Overview

This strategy is an intelligent trading system based on multiple technical indicators, combining Bollinger Bands, Stochastic Oscillator, and Average True Range (ATR) to identify potential trading opportunities through comprehensive analysis of market volatility, momentum, and trends. The strategy employs dynamic stop-loss and profit targets that adapt to market volatility conditions.

Strategy Principles

The core logic is based on a triple verification mechanism: 1. Using Bollinger Bands to define price volatility ranges, identifying oversold opportunities when price breaks below the lower band and overbought opportunities when it breaks above the upper band 2. Momentum confirmation through Stochastic Oscillator in overbought (>80) and oversold (<20) regions, with %K and %D line crossovers as entry signals 3. Incorporating ATR as a volatility filter to ensure trades are executed under sufficient market volatility

Trade signals require the following conditions: Buy conditions: - Price closes below the lower Bollinger Band - Stochastic %K line crosses above %D line in the oversold region - ATR value exceeds the set threshold, confirming adequate market volatility

Sell conditions: - Price closes above the upper Bollinger Band - Stochastic %K line crosses below %D line in the overbought region - ATR value maintains above threshold, confirming trade validity

Strategy Advantages

- Multiple technical indicator cross-validation significantly improves trading signal reliability

- Dynamic stop-loss and profit targets that automatically adjust risk management parameters based on market volatility

- Volatility filtering mechanism effectively avoids false signals during low volatility periods

- Indicator parameters can be flexibly adjusted for different market conditions, providing good adaptability

- Clear strategy logic that is easy to understand and implement, suitable for traders of all levels

Strategy Risks

- Potential slippage during intense market volatility affecting actual execution prices

- Multiple indicators may lead to signal lag, missing optimal entry points

- Over-optimization of parameters may result in overfitting, impacting strategy performance in live trading

- False signals may occur at trend turning points, requiring complementary analysis tools

- Trading costs and commissions may affect overall strategy returns

Strategy Optimization Directions

- Introduce trend filters, such as moving average crossover systems, to enhance trend confirmation

- Optimize the dynamic adjustment mechanism of ATR threshold for better adaptation to different market environments

- Add volume indicator verification to improve trading signal reliability

- Implement adaptive parameter optimization that automatically adjusts indicator parameters based on market conditions

- Add time filters to avoid trading during highly volatile market opening and closing periods

Summary

The strategy constructs a complete trading system through the combined application of Bollinger Bands, Stochastic Oscillator, and ATR. Its strengths lie in multiple indicator cross-validation and dynamic risk management, while attention must be paid to parameter optimization and market environment adaptability. Through continuous optimization and refinement, the strategy shows promise for achieving stable returns in actual trading.

