Overview

This strategy is a trading system that combines moving average trend following with dynamic stop-loss management. It utilizes MACD (Moving Average Convergence Divergence) for momentum capture, EMA (Exponential Moving Average) for trend confirmation, and ATR (Average True Range) for dynamic stop-loss positioning. This multi-dimensional analysis approach effectively captures market opportunities while maintaining robust risk control.

Strategy Principles

The core logic comprises three dimensions: 1. Using MACD indicator crossovers (fast line crossing above slow line) for long entry signals and crossunders (fast line crossing below slow line) for exit signals. 2. Employing a 20-period EMA as a trend filter, allowing long positions only when price is above EMA, thus avoiding entries in downtrends. 3. Setting dynamic stop-loss levels based on ATR, which adapts to market volatility. When trailing stop is enabled, the stop-loss level moves up with price increases to lock in profits.

Strategy Advantages

- Robust Signal System: The combination of MACD momentum indicator and EMA trend indicator effectively filters false signals.

- Flexible Risk Control: Dynamic stop-loss based on ATR automatically adjusts stop distances according to market volatility.

- Comprehensive Profit Protection: The trailing stop mechanism effectively locks in profits while maintaining adequate room for price movement.

- Strong Parameter Adaptability: The strategy offers multiple adjustable parameters that users can optimize for different market characteristics.

Strategy Risks

- Sideways Market Risk: During range-bound conditions, MACD may generate frequent crossover signals, increasing transaction costs.

- Trend Reversal Risk: Despite EMA filtering, significant drawdowns may occur during strong market reversals.

- Stop-Loss Setting Risk: Inappropriate ATR multiplier settings may result in stops being too tight or too loose.

- Slippage Risk: During highly volatile periods, actual stop-loss prices may significantly deviate from expected levels.

Strategy Optimization Directions

- Signal System Enhancement: Consider adding other technical indicators like RSI or KDJ to improve entry signal accuracy.

- Stop-Loss Mechanism Refinement: Implement multiple stop-loss mechanisms, combining directional and time-based stops.

- Position Management Improvement: Introduce an ATR-based dynamic position sizing system to match position size with market volatility.

- Market Adaptability Enhancement: Add market condition recognition mechanisms to use different parameter sets in different market states.

Summary

This strategy builds a comprehensive trading system by combining trend following, momentum analysis, and dynamic risk control. Its main feature is achieving effective market opportunity capture and dynamic risk control while maintaining strategy robustness. While inherent risks exist, the strategy holds good practical application value through appropriate parameter settings and continuous optimization.

