Overview

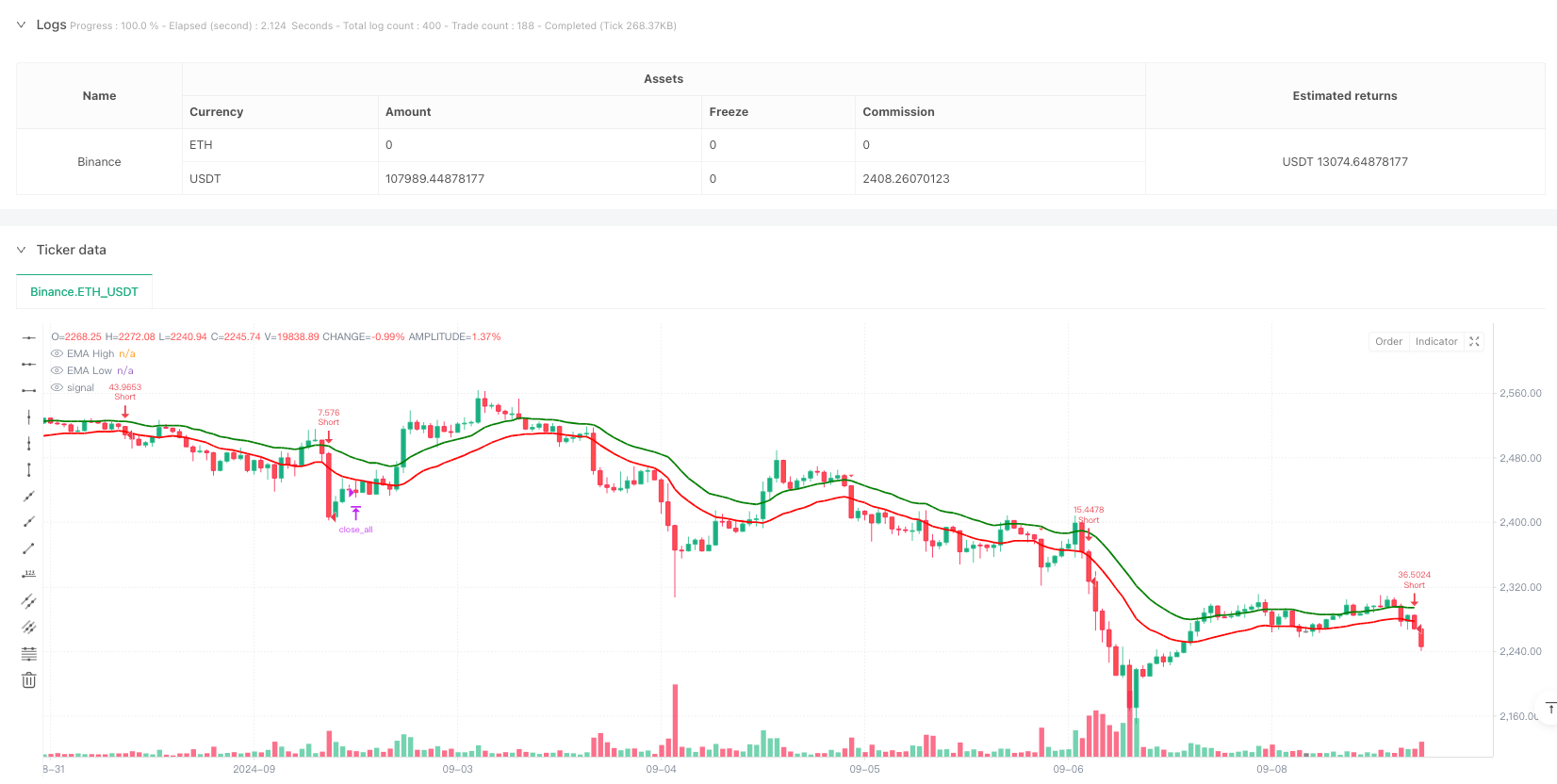

This is an intraday trading strategy based on multiple technical indicators, primarily utilizing EMA channels, RSI overbought/oversold levels, and MACD trend confirmation signals. The strategy operates on a 3-minute timeframe, capturing market trends through EMA high-low channels combined with RSI and MACD crossover confirmations, featuring ATR-based dynamic stop-loss and take-profit levels, and a fixed session closing time.

