Overview

This strategy is a trend following system that combines multiple technical indicators. It primarily uses cross signals from RSI, MACD and SMA to determine trading direction, while using the ATR indicator to dynamically adjust stop-loss and take-profit levels. The strategy also incorporates a volume filter to ensure trading under sufficient market liquidity and employs partial profit-taking mechanisms to optimize money management.

Strategy Principles

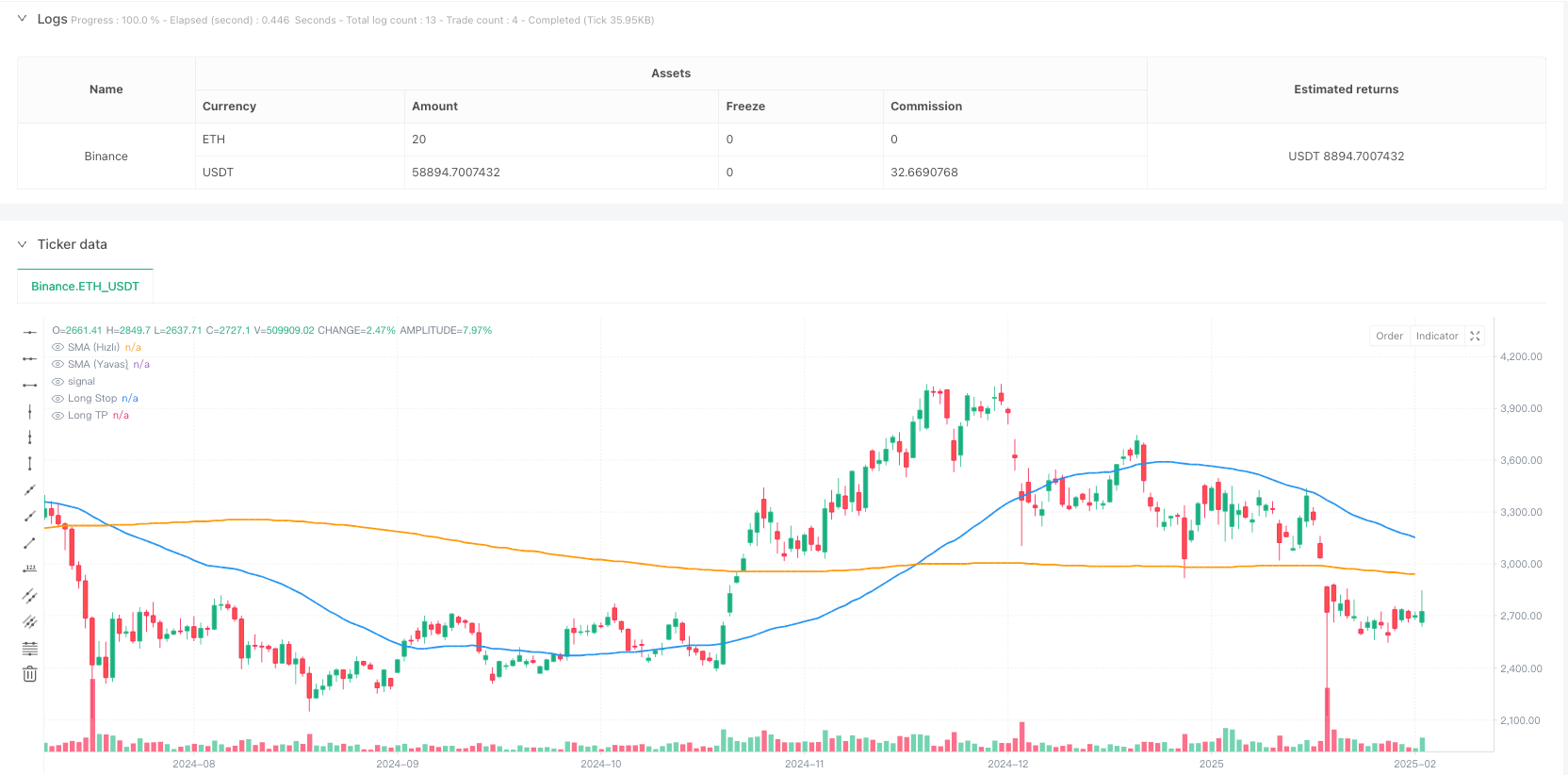

The strategy employs a triple verification mechanism to confirm trading signals: 1. Determines main trend direction through the relationship between 50 and 200-day moving averages 2. Uses RSI crosses in overbought/oversold zones to find entry points 3. Confirms trend momentum with MACD indicator 4. Uses volume filter to ensure adequate market liquidity 5. Employs ATR-based dynamic stop-loss and profit targets

