Overview

This is a trading strategy based on multiple statistical bands and trend analysis. The strategy combines Bollinger Bands, Quantile Bands, and Power-Law Bands to identify key support/resistance zones, using the lower standard deviation line of the upper quantile band as a trigger signal for entry and exit timing. The strategy design fully considers market volatility and improves signal reliability through the overlay of multiple statistical methods.

Strategy Principles

The core principle of the strategy is to capture market trends through the intersection of multiple statistical bands. It includes the following key components: 1. Bollinger Band System - Used to judge price volatility range, turning yellow when price breaks above the upper band. 2. Quantile Band System - Calculates upper and lower quantiles of price to evaluate probability extremes. 3. Power-Law Band System - Calculates significance levels based on historical returns to measure overbought/oversold conditions. 4. Trigger System - Uses the lower standard deviation line of the upper quantile band as the main trigger signal, with price maintenance above this line viewed as a bullish signal. 5. Confirmation System - Filters false signals by setting consecutive confirmation bar requirements.

Strategy Advantages

- Strong Signal Stability - Multiple statistical bands overlay effectively reduces false signals.

- Good Adaptability - Strategy can adapt to different timeframes and market conditions.

- Complete Risk Control - Uses multiple statistical bands to define risk zones with stop-loss mechanisms.

- Flexible Parameters - Provides rich parameter options for optimization based on different market characteristics.

- Clear Visualization - Various indicator lines are clearly color-differentiated with intuitive trading signals.

Strategy Risks

- Lag Risk - Statistical indicators have inherent lag, potentially missing optimal entry points.

- Unfavorable in Choppy Markets - May generate excessive trading signals in sideways markets.

- Parameter Sensitivity - Different parameter combinations show large performance variations, requiring repeated optimization.

- High Computation Load - Real-time calculation of multiple statistical indicators requires significant computational resources.

- Market Environment Dependency - Statistical patterns may fail in extreme market conditions.

Strategy Optimization Directions

- Introduce Dynamic Parameters - Automatically adjust parameters based on market volatility.

- Add Market Environment Assessment - Include trend strength indicators to filter signals in choppy markets.

- Optimize Calculation Efficiency - Simplify certain calculation processes to reduce resource usage.

- Improve Risk Control - Add more stop-loss conditions and position management strategies.

- Enhance Adaptability - Develop adaptive parameter optimization systems.

Summary

This is a comprehensive trend-following strategy that integrates multiple statistical methods. Through the synergy of Bollinger Bands, Quantile Bands, and Power-Law Bands, it can effectively capture market trends while maintaining good risk control capabilities. Although it has certain lag issues and parameter optimization challenges, through continuous improvement and optimization, this strategy has good practical value and development prospects.

