Overview

This is a mean reversion trading strategy based on Bollinger Bands with multiple take-profit levels. The strategy enters trades when price rebounds after breaking the bands, with 5 different take-profit levels for gradual position reduction. It implements dynamic stop-loss for risk control and can operate during custom trading sessions with position adding capability.

Strategy Principle

The strategy uses 20-period Bollinger Bands with 2 standard deviations as the volatility range. Long signals are triggered when price breaks below the lower band and closes inside, while short signals occur when price breaks above the upper band and closes inside. After entry, the strategy employs a 5-level take-profit mechanism, setting profit targets at 0.5%, 1%, 1.5%, 2%, and 2.5%, each closing 20% of the position. The final take-profit is set at the opposite Bollinger Band. A 1% stop-loss is implemented for risk control.

Strategy Advantages

- Multi-level take-profit mechanism captures extended trends while securing partial profits

- Supports position adding when trade direction is correct, enhancing profit potential

- Uses Bollinger Bands as dynamic support/resistance levels, adapting to market volatility

- Customizable trading sessions to avoid off-hours interference

- Implements stop-loss mechanism for effective risk control

Strategy Risks

- May trigger frequent false breakout signals in highly volatile markets

- Could miss larger profit opportunities in rapid trend movements

- Position adding mechanism may lead to larger losses during market reversals

- Multiple take-profit orders may not fully execute due to insufficient liquidity Recommend adjusting Bollinger Band parameters and profit/loss ratios for different market conditions.

Optimization Directions

- Incorporate volume indicators as signal filters to improve breakout reliability

- Dynamically adjust take-profit and stop-loss levels based on volatility

- Add trend filtering indicators to avoid counter-trend trading in strong trends

- Optimize position adding logic with maximum position limits

- Consider adding trailing stop-loss functionality for better profit protection

Summary

The strategy captures mean reversion opportunities using Bollinger Bands, employing multiple take-profit levels and dynamic stop-loss for risk management. Its strengths lie in flexible position management and risk control mechanisms, but market environment compatibility must be considered. Strategy stability and profitability can be further enhanced by adding additional filtering indicators and optimizing profit/loss parameters.

