Overview

This is a trading strategy based on support and resistance zone breakouts, incorporating trend filtering and risk management systems. The strategy dynamically identifies key price levels to determine potential trading opportunities and uses moving averages to confirm market trend direction. It employs a conservative money management approach, limiting risk to 1% of account capital per trade, while using a 2:1 reward-to-risk ratio for profit targets.

Strategy Principles

The core logic includes several key components: 1. Using pivot highs and lows to identify potential support and resistance zones 2. Creating support/resistance zones through price offset percentages 3. Utilizing a 200-day moving average as a trend filter 4. Confirming breakout validity through candlestick patterns 5. Implementing strict money management rules to control risk per trade The system enters long positions when price breaks above resistance in an uptrend and short positions when price breaks below support in a downtrend.

Strategy Advantages

- Dynamic Market Structure Recognition - Automatically identifies and updates important price levels, adapting to market changes

- Multiple Confirmation Mechanisms - Combines trend filtering and candlestick confirmation to reduce false breakout risks

- Comprehensive Risk Management - Uses fixed risk rules to protect account capital

- Clear Profit Objectives - Implements 2:1 reward-to-risk ratio for profit targets

- Visualized Trading Signals - Clearly displays support/resistance zones and stop-loss levels on charts

Strategy Risks

- Market Volatility Risk - Slippage during high volatility periods may affect actual trading results

- Trend Reversal Risk - Market might quickly reverse after breakout, triggering stop-loss

- Parameter Optimization Risk - Over-optimization may lead to overfitting

- Money Management Risk - Consecutive losses may impact account growth Suggested to manage these risks through backtesting different market conditions and adjusting parameters accordingly.

Strategy Optimization Directions

- Dynamic Zone Width Adjustment - Automatically adjust zone ranges based on market volatility

- Add Volume Confirmation - Incorporate volume filters in breakout signals

- Enhance Trend Filter - Consider multi-timeframe trend confirmation

- Improve Profit-Taking Strategy - Implement dynamic profit targets based on market conditions

- Add Time Filters - Avoid trading during highly volatile market periods

Summary

This is a well-structured trading strategy that combines technical analysis and risk management principles to provide a systematic trading approach. Its strengths lie in comprehensive trading rules and strict risk control, but traders need to understand its limitations and make appropriate optimizations based on actual trading conditions. Through continuous improvement and validation, the strategy has the potential to maintain stable performance across different market environments.