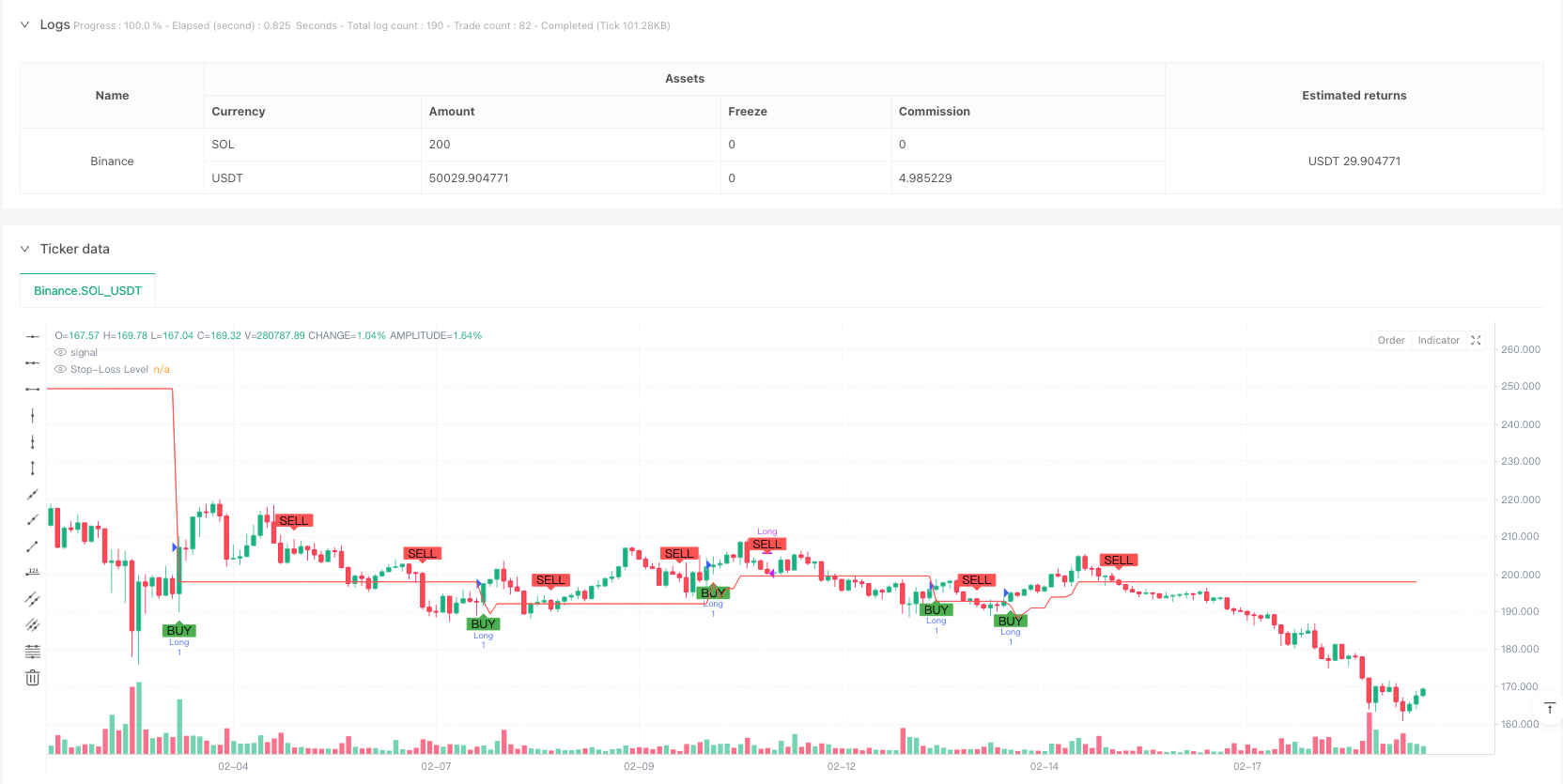

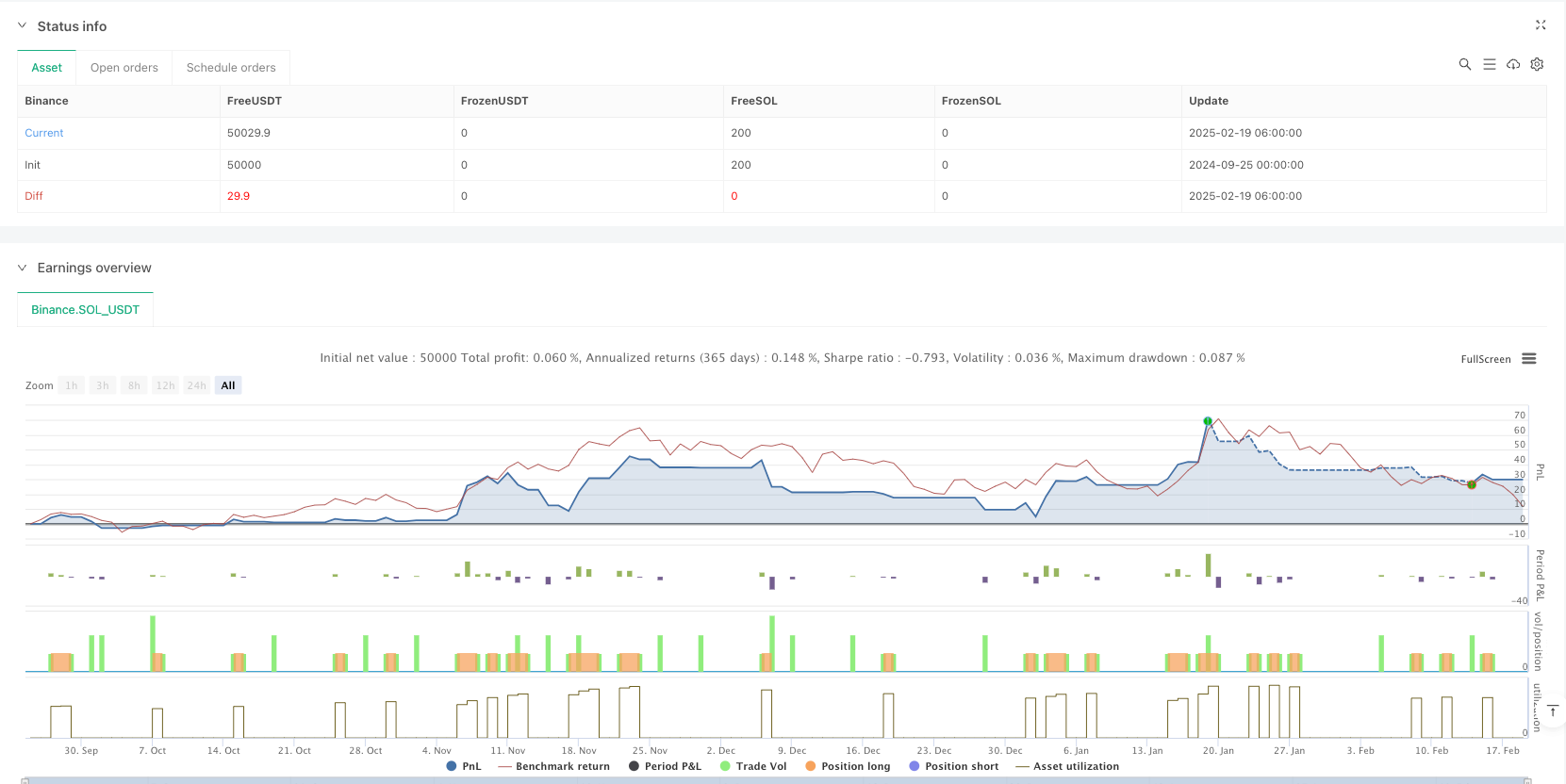

/*backtest

start: 2024-09-25 00:00:00

end: 2025-02-19 08:00:00

period: 2h

basePeriod: 2h

exchanges: [{"eid":"Binance","currency":"SOL_USDT"}]

*/

//@version=5

strategy("MACD + ATR Dynamic Stop-Loss Strategy", overlay=true)

// Input parameters

macdFastLength = input.int(12, title="MACD Fast Length")

macdSlowLength = input.int(26, title="MACD Slow Length")

macdSignalSmoothing = input.int(9, title="MACD Signal Smoothing")

atrLength = input.int(14, title="ATR Length")

stopLossMultiplier = input.float(1.0, title="Stop-Loss ATR Multiplier")

useTrailingStop = input.bool(true, title="Use Trailing Stop")

trailATRMultiplier = input.float(2.0, title="Trailing Stop ATR Multiplier")

emaLength = input.int(20, title="EMA Length")

// Calculate MACD

[macdLine, signalLine, _] = ta.macd(close, macdFastLength, macdSlowLength, macdSignalSmoothing)

// Calculate ATR

atr = ta.atr(atrLength)

// Calculate 20-period EMA

ema20 = ta.ema(close, emaLength)

// Entry Conditions

buyCondition = ta.crossover(macdLine, signalLine) and close > ema20

sellCondition = ta.crossunder(macdLine, signalLine)

// Plot Buy and Sell Signals

plotshape(series=buyCondition, title="Buy Signal", location=location.belowbar, color=color.green, style=shape.labelup, text="BUY")

plotshape(series=sellCondition, title="Sell Signal", location=location.abovebar, color=color.red, style=shape.labeldown, text="SELL")

// Dynamic Stop-Loss and Trailing Stop Logic

var float stopLossLevel = na

var float trailingStopLevel = na

if (buyCondition)

stopLossLevel := close - atr * stopLossMultiplier

trailingStopLevel := close - atr * trailATRMultiplier

if (strategy.position_size > 0)

if (useTrailingStop)

trailingStopLevel := math.max(trailingStopLevel, close - atr * trailATRMultiplier)

stopLossLevel := trailingStopLevel

strategy.exit("Trailing Stop", stop=stopLossLevel)

// Execute Trades

if (buyCondition)

strategy.entry("Long", strategy.long)

if (sellCondition)

strategy.close("Long")

// Plot Stop-Loss Level

plot(stopLossLevel, title="Stop-Loss Level", color=color.red, linewidth=1, style=plot.style_linebr)