Overview

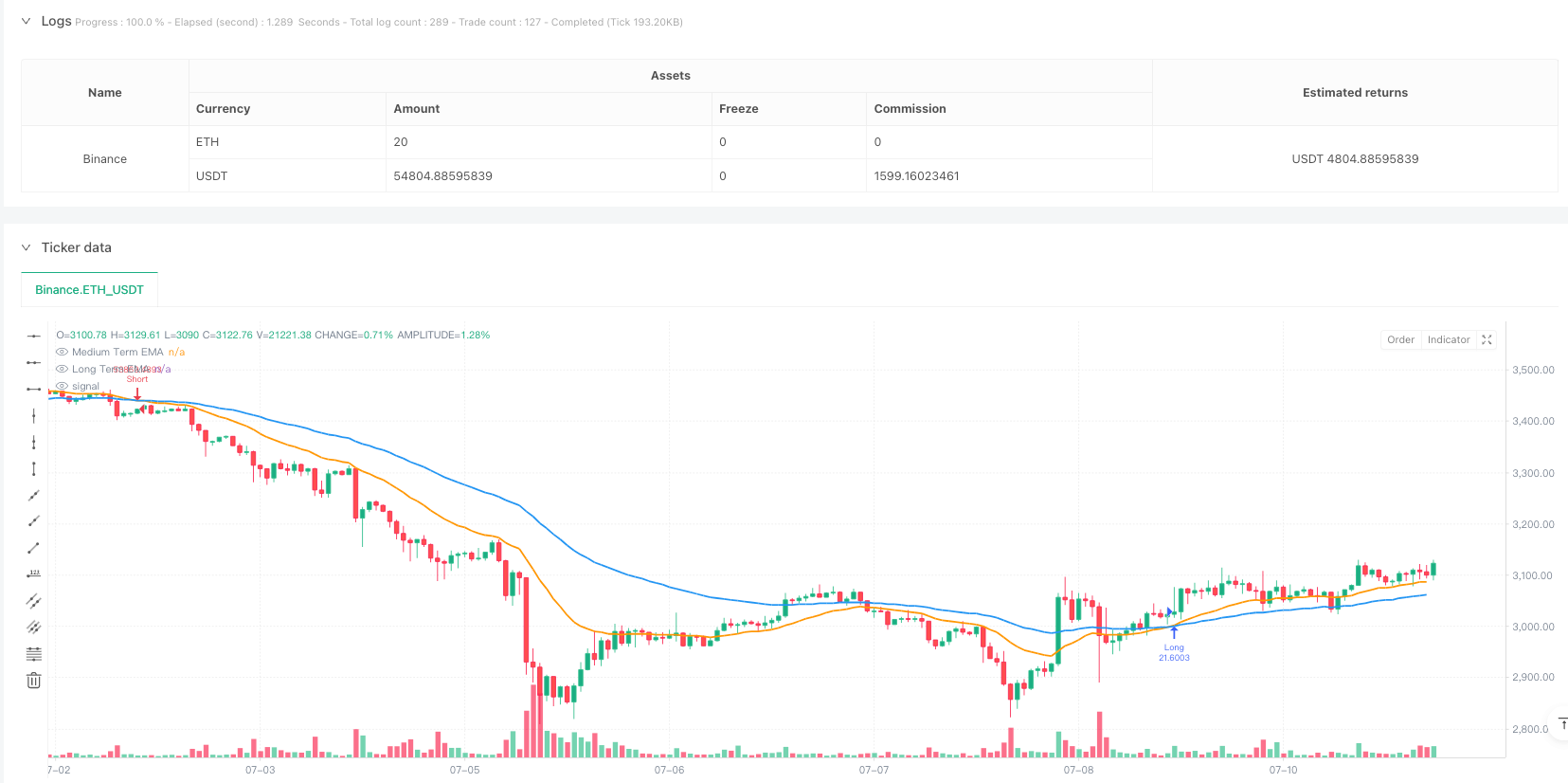

This strategy is a trading system based on medium and long-term Exponential Moving Average (EMA) crossovers, incorporating dynamic position management and risk control mechanisms. The strategy identifies market trends through the crossover of 21-period and 55-period EMAs while dynamically adjusting position sizes based on user-defined risk-reward ratios and risk percentages, achieving precise risk control.

