Overview

This is a long-only strategy based on support levels and trend EMA. The strategy identifies optimal entry points by recognizing market trends and key support levels, combining ATR-based dynamic stop-loss and staged profit-taking for risk management. It focuses on price pullbacks to support levels during uptrends and aims to achieve high success rates through reasonable risk-reward ratios.

Strategy Principle

The strategy uses a 100-period EMA as a trend indicator, confirming an uptrend when price is above EMA. It calculates 10-period lows as short-term support levels and looks for entry opportunities when price pulls back near support (support + 0.5*ATR). After entry, it implements staged profit-taking, closing 50% position at 5x ATR and the remainder at 10x ATR, with a 1x ATR dynamic stop-loss. Risk is controlled within 3% of account equity per trade through dynamic position sizing.

Strategy Advantages

- Trend-following characteristics: Uses EMA for trend identification, avoiding counter-trend trades

- Dynamic support levels: Uses recent 10-period lows as support, better reflecting current market conditions

- Flexible risk management: ATR-based dynamic stop-loss and profit targets, adapting to market volatility

- Staged profit-taking: Gradual position closure at different price levels, securing profits while maintaining upside potential

- Precise position sizing: Dynamic calculation based on stop-loss distance, achieving quantified risk management

Strategy Risks

- False breakout risk: Potential false signals near support levels, additional confirmation indicators recommended

- Trend reversal risk: EMA lag may cause losses at trend turning points

- Overtrading risk: Frequent support level triggers may lead to excessive trading

- Slippage risk: Significant slippage possible during volatile periods Solutions:

- Add trend confirmation indicators

- Optimize entry conditions

- Set trading interval restrictions

- Adjust stop-loss ranges

Strategy Optimization Directions

- Multi-dimensional trend analysis: Incorporate multiple timeframe trend indicators for improved accuracy

- Entry condition optimization: Add volume, volatility, and other auxiliary indicators as entry filters

- Dynamic parameter optimization: Adaptive parameter adjustment based on market conditions

- Market sentiment integration: Include VIX and other sentiment indicators to optimize timing

- Enhanced profit-taking: Dynamic adjustment of profit targets based on market volatility

Summary

The strategy establishes a complete trading system by combining trend following and support level pullbacks, implementing risk management through staged profit-taking and dynamic stop-loss. Its core strengths lie in comprehensive risk control mechanisms and clear trading logic, but continuous optimization of parameters and entry conditions is needed for different market environments. Traders are advised to conduct thorough backtesting before live implementation and make personalized adjustments based on market experience.