Strategy Principles

The strategy uses 20-period EMAs on high and low prices to form a channel, entering positions when price breaks the channel and meets the following conditions: 1. Long Entry: Close above EMA high, RSI between 50-70, MACD line crosses above signal line 2. Short Entry: Close below EMA low, RSI between 30-50, MACD line crosses below signal line 3. Uses ATR for dynamic stop-loss calculation, with 2.5:1 risk-reward ratio for take-profit 4. Risks 1% of account per trade, with position sizing based on stop-loss distance 5. Forces position closure at 15:00 IST

Strategy Advantages

- Multiple technical indicator cross-validation improves signal reliability

- Dynamic stop-loss based on ATR better adapts to market volatility

- Fixed risk percentage and risk-reward ratio for effective risk control

- Considers trading costs with commission calculations

- Prevents pyramiding to avoid excessive position risk

- Fixed closing time eliminates overnight risk

Strategy Risks

- Multiple indicators may lead to delayed signals affecting entry timing

- EMA channels might generate frequent false breakouts in ranging markets

- Fixed risk-reward ratio may lack flexibility in different market conditions

- RSI range restrictions might miss some strong trend movements

- Forced closure at session end may lead to premature exits at critical levels

Strategy Optimization Directions

- Consider adding volume indicators for additional confirmation

- Implement dynamic risk-reward ratios based on different session volatility characteristics

- Introduce volatility-based dynamic RSI thresholds

- Add trend strength filters to reduce false breakouts

- Consider parameter adjustments based on intraday session characteristics

- Incorporate historical volatility analysis for position sizing optimization

Summary

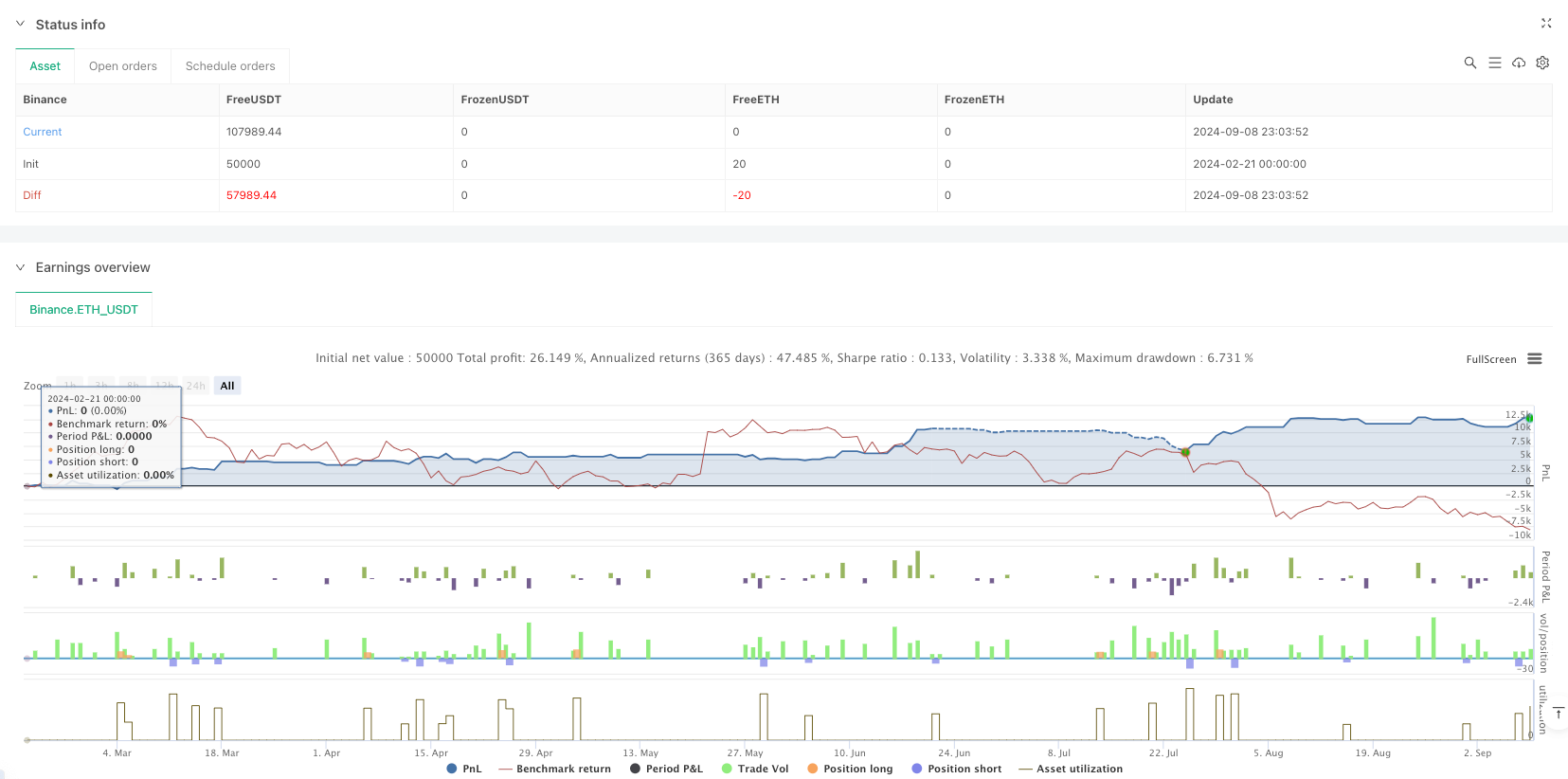

The strategy constructs a relatively complete trading system through the combination of multiple technical indicators. Its strength lies in comprehensive risk control, including dynamic stops, fixed risk parameters, and session-end closure mechanisms. While there are inherent lag risks, performance can be further enhanced through parameter optimization and additional confirmatory indicators. The strategy is particularly suited for volatile intraday markets, achieving stable returns through strict risk control and multiple signal confirmation.

