Dual Moving Average Crossover Dynamic Position Optimization Strategy with EMA Cross Signal System

EMA SMA CROSSOVER GOLDEN CROSS DEATH CROSS POSITION SIZING optimization

Overview

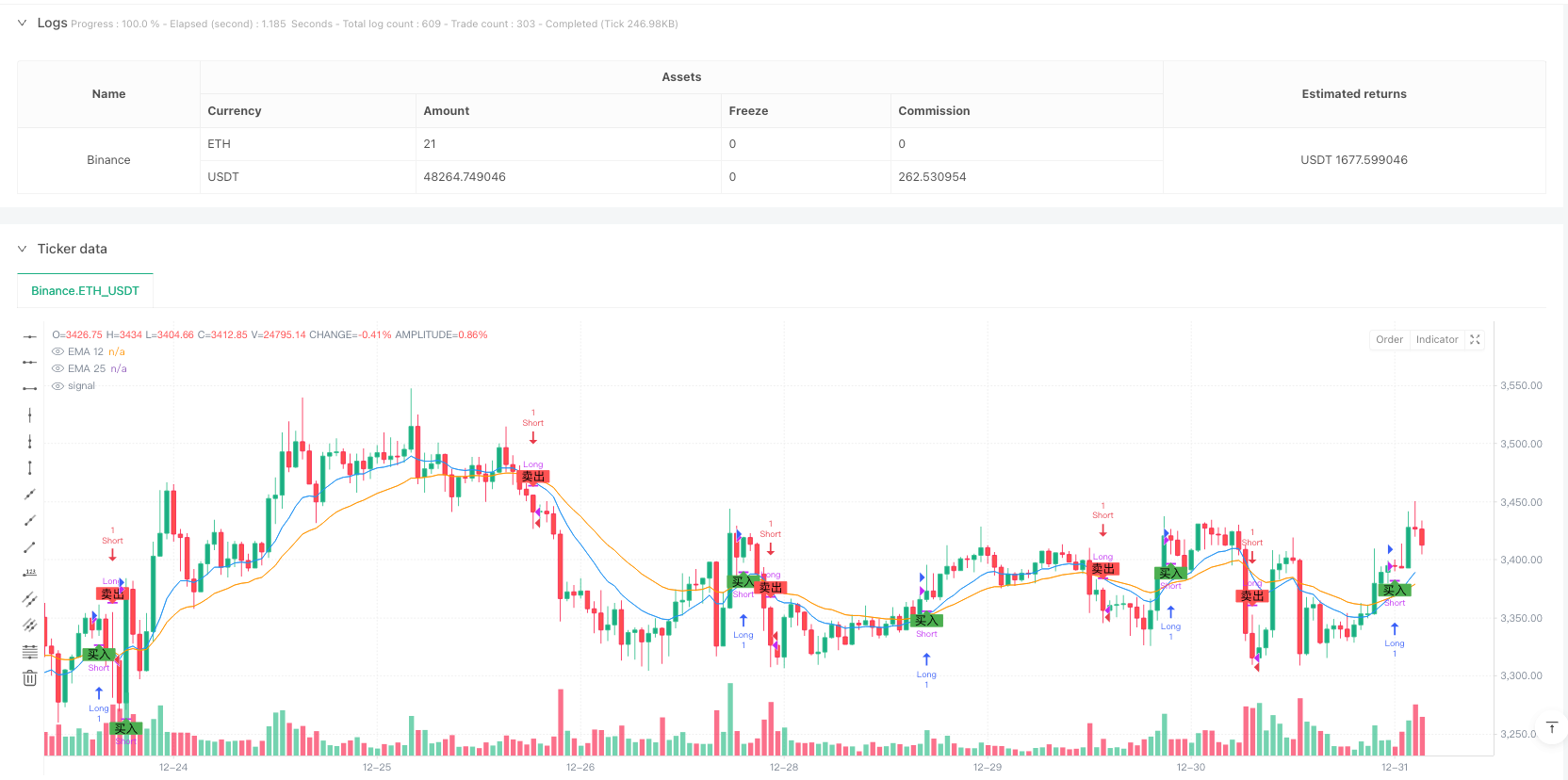

This strategy is an automated trading system based on Exponential Moving Average (EMA) crossover signals. It utilizes the crossover relationship between 12-day and 25-day EMA lines to generate buy and sell signals, while automatically optimizing position switching based on current position status. This is an improved version of the traditional dual moving average strategy with enhanced dynamic position management capabilities.