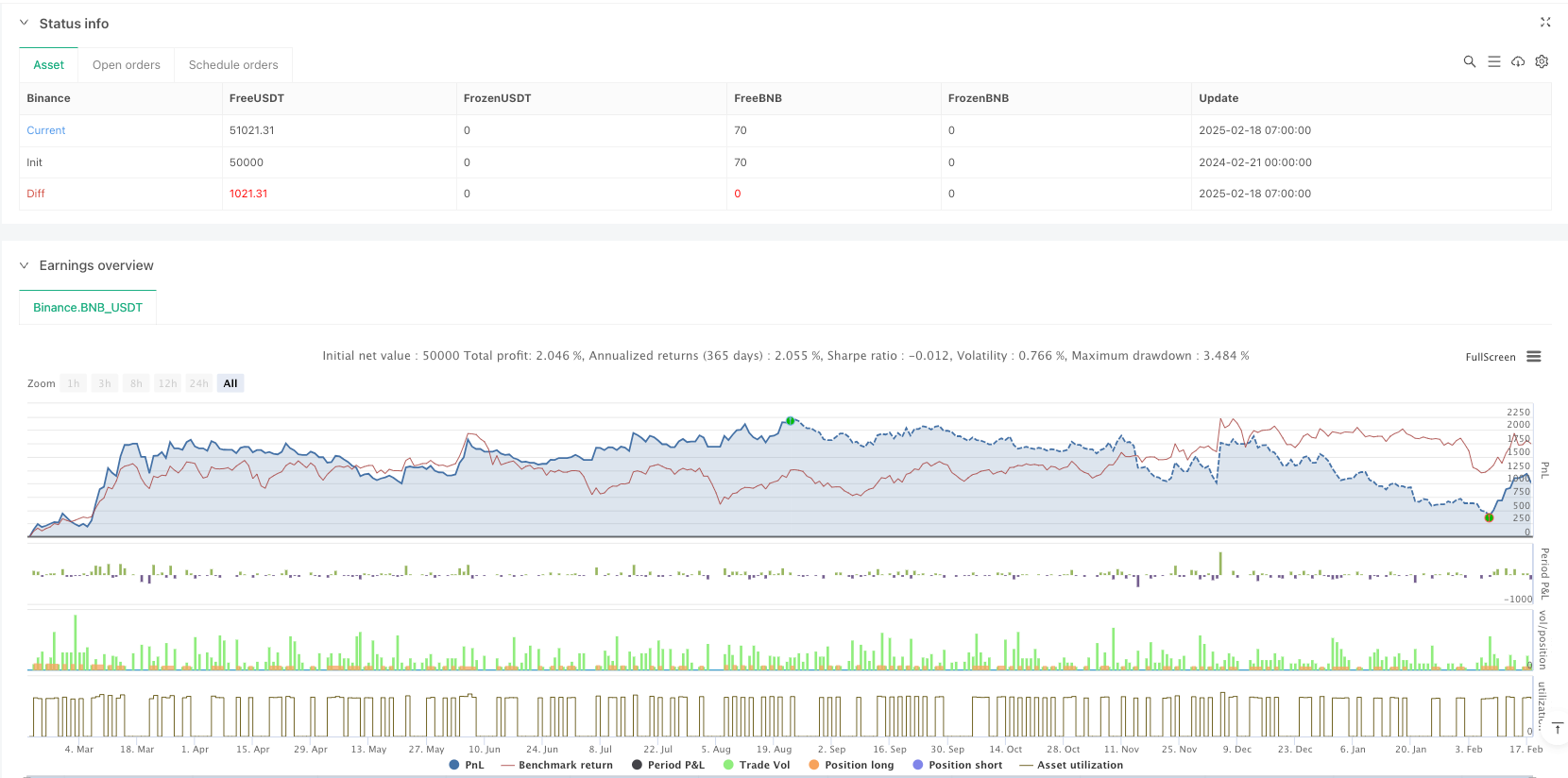

/*backtest

start: 2024-02-21 00:00:00

end: 2025-02-18 08:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Binance","currency":"BNB_USDT"}]

*/

//@version=6

strategy("Multi-Band Comparison Strategy with Separate Entry/Exit Confirmation", overlay=true,

default_qty_type=strategy.percent_of_equity, default_qty_value=10,

initial_capital=5000, currency=currency.USD)

// === Inputs ===

// Basic Parameters

length = input.int(20, "Length (SMA)", minval=1)

boll_mult = input.float(1.0, "Bollinger Band Multiplier", minval=0.1, step=0.1)

upper_quantile = input.float(0.95, "Upper Quantile (0.0-1.0)", minval=0.0, maxval=1.0)

lower_quantile = input.float(0.05, "Lower Quantile (0.0-1.0)", minval=0.0, maxval=1.0)

// Separate confirmation inputs

entry_confirmBars = input.int(1, "Entry Confirmation Bars", minval=1, tooltip="Number of consecutive bars the entry condition must hold")

exit_confirmBars = input.int(1, "Exit Confirmation Bars", minval=1, tooltip="Number of consecutive bars the exit condition must hold")

// Toggle Visibility for Bands

show_lower_boll = input.bool(false, "Show Lower Bollinger Band", tooltip="Enable or disable the lower Bollinger Band")

show_upper_boll = input.bool(true, "Show Upper Bollinger Band", tooltip="Enable or disable the upper Bollinger Band")

show_lower_quant = input.bool(true, "Show Lower Quantile Band", tooltip="Enable or disable the lower Quantile Band")

show_upper_quant = input.bool(true, "Show Upper Quantile Band", tooltip="Enable or disable the upper Quantile Band")

show_upper_power = input.bool(true, "Show Upper Power-Law Band", tooltip="Enable or disable the upper Power-Law Band")

show_lower_power = input.bool(false, "Show Lower Power-Law Band", tooltip="Enable or disable the lower Power-Law Band")

show_quant_std = input.bool(true, "Show Standard Deviation around Quantile Bands", tooltip="Enable or disable standard deviation lines around Quantile Bands")

