Overview

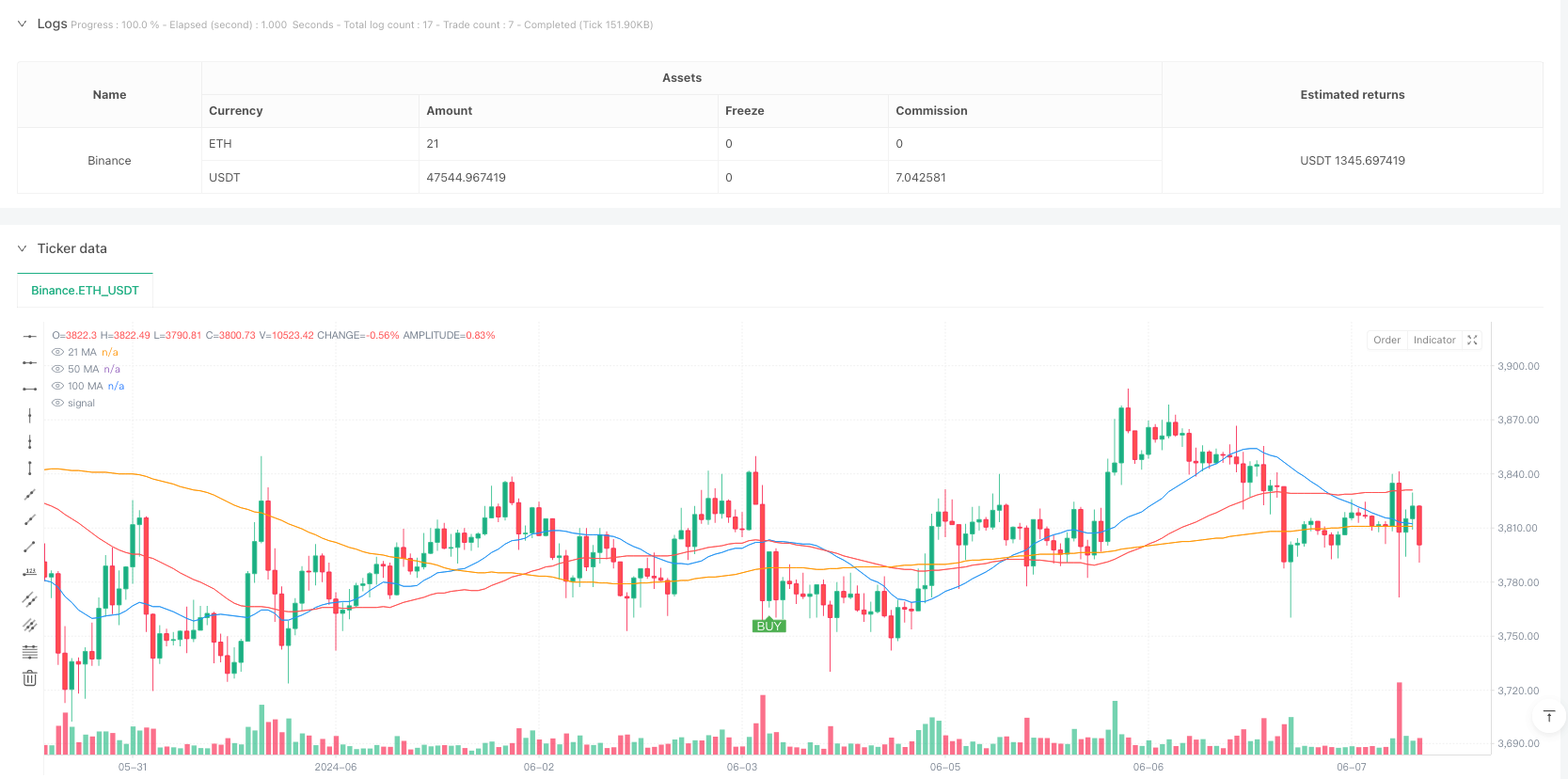

This is a trend-following strategy based on three Simple Moving Averages (SMA). The strategy utilizes the crossover and relative positions of 21, 50, and 100-period moving averages to identify market trends and generate trading signals. It primarily operates on a 5-minute timeframe, with recommended confirmation from the 30-minute chart.