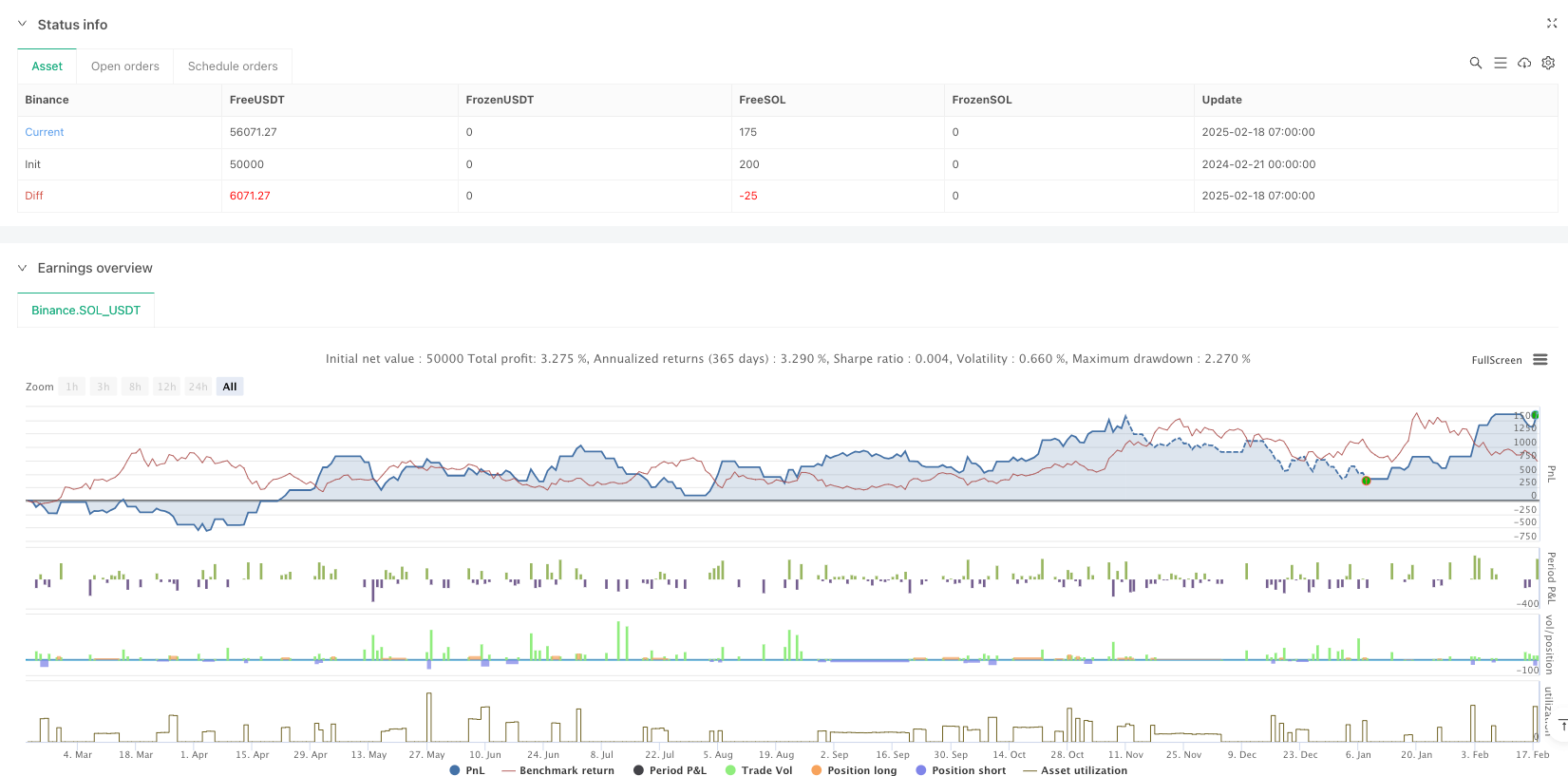

/*backtest

start: 2024-02-21 00:00:00

end: 2025-02-18 08:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Binance","currency":"SOL_USDT"}]

*/

//@version=5

strategy("支撑/阻力区域突破策略(2倍止盈 + 蜡烛确认 + 趋势过滤)", overlay=true, initial_capital=10000, currency=currency.USD, pyramiding=0, calc_on_order_fills=true, calc_on_every_tick=true)

// 用户输入设置

pivotLen = input.int(title="枢轴识别窗口长度", defval=5, minval=1)

zoneOffsetPercent = input.float(title="区域偏移百分比 (%)", defval=0.1, step=0.1)

maLength = input.int(200, title="移动平均线周期")

// 趋势指标: 简单移动平均线(SMA)

trendMA = ta.sma(close, maLength)

// 识别高点和低点(枢轴高点/低点)

ph = ta.pivothigh(high, pivotLen, pivotLen)

pl = ta.pivotlow(low, pivotLen, pivotLen)

// 存储最近的阻力位和支撑位

var float resistanceLevel = na

var int resistanceBar = na

if not na(ph)

resistanceLevel := ph

resistanceBar := bar_index - pivotLen

var float supportLevel = na

var int supportBar = na

if not na(pl)

supportLevel := pl

supportBar := bar_index - pivotLen

// 将阻力和支撑区域绘制为区域框

if not na(resistanceLevel)

resOffset = resistanceLevel * (zoneOffsetPercent / 100)

resTop = resistanceLevel + resOffset

resBottom = resistanceLevel - resOffset

if not na(supportLevel)

supOffset = supportLevel * (zoneOffsetPercent / 100)

supTop = supportLevel + supOffset

supBottom = supportLevel - supOffset

// 风险管理: 定义资金、风险百分比和计算风险金额

riskCapital = 10000.0

riskPercent = 0.01

riskAmount = riskCapital * riskPercent // 1% of $10,000 = $100

// activeStop变量用于显示止损位

var float activeStop = na

if strategy.position_size == 0

activeStop := na

// 确定趋势方向

isUptrend = close > trendMA // 上升趋势(价格在MA之上)

isDowntrend = close < trendMA // 下降趋势(价格在MA之下)

// 定义突破蜡烛和确认蜡烛

var bool breakoutUp = false

var bool breakoutDown = false

if not na(resistanceLevel) and close[1] > resistanceLevel and open[1] < resistanceLevel

breakoutUp := true

else

breakoutUp := false

if not na(supportLevel) and close[1] < supportLevel and open[1] > supportLevel

breakoutDown := true

else

breakoutDown := false

// 突破确认: 下一根蜡烛必须在突破方向收盘

confirmLong = breakoutUp and close > close[1] and strategy.position_size == 0 and isUptrend

confirmShort = breakoutDown and close < close[1] and strategy.position_size == 0 and isDowntrend

// 做多入场: 确认蜡烛 + 在突破蜡烛低点设置止损

if confirmLong

entryPrice = close

stopLevelLong = low[1]

riskPerUnit = entryPrice - stopLevelLong

if riskPerUnit > 0

qty = riskAmount / riskPerUnit

activeStop := stopLevelLong

takeProfitLong = entryPrice + (riskPerUnit * 2) // 止盈设为止损的2倍

strategy.entry("Long", strategy.long, qty=qty)

strategy.exit("Exit Long", from_entry="Long", stop=stopLevelLong, limit=takeProfitLong)

// 做空入场: 确认蜡烛 + 在突破蜡烛高点设置止损

if confirmShort

entryPrice = close

stopLevelShort = high[1]

riskPerUnit = stopLevelShort - entryPrice

if riskPerUnit > 0

qty = riskAmount / riskPerUnit

activeStop := stopLevelShort

takeProfitShort = entryPrice - (riskPerUnit * 2) // 止盈设为止损的2倍

strategy.entry("Short", strategy.short, qty=qty)

strategy.exit("Exit Short", from_entry="Short", stop=stopLevelShort, limit=takeProfitShort)

// 当有持仓时在图表上显示止损线(水平线)

plot(strategy.position_size != 0 ? activeStop : na, title="止损线", color=color.red, linewidth=2, style=plot.style_line)

// 在图表上显示移动平均线

plot(trendMA, title="趋势MA", color=color.blue, linewidth=2)