Overview

This is a contrarian trading strategy based on RSI indicator and volume analysis. The strategy identifies overbought and oversold market conditions, combined with volume confirmation, to take contrary positions when prices reach extreme levels. The core concept is to trade when RSI shows overbought or oversold signals with above-average volume, using RSI midline (50) as exit signals.

Strategy Principles

The strategy is based on these core components: 1. RSI Calculation: Uses 14-period RSI to monitor price momentum 2. Volume Confirmation: Employs 20-period volume Simple Moving Average (SMA) 3. Entry Logic: - Long Entry: When RSI is below 30 (oversold) and volume exceeds its moving average - Short Entry: When RSI is above 70 (overbought) and volume exceeds its moving average 4. Exit Logic: - Long Exit: RSI crosses above 50 - Short Exit: RSI crosses below 50

Strategy Advantages

- Systematic Trading Decisions: Establishes objective trading system through clear technical indicator combinations

- Multiple Confirmation Mechanism: Combines RSI and volume dimensions to improve signal reliability

- Comprehensive Risk Control: Uses percentage-based money management and prevents pyramiding

- Visualization Support: Includes complete charting functionality for analysis and monitoring

- High Adaptability: All major parameters are customizable to adapt to different market conditions

Strategy Risks

- Trend Continuation Risk: Contrarian strategy may experience frequent losses in strong trend markets

- False Breakout Risk: High volume doesn’t necessarily indicate genuine market reversal

- Parameter Sensitivity: Choice of RSI period and threshold levels significantly impacts strategy performance

- Slippage Impact: Execution prices may significantly deviate from expected levels during volatile periods

- Money Management Risk: Fixed percentage position sizing may be too aggressive in certain market conditions

Optimization Directions

- Trend Filtering: Introduce trend identification indicators to avoid counter-trend trading during strong trends

- Dynamic Parameters: Adjust RSI overbought/oversold thresholds dynamically based on market volatility

- Exit Enhancement: Add stop-loss and trailing stop mechanisms to improve risk control

- Volume Analysis Enhancement: Incorporate volume pattern analysis to improve signal quality

- Time Filtering: Add trading time windows to avoid inefficient trading periods

Summary

The strategy constructs a complete contrarian trading system by combining RSI indicator and volume analysis. The strategy design is rational with good operability and flexibility. Through the suggested optimization directions, there is room for further improvement. For live trading implementation, it is recommended to thoroughly test parameters and optimize based on market characteristics.

