Overview

This strategy is a trading signal generation system based on multiple technical indicator collaborative analysis. The strategy integrates four classic technical indicators: Relative Strength Index (RSI), Bollinger Bands (BB), Intraday Momentum Index (IMI), and Money Flow Index (MFI), utilizing cross-validation between indicators to generate more reliable trading signals. The strategy is specifically designed for 4-hour timeframes and classifies signals into regular and strong levels based on signal strength.

Strategy Principle

The core logic of the strategy is to confirm trading signals through the collaboration of multiple indicators. Specifically: 1. Buy Signal Trigger Conditions: - RSI below 30, indicating oversold market - Price below lower Bollinger Band, showing significant price deviation - IMI below 30, indicating weakening downward intraday momentum - MFI below 20, showing reduced selling pressure 2. Sell Signal Trigger Conditions: - RSI above 70, indicating overbought market - Price above upper Bollinger Band, showing significant price deviation - IMI above 70, indicating weakening upward intraday momentum - MFI above 80, showing reduced buying pressure 3. Strong signal conditions further tighten threshold requirements based on regular signals

Strategy Advantages

- Multiple technical indicators cross-validation significantly improves signal reliability

- Distinguishes between regular and strong signals for flexible position adjustment

- Clear and simple strategy logic, easy to understand and maintain

- Adjustable indicator parameters, strong adaptability

- Integrated backtesting functionality for strategy optimization

Strategy Risks

- Multiple indicator collaboration may lead to signal lag Solution: Appropriately relax trigger conditions or introduce trend prediction indicators

- Fixed thresholds may not be suitable in different market environments Solution: Introduce adaptive threshold mechanism

- 4-hour timeframe may miss short-term opportunities Solution: Add multiple timeframe analysis

Strategy Optimization Directions

- Introduce adaptive threshold mechanism Dynamically adjust signal thresholds by calculating historical percentiles of indicators

- Add trend strength filtering Introduce trend strength indicators like ADX to filter false signals in ranging markets

- Optimize position management Dynamically adjust position size based on signal strength and market volatility

- Add stop-loss and take-profit mechanism Set dynamic stop-loss and take-profit levels based on ATR

Summary

This strategy constructs a relatively reliable trading signal generation system through the collaborative analysis of multiple classic technical indicators. The strategy design emphasizes practicality and maintainability while leaving ample room for optimization. Through reasonable parameter adjustment and implementation of optimization directions, the strategy shows promise for stable performance in actual trading.