The multiple verifications aim to reduce false signals and improve trading accuracy. The strategy opens positions when long conditions are met (uptrend + RSI crosses above 40 + MACD up + volume confirmation) and uses 2x ATR for stop-loss and 4x ATR for take-profit.

Strategy Advantages

- Multiple technical indicator cross-verification effectively reduces false signals

- Dynamic volatility-based stop-loss mechanism adapts to different market conditions

- Partial profit-taking strategy locks in profits while maintaining upside potential

- Volume filtering ensures sufficient market liquidity

- Comprehensive risk management system including fixed stops, trailing stops and partial profits

Strategy Risks

- Multiple indicators may cause missed trading opportunities

- May suffer larger drawdowns in highly volatile markets

- Parameter optimization may lead to overfitting

- Volume filtering might miss good opportunities in low liquidity markets

- Dynamic stops may trigger too early during high volatility periods

Optimization Directions

- Consider adding market volatility adaptation mechanism to dynamically adjust parameters in different volatility environments

- Introduce multi-timeframe analysis to improve trend determination accuracy

- Optimize partial profit-taking ratios, adjusting take-profit strategy in different market conditions

- Add trend strength filter to avoid trading in weak trend environments

- Consider adding seasonality analysis to optimize trading timing

Summary

This is a comprehensive trend following strategy that establishes a robust trading system through the coordinated use of multiple technical indicators. The strategy’s main feature is its ability to adapt to market changes through dynamic stop-loss and profit mechanisms while maintaining safety. Although there are areas for optimization, the overall framework is sound and suitable for further refinement and live testing.

