Overview

This strategy is a trend-following system that combines technical indicators with machine learning methods. The strategy integrates the Relative Strength Index (RSI), Average Directional Index (ADX), and linear regression prediction model to analyze market trends and trading opportunities from multiple dimensions. Operating on a 5-minute timeframe, it creates a complete trading decision system by combining RSI overbought/oversold signals, ADX trend confirmation, and linear regression predictions.

Strategy Principles

The strategy employs a three-layer filtering mechanism to determine trading signals: 1. RSI indicator identifies overbought/oversold conditions, generating long signals at RSI 30 (oversold) and short signals at RSI 70 (overbought) 2. ADX indicator confirms trend strength, allowing trades only when ADX is above 25 to ensure operations in strong trend environments 3. Linear regression prediction module analyzes data from the past 20 price periods to calculate price trend slope and intercept, predicting the next price level Trading signals are only generated when all three conditions align in direction.

Strategy Advantages

- Multi-dimensional verification: Combines technical indicators and statistical prediction methods for more reliable trading signals

- Trend confirmation: Uses ADX filtering to ensure trading only in strong trend markets, avoiding false signals in ranging markets

- Predictive capability: Incorporates linear regression prediction model for forward-looking price analysis

- High flexibility: Key parameters can be adjusted according to different market conditions

- Clear execution: Trading rules are clear and signal generation conditions are strict, reducing subjective judgment impact

Strategy Risks

- Parameter sensitivity: Strategy effectiveness heavily depends on RSI, ADX, and regression period parameter settings

- Lag risk: Technical indicators have inherent lag, potentially causing delayed entry timing

- Trend reversal risk: Sudden trend reversals may cause losses due to system response delay

- Overfitting risk: Linear regression predictions may overfit historical data, affecting prediction accuracy

- Market condition dependency: Strategy may underperform in ranging markets

Strategy Optimization Directions

- Dynamic parameter adjustment: Introduce adaptive parameter mechanisms to automatically adjust RSI and ADX parameters based on market volatility

- Enhanced market environment filtering: Add volatility indicators to adjust strategy parameters or pause trading in different market conditions

- Improved prediction model: Consider using more sophisticated machine learning models like LSTM or Random Forests for better prediction accuracy

- Enhanced risk management: Add dynamic stop-loss mechanisms that adjust based on market volatility

- Trading time filters: Avoid low liquidity periods and major news release times

Summary

This strategy builds a relatively complete trading system by combining traditional technical analysis with modern prediction methods. Its core advantage lies in the multi-dimensional signal confirmation mechanism, effectively reducing the impact of false signals. There is significant optimization potential through improving the prediction model, optimizing parameter adjustment mechanisms, and enhancing risk management. In practical application, investors should adjust strategy parameters according to specific market characteristics and their risk tolerance.

