Overview

This strategy is an adaptive trading system that combines ZigZag percentage reversal with the Stochastic indicator. It identifies key reversal points through dynamic market volatility calculation and determines trading opportunities using Stochastic overbought/oversold signals. The strategy incorporates automatic take-profit and stop-loss mechanisms for effective risk management.

Strategy Principles

The core mechanism uses percentage reversal method to dynamically track market trends. Users can choose between manual setting of reversal percentage or dynamic calculation based on ATR across different periods (5-250 days). Buy signals are generated when price breaks above the reversal line with Stochastic K value below 30; sell signals occur when price breaks below the reversal line with K value above 70. The system automatically sets take-profit and stop-loss levels to protect profits and control risks.

Strategy Advantages

- Dynamic adaptive reversal calculation method better suits different market conditions

- Integration of trend reversal and momentum indicators provides more reliable trading signals

- Built-in take-profit and stop-loss mechanisms help traders manage risk automatically

- Flexible parameter settings allow traders to optimize according to personal trading styles

- Visualized trading signals facilitate analysis and decision-making

Strategy Risks

- May generate frequent false signals in ranging markets

- ATR period selection impacts strategy performance

- Fixed take-profit and stop-loss levels may not suit all market conditions

- Stochastic indicator may lag in certain market conditions

- Requires proper parameter setting to avoid overtrading

Strategy Optimization Directions

- Introduce multiple timeframe analysis to improve signal reliability

- Implement dynamic adjustment of take-profit and stop-loss levels for better market adaptation

- Add volume indicators as confirmation signals

- Develop adaptive Stochastic indicator parameters

- Include trend strength filters to reduce false signals

Summary

This is a modernized trading strategy combining classic technical analysis tools. By integrating ZigZag reversal, Stochastic indicator, and risk management, it provides traders with a comprehensive trading system. The strategy’s high customizability makes it suitable for traders with different risk preferences. Continuous optimization and parameter adjustment can further enhance the strategy’s stability and profitability.

