Overview

This strategy is a trend-following trading system based on the 33-period Exponential Moving Average (EMA). It identifies market trend changes through price-EMA crossover relationships and combines swing highs and lows for setting profit targets and stop losses, achieving dynamic trend tracking and risk control.

Strategy Principles

The core logic relies on observing the crossover relationship between price and 33-period EMA to determine trend direction. Buy signals are triggered when the closing price breaks above and stabilizes above the EMA, while sell signals are triggered when the closing price breaks and remains below the EMA. The strategy uses 14-period highs and lows as volatility references, setting swing highs as profit targets and swing lows as stop losses for long positions, and vice versa for short positions. This design ensures both trend capture and reasonable risk control.

Strategy Advantages

- Clear Signals: Using EMA crossovers as trading signals provides objective and clear judgment criteria, avoiding subjective bias.

- Dynamic Management: Dynamically adjusts profit targets and stop losses based on swing points, adapting to market volatility characteristics.

- Risk Control: Each trade has a defined stop loss position, enabling effective risk management.

- Trend Following: Effectively captures medium to long-term trends through EMA’s trending characteristics.

- Parameter Optimization: Key parameters can be adjusted to optimize for different market characteristics.

Strategy Risks

- Consolidation Losses: Frequent crossovers in sideways markets may lead to consecutive stop losses.

- Lag Risk: EMA has inherent lag, potentially missing important price levels at trend beginnings.

- False Breakout Risk: Short-term price fluctuations may cause false breakouts, leading to incorrect signals.

- Stop Loss Range: Using volatility extremes as stop points may result in large stop loss distances in some cases.

Strategy Optimization Directions

- Trend Filtering: Add longer-period moving averages or trend indicators to filter out consolidation market signals.

- Entry Timing Improvement: Incorporate oscillators like RSI for better entry price positions.

- Stop Loss Optimization: Consider using ATR for dynamic stop loss adjustment, making risk control more flexible.

- Volume Confirmation: Add volume analysis to improve signal reliability.

- Exit Mechanism Enhancement: Design more detailed exit conditions, such as implementing trailing stops.

Summary

This is a well-structured trend-following strategy with clear logic. It captures trends through EMA crossovers and manages risk using swing points, demonstrating good practicality. While it has some inherent limitations, the suggested optimization directions can further enhance strategy stability and profitability. The overall design philosophy aligns with core quantitative trading principles, making it a trading system worthy of in-depth study and implementation.

