Overview

This strategy is a trading system based on market maker behavior and institutional-level liquidity analysis. It identifies high-probability trading opportunities by tracking market liquidity indicators, order book imbalances, and market maker footprints. The strategy combines Dynamic Cost Averaging (DCAA) with a hedge flow system to minimize risks and maximize returns. The system completely abandons traditional technical indicators in favor of institutional-level market microstructure analysis.

Strategy Principles

The core of the strategy is tracking market maker behavior through multi-dimensional data: 1. Using VWAP (Volume Weighted Average Price) to confirm institutional absorption/distribution positions 2. Analyzing CVD (Cumulative Volume Delta) to detect actual strength comparison between bulls and bears 3. Combining order book data to identify liquidity traps and stop-loss hunting zones 4. Implementing dynamic cost averaging method to establish staged position building at key support levels 5. Utilizing a hedging system for risk management during extreme market volatility

Strategy Advantages

- Entirely based on market microstructure, avoiding the lag of technical indicators

- Ability to predict large price movements in advance through market maker behavior analysis

- Dynamic cost averaging system enables gradual position building during downtrends, reducing overall position cost

- Hedging system provides additional risk protection, especially during periods of extreme market volatility

- Strategy can adapt to market conditions in real-time, not relying on static support/resistance levels

Strategy Risks

- Requires high-quality real-time market data, sensitive to data latency

- May struggle to accurately judge market maker intentions during extremely low liquidity periods

- Over-reliance on market maker behavior analysis may lead to false signals under certain market conditions

- Dynamic cost averaging system may accumulate significant losses in continuously declining markets

- Hedging strategy costs may erode profits in ranging markets

Optimization Directions

- Introduce machine learning algorithms to improve market maker behavior identification accuracy

- Optimize capital allocation ratios in the dynamic cost averaging system

- Add more market microstructure indicators to enhance signal reliability

- Develop adaptive hedge ratio adjustment mechanisms

- Establish more comprehensive risk control systems, especially under extreme market conditions

Summary

This is an institutional-grade trading strategy built on market microstructure foundations. Through deep analysis of market maker behavior, combined with dynamic cost averaging and hedging systems, the strategy maintains stability across different market environments. While implementation faces some technical and operational challenges, its core concepts and methodology have solid market microstructure foundations, showing potential for long-term stable profitability.