Strategy Principles

The core logic of the strategy is based on the following key elements: 1. Uses shorter-period (12-day) and longer-period (25-day) exponential moving averages as primary technical indicators 2. Detects market trend reversal points through EMA line crossovers 3. Generates long signals when 12-day EMA crosses above 25-day EMA (Golden Cross) 4. Generates short signals when 12-day EMA crosses below 25-day EMA (Death Cross) 5. Automatically checks current position status and optimizes position transitions based on new crossover signals

Strategy Advantages

- Stable and reliable signal system: EMA-based crossover signals respond more quickly to market changes compared to simple moving averages

- Intelligent position management: System automatically detects current position status and ensures optimal position transitions when signals appear

- Comprehensive risk control: Strategy includes complete stop-loss and position closing mechanisms

- Outstanding visualization: Clearly marks buy and sell signal points on charts for easy trader understanding and tracking

- Clear code structure: Facilitates subsequent strategy optimization and parameter adjustment

Strategy Risks

- Choppy market risk: May generate frequent false breakout signals in sideways markets

- Slippage risk: May face significant price execution deviation from signal prices in low-volume markets

- Trend delay risk: Due to moving average system, signals will have some lag relative to market tops and bottoms

- Capital management risk: Without proper position control, may result in significant account losses during consecutive losses

- Technical risk: Algorithmic trading may be affected by network latency, system failures, and other technical factors

Strategy Optimization Directions

- Introduce volatility indicators: Can add ATR or Bollinger Bands to filter false breakout signals

- Optimize parameter selection: Can optimize EMA periods through backtesting to better suit specific markets

- Enhance position management: Can dynamically adjust position sizes based on market volatility

- Add stop-loss mechanisms: Can set trailing stops to protect existing profits

- Improve signal filtering: Can add volume, trend strength, and other auxiliary indicators to improve signal quality

Summary

This is a well-designed automated trading strategy with clear logic. By combining EMA crossover signals with intelligent position management, the strategy can effectively capture market trends and make timely position adjustments. While there are some inherent risks, the strategy has good practical value and room for expansion through reasonable optimization and risk control measures.