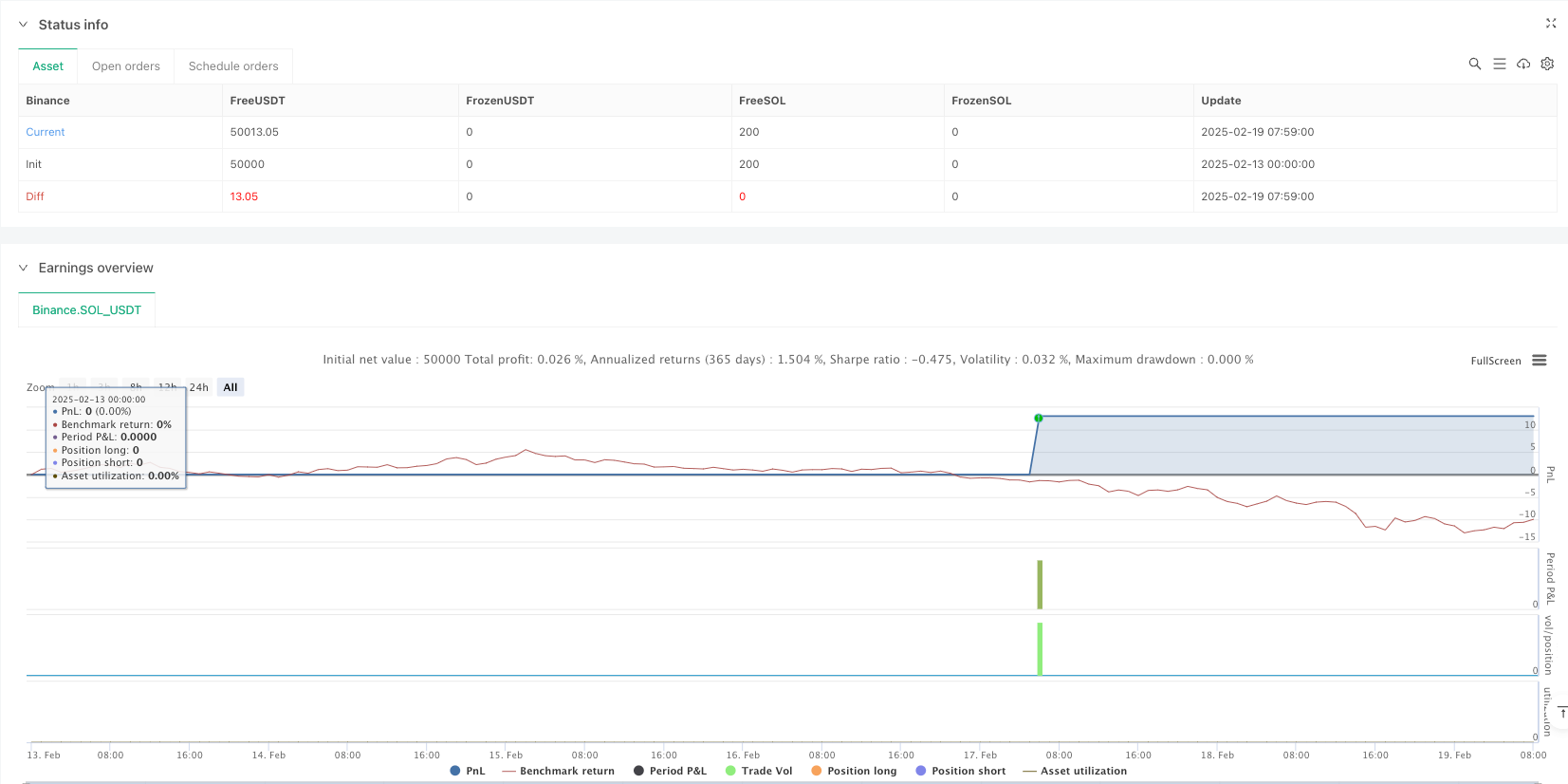

/*backtest

start: 2025-02-13 00:00:00

end: 2025-02-19 08:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Binance","currency":"SOL_USDT"}]

*/

//@version=5

strategy("Bollinger Bands + Stochastic Oscillator + ATR Strategy", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=10)

// Bollinger Bands Parameters

bb_length = 20

bb_mult = 2.0

basis = ta.sma(close, bb_length)

dev = bb_mult * ta.stdev(close, bb_length)

upper_bb = basis + dev

lower_bb = basis - dev

// Stochastic Oscillator Parameters

stoch_length = 14

k_smooth = 3

d_smooth = 3

stoch_k = ta.sma(ta.stoch(close, high, low, stoch_length), k_smooth)

stoch_d = ta.sma(stoch_k, d_smooth)

// ATR Parameters

atr_length = 14

atr_mult = 1.5

atr = ta.atr(atr_length)

// ATR Threshold based on ATR Moving Average

atr_ma = ta.sma(atr, atr_length)

atr_threshold = atr_ma * atr_mult

// Plot Bollinger Bands

plot(basis, color=color.blue, title="BB Basis")

p1 = plot(upper_bb, color=color.red, title="Upper BB")

p2 = plot(lower_bb, color=color.green, title="Lower BB")

fill(p1, p2, color=color.rgb(173, 216, 230, 90), title="BB Fill")

// Plot Stochastic Oscillator

hline(80, "Overbought", color=color.orange)

hline(20, "Oversold", color=color.orange)

plot(stoch_k, color=color.purple, title="%K")

plot(stoch_d, color=color.orange, title="%D")

// Plot ATR and ATR Threshold for Visualization

hline(0, "ATR Zero Line", color=color.gray, linestyle=hline.style_dotted)

plot(atr, title="ATR", color=color.blue)

plot(atr_threshold, title="ATR Threshold", color=color.gray, style=plot.style_stepline)

// Buy Condition:

// - Price closes below the lower Bollinger Band

// - Stochastic %K crosses above %D in oversold region

// - ATR is above the ATR threshold

buyCondition = close < lower_bb and ta.crossover(stoch_k, stoch_d) and stoch_k < 20 and atr > atr_threshold

// Sell Condition:

// - Price closes above the upper Bollinger Band

// - Stochastic %K crosses below %D in overbought region

// - ATR is above the ATR threshold

sellCondition = close > upper_bb and ta.crossunder(stoch_k, stoch_d) and stoch_k > 80 and atr > atr_threshold

// Plot Buy/Sell Signals

plotshape(series=buyCondition, title="Buy Signal", location=location.belowbar, color=color.green, style=shape.labelup, text="BUY")

plotshape(series=sellCondition, title="Sell Signal", location=location.abovebar, color=color.red, style=shape.labeldown, text="SELL")

// Execute Trades

if (buyCondition)

strategy.entry("Long", strategy.long)

if (sellCondition)

strategy.close("Long")

// Optional: Add Stop Loss and Take Profit

// Stop Loss at ATR-based distance

stop_level = close - atr_mult * atr

take_level = close + atr_mult * atr

if (buyCondition)

strategy.exit("Take Profit/Stop Loss", from_entry="Long", stop=stop_level, limit=take_level)