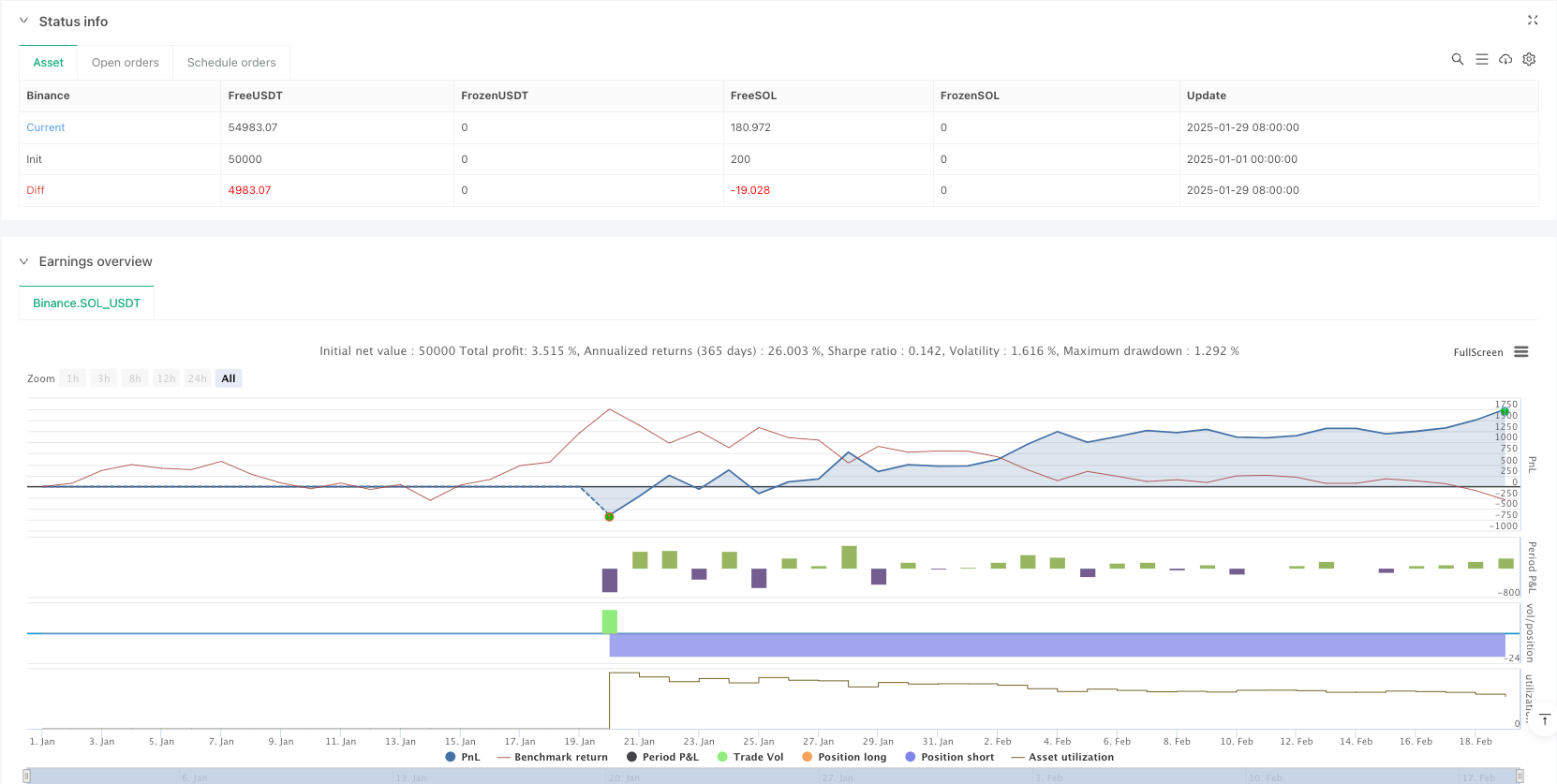

/*backtest

start: 2025-01-01 00:00:00

end: 2025-02-19 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Binance","currency":"SOL_USDT"}]

*/

//@version=5

strategy("RSI & Volume Contrarian Strategy", overlay=true, initial_capital=100000, default_qty_type=strategy.percent_of_equity, default_qty_value=10, pyramiding=0)

//---------------------------

// Inputs and Parameters

//---------------------------

rsiPeriod = input.int(14, title="RSI Period", minval=1)

oversold = input.int(30, title="RSI Oversold Level", minval=1, maxval=50)

overbought = input.int(70, title="RSI Overbought Level", minval=50, maxval=100)

volMAPeriod = input.int(20, title="Volume MA Period", minval=1)

//---------------------------

// Indicator Calculations

//---------------------------

rsiValue = ta.rsi(close, rsiPeriod)

volMA = ta.sma(volume, volMAPeriod)

//---------------------------

// Trade Logic

//---------------------------

// Long Entry: Look for oversold conditions (RSI < oversold)

// accompanied by above-average volume (volume > volMA)

// In an uptrend, oversold conditions with high volume may signal a strong reversal opportunity.

longCondition = (rsiValue < oversold) and (volume > volMA)

// Short Entry: When RSI > overbought and volume is above its moving average,

// the temporary strength in a downtrend can be exploited contrarily.

shortCondition = (rsiValue > overbought) and (volume > volMA)

if longCondition

strategy.entry("Long", strategy.long)

if shortCondition

strategy.entry("Short", strategy.short)

// Exit Logic:

// Use a simple RSI midline crossover as an exit trigger.

// For longs, if RSI crosses above 50 (indicating a recovery), exit the long.

// For shorts, if RSI crosses below 50, exit the short.

exitLong = ta.crossover(rsiValue, 50)

exitShort = ta.crossunder(rsiValue, 50)

if strategy.position_size > 0 and exitLong

strategy.close("Long", comment="RSI midline exit")

log.info("strategy.position_size > 0 and exitLong")

if strategy.position_size < 0 and exitShort

strategy.close("Short", comment="RSI midline exit")

log.info("strategy.position_size > 0 and exitLong")

//---------------------------

// Visualization

//---------------------------

// Plot the RSI on a separate pane for reference

plot(rsiValue, title="RSI", color=color.blue, linewidth=2)

hline(oversold, title="Oversold", color=color.green)

hline(overbought, title="Overbought", color=color.red)

hline(50, title="Midline", color=color.gray, linestyle=hline.style_dotted)

// Optionally, you may plot the volume moving average on a hidden pane

plot(volMA, title="Volume MA", color=color.purple, display=display.none)