Overview

This strategy is a trend-following trading system based on cross-timeframe analysis, combining weekly and daily EMA levels with RSI indicators to identify market trends and momentum. The strategy determines trading opportunities through trend confluence across multiple timeframes and uses ATR-based dynamic stop-loss for risk management. The system employs a capital management approach, using 100% of account funds per trade, with a 0.1% trading commission consideration.

Strategy Principles

The core logic of the strategy is based on the following key elements: 1. Uses weekly EMA as the primary trend filter, combined with the relationship between daily closing price and weekly EMA to determine market conditions 2. Dynamically adjusts trend determination thresholds through ATR indicator, increasing strategy adaptability 3. Integrates RSI momentum indicator as additional trading filter 4. Employs a trailing stop-loss system based on 7-day low and ATR 5. Strategy pauses new positions when excessive uptrend warning signals appear to avoid risks

Strategy Advantages

- Multi-timeframe analysis provides a more comprehensive market perspective, effectively filtering false breakouts

- Dynamic stop-loss mechanism adapts to market volatility, providing flexible risk control

- RSI momentum filter helps confirm trend strength, improving entry quality

- System includes excessive uptrend warning mechanism, helping avoid drawdown risks

- Strategy parameters are highly adjustable, facilitating optimization for different market environments

Strategy Risks

- May result in frequent entries and exits in ranging markets, increasing trading costs

- Using 100% funds per trade carries significant drawdown risk

- Reliance on technical indicators may lead to delayed responses to market events

- Multi-timeframe analysis may produce conflicting signals at different levels

- Trailing stop-loss may be triggered prematurely during severe volatility

Strategy Optimization Directions

- Introduce volatility filter to reduce trading frequency during low volatility periods

- Add position management system to dynamically adjust holding ratios based on market conditions

- Integrate fundamental indicators for additional market environment assessment

- Optimize trailing stop-loss parameters for better adaptation to different market phases

- Include volume analysis to improve trend determination accuracy

Summary

This is a well-structured trend-following strategy with clear logic. Through multi-timeframe analysis and dynamic indicator filtering, the strategy can effectively capture major trends. While inherent risks exist, there is significant room for improvement through parameter optimization and supplementary indicators. It is recommended to conduct thorough backtesting before live trading and adjust parameters according to specific market conditions.

