Overview

This strategy is a trading system based on volume anomalies and RSI indicators. It identifies potential trading opportunities by monitoring volume breakouts and RSI overbought/oversold levels, combined with price action confirmation. The strategy employs dynamic stop-loss and take-profit targets to optimize risk-reward configuration.

Strategy Principles

The core logic includes several key elements: 1. Volume Verification: Uses 20-period SMA to calculate average volume, triggering volume spike signals when real-time volume exceeds 1.5 times the average 2. RSI Indicator: Employs 14-period RSI for overbought/oversold detection, with RSI<30 considered oversold and RSI>70 overbought 3. Entry Conditions: - Long: Volume spike + RSI oversold + closing price above opening price - Short: Volume spike + RSI overbought + closing price below opening price 4. Risk Management: Uses ATR for dynamic stop-loss calculation and automatically determines profit targets based on set risk-reward ratio (1:2)

Strategy Advantages

- Multiple Confirmation Mechanism: Combines volume, RSI, and price action dimensions for trade confirmation, improving signal reliability

- Dynamic Risk Management: Adjusts stop-loss positions through ATR, better adapting to market volatility changes

- All-Session Applicability: Not restricted by time, capable of capturing trading opportunities around the clock

- High Customizability: Key parameters like RSI thresholds, volume multiplier, risk-reward ratio can be adjusted according to specific needs

- Clear Visualization: Marks trading signals with background colors, facilitating strategy monitoring and backtesting analysis

Strategy Risks

- False Breakout Risk: Volume spikes may arise from market noise, requiring optimization through volume multiplier parameter adjustment

- Off-Hours Risk: During periods of low market liquidity, slippage or execution difficulties may occur

- Market Environment Dependency: Strategy may perform better in trending markets than ranging markets

- Parameter Sensitivity: Multiple key parameter settings significantly affect strategy performance, requiring thorough testing

Strategy Optimization Directions

- Market State Recognition: Add market condition assessment mechanism to use different parameter settings under different market conditions

- Signal Filtering: Add trend filters, such as moving average systems, to improve trade direction accuracy

- Position Management: Introduce dynamic position sizing mechanism, adjusting position size based on market volatility

- Volume Analysis Enhancement: Incorporate volume pattern analysis, such as volume up/down ratio indicators, to improve volume anomaly detection accuracy

- Liquidity Assessment: Add liquidity evaluation indicators to adjust or pause trading during periods of insufficient liquidity

Summary

The strategy integrates multiple classic technical indicators to build a logically rigorous trading system. Its strengths lie in multiple confirmation mechanisms and comprehensive risk management system, while attention needs to be paid to false breakouts and off-hours risks. Through continuous optimization and improvement, the strategy shows promise for stable performance in actual trading.