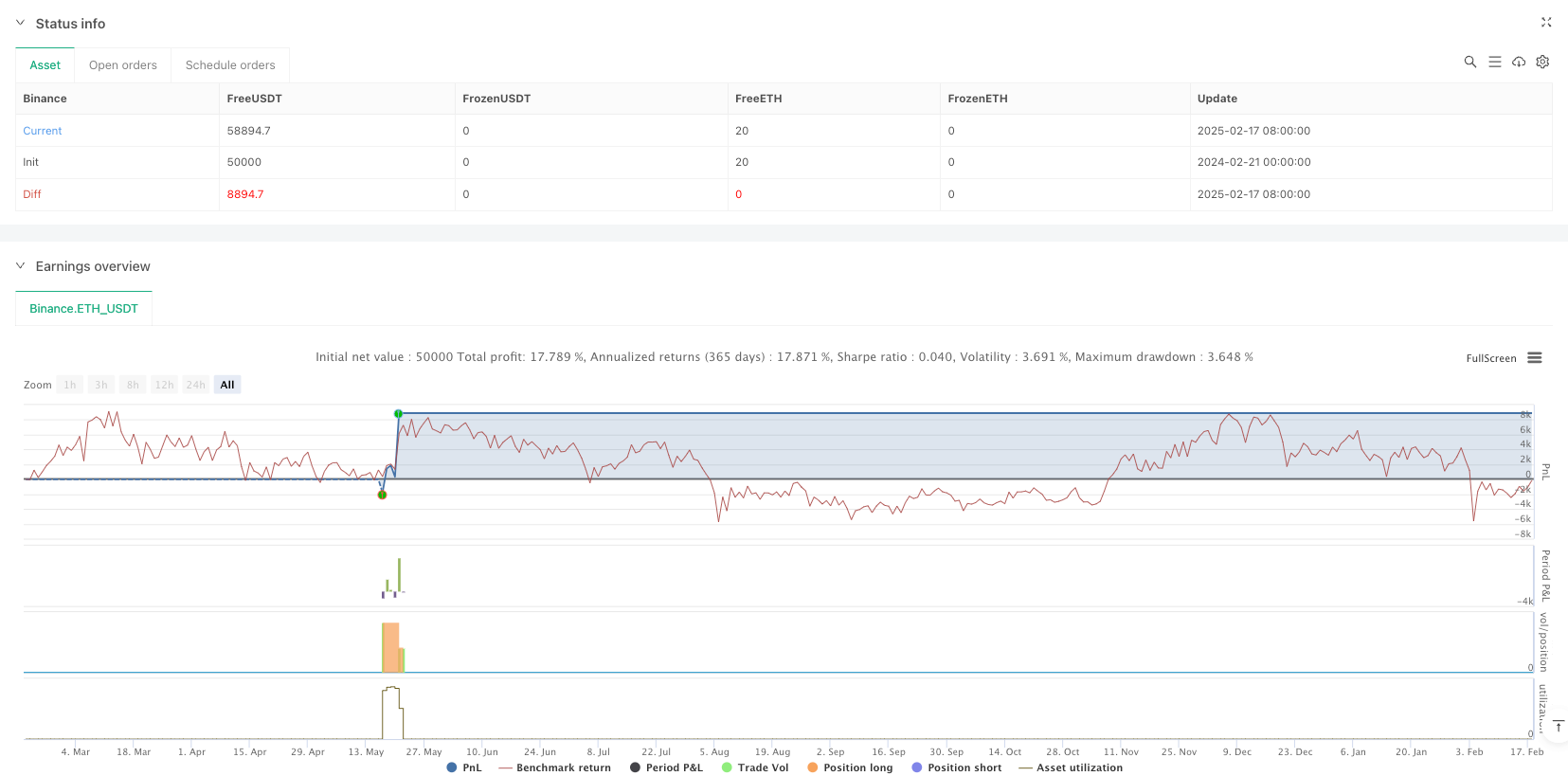

/*backtest

start: 2024-02-21 00:00:00

end: 2025-02-18 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Binance","currency":"ETH_USDT"}]

*/

//@version=5

strategy( title="AI Trade Strategy v2 (Extended) - Fixed", shorttitle="AI_Trade_v2", overlay=true, format=format.price, initial_capital=100000, default_qty_type=strategy.percent_of_equity, default_qty_value=100, pyramiding=0)

//============================================================================

//=== 1) Basic Indicators (SMA, RSI, MACD) ==================================

//============================================================================

// Time Filter (optional, you can update)

inDateRange = (time >= timestamp("2018-01-01T00:00:00")) and (time <= timestamp("2069-01-01T00:00:00"))

// RSI Parameters

rsiLength = input.int(14, "RSI Period")

rsiOB = input.int(60, "RSI Overbought Level")

rsiOS = input.int(40, "RSI Oversold Level")

rsiSignal = ta.rsi(close, rsiLength)

// SMA Parameters

smaFastLen = input.int(50, "SMA Fast Period")

smaSlowLen = input.int(200, "SMA Slow Period")

smaFast = ta.sma(close, smaFastLen)

smaSlow = ta.sma(close, smaSlowLen)

// MACD Parameters

fastLength = input.int(12, "MACD Fast Period")

slowLength = input.int(26, "MACD Slow Period")

signalLength = input.int(9, "MACD Signal Period")

[macdLine, signalLine, histLine] = ta.macd(close, fastLength, slowLength, signalLength)

//============================================================================

//=== 2) Additional Filter (Volume) ========================================

//============================================================================

useVolumeFilter = input.bool(true, "Use Volume Filter?")

volumeMaPeriod = input.int(20, "Volume MA Period")

volumeMa = ta.sma(volume, volumeMaPeriod)

// If volume filter is enabled, current bar volume should be greater than x times the average volume

volMultiplier = input.float(1.0, "Volume Multiplier (Volume > x * MA)")

volumeFilter = not useVolumeFilter or (volume > volumeMa * volMultiplier)