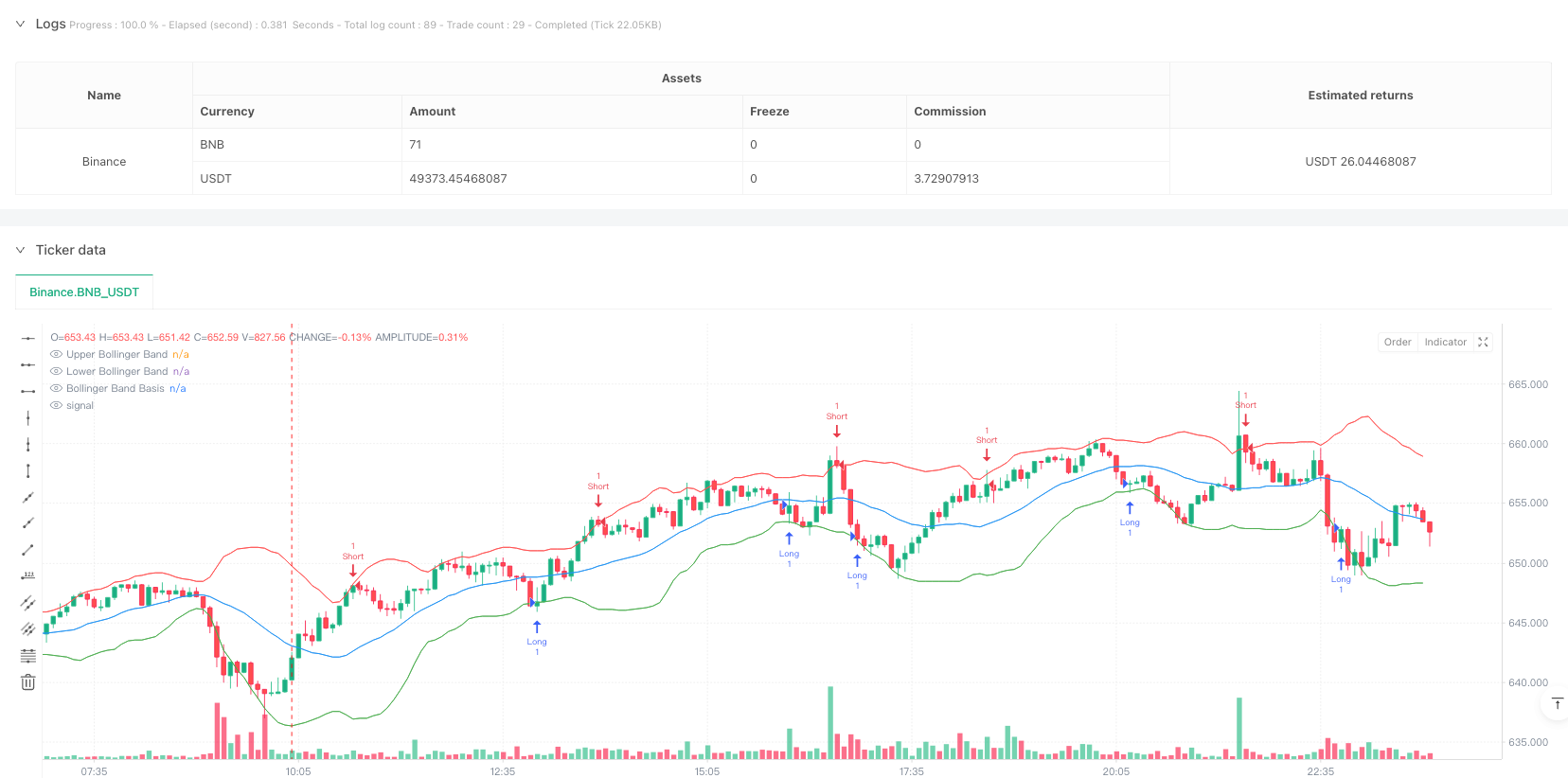

/*backtest

start: 2025-02-19 10:00:00

end: 2025-02-20 00:00:00

period: 5m

basePeriod: 5m

exchanges: [{"eid":"Binance","currency":"BNB_USDT"}]

*/

//@version=5

strategy("Bollinger Band Reentry Strategy", overlay=true)

// Inputs

bbLength = input.int(20, title="Bollinger Band Length")

bbMult = input.float(2.0, title="Bollinger Band Multiplier")

stopLossPerc = input.float(1.0, title="Stop Loss (%)") / 100

tp1Perc = input.float(0.5, title="Take Profit 1 (%)") / 100

tp2Perc = input.float(1.0, title="Take Profit 2 (%)") / 100

tp3Perc = input.float(1.5, title="Take Profit 3 (%)") / 100

tp4Perc = input.float(2.0, title="Take Profit 4 (%)") / 100

tp5Perc = input.float(2.5, title="Take Profit 5 (%)") / 100

allowAddToPosition = input.bool(true, title="Allow Adding to Position")

customSession = input.timeframe("0930-1600", title="Custom Trading Session")

// Calculate Bollinger Bands

basis = ta.sma(close, bbLength)

dev = ta.stdev(close, bbLength)

upperBB = basis + bbMult * dev

lowerBB = basis - bbMult * dev

// Plot Bollinger Bands

plot(upperBB, color=color.red, title="Upper Bollinger Band")

plot(lowerBB, color=color.green, title="Lower Bollinger Band")

plot(basis, color=color.blue, title="Bollinger Band Basis")

// Entry Conditions

longCondition = (ta.crossover(close, lowerBB) or (low < lowerBB and close > lowerBB)) and time(timeframe.period, customSession)

shortCondition = (ta.crossunder(close, upperBB) or (high > upperBB and close < upperBB)) and time(timeframe.period, customSession)

// Execute Trades

if (longCondition)

strategy.entry("Long", strategy.long, when=allowAddToPosition or strategy.position_size == 0)

if (shortCondition)

strategy.entry("Short", strategy.short, when=allowAddToPosition or strategy.position_size == 0)

// Take-Profit and Stop-Loss Levels for Long Trades

if (strategy.position_size > 0)

strategy.exit("TP1", "Long", limit=strategy.position_avg_price * (1 + tp1Perc), qty=strategy.position_size * 0.2) // Take 20% profit

strategy.exit("TP2", "Long", limit=strategy.position_avg_price * (1 + tp2Perc), qty=strategy.position_size * 0.2)

strategy.exit("TP3", "Long", limit=strategy.position_avg_price * (1 + tp3Perc), qty=strategy.position_size * 0.2)

strategy.exit("TP4", "Long", limit=strategy.position_avg_price * (1 + tp4Perc), qty=strategy.position_size * 0.2)

strategy.exit("TP5", "Long", limit=upperBB, qty=strategy.position_size * 0.2) // Take final 20% at opposite band

strategy.exit("Stop Loss", "Long", stop=strategy.position_avg_price * (1 - stopLossPerc))

// Take-Profit and Stop-Loss Levels for Short Trades

if (strategy.position_size < 0)

strategy.exit("TP1", "Short", limit=strategy.position_avg_price * (1 - tp1Perc), qty=strategy.position_size * 0.2)

strategy.exit("TP2", "Short", limit=strategy.position_avg_price * (1 - tp2Perc), qty=strategy.position_size * 0.2)

strategy.exit("TP3", "Short", limit=strategy.position_avg_price * (1 - tp3Perc), qty=strategy.position_size * 0.2)

strategy.exit("TP4", "Short", limit=strategy.position_avg_price * (1 - tp4Perc), qty=strategy.position_size * 0.2)

strategy.exit("TP5", "Short", limit=lowerBB, qty=strategy.position_size * 0.2)

strategy.exit("Stop Loss", "Short", stop=strategy.position_avg_price * (1 + stopLossPerc))

// Alerts

alertcondition(longCondition, title="Long Signal", message="Price closed inside Bollinger Band from below.")

alertcondition(shortCondition, title="Short Signal", message="Price closed inside Bollinger Band from above.")