Overview

This strategy is an intelligent trading system based on trend following and momentum trading, specifically designed for short-term and rapid trading scenarios. The strategy core employs a combination of Exponential Moving Average (EMA) crossovers, Relative Strength Index (RSI), and Average True Range (ATR), coupled with a percentage-based smart stop-loss mechanism. It is particularly suitable for trading on shorter timeframe charts like 1-minute and 5-minute, with dynamic parameter adjustments to adapt to different market conditions.

Strategy Principles

The strategy utilizes three core technical indicators to construct its trading signal system: 1. Fast/Slow EMA Crossover System - Uses 9-period and 21-period EMA combination, identifying trends through golden and death crosses 2. RSI Overbought/Oversold Filter - Employs 14-period RSI, with 70 and 30 as thresholds to avoid extreme condition entries 3. ATR Volatility Confirmation Mechanism - Utilizes ATR to measure market volatility, ensuring trades are only executed when breakouts show sufficient strength

The trading logic is clearly defined: long entries require fast EMA crossing above slow EMA, RSI below 70, and price confirmation above ATR multiplier; short entries require fast EMA crossing below slow EMA, RSI above 30, and price confirmation below ATR multiplier. The system includes a 1% dynamic stop-loss mechanism for effective risk control.

Strategy Advantages

- Multiple technical indicator cross-validation improves signal reliability

- Dynamic parameter adaptation system suits different timeframes

- ATR-based volatility filtering mechanism reduces false signals

- Smart stop-loss system strictly controls risk per trade

- Complete visualization system including clear graphical markers and background alerts

Strategy Risks

- Ranging markets may generate frequent trading signals, increasing transaction costs

- Fixed percentage stop-loss may not suit all market environments

- Slippage risk during high volatility periods

- Parameters require continuous monitoring and adjustment

To mitigate risks, it is recommended to: - Adjust stop-loss percentages based on instrument characteristics - Add trend strength confirmation mechanisms - Monitor market volatility in real-time - Establish comprehensive money management systems

Strategy Optimization Directions

- Introduce adaptive stop-loss mechanism to dynamically adjust stop-loss percentages based on market volatility

- Add trend strength filters to improve trading signal quality

- Develop smart time filtering system to avoid low liquidity periods

- Integrate volume indicators to enhance signal reliability

- Develop dynamic parameter optimization system for strategy self-adjustment

Summary

This strategy constructs a complete trading system through the synergistic effect of multiple technical indicators. While maintaining flexibility, the system ensures trading safety through strict risk control. Although certain limitations exist, through continuous optimization and improvement, the strategy demonstrates good application value and development potential.