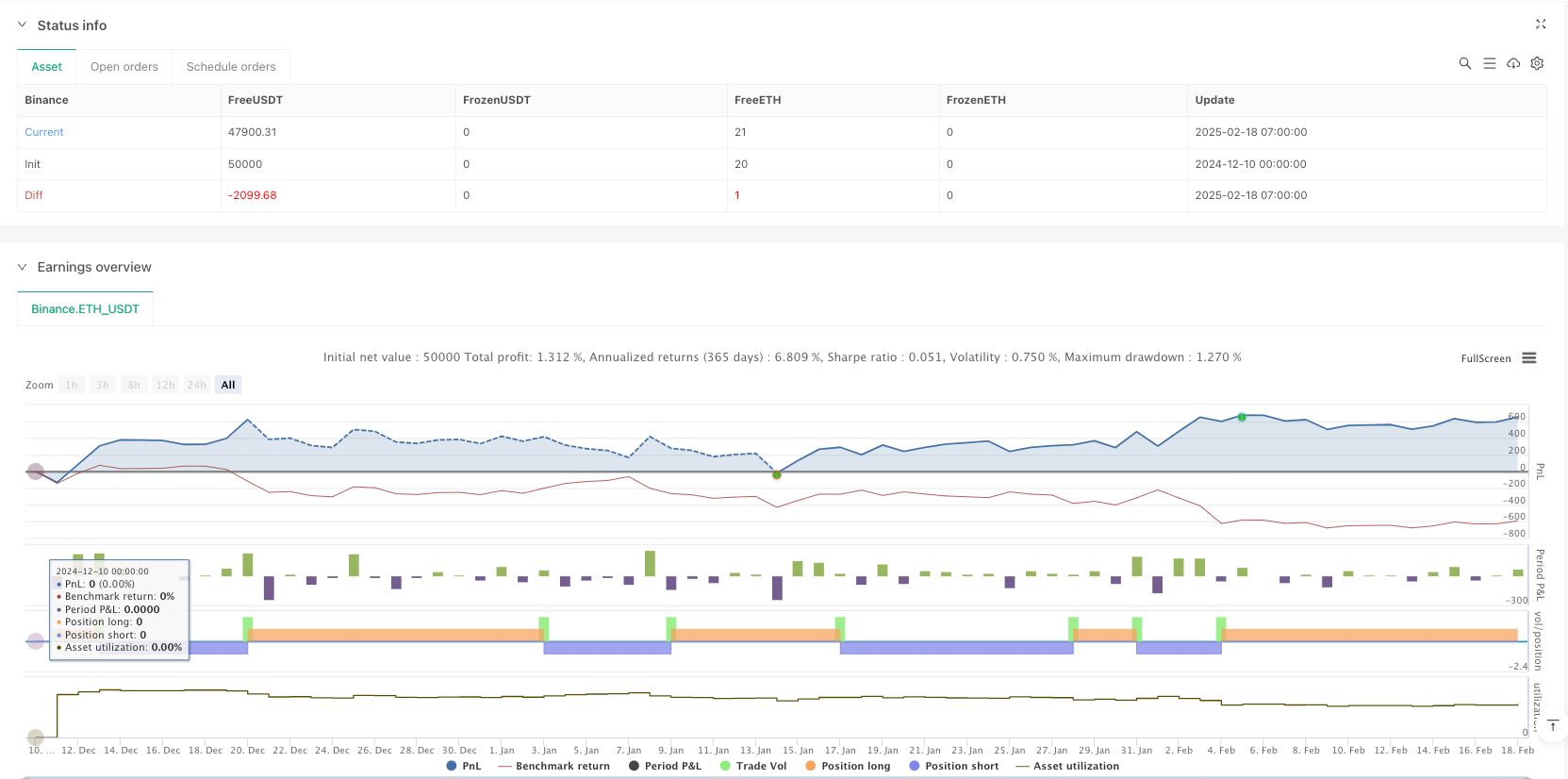

/*backtest

start: 2024-12-10 00:00:00

end: 2025-02-18 08:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Binance","currency":"ETH_USDT"}]

*/

//@version=5

strategy("Clear Buy/Sell Signals with RSI, Bollinger Bands, IMI, and MFI", overlay=true)

// Input parameters

rsiLength = input.int(14, title="RSI Length")

bbLength = input.int(20, title="Bollinger Bands Length")

bbStdDev = input.float(2.0, title="Bollinger Bands Std Dev")

imiLength = input.int(14, title="IMI Length")

mfiLength = input.int(14, title="MFI Length")

// RSI Calculation

rsi = ta.rsi(close, rsiLength)

// Bollinger Bands Calculation

[bbUpper, bbMiddle, bbLower] = ta.bb(close, bbLength, bbStdDev)

// Intraday Momentum Index (IMI) Calculation

upSum = math.sum(close > open ? close - open : 0, imiLength)

downSum = math.sum(close < open ? open - close : 0, imiLength)

imi = (upSum / (upSum + downSum)) * 100

// Money Flow Index (MFI) Calculation

typicalPrice = (high + low + close) / 3

mfi = ta.mfi(typicalPrice, mfiLength)

// Buy/Sell Conditions

buyCondition = rsi < 30 and close < bbLower and imi < 30 and mfi < 20

sellCondition = rsi > 70 and close > bbUpper and imi > 70 and mfi > 80

// Strong Buy/Sell Conditions

strongBuyCondition = rsi < 20 and close < bbLower and imi < 20 and mfi < 10

strongSellCondition = rsi > 80 and close > bbUpper and imi > 80 and mfi > 90

// Plot Buy/Sell Signals

plotshape(series=buyCondition, title="Buy Signal", location=location.belowbar, color=color.green, style=shape.labelup, text="BUY", size=size.small)

plotshape(series=sellCondition, title="Sell Signal", location=location.abovebar, color=color.red, style=shape.labeldown, text="SELL", size=size.small)

// Plot Strong Buy/Sell Signals

plotshape(series=strongBuyCondition, title="Strong Buy Signal", location=location.belowbar, color=color.lime, style=shape.labelup, text="STRONG BUY", size=size.normal)

plotshape(series=strongSellCondition, title="Strong Sell Signal", location=location.abovebar, color=color.red, style=shape.labeldown, text="STRONG SELL", size=size.normal)

// Strategy Logic (for Backtesting)

if (buyCondition or strongBuyCondition)

strategy.entry("Buy", strategy.long)

if (sellCondition or strongSellCondition)

strategy.entry("Sell", strategy.short)