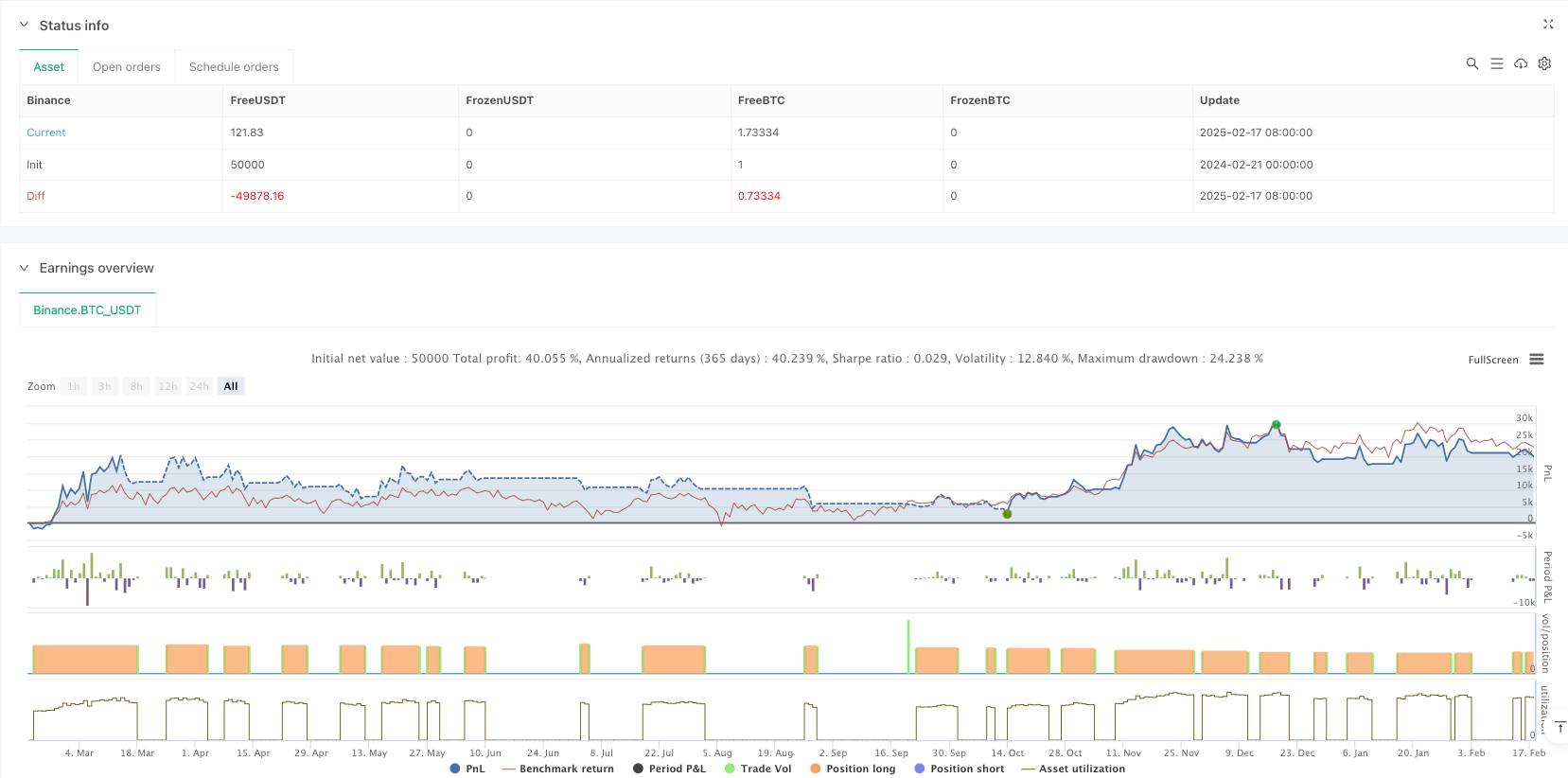

/*backtest

start: 2024-02-21 00:00:00

end: 2025-02-18 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Binance","currency":"BTC_USDT"}]

*/

// @version=6

strategy("Bitcoin Regime Filter Strategy", // Strategy name

overlay=true, // The strategy will be drawn directly on the price chart

initial_capital=10000, // Initial capital of 10000 USD

currency=currency.USDT, // Defines the currency used, USDT

default_qty_type=strategy.percent_of_equity, // Position size will be calculated as a percentage of equity

default_qty_value=100, // The strategy uses 100% of available capital for each trade

commission_type=strategy.commission.percent, // The strategy uses commission as a percentage

commission_value=0.1) // Transaction fee is 0.1%

// User input

res = input.timeframe(title = "Timeframe", defval = "W") // Higher timeframe for reference

len = input.int(title = "EMA Length", defval = 20) // EMA length input

marketTF = input.timeframe(title = "Market Timeframe", defval = "D") // Current analysis timeframe (D)

useRSI = input.bool(title = "Use RSI Momentum Filter", defval = false) // Option to use RSI filter

rsiMom = input.int(title = "RSI Momentum Threshold", defval = 70) // RSI momentum threshold (default 70)

// Custom function to output data

f_sec(_market, _res, _exp) => request.security(_market, _res, _exp[barstate.isrealtime ? 1 : 0])[barstate.isrealtime ? 0: 1]

// The f_sec function has three input parameters: _market, _res, _exp

// request.security = a Pine Script function to fetch market data, accessing OHLC data

// _exp[barstate.isrealtime ? 1 : 0] checks if the current bar is real-time, and retrieves the previous bar (1) or the current bar (0)

// [barstate.isrealtime ? 0 : 1] returns the value of request.security, with a real-time check on the bar

// Define time filter

dateFilter(int st, int et) => time >= st and time <= et

// The dateFilter function has two input parameters: st (start time) and et (end time)

// It checks if the current bar's time is between st and et

// Fetch EMA value

ema = ta.ema(close, len) // Calculate EMA with close prices and input length

htfEmaValue = f_sec(syminfo.tickerid, res, ema) // EMA value for high time frame, using f_sec function

// Fetch ATR value

atrValue = ta.atr(5)

// Check if price is above or below EMA

marketPrice = f_sec(syminfo.tickerid, marketTF, close)

regimeFilter = marketPrice > (htfEmaValue + (atrValue * 0.25)) // Compare current price with EMA in higher timeframe (with ATR dependency)

// Calculate RSI value

rsiValue = ta.rsi(close, 7)

// Bullish momentum filter

bullish = regimeFilter and (rsiValue > rsiMom or not useRSI)

// Set caution alert

caution = bullish and (ta.highest(high, 7) - low) > (atrValue * 1.5)

// Set momentum background color

bgCol = color.red

if bullish[1]

bgCol := color.green

if caution[1]

bgCol := color.orange

// Plot background color

plotshape(1, color = bgCol, style = shape.square, location = location.bottom, size = size.auto, title = "Momentum Strength")

plot(htfEmaValue, color = close > htfEmaValue ? color.green : color.red, linewidth = 2)

// Initialize trailing stop variable

var float trailStop = na

// Entry logic

if bullish and strategy.position_size == 0 and not caution

strategy.entry(id = "Buy", direction = strategy.long)

trailStop := na

// Trailing stop logic

temp_trailStop = ta.highest(low, 7) - (caution[1] ? atrValue * 0.2 : atrValue)

if strategy.position_size > 0

if temp_trailStop > trailStop or na(trailStop)

trailStop := temp_trailStop

// Exit logic

if (close < trailStop or close < htfEmaValue)

strategy.close("Buy", comment = "Sell")

// Plot stop loss line

plot(strategy.position_size[1] > 0 ? trailStop : na, style = plot.style_linebr, color = color.red, title = "Stoploss")