Overview

This strategy is an adaptive trading system based on the Relative Strength Index (RSI). Operating on the M5 timeframe, it identifies potential trading opportunities by monitoring RSI overbought and oversold levels. The system implements fixed stop-loss and take-profit ratios and operates within specific trading hours. The strategy employs percentage-based money management, investing 10% of total capital per trade.

Strategy Principles

The core mechanism relies on RSI fluctuations over a 14-period cycle. The system generates long signals when RSI falls below the oversold level of 30 and short signals when RSI exceeds the overbought level of 70. Trading is restricted to the 6:00-17:00 time window, helping avoid highly volatile market periods. Each trade is set with a 1% stop-loss and 2% take-profit level, creating an asymmetric risk-reward ratio favorable for long-term profitability.

Strategy Advantages

- Scientific Indicator Selection: RSI is a market-proven momentum indicator effective at capturing price reversal opportunities in overbought and oversold conditions.

- Comprehensive Risk Control: The strategy employs fixed percentage-based stop-loss and take-profit settings, effectively controlling risk per trade.

- Rational Time Management: By restricting trading hours, the strategy avoids periods of poor market liquidity.

- Robust Money Management: Using 10% capital allocation per trade ensures good profit potential while avoiding excessive risk.

Strategy Risks

- Trend Market Risk: In strong trend markets, RSI may remain in overbought or oversold zones for extended periods, increasing false signals.

- Slippage Risk: During volatile market conditions, actual execution prices may significantly deviate from signal prices.

- Fixed Parameter Risk: The fixed RSI parameters and overbought/oversold thresholds may not adapt to all market conditions.

Optimization Directions

- Introduce Trend Filters: Add trend indicators like moving averages to trade in the direction of the main trend.

- Dynamic Parameter Optimization: Consider using adaptive RSI periods and overbought/oversold thresholds to suit different market conditions.

- Optimize Trading Hours: Further refine optimal trading periods based on market statistics.

- Enhance Money Management: Dynamically adjust position sizes based on volatility for more precise risk control.

Summary

This is a well-designed trading strategy with clear logic. It captures market overbought and oversold opportunities through the RSI indicator, combined with strict risk control and time management, demonstrating good practical application value. The strategy’s main strengths lie in its system completeness and operational clarity, but attention must be paid to market conditions’ impact on strategy performance in live trading, with appropriate parameter optimization based on actual circumstances.

