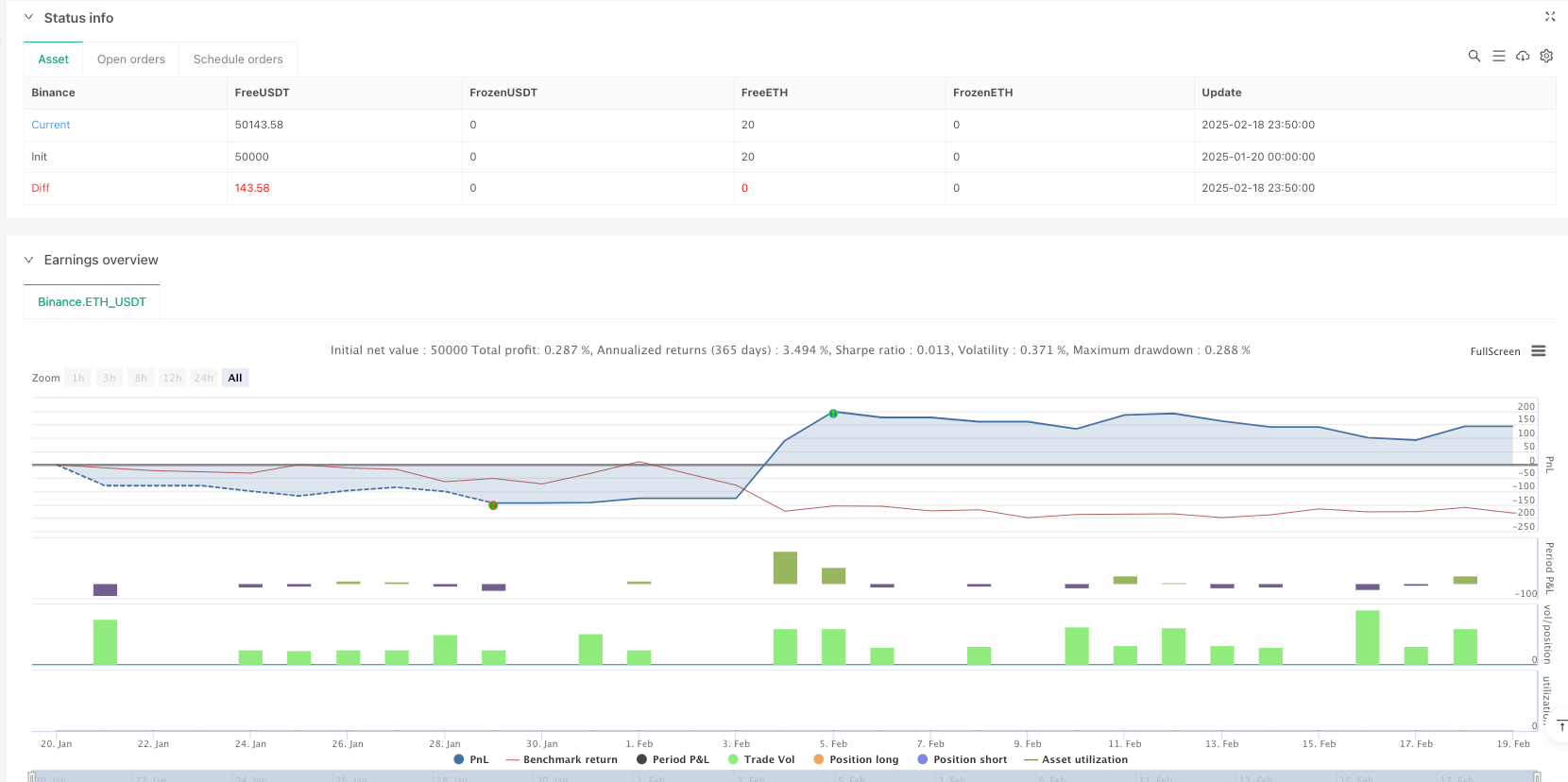

/*backtest

start: 2025-01-20 00:00:00

end: 2025-02-19 00:00:00

period: 10m

basePeriod: 10m

exchanges: [{"eid":"Binance","currency":"ETH_USDT"}]

*/

//@version=5

// Volatility Momentum Breakout Strategy

//

// Description:

// This strategy is designed to capture significant price moves by combining a volatility breakout method

// with a momentum filter. Volatility is measured by the Average True Range (ATR), which is used to set dynamic

// breakout levels. A short‑term Exponential Moving Average (EMA) is applied as a trend filter, and the Relative

// Strength Index (RSI) is used to help avoid entries when the market is overextended.

//

// Signal Logic:

// • Long Entry: When the current close is above the highest high of the previous N bars (excluding the current bar)

// plus a multiple of ATR, provided that the price is above the short‑term EMA and the RSI is above 50.

// • Short Entry: When the current close is below the lowest low of the previous N bars (excluding the current bar)

// minus a multiple of ATR, provided that the price is below the short‑term EMA and the RSI is below 50.

//

// Risk Management:

// • Trades are sized to risk 2% of account equity.