// Individual Toggles for Std Dev Lines

show_upper_quant_std_up = input.bool(true, "Show Upper Quantile + Std Dev", tooltip="Enable or disable the Upper Quantile + Std Dev line")

show_upper_quant_std_down = input.bool(true, "Show Upper Quantile - Std Dev", tooltip="Enable or disable the Upper Quantile - Std Dev line")

show_lower_quant_std_up = input.bool(false, "Show Lower Quantile + Std Dev", tooltip="Enable or disable the Lower Quantile + Std Dev line")

show_lower_quant_std_down = input.bool(true, "Show Lower Quantile - Std Dev", tooltip="Enable or disable the Lower Quantile - Std Dev line")

// Moving Average Toggles

show_ema = input.bool(false, "Show EMA", tooltip="Enable or disable the Exponential Moving Average")

show_sma = input.bool(false, "Show SMA", tooltip="Enable or disable the Simple Moving Average")

// EMA Parameters

ema_length = input.int(50, minval=1, title="EMA Length")

ema_source = input.source(close, title="EMA Source")

// === Data Handling ===

// Create persistent arrays to store data

var float[] data_array = array.new_float()

var float[] return_array = array.new_float()

// Update the data array with the latest close prices

if array.size(data_array) < length

array.push(data_array, close)

else

array.shift(data_array)

array.push(data_array, close)

// Update the return array with the latest returns

returns = close / close[1] - 1

if array.size(return_array) < length

array.push(return_array, returns)

else

array.shift(return_array)

array.push(return_array, returns)

// === Helper Function ===

// Function to calculate a custom percentile

f_percentile(arr, quantile) =>

arr_sorted = array.copy(arr)

array.sort(arr_sorted, order.ascending)

index = math.round((array.size(arr_sorted) - 1) * quantile)

array.get(arr_sorted, index)

// === Calculations ===

// Bollinger Bands Calculation

sma = ta.sma(close, length)

stdev = ta.stdev(close, length)

boll_upper = sma + boll_mult * stdev

boll_lower = sma - boll_mult * stdev

// Power-Law Bands Calculation

var float power_upper = na

var float power_lower = na

if array.size(return_array) == length

power_upper := f_percentile(return_array, upper_quantile)

power_lower := f_percentile(return_array, lower_quantile)

var float power_upper_band = na

var float power_lower_band = na

if not na(power_upper) and not na(power_lower)

power_upper_band := close * (1 + power_upper)

power_lower_band := close * (1 + power_lower)

// Quantile Bands Calculation

var float quant_upper = na

var float quant_lower = na

if array.size(data_array) == length

quant_upper := f_percentile(data_array, upper_quantile)

quant_lower := f_percentile(data_array, lower_quantile)

// Standard Deviation around Quantile Bands

quant_upper_std_up = quant_upper + stdev

quant_upper_std_down = quant_upper - stdev

quant_lower_std_up = quant_lower + stdev

quant_lower_std_down = quant_lower - stdev

// === Color Calculations ===

// For the upper Bollinger band, color it yellow when price is above it, black otherwise.

upper_boll_color = close > boll_upper ? color.yellow : color.black

// The entry/exit trigger is based on the lower std dev band of the upper quantile band.