Strategy Principle

The strategy employs a triple-filter mechanism to determine trading signals: 1. Uses 21-period MA as fast line to capture short-term price movements 2. Uses 50-period MA as medium-term line for crossover signals 3. Uses 100-period MA as trend filter to ensure alignment with main trend

Buy conditions require: - 21 MA crosses above 50 MA - Both 21 MA and 50 MA are above 100 MA

Sell conditions require: - 21 MA crosses below 50 MA - Both 21 MA and 50 MA are below 100 MA

Strategy Advantages

- Multiple confirmation mechanisms reduce false signals

- Trend filtering improves trading success rate

- Clear entry and exit rules

- Applicable across multiple timeframes

- Risk-reward ratio set at 1:2 for long-term profitability

- Simple logic, easy to understand and execute

Strategy Risks

- Frequent trades in ranging markets

- MA lag may cause delayed entries and exits

- Quick reversals can lead to significant losses

- Parameters need adjustment for different market conditions

Risk control suggestions: - Set stop loss below recent significant low - Confirm trends on higher timeframes - Avoid trading in sideways markets - Regular strategy parameter evaluation

Strategy Optimization

- Incorporate volume indicators for trend strength confirmation

- Implement dynamic stop-loss mechanism

- Add trend strength filters

- Optimize parameter adaptation

- Integrate additional technical indicators

- Add market volatility filters

Summary

This is a well-structured trend-following strategy with clear logic. Through triple moving average filtering and trend confirmation mechanisms, it effectively reduces false signals and improves trading success rate. The strategy offers good scalability and can be optimized for different market conditions. Thorough backtesting and parameter optimization are recommended before live trading.