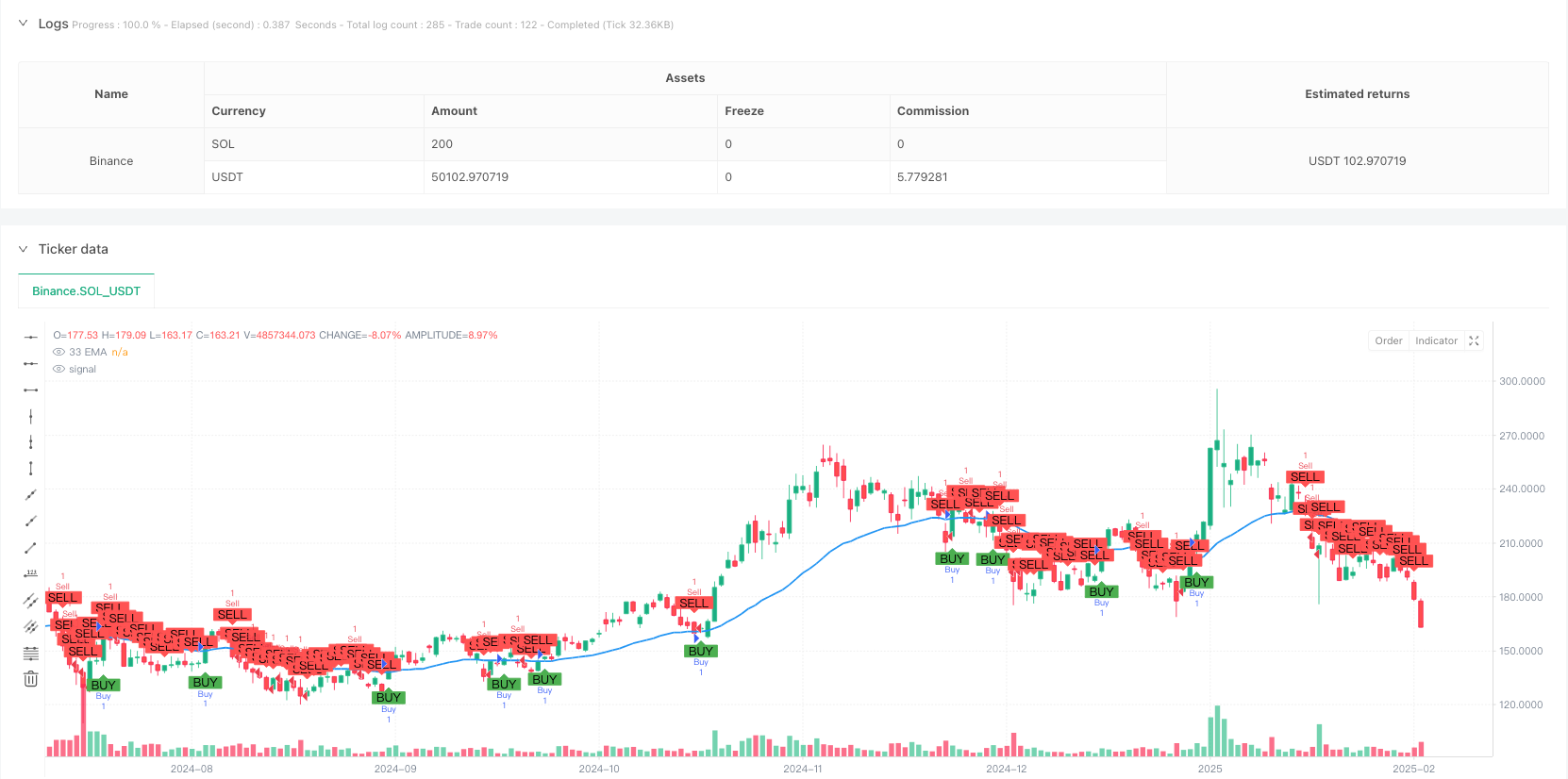

/*backtest

start: 2024-02-22 00:00:00

end: 2025-02-19 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Binance","currency":"SOL_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © GlenMabasa

//@version=6

strategy("33 EMA Crossover Strategy", overlay=true)

// Input for the EMA length

ema_length = input.int(33, title="EMA Length")

// Calculate the 33-day Exponential Moving Average

ema_33 = ta.ema(close, ema_length)

// Plot the 33 EMA

plot(ema_33, color=color.blue, title="33 EMA", linewidth=2)

// Buy condition: Price crosses and closes above the 33 EMA

buy_condition = ta.crossover(close, ema_33) and close > ema_33

// Sell condition: Price crosses or closes below the 33 EMA

sell_condition = ta.crossunder(close, ema_33) or close < ema_33

// Swing high and swing low calculations

swing_high_length = input.int(14, title="Swing High Lookback")

swing_low_length = input.int(14, title="Swing Low Lookback")

swing_high = ta.highest(high, swing_high_length) // Previous swing high

swing_low = ta.lowest(low, swing_low_length) // Previous swing low

// Profit target and stop loss for buys

buy_profit_target = swing_high

buy_stop_loss = swing_low

// Profit target and stop loss for sells

sell_profit_target = swing_low

sell_stop_loss = swing_high

// Plot buy and sell signals

plotshape(series=buy_condition, title="Buy Signal", location=location.belowbar, color=color.green, style=shape.labelup, text="BUY")

plotshape(series=sell_condition, title="Sell Signal", location=location.abovebar, color=color.red, style=shape.labeldown, text="SELL")

// Strategy logic for backtesting

if (buy_condition)

strategy.entry("Buy", strategy.long)

strategy.exit("Take Profit/Stop Loss", "Buy", limit=buy_profit_target, stop=buy_stop_loss)

if (sell_condition)

strategy.entry("Sell", strategy.short)

strategy.exit("Take Profit/Stop Loss", "Sell", limit=sell_profit_target, stop=sell_stop_loss)