// It "turns green" (i.e. favorable for entry) when the price is above this level,

// and "turns red" (i.e. unfavorable, triggering an exit) when price is below it.

triggerCondition = close > quant_upper_std_down

// For plotting purposes, define the color of the lower std dev band of the upper quantile band:

triggerColor = triggerCondition ? color.green : color.red

// (Other color definitions remain for the additional bands.)

upper_power_color = (not na(power_upper_band) and not na(quant_upper_std_up) and power_upper_band > quant_upper_std_up) ? color.new(#FF00FF, 0) : color.black

upper_quant_color = (not na(quant_upper) and not na(power_upper_band) and power_upper_band > quant_upper) ? color.new(#FFAE00, 0) : color.rgb(50, 50, 50)

upper_quant_std_down_color = (not na(quant_upper_std_down) and close > quant_upper_std_down) ? color.green : color.red

lower_quant_std_down_color = (not na(quant_lower_std_down) and close > quant_lower_std_down) ? color.rgb(24, 113, 0, 44) : color.red

lower_quant_color = (ta.cross(close, quant_lower) or close == quant_lower) ? color.red : color.rgb(0, 238, 255)

// For demonstration, a variable to toggle a color on the Bollinger crossover.

var color upper_quant_std_up_color = color.black

if ta.crossover(close, boll_upper)

upper_quant_std_up_color := color.yellow

if ta.crossunder(close, boll_upper)

upper_quant_std_up_color := color.black

// === Confirmation Bars Logic with Separate Counters Based on Trigger Condition ===

// Use the trigger condition (based on the lower std dev band of the upper quantile band)

// for entry/exit confirmation.

var int entryCounter = 0

var int exitCounter = 0

// When triggerCondition is true (price above quant_upper_std_down) the "green" state holds.

entryCounter := triggerCondition ? entryCounter + 1 : 0

// When triggerCondition is false (price below quant_upper_std_down) the "red" state holds.

exitCounter := not triggerCondition ? exitCounter + 1 : 0

// === Strategy Orders ===

// Enter long when triggerCondition has been true for at least entry_confirmBars bars and no position is active.

if (entryCounter >= entry_confirmBars) and (strategy.position_size <= 0)

strategy.entry("Long", strategy.long)

// Exit long when triggerCondition has been false for at least exit_confirmBars bars and a long position is active.

if (exitCounter >= exit_confirmBars) and (strategy.position_size > 0)

strategy.close("Long")

// === Plotting ===

// Plot Bollinger Bands

plot(show_upper_boll ? boll_upper : na, color=upper_boll_color, title="Bollinger Upper", linewidth=2)

plot(show_lower_boll ? boll_lower : na, color=color.red, title="Bollinger Lower", linewidth=1)

// Plot Power-Law Bands

plot(show_upper_power ? power_upper_band : na, color=upper_power_color, title="Power-Law Upper", linewidth=1)

plot(show_lower_power ? power_lower_band : na, color=color.rgb(255, 59, 248), title="Power-Law Lower", linewidth=1)

// Plot Quantile Bands

plot(show_upper_quant ? quant_upper : na, color=upper_quant_color, title="Quantile Upper", linewidth=1)

plot(show_lower_quant ? quant_lower : na, color=lower_quant_color, title="Quantile Lower", linewidth=1)

// Plot Standard Deviation around Quantile Bands

plot(show_quant_std and show_upper_quant and show_upper_quant_std_up ? quant_upper_std_up : na, color=upper_quant_std_up_color, title="Quantile Upper + Std Dev", linewidth=2)

plot(show_quant_std and show_upper_quant and show_upper_quant_std_down ? quant_upper_std_down : na, color=upper_quant_std_down_color, title="Quantile Upper - Std Dev", linewidth=2)

plot(show_quant_std and show_lower_quant and show_lower_quant_std_up ? quant_lower_std_up : na, color=color.green, title="Quantile Lower + Std Dev", linewidth=1)

plot(show_quant_std and show_lower_quant and show_lower_quant_std_down ? quant_lower_std_down : na, color=lower_quant_std_down_color, title="Quantile Lower - Std Dev", linewidth=1)

// Also plot the trigger line (lower std dev band of upper quantile band) with its own color

plot(show_quant_std ? quant_upper_std_down : na, color=triggerColor, title="Trigger (Lower Std Dev of Upper Quantile)", linewidth=2)

// Plot SMA for reference

plot(show_sma ? sma : na, color=color.rgb(0, 24, 132), title="SMA", linewidth=3)

// Plot EMA for reference

ema_value = ta.ema(ema_source, ema_length)

plot(show_ema ? ema_value : na, color=color.rgb(147, 0, 0), title="EMA", linewidth=2)