Strategy Principles

The core logic is built on EMA crossover signals from two time periods. When the 21-period EMA crosses above the 55-period EMA, the system identifies an uptrend and triggers a long signal; when the 21-period EMA crosses below the 55-period EMA, it identifies a downtrend and triggers a short signal. Stop-loss levels are set at the lowest point (for longs) or highest point (for shorts) of the past two candles, while take-profit levels are dynamically calculated based on the user-defined risk-reward ratio. Position sizing is dynamically calculated based on total account equity, risk percentage, and current stop-loss distance, ensuring risk control within preset parameters.

Strategy Advantages

- Dynamic Risk Management: Position sizes are dynamically calculated to ensure strict risk control within set percentage parameters.

- High Adaptability: EMA indicators adapt to market volatility, reducing false signals.

- Adjustable Risk-Reward Ratio: Users can set risk-reward ratios according to their risk preferences.

- Scientific Position Management: Positions are dynamically adjusted based on account size and risk distance, avoiding excessive leverage.

- Fully Automated Operation: Strategy can run 24⁄7 without manual intervention.

Strategy Risks

- Choppy Market Risk: EMA crossover signals may generate frequent false signals in ranging markets.

- Slippage Risk: Actual execution prices may significantly differ from signal prices in fast-moving markets.

- Money Management Risk: Despite risk controls, consecutive losses may still significantly impact the account.

- Systemic Risk: Sudden market events may render stop-losses ineffective.

Strategy Optimization Directions

- Add Trend Filters: Incorporate ADX or trend strength indicators to filter ranging market conditions.

- Optimize Stop-Loss Method: Consider using ATR for dynamic stop-loss adjustment to improve adaptability.

- Incorporate Volatility Adjustment: Dynamically adjust risk parameters based on market volatility.

- Time Filtering: Add trading time filters to avoid low liquidity periods.

- Include Volume Indicators: Integrate volume indicators to validate trend validity.

Summary

This strategy constructs a complete trading system by combining EMA trend signals with dynamic risk management. Its core advantages lie in scientific position management and risk control mechanisms, but it still requires appropriate parameter optimization based on market conditions and individual risk preferences. Through the suggested optimization directions, the strategy’s stability and profitability can be further enhanced.