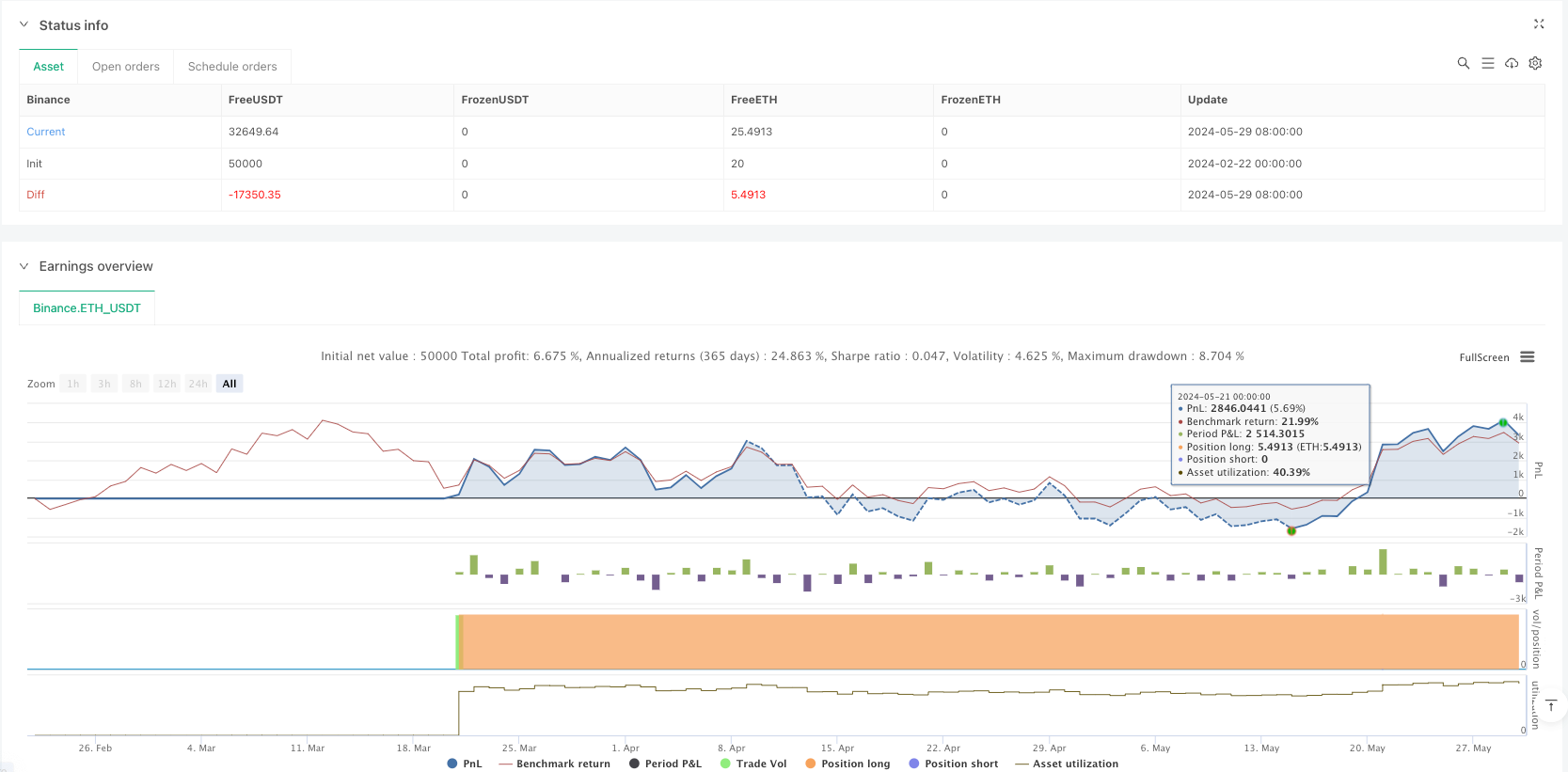

/*backtest

start: 2024-02-22 00:00:00

end: 2024-05-30 00:00:00

period: 2d

basePeriod: 2d

exchanges: [{"eid":"Binance","currency":"ETH_USDT"}]

*/

//@version=5

strategy("Ultra-Profitable SMC Long-Only Strategy", shorttitle="Ultra_Profit_SMC", overlay=true)

// User Inputs

emaTrendLength = input.int(100, title="Trend EMA Length") // Faster EMA to align with aggressive trends

supportLookback = input.int(10, title="Support Lookback Period") // Short-term support zones

atrLength = input.int(14, title="ATR Length")

atrMultiplierSL = input.float(1.0, title="ATR Multiplier for Stop-Loss")

atrMultiplierTP1 = input.float(5.0, title="ATR Multiplier for TP1")

atrMultiplierTP2 = input.float(10.0, title="ATR Multiplier for TP2")

riskPercent = input.float(3.0, title="Risk per Trade (%)", step=0.1)

// Calculate Indicators

emaTrend = ta.ema(close, emaTrendLength) // Trend EMA

supportLevel = ta.lowest(low, supportLookback) // Support Level

atr = ta.atr(atrLength) // ATR

// Entry Conditions

isTrendingUp = close > emaTrend // Price above Trend EMA

nearSupport = close <= supportLevel + (atr * 0.5) // Price near support zone

longCondition = isTrendingUp and nearSupport

// Dynamic Stop-Loss and Take-Profit Levels

longStopLoss = supportLevel - (atr * atrMultiplierSL)

takeProfit1 = close + (atr * atrMultiplierTP1) // Partial Take-Profit at 5x ATR

takeProfit2 = close + (atr * atrMultiplierTP2) // Full Take-Profit at 10x ATR

// Position Sizing

capital = strategy.equity

tradeRisk = riskPercent / 100 * capital

positionSize = tradeRisk / (close - longStopLoss)

// Execute Long Trades

if (longCondition)

strategy.entry("Ultra Long", strategy.long, qty=positionSize)

// Exit Conditions

strategy.exit("Partial Exit", from_entry="Ultra Long", limit=takeProfit1, qty_percent=50) // Exit 50% at TP1

strategy.exit("Full Exit", from_entry="Ultra Long", limit=takeProfit2, qty_percent=100, stop=longStopLoss) // Exit the rest at TP2

// Plot Indicators

plot(emaTrend, color=color.blue, title="Trend EMA")

plot(supportLevel, color=color.green, title="Support Level", linewidth=2)