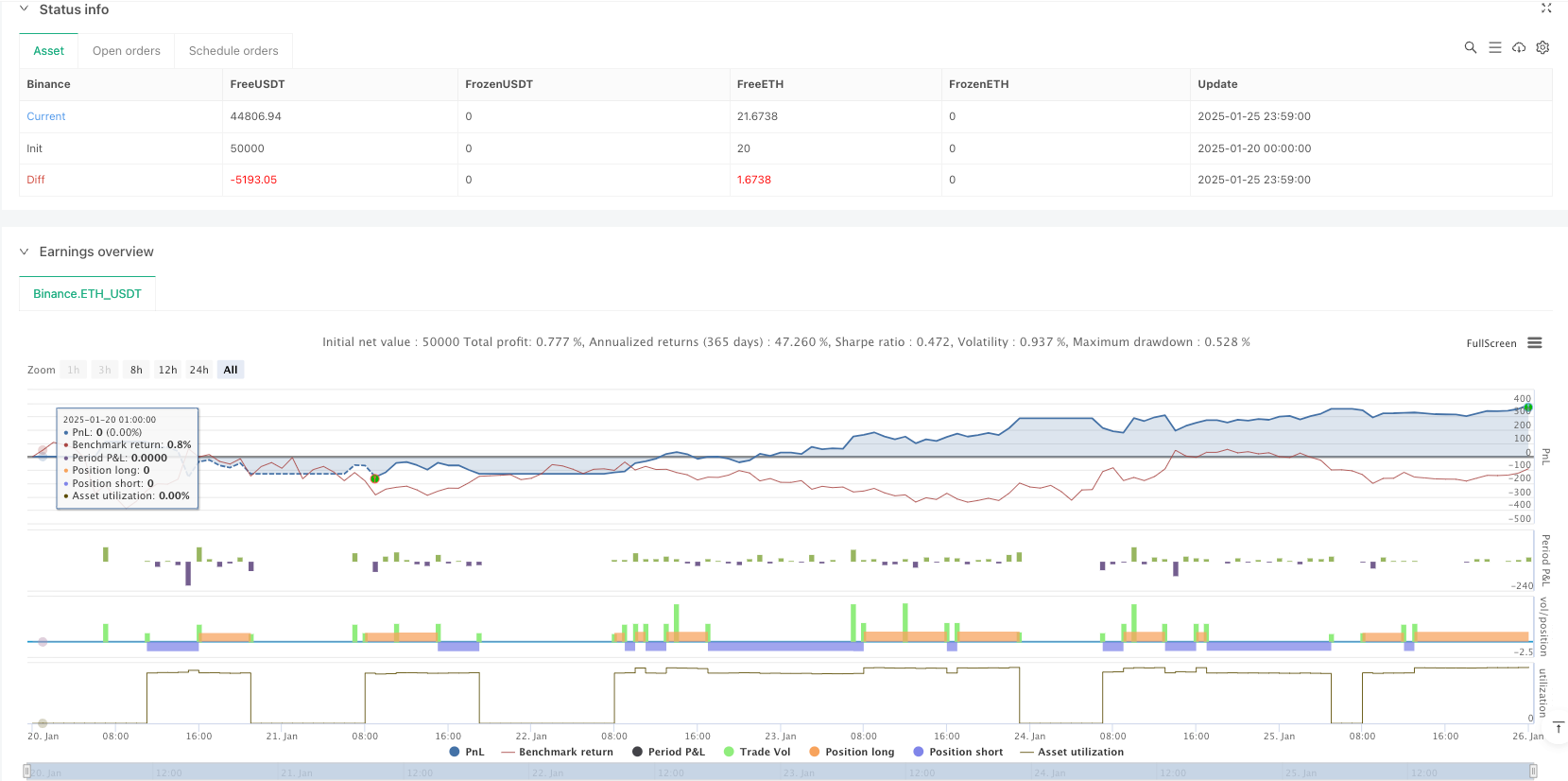

/*backtest

start: 2025-01-20 00:00:00

end: 2025-01-26 00:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Binance","currency":"ETH_USDT"}]

*/

//@version=6

strategy("Gold Trading RSI", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=10)

// Input parameters configuration

rsi_length = input.int(14, title="RSI Period") // RSI period

rsi_overbought = input.int(70, title="RSI Overbought Level") // Overbought level

rsi_oversold = input.int(30, title="RSI Oversold Level") // Oversold level

sl_percent = input.float(1.0, title="Stop Loss (%)") / 100 // Stop loss percentage

tp_percent = input.float(2.0, title="Take Profit (%)") / 100 // Take profit percentage

capital = strategy.equity // Current equity

// Calculate RSI on the 5-minute timeframe

rsi_m5 = ta.rsi(close, rsi_length)

// Get the current hour based on the chart's timezone

current_hour = hour(time)

// Limit trading to the hours between 6:00 AM and 5:00 PM

is_trading_time = current_hour >= 6 and current_hour < 17

// Entry conditions

long_condition = is_trading_time and rsi_m5 < rsi_oversold

short_condition = is_trading_time and rsi_m5 > rsi_overbought

// Calculate Stop Loss and Take Profit levels

sl_long = close * (1 - sl_percent)

tp_long = close * (1 + tp_percent)

sl_short = close * (1 + sl_percent)

tp_short = close * (1 - tp_percent)

// Enter trade

if (long_condition)

strategy.entry("Buy", strategy.long)

strategy.exit("Exit Buy", from_entry="Buy", stop=sl_long, limit=tp_long)

if (short_condition)

strategy.entry("Sell", strategy.short)

strategy.exit("Exit Sell", from_entry="Sell", stop=sl_short, limit=tp_short)