/*backtest

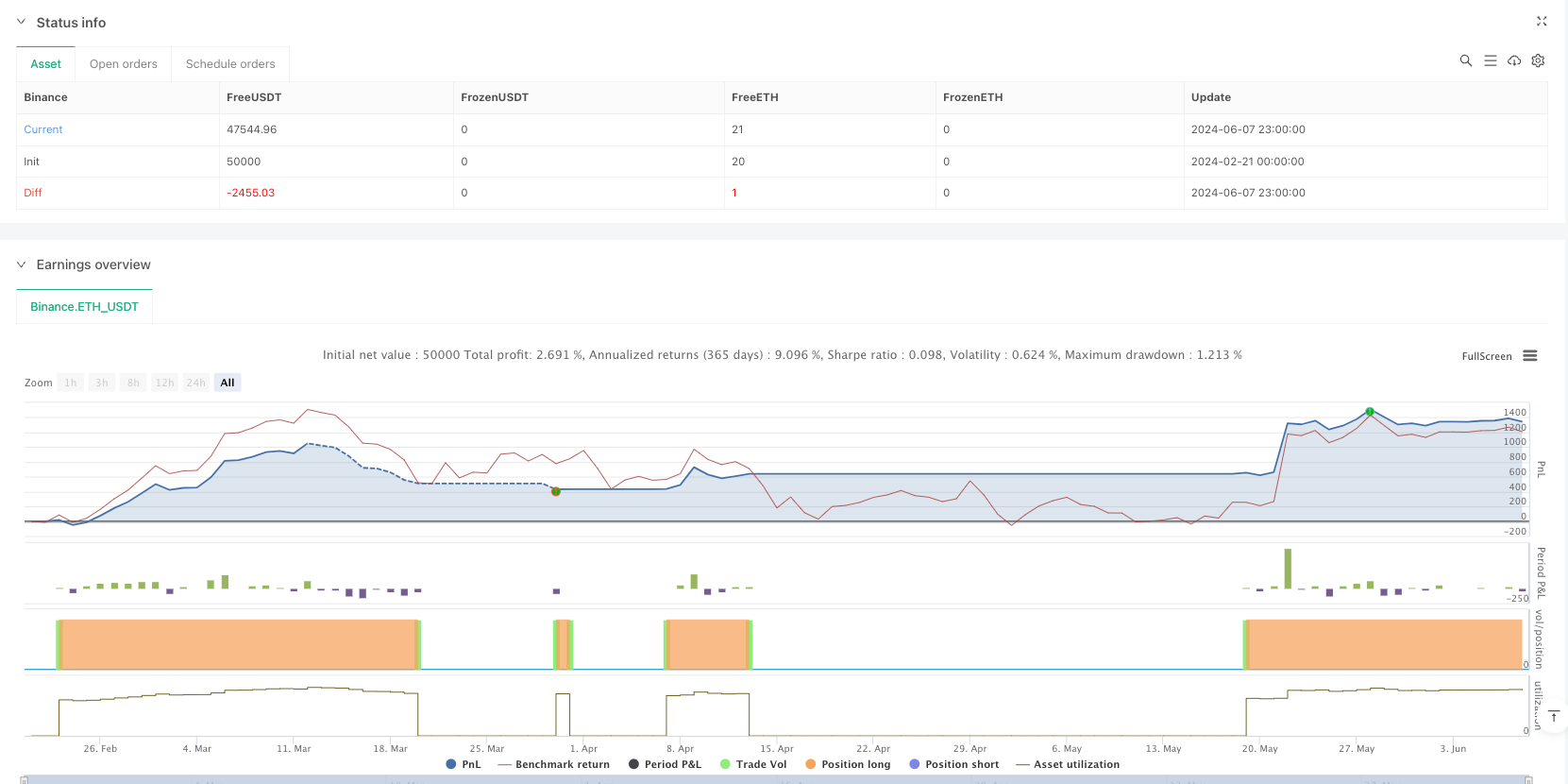

start: 2024-02-21 00:00:00

end: 2024-06-08 00:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Binance","currency":"ETH_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Vezpa

//@version=5

strategy("Vezpa's Gold Strategy", overlay=true)

// ======================== MAIN STRATEGY ========================

// Input parameters for the main strategy

fast_length = input.int(21, title="Fast MA Length", minval=1)

slow_length = input.int(50, title="Slow MA Length", minval=1)

trend_filter_length = input.int(100, title="Trend Filter MA Length", minval=1)

// Calculate moving averages for the main strategy

fast_ma = ta.sma(close, fast_length)

slow_ma = ta.sma(close, slow_length)

trend_ma = ta.sma(close, trend_filter_length)

// Plot moving averages

plot(fast_ma, color=color.blue, title="21 MA")

plot(slow_ma, color=color.red, title="50 MA")

plot(trend_ma, color=color.orange, title="100 MA")

// Buy condition: 21 MA crosses above 50 MA AND both are above the 100 MA

if (ta.crossover(fast_ma, slow_ma) and fast_ma > trend_ma and slow_ma > trend_ma)

strategy.entry("Buy", strategy.long)

// Sell condition: 21 MA crosses below 50 MA AND both are below the 100 MA

if (ta.crossunder(fast_ma, slow_ma) and fast_ma < trend_ma and slow_ma < trend_ma)

strategy.close("Buy")

// Plot buy signals as green balloons

plotshape(series=ta.crossover(fast_ma, slow_ma) and fast_ma > trend_ma and slow_ma > trend_ma,

title="Buy Signal",

location=location.belowbar,

color=color.green,

style=shape.labelup,

text="BUY",

textcolor=color.white,

size=size.small,

transp=0)

// Plot sell signals as red balloons

plotshape(series=ta.crossunder(fast_ma, slow_ma) and fast_ma < trend_ma and slow_ma < trend_ma,

title="Sell Signal",

location=location.abovebar,

color=color.red,

style=shape.labeldown,

text="SELL",

textcolor=color.white,

size=size.small,

transp=0)