Overview

This strategy is an advanced trading system based on the classic Three-Line Strike pattern, incorporating ADX trend confirmation and ATR-based dynamic stop-loss/take-profit mechanisms to provide a comprehensive trading solution. The core strategy identifies breakthrough patterns following three consecutive candlesticks in the same direction, combined with trend strength confirmation for precise signal generation.

Strategy Principles

The strategy operates on three core mechanisms: First, it identifies classic Three-Line Strike patterns, including bullish patterns (breakout after three consecutive red candles) and bearish patterns (breakout after three consecutive green candles); second, it uses ADX (Average Directional Index) for trend strength filtering, confirming signals only when ADX exceeds a set threshold; finally, it utilizes ATR (Average True Range) to dynamically calculate stop-loss and take-profit levels, achieving adaptive risk management. Technically, the strategy ensures signal quality through precise candlestick color determination and breakout strength verification.

Strategy Advantages

- Comprehensive Signal Confirmation: Combines multiple technical indicators (candlestick patterns, ADX, ATR) to enhance signal reliability

- Intelligent Risk Management: Dynamic stop-loss and take-profit settings based on ATR, automatically adjusting to market volatility

- High Customizability: Offers adjustment options for multiple key parameters, including ADX threshold and ATR period

- Enhanced Trend Following: ADX filtering ensures entry only in strong trend environments

- Clear Code Structure: Modular design facilitates maintenance and expansion

Strategy Risks

- Pattern Recognition Delay: Three-Line Strike pattern confirmation requires four candles, potentially causing delayed entry

- False Breakout Risk: False breakout signals may occur in choppy markets

- ADX Lag: As a trend confirmation indicator, ADX inherently has some lag

- Stop-Loss Consideration: ATR-based stop-loss settings may be too wide or narrow during extreme volatility

- Market Environment Dependency: Strategy performs better in trending markets, may underperform in ranging conditions

Strategy Optimization Directions

- Enhanced Signal Filtering: Add volume confirmation mechanism to improve signal reliability

- Dynamic Parameter Optimization: Introduce adaptive mechanisms for dynamic adjustment of ADX threshold and ATR period

- Entry Timing Optimization: Incorporate price structure (support/resistance levels) to optimize entry points

- Position Management Improvement: Add volatility-based dynamic position sizing mechanism

- Market Environment Recognition: Add market condition classification logic to use different parameter settings in different market conditions

Summary

This strategy creates a trading system combining theoretical foundation and practicality by integrating the classic Three-Line Strike pattern with modern technical indicators. Its core strengths lie in multiple signal confirmation mechanisms and intelligent risk management, though attention must be paid to market environment compatibility and parameter optimization. Through the suggested optimization directions, the strategy has room for further improvement.