// • A stop loss is placed at a fixed ATR multiple away from the entry price.

// • A take profit target is set to achieve a 1:2 risk‑reward ratio.

//

// Backtesting Parameters:

// • Initial Capital: $10,000

// • Commission: 0.1% per trade

// • Slippage: 1 tick per bar

//

// Disclaimer:

// Past performance is not indicative of future results. This strategy is experimental and provided solely for educational

// purposes. Always backtest and paper trade before any live deployment.

//

// Author: [Your Name]

// Date: [Date]

strategy("Volatility Momentum Breakout Strategy", overlay=true, initial_capital=10000, default_qty_type=strategy.percent_of_equity, default_qty_value=5, commission_type=strategy.commission.percent, commission_value=0.1, slippage=1)

// ─── INPUTS ─────────────────────────────────────────────────────────────

atrPeriod = input.int(14, "ATR Period", minval=1)

atrMultiplier = input.float(1.5, "ATR Multiplier for Breakout", step=0.1)

lookback = input.int(20, "Breakout Lookback Period", minval=1)

emaPeriod = input.int(50, "EMA Period", minval=1)

rsiPeriod = input.int(14, "RSI Period", minval=1)

rsiLongThresh = input.float(50, "RSI Long Threshold", step=0.1)

rsiShortThresh = input.float(50, "RSI Short Threshold", step=0.1)

// Risk management inputs:

riskPercent = input.float(2.0, "Risk Percent per Trade (%)", step=0.1) * 0.01 // 2% risk per trade

riskReward = input.float(2.0, "Risk-Reward Ratio", step=0.1) // Target profit is 2x risk

atrStopMult = input.float(1.0, "ATR Multiplier for Stop Loss", step=0.1) // Stop loss distance in ATRs

// ─── INDICATOR CALCULATIONS ───────────────────────────────────────────────

atrVal = ta.atr(atrPeriod)

emaVal = ta.ema(close, emaPeriod)

rsiVal = ta.rsi(close, rsiPeriod)

// Calculate breakout levels using the highest high and lowest low of the previous N bars,

// excluding the current bar (to avoid look-ahead bias).

highestHigh = ta.highest(high[1], lookback)

lowestLow = ta.lowest(low[1], lookback)

// Define breakout thresholds.

longBreakoutLevel = highestHigh + atrMultiplier * atrVal

shortBreakoutLevel = lowestLow - atrMultiplier * atrVal

// ─── SIGNAL LOGIC ─────────────────────────────────────────────────────────

// Long Entry: Price closes above the long breakout level,

// the close is above the EMA, and RSI > 50.

longCondition = (close > longBreakoutLevel) and (close > emaVal) and (rsiVal > rsiLongThresh)

// Short Entry: Price closes below the short breakout level,

// the close is below the EMA, and RSI < 50.

shortCondition = (close < shortBreakoutLevel) and (close < emaVal) and (rsiVal < rsiShortThresh)

if (longCondition)

strategy.entry("Long", strategy.long)

if (shortCondition)

strategy.entry("Short", strategy.short)

// ─── RISK MANAGEMENT ──────────────────────────────────────────────────────

// For each new trade, use the entry price as the basis for stop loss and target calculations.

// We assume the entry price equals the close on the bar where the trade is triggered.

var float longEntryPrice = na

var float shortEntryPrice = na

// Record entry prices when a trade is opened.

if (strategy.position_size > 0 and na(longEntryPrice))

longEntryPrice := strategy.position_avg_price

if (strategy.position_size < 0 and na(shortEntryPrice))

shortEntryPrice := strategy.position_avg_price

// Calculate stop loss and take profit levels based on ATR.

longStop = longEntryPrice - atrStopMult * atrVal

longTarget = longEntryPrice + (longEntryPrice - longStop) * riskReward

shortStop = shortEntryPrice + atrStopMult * atrVal

shortTarget= shortEntryPrice - (shortStop - shortEntryPrice) * riskReward

// Issue exit orders if a position is open.

if (strategy.position_size > 0 and not na(longEntryPrice))

strategy.exit("Long Exit", from_entry="Long", stop=longStop, limit=longTarget)

if (strategy.position_size < 0 and not na(shortEntryPrice))

strategy.exit("Short Exit", from_entry="Short", stop=shortStop, limit=shortTarget)

// Reset recorded entry prices when the position is closed.

if (strategy.position_size == 0)

longEntryPrice := na

shortEntryPrice := na

// ─── CHART VISUAL AIDS ─────────────────────────────────────────────────────

// Plot the breakout levels and EMA.

plot(longBreakoutLevel, color=color.new(color.green, 0), title="Long Breakout Level", style=plot.style_linebr)

plot(shortBreakoutLevel, color=color.new(color.red, 0), title="Short Breakout Level", style=plot.style_linebr)

plot(emaVal, color=color.blue, title="EMA")

// Optionally, shade the background: green when price is above the EMA (bullish) and red when below.

bgcolor(close > emaVal ? color.new(color.green, 90) : color.new(color.red, 90), title="Trend Background")