//============================================================================

//=== 3) Trend Conditions (SMA) ============================================

//============================================================================

isBullTrend = smaFast > smaSlow

isBearTrend = smaFast < smaSlow

//============================================================================

//=== 4) Entry Conditions (RSI + MACD + Trend + Volume) ====================

//============================================================================

// RSI crossing above 30 + Bullish Trend + Positive MACD + Volume Filter

longCondition = isBullTrend and ta.crossover(rsiSignal, rsiOS) and (macdLine > signalLine) and volumeFilter

shortCondition = isBearTrend and ta.crossunder(rsiSignal, rsiOB) and (macdLine < signalLine) and volumeFilter

//============================================================================

//=== 5) ATR-based Stop + Trailing Stop ===================================

//============================================================================

atrPeriod = input.int(14, "ATR Period")

atrMultiplierSL = input.float(2.0, "Stop Loss ATR Multiplier")

atrMultiplierTP = input.float(4.0, "Take Profit ATR Multiplier")

atrValue = ta.atr(atrPeriod)

//============================================================================

//=== 6) Trade (Position) Management ======================================

//============================================================================

if inDateRange

//--- Long Entry ---

if longCondition

strategy.entry(id="Long", direction=strategy.long, comment="Long Entry")

//--- Short Entry ---

if shortCondition

strategy.entry(id="Short", direction=strategy.short, comment="Short Entry")

//--- Stop & TP for Long Position ---

if strategy.position_size > 0

// ATR-based fixed Stop & TP calculation

longStopPrice = strategy.position_avg_price - atrValue * atrMultiplierSL

longTakeProfit = strategy.position_avg_price + atrValue * atrMultiplierTP

// PARTIAL EXIT: (Example) take 50% of the position at early TP

partialTP = strategy.position_avg_price + (atrValue * 2.5)

strategy.exit( id = "Partial TP Long", stop = na, limit = partialTP, qty_percent= 50, from_entry = "Long" )

// Trailing Stop + Final ATR Stop

// WARNING: trail_offset=... is the offset in price units.

// For example, in BTCUSDT, a value like 300 means a 300 USDT trailing distance.

float trailingDist = atrValue * 1.5

strategy.exit( id = "Long Exit (Trail)", stop = longStopPrice, limit = longTakeProfit, from_entry = "Long", trail_offset= trailingDist )

//--- Stop & TP for Short Position ---

if strategy.position_size < 0

// ATR-based fixed Stop & TP calculation for Short

shortStopPrice = strategy.position_avg_price + atrValue * atrMultiplierSL

shortTakeProfit = strategy.position_avg_price - atrValue * atrMultiplierTP

// PARTIAL EXIT: (Example) take 50% of the position at early TP

partialTPShort = strategy.position_avg_price - (atrValue * 2.5)

strategy.exit( id = "Partial TP Short", stop = na, limit = partialTPShort, qty_percent= 50, from_entry = "Short" )

// Trailing Stop + Final ATR Stop for Short

float trailingDistShort = atrValue * 1.5

strategy.exit( id = "Short Exit (Trail)", stop = shortStopPrice, limit = shortTakeProfit, from_entry = "Short", trail_offset= trailingDistShort )

//============================================================================

//=== 7) Plot on Chart (SMA, etc.) =========================================

//============================================================================

plot(smaFast, color=color.blue, linewidth=2, title="SMA (Fast)")

plot(smaSlow, color=color.orange, linewidth=2, title="SMA (Slow)")

// (Optional) Plot Stop & TP levels dynamically:

longStopForPlot = strategy.position_size > 0 ? strategy.position_avg_price - atrValue * atrMultiplierSL : na

longTPForPlot = strategy.position_size > 0 ? strategy.position_avg_price + atrValue * atrMultiplierTP : na

shortStopForPlot = strategy.position_size < 0 ? strategy.position_avg_price + atrValue * atrMultiplierSL : na

shortTPForPlot = strategy.position_size < 0 ? strategy.position_avg_price - atrValue * atrMultiplierTP : na

plot(longStopForPlot, color=color.red, style=plot.style_linebr, title="Long Stop")

plot(longTPForPlot, color=color.green, style=plot.style_linebr, title="Long TP")

plot(shortStopForPlot, color=color.red, style=plot.style_linebr, title="Short Stop")

plot(shortTPForPlot, color=color.green, style=plot.style_linebr, title="Short TP")