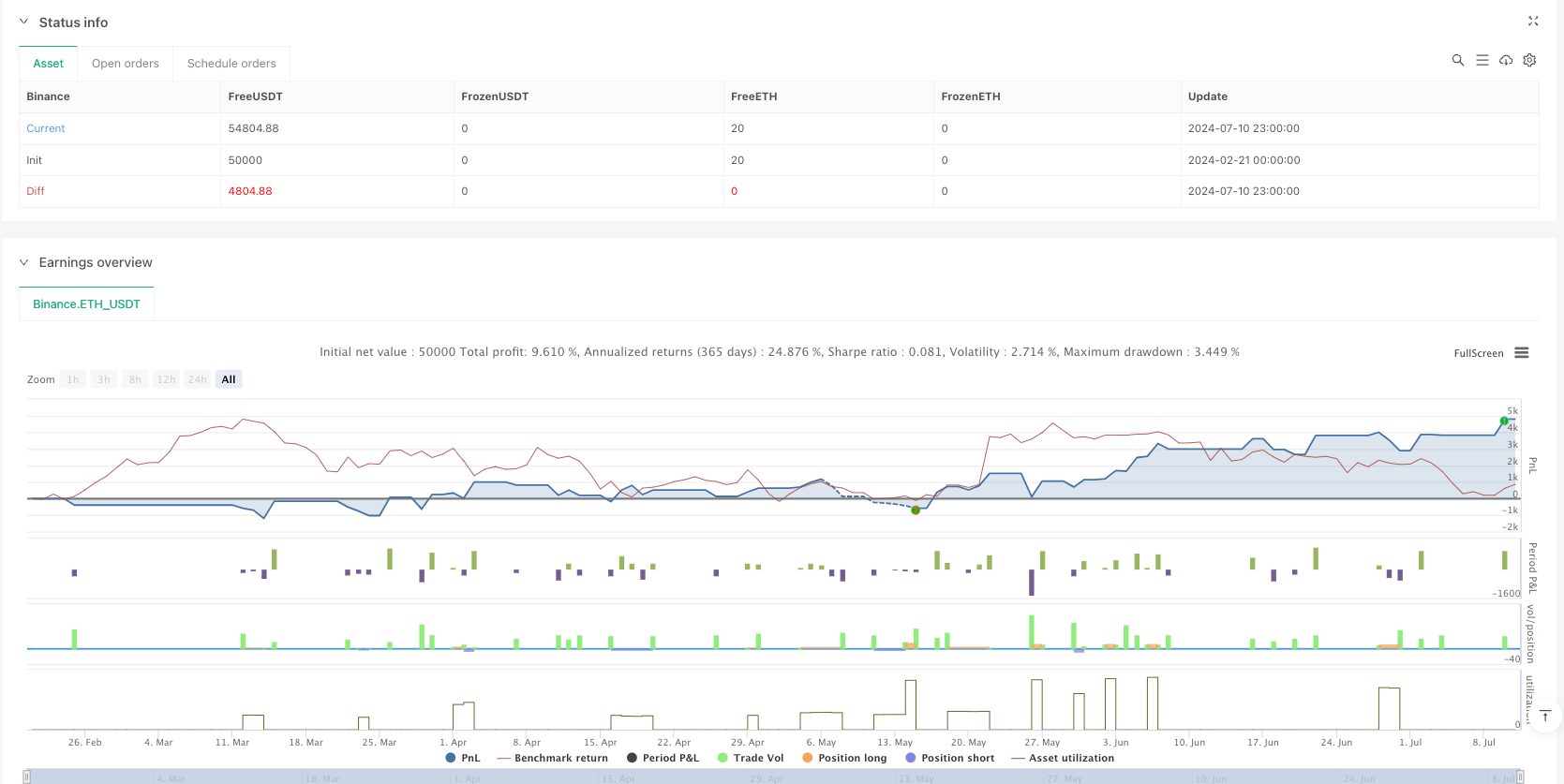

/*backtest

start: 2024-02-21 00:00:00

end: 2024-07-11 00:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Binance","currency":"ETH_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Carlos Humberto Rodríguez Arias

//@version=5

strategy("EMA Crossover Strategy", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=10)

// EMA periods

MT_EMA = input.int(21, title="Medium Term EMA")

LT_EMA = input.int(55, title="Long Term EMA")

RR = input.float(2.0, title="Risk-Reward Ratio") // User-defined RR

RiskPercent = input.float(1.0, title="Risk Percentage") // User-defined risk percentage

// Calculate EMAs

Signal_MT_EMA = ta.ema(close, MT_EMA)

Signal_LT_EMA = ta.ema(close, LT_EMA)

// Plot EMAs

plot(Signal_MT_EMA, title="Medium Term EMA", color=color.orange, linewidth=2)

plot(Signal_LT_EMA, title="Long Term EMA", color=color.blue, linewidth=2)

// Determine trend conditions

uptrend = ta.crossover(Signal_MT_EMA, Signal_LT_EMA)

downtrend = ta.crossunder(Signal_MT_EMA, Signal_LT_EMA)

// Stop-Loss Calculations

longStopLoss = ta.lowest(low, 2) // SL for buy = lowest low of last 2 candles

shortStopLoss = ta.highest(high, 2) // SL for sell = highest high of last 2 candles

// Take-Profit Calculations

longTakeProfit = close + (close - longStopLoss) * RR

shortTakeProfit = close - (shortStopLoss - close) * RR

// Calculate Position Size based on Risk Percentage

capital = strategy.equity * (RiskPercent / 100)

longPositionSize = capital / (close - longStopLoss)

shortPositionSize = capital / (shortStopLoss - close)

// Execute Buy Order

if uptrend

strategy.entry("Long", strategy.long, qty=longPositionSize)

strategy.exit("Long Exit", from_entry="Long", stop=longStopLoss, limit=longTakeProfit)

// Execute Sell Order

if downtrend

strategy.entry("Short", strategy.short, qty=shortPositionSize)

strategy.exit("Short Exit", from_entry="Short", stop=shortStopLoss, limit=shortTakeProfit)