/*backtest

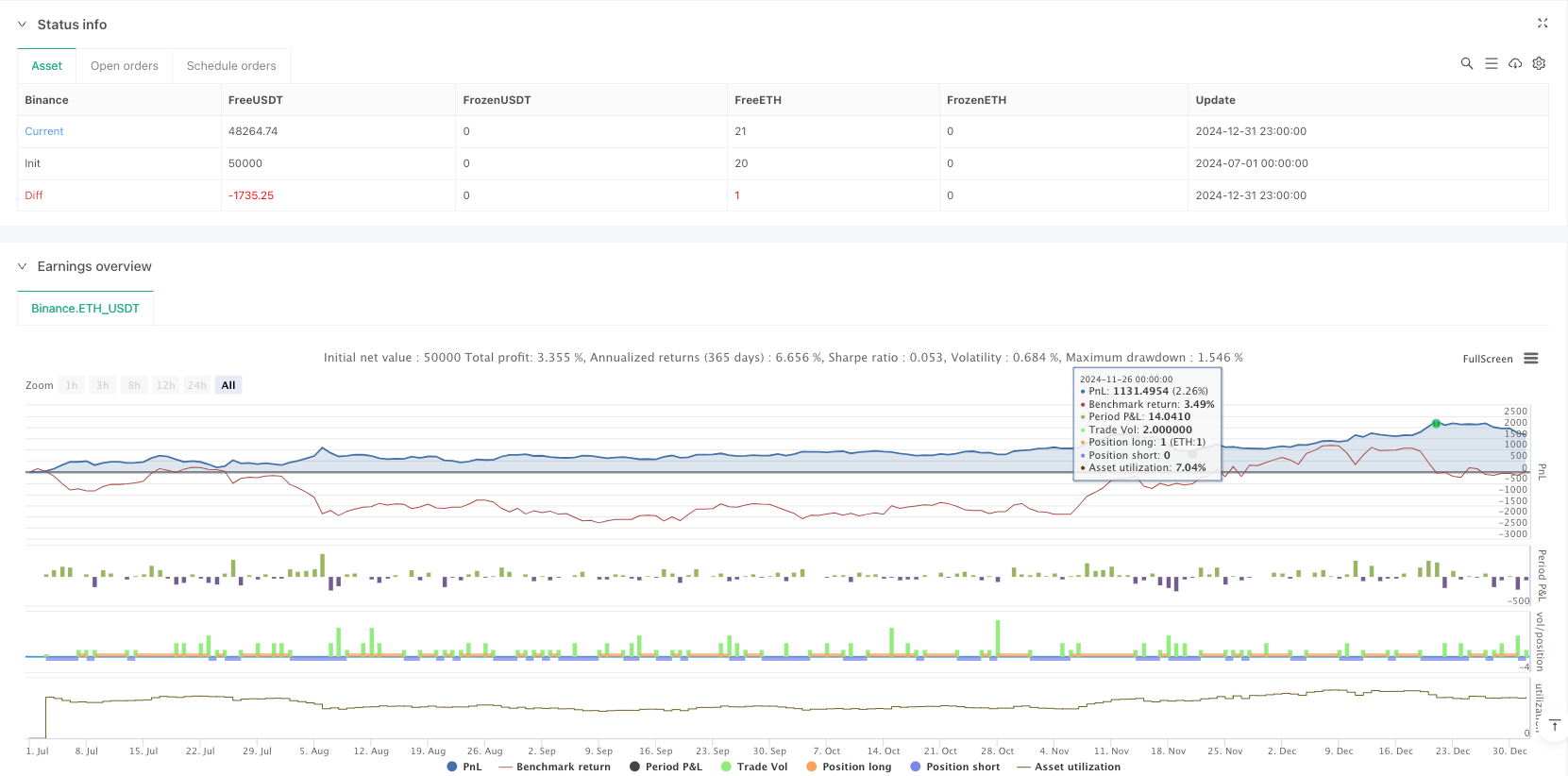

start: 2024-07-01 00:00:00

end: 2025-01-01 00:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Binance","currency":"ETH_USDT"}]

*/

// 本 Pine Script™ 代码遵循 Mozilla Public License 2.0 条款 https://mozilla.org/MPL/2.0/

// © pyoungil0842

//@version=6

strategy("EMA黄金/死亡交叉带优化持仓切换", overlay=true, calc_on_every_tick=true)

// EMA设置

ema12 = ta.ema(close, 12)

ema25 = ta.ema(close, 25)

// 黄金交叉和死亡交叉条件

goldenCross = ta.crossover(ema12, ema25) // 当EMA12向上穿过EMA25时

deathCross = ta.crossunder(ema12, ema25) // 当EMA12向下穿过EMA25时

// 检查当前持仓状态

isLong = strategy.position_size > 0 // 是否持有多头仓位

isShort = strategy.position_size < 0 // 是否持有空头仓位

// 黄金交叉发生时的处理

if (goldenCross)

if (isShort) // 如果持有空头仓位,则平空并开多

strategy.close("Short") // 平掉空头仓位

strategy.entry("Long", strategy.long) // 进入多头仓位

else if (not isLong) // 如果没有多头仓位,则开新多头

strategy.entry("Long", strategy.long)

// 死亡交叉发生时的处理

if (deathCross)

if (isLong) // 如果持有多头仓位,则平多并开空

strategy.close("Long") // 平掉多头仓位

strategy.entry("Short", strategy.short) // 进入空头仓位

else if (not isShort) // 如果没有空头仓位,则开新空头

strategy.entry("Short", strategy.short)

// 在图表上显示EMA线

plot(ema12, title="EMA 12", color=color.blue)

plot(ema25, title="EMA 25", color=color.orange)

// 在图表上显示信号

plotshape(series=goldenCross, title="黄金交叉", location=location.belowbar, color=color.green, style=shape.labelup, text="买入")

plotshape(series=deathCross, title="死亡交叉", location=location.abovebar, color=color.red, style=shape.labeldown, text="卖出")