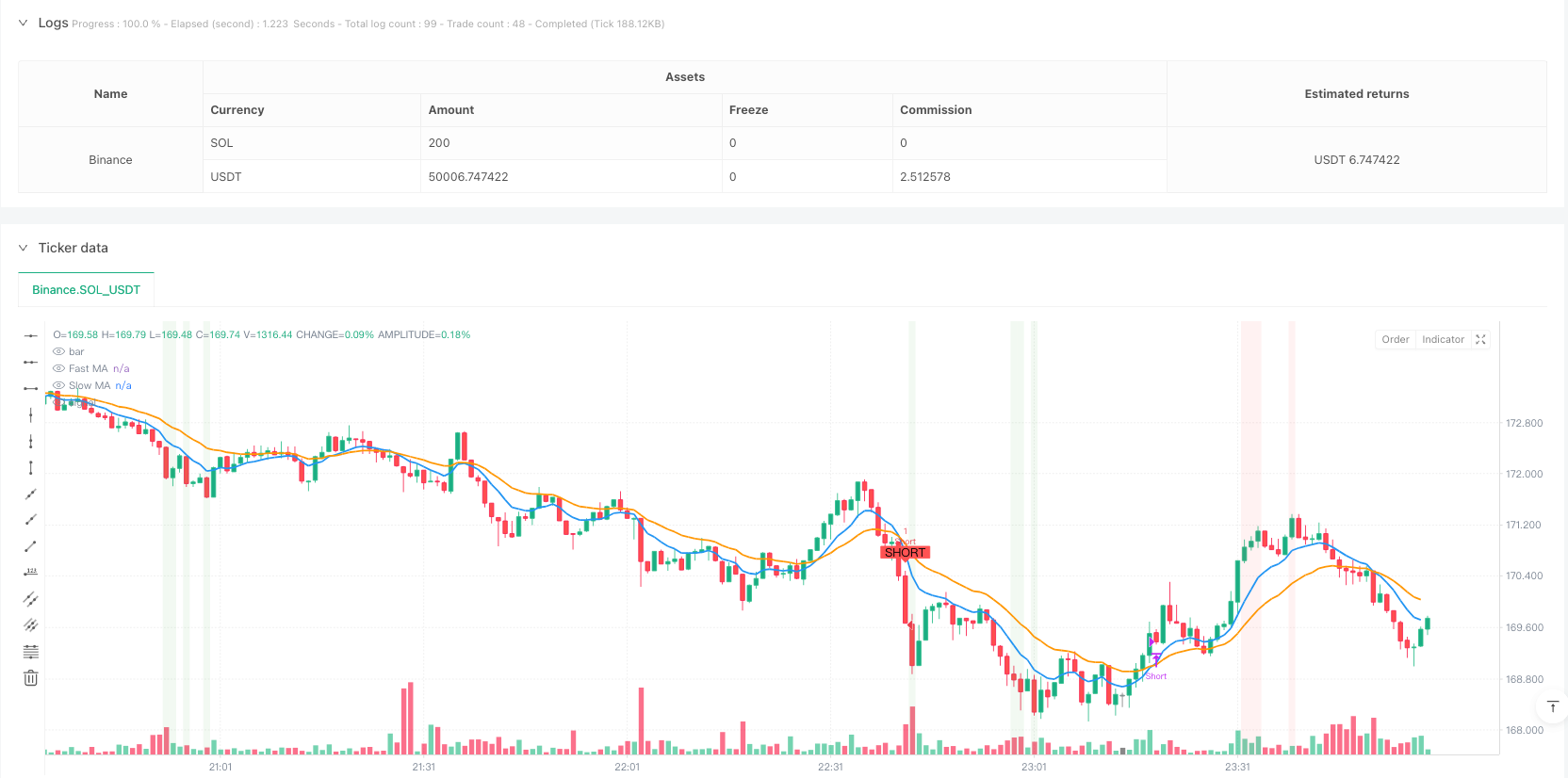

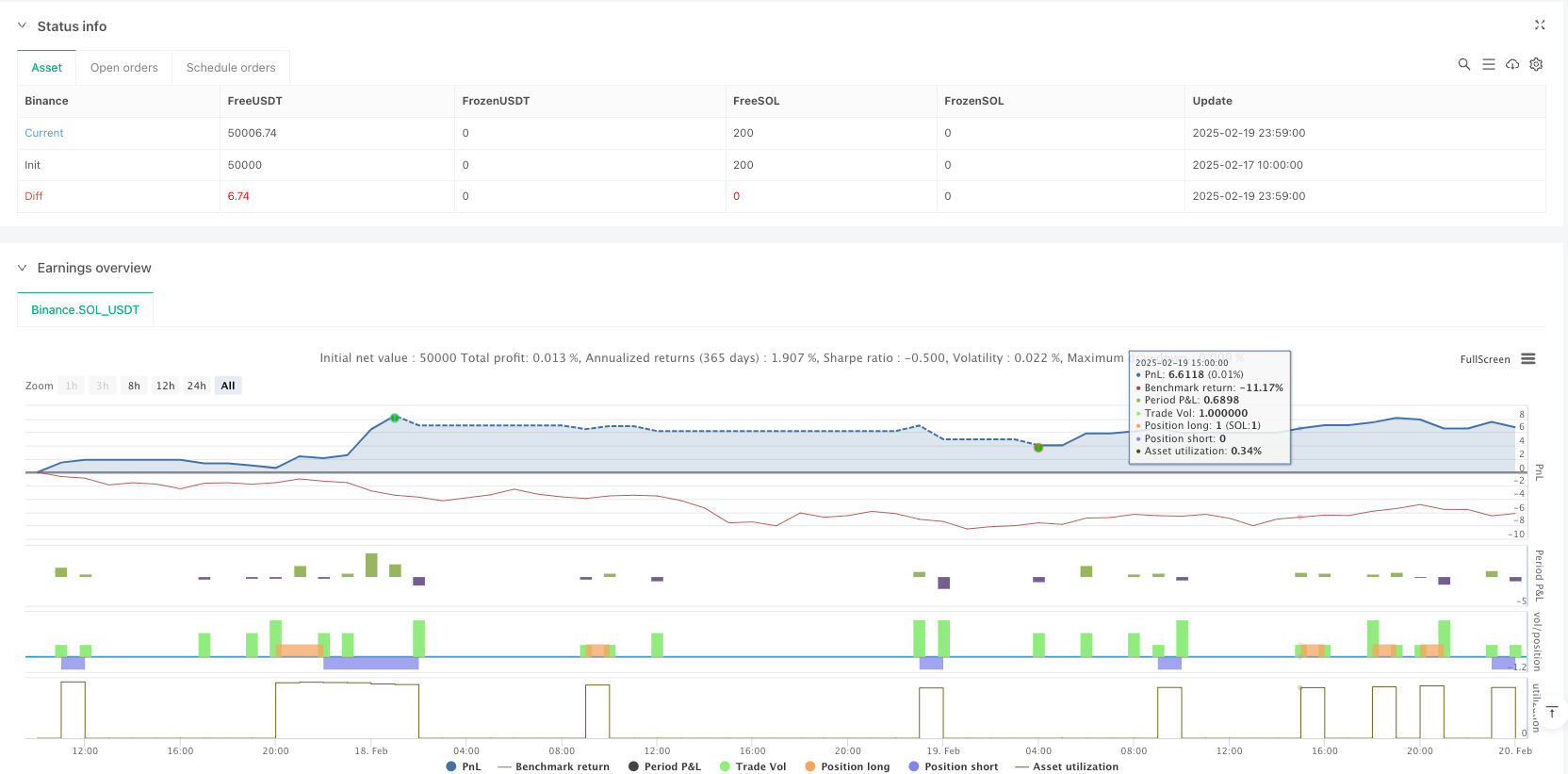

/*backtest

start: 2025-02-17 10:00:00

end: 2025-02-20 00:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Binance","currency":"SOL_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © DBate

//@version=6

strategy("Enhanced Scalping Strategy with Stop Loss", overlay=true)

// Input parameters

fastMA_length = input.int(9, title="Fast MA Length", minval=1)

slowMA_length = input.int(21, title="Slow MA Length", minval=1)

RSI_length = input.int(14, title="RSI Length", minval=1)

RSI_overbought = input.int(70, title="RSI Overbought")

RSI_oversold = input.int(30, title="RSI Oversold")

ATR_multiplier = input.float(1.5, title="ATR Multiplier")

ATR_length = input.int(14, title="ATR Length", minval=1)

stopLossPercent = input.float(1.0, title="Stop Loss %", minval=0.1) / 100 // Convert percentage to decimal

// Timeframe-specific adjustments

is1m = timeframe.period == "1"

is5m = timeframe.period == "5"

// Adjust input parameters based on timeframe

fastMA_length := is1m ? 9 : is5m ? 12 : fastMA_length

slowMA_length := is1m ? 21 : is5m ? 26 : slowMA_length

RSI_length := is1m ? 14 : is5m ? 14 : RSI_length

// Moving Averages

fastMA = ta.ema(close, fastMA_length)

slowMA = ta.ema(close, slowMA_length)

// RSI Calculation

rsi = ta.rsi(close, RSI_length)

// ATR Calculation for volatility filter

atr = ta.atr(ATR_length)

// Trade state variables

var bool inLongTrade = false

var bool inShortTrade = false

var float entryPrice = na

var float stopLossLevel = na

// Long and Short Conditions with added filters

longCondition = ta.crossover(fastMA, slowMA) and rsi < RSI_overbought and close > fastMA + ATR_multiplier * atr

shortCondition = ta.crossunder(fastMA, slowMA) and rsi > RSI_oversold and close < fastMA - ATR_multiplier * atr

// Ensure previous trades are closed before entering new ones

if (longCondition)

strategy.close("Short")

strategy.entry("Long", strategy.long)