/*backtest

start: 2024-02-21 00:00:00

end: 2024-09-09 00:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Binance","currency":"ETH_USDT"}]

*/

//@version=6

strategy("Intraday 3min EMA HL Strategy v6",

overlay=true,

margin_long=100,

margin_short=100,

initial_capital=100000,

default_qty_type=strategy.percent_of_equity,

default_qty_value=100,

commission_type=strategy.commission.percent,

commission_value=0.05,

calc_on_every_tick=false,

process_orders_on_close=true,

pyramiding=0)

// Input Parameters

i_emaLength = input.int(20, "EMA Length", minval=5, group="Strategy Parameters")

i_rsiLength = input.int(14, "RSI Length", minval=5, group="Strategy Parameters")

i_atrLength = input.int(14, "ATR Length", minval=5, group="Risk Management")

i_rrRatio = input.float(2.5, "Risk:Reward Ratio", minval=1, maxval=10, step=0.5, group="Risk Management")

i_riskPercent = input.float(1, "Risk % per Trade", minval=0.1, maxval=5, step=0.1, group="Risk Management")

// Time Exit Parameters (IST)

i_exitHour = input.int(15, "Exit Hour (IST)", minval=0, maxval=23, group="Session Rules")

i_exitMinute = input.int(0, "Exit Minute (IST)", minval=0, maxval=59, group="Session Rules")

// Indicator Calculations

emaHigh = ta.ema(high, i_emaLength)

emaLow = ta.ema(low, i_emaLength)

rsi = ta.rsi(close, i_rsiLength)

atr = ta.atr(i_atrLength)

fastMA = ta.ema(close, 12)

slowMA = ta.ema(close, 26)

macdLine = fastMA - slowMA

signalLine = ta.ema(macdLine, 9)

// Time Calculations (UTC to IST Conversion)

istHour = (hour(time) + 5) % 24 // UTC+5

istMinute = minute(time) + 30 // 30 minute offset

istHour += istMinute >= 60 ? 1 : 0

istMinute := istMinute % 60

// Exit Condition

timeExit = istHour > i_exitHour or (istHour == i_exitHour and istMinute >= i_exitMinute)

// Entry Conditions (Multi-line formatting fix)

longCondition = close > emaHigh and

rsi > 50 and

rsi < 70 and

ta.crossover(macdLine, signalLine)

shortCondition = close < emaLow and

rsi < 50 and

rsi > 30 and

ta.crossunder(macdLine, signalLine)

// Risk Calculations

var float entryPrice = na

var float stopLoss = na

var float takeProfit = na

var float posSize = na

// Strategy Logic

if longCondition and not timeExit and strategy.position_size == 0

entryPrice := close

stopLoss := math.min(low, entryPrice - atr)

takeProfit := entryPrice + (entryPrice - stopLoss) * i_rrRatio

posSize := strategy.equity * i_riskPercent / 100 / (entryPrice - stopLoss)

strategy.entry("Long", strategy.long, qty=posSize)

strategy.exit("Long Exit", "Long", stop=stopLoss, limit=takeProfit)

if shortCondition and not timeExit and strategy.position_size == 0

entryPrice := close

stopLoss := math.max(high, entryPrice + atr)

takeProfit := entryPrice - (stopLoss - entryPrice) * i_rrRatio

posSize := strategy.equity * i_riskPercent / 100 / (stopLoss - entryPrice)

strategy.entry("Short", strategy.short, qty=posSize)

strategy.exit("Short Exit", "Short", stop=stopLoss, limit=takeProfit)

// Force Close at Session End

if timeExit

strategy.close_all()

// Visual Components

plot(emaHigh, "EMA High", color=color.rgb(0, 128, 0), linewidth=2)

plot(emaLow, "EMA Low", color=color.rgb(255, 0, 0), linewidth=2)

plotshape(longCondition, "Long Signal", shape.triangleup,

location.belowbar, color=color.green, size=size.small)

plotshape(shortCondition, "Short Signal", shape.triangledown,

location.abovebar, color=color.red, size=size.small)

// Debugging Table

var table infoTable = table.new(position.top_right, 3, 3)

if barstate.islast

table.cell(infoTable, 0, 0, "EMA High: " + str.tostring(emaHigh, "#.00"))

table.cell(infoTable, 0, 1, "EMA Low: " + str.tostring(emaLow, "#.00"))

table.cell(infoTable, 0, 2, "Current RSI: " + str.tostring(rsi, "#.00"))