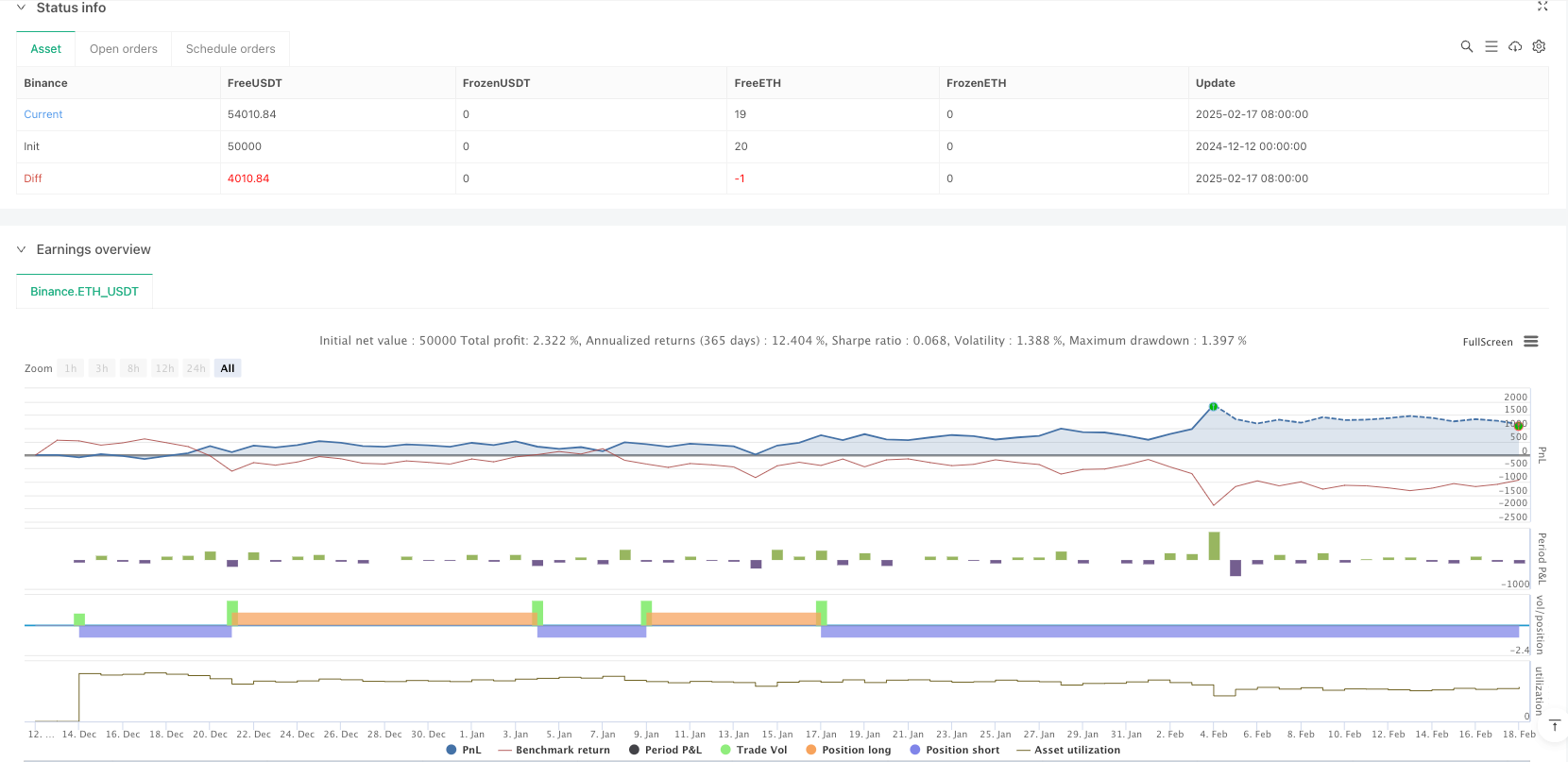

/*backtest

start: 2024-12-12 00:00:00

end: 2025-02-18 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Binance","currency":"ETH_USDT"}]

*/

//@version=6

strategy("EDGE Market Maker Strategy – DCAA & HedgeFlow", overlay=true)

// ✅ Import Indicators

vwapLine = ta.vwap

superTrend = ta.sma(close, 10) // Replace with actual Supertrend formula if needed

volData = volume // Volume from current timeframe

cvdData = ta.cum(close - close[1]) // Approximation of CVD (Cumulative Volume Delta)

orderBlockHigh = ta.highest(high, 20) // Approximate Order Block Detection

orderBlockLow = ta.lowest(low, 20)

// ✅ Market Maker Buy Conditions

longCondition = ta.crossover(close, vwapLine) and cvdData > cvdData[1] and volData > volData[1]

if longCondition

strategy.entry("BUY", strategy.long)

// ✅ Market Maker Sell Conditions

shortCondition = ta.crossunder(close, vwapLine) and cvdData < cvdData[1] and volData > volData[1]

if shortCondition

strategy.entry("SELL", strategy.short)

// ✅ Order Block Confirmation (For Stronger Signals)

longOB = longCondition and close > orderBlockHigh

shortOB = shortCondition and close < orderBlockLow

if longOB

label.new(bar_index, high, "BUY (Order Block)", color=color.green, textcolor=color.white, style=label.style_label_down)

if shortOB

label.new(bar_index, low, "SELL (Order Block)", color=color.red, textcolor=color.white, style=label.style_label_up)

// ✅ DCAA Levels – Adaptive Re-Entry Strategy

dcaaBuy1 = close * 0.97 // First re-entry for long position (3% drop)

dcaaBuy2 = close * 0.94 // Second re-entry for long position (6% drop)

dcaaSell1 = close * 1.03 // First re-entry for short position (3% rise)

dcaaSell2 = close * 1.06 // Second re-entry for short position (6% rise)

if longCondition

strategy.entry("DCAA_BUY_1", strategy.long, limit=dcaaBuy1)

strategy.entry("DCAA_BUY_2", strategy.long, limit=dcaaBuy2)

if shortCondition

strategy.entry("DCAA_SELL_1", strategy.short, limit=dcaaSell1)

strategy.entry("DCAA_SELL_2", strategy.short, limit=dcaaSell2)

// ✅ HedgeFlow System – Dynamic Hedge Adjustments

hedgeLong = ta.crossunder(close, superTrend) and cvdData < cvdData[1] and volData > volData[1]

hedgeShort = ta.crossover(close, superTrend) and cvdData > cvdData[1] and volData > volData[1]

if hedgeLong

strategy.entry("HEDGE_LONG", strategy.long)

if hedgeShort

strategy.entry("HEDGE_SHORT", strategy.short)

// ✅ Take Profit & Stop Loss

tpLong = close * 1.05

tpShort = close * 0.95

slLong = close * 0.97

slShort = close * 1.03

strategy.exit("TP_Long", from_entry="BUY", limit=tpLong, stop=slLong)

strategy.exit("TP_Short", from_entry="SELL", limit=tpShort, stop=slShort)

// ✅ Plot VWAP & Supertrend for Reference

plot(vwapLine, title="VWAP", color=color.blue, linewidth=2)

plot(superTrend, title="Supertrend", color=color.orange, linewidth=2)