entryPrice := close

stopLossLevel := close * (1 - stopLossPercent) // 1% below entry for long trades

inLongTrade := true

inShortTrade := false

if (shortCondition)

strategy.close("Long")

strategy.entry("Short", strategy.short)

entryPrice := close

stopLossLevel := close * (1 + stopLossPercent) // 1% above entry for short trades

inShortTrade := true

inLongTrade := false

// Stop Loss Exits

stopLossLongCondition = inLongTrade and close <= stopLossLevel

stopLossShortCondition = inShortTrade and close >= stopLossLevel

// Exit Conditions (Moving Average crossover or Stop Loss)

exitLongCondition = inLongTrade and (ta.crossunder(fastMA, slowMA) or stopLossLongCondition)

exitShortCondition = inShortTrade and (ta.crossover(fastMA, slowMA) or stopLossShortCondition)

// Reset trade state on exit

if (exitLongCondition)

strategy.close("Long")

inLongTrade := false

inShortTrade := false

if (exitShortCondition)

strategy.close("Short")

inShortTrade := false

inLongTrade := false

// Plot buy and sell signals

plotshape(longCondition, title="Long Signal", location=location.belowbar, color=color.green, style=shape.labelup, text="LONG")

plotshape(shortCondition, title="Short Signal", location=location.abovebar, color=color.red, style=shape.labeldown, text="SHORT")

// Plot moving averages

plot(fastMA, title="Fast MA", color=color.blue, linewidth=2)

plot(slowMA, title="Slow MA", color=color.orange, linewidth=2)

// Background color for overbought/oversold RSI

bgcolor(rsi > RSI_overbought ? color.new(color.red, 90) : na, title="Overbought Background")

bgcolor(rsi < RSI_oversold ? color.new(color.green, 90) : na, title="Oversold Background")

// Alerts

alertcondition(longCondition, title="Long Alert", message="Buy Signal")

alertcondition(shortCondition, title="Short Alert", message="Sell Signal")

alertcondition(exitLongCondition, title="Exit Long Alert", message="Exit Long Signal")

alertcondition(exitShortCondition, title="Exit Short Alert", message="Exit Short Signal")