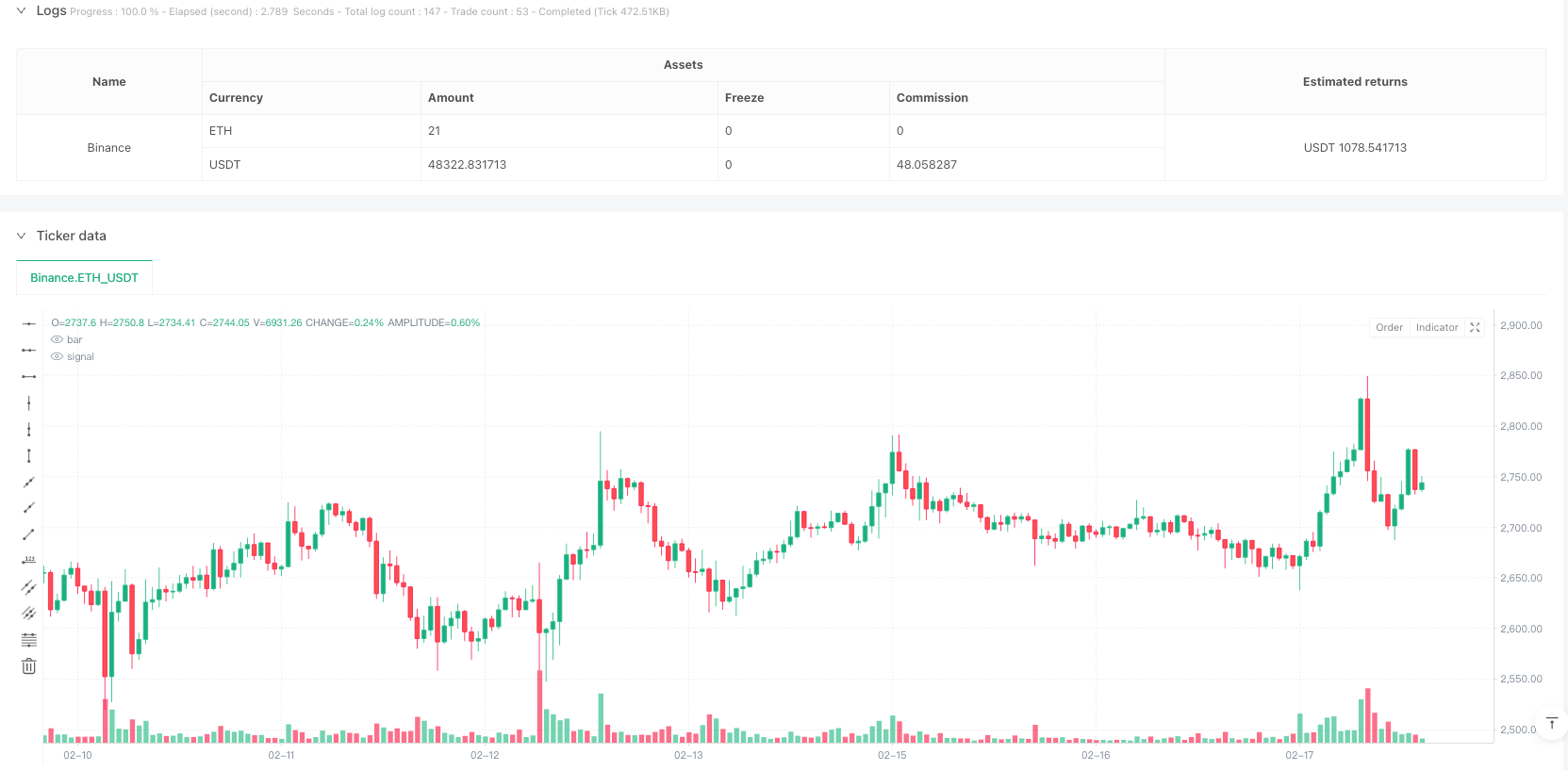

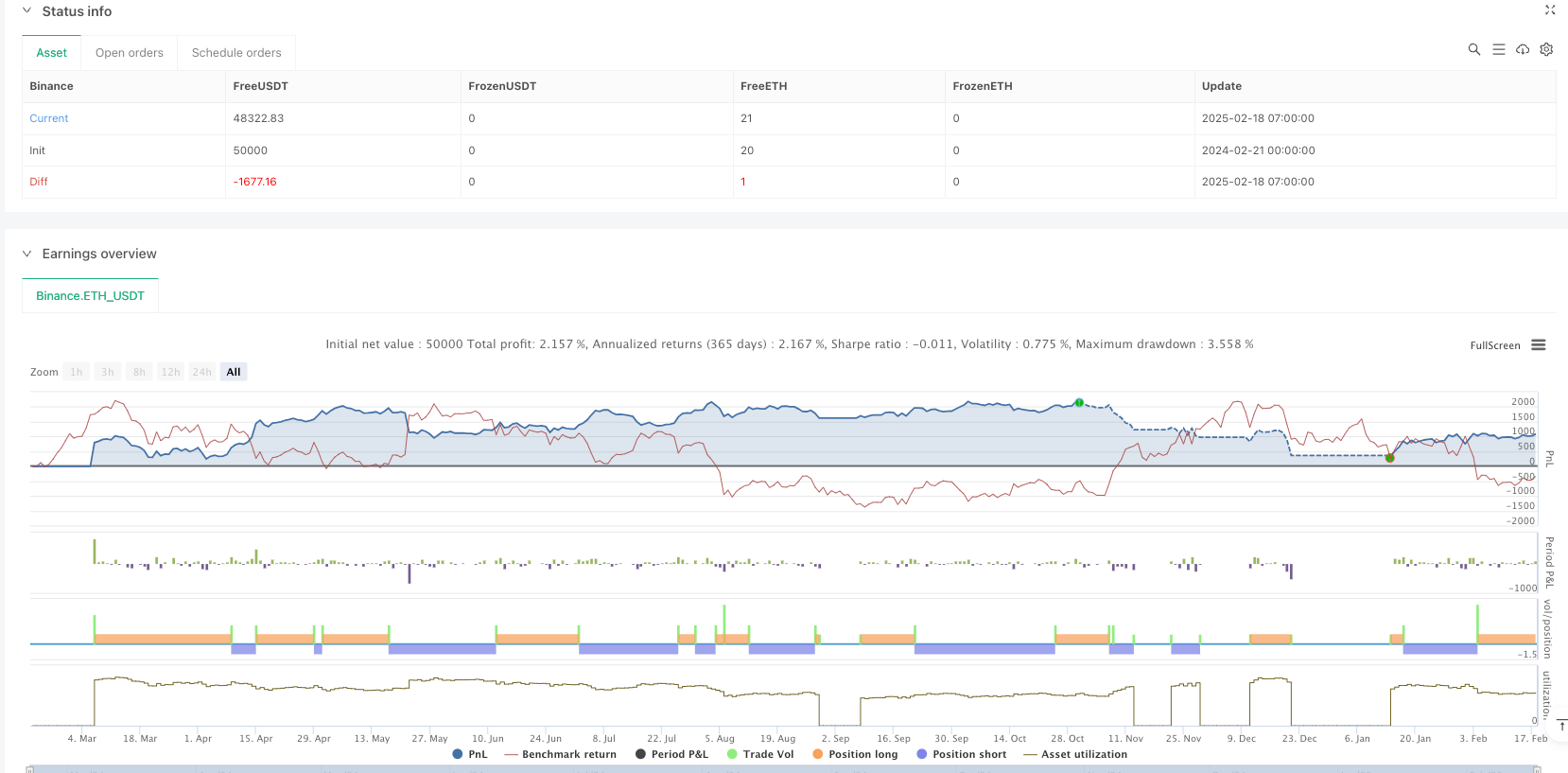

/*backtest

start: 2024-02-21 00:00:00

end: 2025-02-18 08:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Binance","currency":"ETH_USDT"}]

*/

//@version=6

strategy("Volume Spike & RSI Scalping (Session Restricted)", overlay=true)

// Inputs

rsi_length = input(14, title="RSI Length")

overSold = input(30, title="RSI Oversold Level")

overBought = input(70, title="RSI Overbought Level")

volume_threshold = input(1.5, title="Volume Spike Multiplier (e.g., 1.5x avg volume)")

risk_reward_ratio = input(2.0, title="Risk-Reward Ratio (1:X)")

atr_length = input(14, title="ATR Length")

// RSI Calculation

vrsi = ta.rsi(close, rsi_length)

// Volume Spike Detection

avg_volume = ta.sma(volume, 20)

volume_spike = volume > avg_volume * volume_threshold

// Entry Signals Based on RSI and Volume

long_condition = volume_spike and vrsi < overSold and close > open // Bullish price action

short_condition = volume_spike and vrsi > overBought and close < open // Bearish price action

// Execute Trades

if (long_condition)

stop_loss = low - ta.atr(atr_length)

take_profit = close + (close - stop_loss) * risk_reward_ratio

strategy.entry("Buy", strategy.long, comment="Buy Signal")

strategy.exit("Take Profit/Stop Loss", "Buy", stop=stop_loss, limit=take_profit)

if (short_condition)

stop_loss = high + ta.atr(atr_length)

take_profit = close - (stop_loss - close) * risk_reward_ratio

strategy.entry("Sell", strategy.short, comment="Sell Signal")

strategy.exit("Take Profit/Stop Loss", "Sell", stop=stop_loss, limit=take_profit)

// Background Highlighting for Signals

bgcolor(long_condition ? color.new(color.green, 85) : na, title="Long Signal Background")

bgcolor(short_condition ? color.new(color.red, 85) : na, title="Short Signal Background")