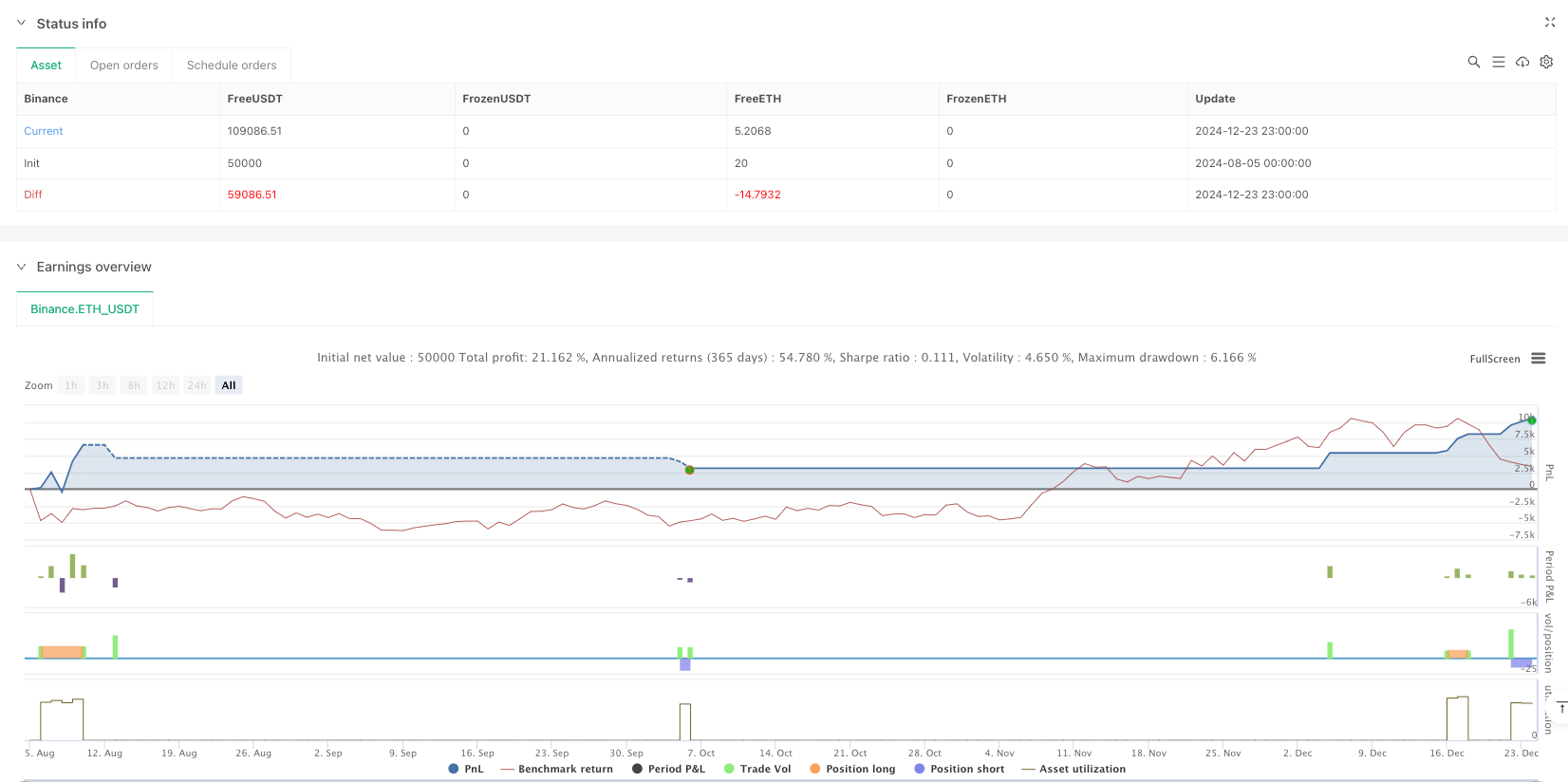

/*backtest

start: 2024-08-05 00:00:00

end: 2024-12-24 00:00:00

period: 5h

basePeriod: 5h

exchanges: [{"eid":"Binance","currency":"ETH_USDT"}]

*/

// Copyright ...

// Based on the TMA Overlay by Arty, converted to a simple strategy example.

// Pine Script v5

//@version=5

strategy(title='3 Line Strike [TTF] - Strategy with ATR and ADX Filter',

shorttitle='3LS Strategy [TTF]',

overlay=true,

initial_capital=100000,

default_qty_type=strategy.percent_of_equity,

default_qty_value=100,

pyramiding=0)

// -----------------------------------------------------------------------------

// INPUTS

// -----------------------------------------------------------------------------

// ATR and ADX Inputs

atrLength = input.int(title='ATR Length', defval=14, group='ATR & ADX')

adxLength = input.int(title='ADX Length', defval=14, group='ATR & ADX')

adxThreshold = input.float(title='ADX Threshold', defval=25, group='ATR & ADX')

// ### 3 Line Strike

showBear3LS = input.bool(title='Show Bearish 3 Line Strike', defval=true, group='3 Line Strike',

tooltip="Bearish 3 Line Strike (3LS-Bear) = 3 zelené sviečky, potom veľká červená sviečka (engulfing).")

showBull3LS = input.bool(title='Show Bullish 3 Line Strike', defval=true, group='3 Line Strike',

tooltip="Bullish 3 Line Strike (3LS-Bull) = 3 červené sviečky, potom veľká zelená sviečka (engulfing).")

// -----------------------------------------------------------------------------

// CALCULATIONS

// -----------------------------------------------------------------------------

// Calculate ATR

atr = ta.atr(atrLength)

// Calculate ADX components manually

tr = ta.tr(true)

plusDM = ta.change(high) > ta.change(low) and ta.change(high) > 0 ? ta.change(high) : 0

minusDM = ta.change(low) > ta.change(high) and ta.change(low) > 0 ? ta.change(low) : 0

smoothedPlusDM = ta.rma(plusDM, adxLength)

smoothedMinusDM = ta.rma(minusDM, adxLength)

smoothedTR = ta.rma(tr, adxLength)

plusDI = (smoothedPlusDM / smoothedTR) * 100

minusDI = (smoothedMinusDM / smoothedTR) * 100

dx = math.abs(plusDI - minusDI) / (plusDI + minusDI) * 100

adx = ta.rma(dx, adxLength)

// Helper Functions

getCandleColorIndex(barIndex) =>

int ret = na

if (close[barIndex] > open[barIndex])

ret := 1

else if (close[barIndex] < open[barIndex])

ret := -1

else

ret := 0

ret

isEngulfing(checkBearish) =>

sizePrevCandle = close[1] - open[1]

sizeCurrentCandle = close - open

isCurrentLargerThanPrevious = math.abs(sizeCurrentCandle) > math.abs(sizePrevCandle)

if checkBearish

isGreenToRed = (getCandleColorIndex(0) < 0) and (getCandleColorIndex(1) > 0)

isCurrentLargerThanPrevious and isGreenToRed

else

isRedToGreen = (getCandleColorIndex(0) > 0) and (getCandleColorIndex(1) < 0)

isCurrentLargerThanPrevious and isRedToGreen

isBearishEngulfing() => isEngulfing(true)

isBullishEngulfing() => isEngulfing(false)

is3LSBear() =>

is3LineSetup = (getCandleColorIndex(1) > 0) and (getCandleColorIndex(2) > 0) and (getCandleColorIndex(3) > 0)

is3LineSetup and isBearishEngulfing()

is3LSBull() =>

is3LineSetup = (getCandleColorIndex(1) < 0) and (getCandleColorIndex(2) < 0) and (getCandleColorIndex(3) < 0)

is3LineSetup and isBullishEngulfing()

// Signals

is3LSBearSig = is3LSBear() and adx > adxThreshold

is3LSBullSig = is3LSBull() and adx > adxThreshold

// Take Profit and Stop Loss

longTP = close + 2 * atr

longSL = close - 1 * atr

shortTP = close - 2 * atr

shortSL = close + 1 * atr

// -----------------------------------------------------------------------------

// STRATEGY ENTRY PRÍKAZY

// -----------------------------------------------------------------------------

if (showBull3LS and is3LSBullSig)

strategy.entry("3LS_Bull", strategy.long, comment="3LS Bullish")

strategy.exit("Exit Bull", from_entry="3LS_Bull", limit=longTP, stop=longSL)

if (showBear3LS and is3LSBearSig)

strategy.entry("3LS_Bear", strategy.short, comment="3LS Bearish")

strategy.exit("Exit Bear", from_entry="3LS_Bear", limit=shortTP, stop=shortSL)