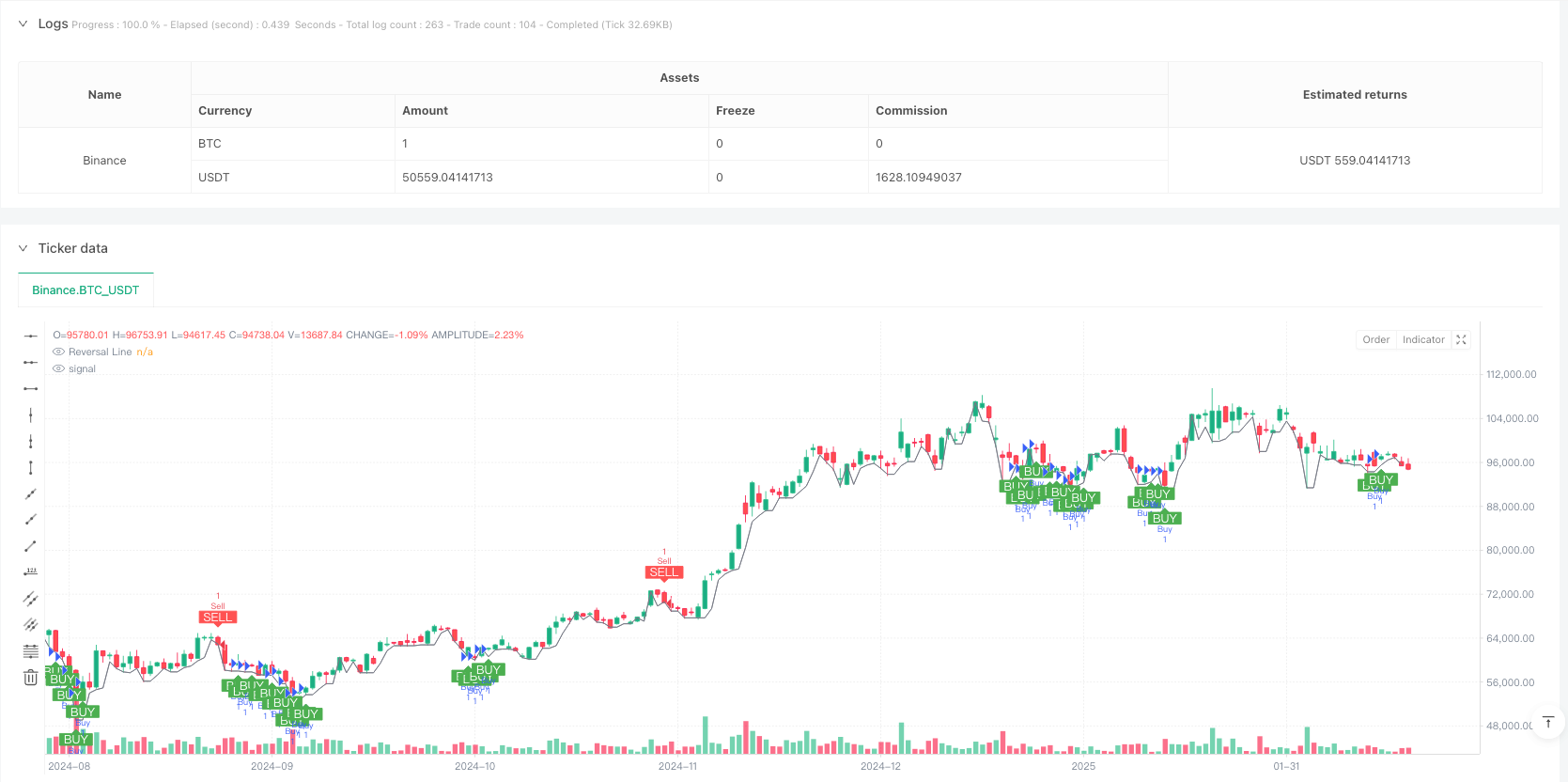

/*backtest

start: 2024-06-04 00:00:00

end: 2025-02-19 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("[RS]ZigZag Percent Reversal with Stochastic Strategy", overlay=true)

// ZigZag Settings

string percent_method = input.string(

defval="MANUAL",

title="Method to use for the zigzag reversal range:",

options=[

"MANUAL",

"ATR005 * X", "ATR010 * X", "ATR020 * X", "ATR050 * X", "ATR100 * X", "ATR250 * X"

]

)

var float percent = input.float(

defval=0.25,

title="Percent of last pivot price for zigzag reversal:",

minval=0.0, maxval=99.0

) / 100

float percent_multiplier = input.float(

defval=1.0,

title="Multiplier to apply to ATR if applicable:"

)

if percent_method == "ATR005 * X"

percent := ta.atr(5) / open * percent_multiplier

if percent_method == "ATR010 * X"

percent := ta.atr(10) / open * percent_multiplier

if percent_method == "ATR020 * X"

percent := ta.atr(20) / open * percent_multiplier

if percent_method == "ATR050 * X"

percent := ta.atr(50) / open * percent_multiplier

if percent_method == "ATR100 * X"

percent := ta.atr(100) / open * percent_multiplier

if percent_method == "ATR250 * X"

percent := ta.atr(250) / open * percent_multiplier

// Zigzag function

f_zz(_percent)=>

// Direction

var bool _is_direction_up = na

var float _htrack = na

var float _ltrack = na

var float _pivot = na

float _reverse_range = 0.0

var int _real_pivot_time = na

var int _htime = na

var int _ltime = na

var float _reverse_line = na

if bar_index >= 1

if na(_is_direction_up)

_is_direction_up := true

_reverse_range := nz(_pivot[1]) * _percent

if _is_direction_up

_ltrack := na

_ltime := time

if na(_htrack)

if high > high[1]

_htrack := high

_htime := time

else

_htrack := high[1]

_htime := time[1]

else

if high > _htrack

_htrack := high

_htime := time

_reverse_line := _htrack - _reverse_range

if close <= _reverse_line

_pivot := _htrack

_real_pivot_time := _htime

_is_direction_up := false

if not _is_direction_up

_htrack := na

_htime := na

if na(_ltrack)

if low < low[1]

_ltrack := low

_ltime := time

else

_ltrack := low[1]

_ltime := time[1]

else

if low < _ltrack

_ltrack := low

_ltime := time

_reverse_line := _ltrack + _reverse_range

if close >= _reverse_line

_pivot := _ltrack

_real_pivot_time := _ltime

_is_direction_up := true

[_pivot, _is_direction_up, _reverse_line, _real_pivot_time]

[pivot, direction_up, reverse_line, pivot_time] = f_zz(percent)

// Reversal line

var float static_reverse_line = na

if (not na(reverse_line))

static_reverse_line := reverse_line

plot(series=static_reverse_line, color=color.gray, style=plot.style_line, title="Reversal Line", trackprice=false)

// Stochastic Settings

K_length = input.int(9, title="Stochastic K Length", minval=1) // User input

K_smoothing = input.int(3, title="Stochastic K Smoothing", minval=1) // User input

stochK = ta.sma(ta.stoch(close, high, low, K_length), K_smoothing)

// User Input: Take Profit and Stop Loss Levels

stop_loss_pips = input.int(100, title="Stop Loss (pips)", minval=1) // Stop Loss

take_profit_pips = input.int(300, title="Take Profit (pips)", minval=1) // Take Profit

// Calculating levels

long_stop_loss = close - stop_loss_pips * syminfo.mintick

long_take_profit = close + take_profit_pips * syminfo.mintick

short_stop_loss = close + stop_loss_pips * syminfo.mintick

short_take_profit = close - take_profit_pips * syminfo.mintick

// Buy and Sell Conditions

buy_signal = close > static_reverse_line and stochK < 30 // K < 30 condition

sell_signal = close < static_reverse_line and stochK > 70 // K > 70 condition

if buy_signal

strategy.entry("Buy", strategy.long)

strategy.exit("TP/SL", "Buy", stop=long_stop_loss, limit=long_take_profit)

if sell_signal

strategy.entry("Sell", strategy.short)

strategy.exit("TP/SL", "Sell", stop=short_stop_loss, limit=short_take_profit)

// Signal Visualization

plotshape(series=buy_signal, location=location.belowbar, color=color.green, style=shape.labelup, title="Buy Signal", text="BUY", textcolor=color.white)

plotshape(series=sell_signal, location=location.abovebar, color=color.red, style=shape.labeldown, title="Sell Signal", text="SELL", textcolor=color.white)