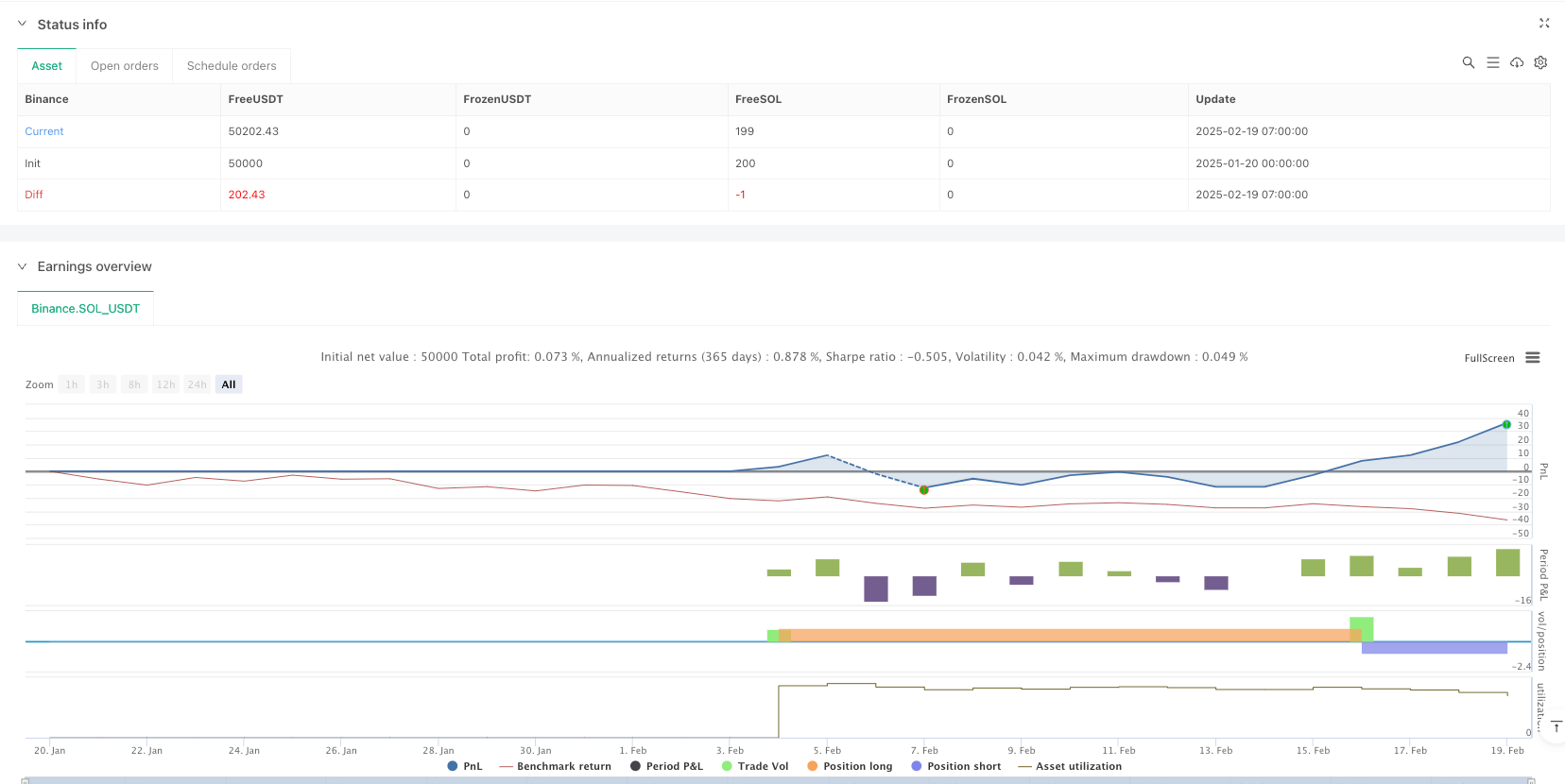

/*backtest

start: 2025-01-20 00:00:00

end: 2025-02-19 08:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Binance","currency":"SOL_USDT"}]

*/

//@version=5

strategy("RSI + ADX + ML-like Strategy (5min)", overlay=true)

// ———— 1. Inputs ————

rsiLength = input(14, "RSI Length")

adxLength = input(14, "ADX Length")

mlLookback = input(20, "ML Lookback (Bars)")

// ———— 2. Calculate Indicators ————

// RSI

rsi = ta.rsi(close, rsiLength)

// ADX

[diPlus, diMinus, adx] = ta.dmi(adxLength, adxLength)

// ———— 3. Simplified ML-like Component (Linear Regression) ————

var float predictedClose = na

sumX = math.sum(bar_index, mlLookback) // FIXED: Using math.sum()

sumY = math.sum(close, mlLookback) // FIXED: Using math.sum()

sumXY = math.sum(bar_index * close, mlLookback) // FIXED: Using math.sum()

sumX2 = math.sum(bar_index * bar_index, mlLookback)

slope = (mlLookback * sumXY - sumX * sumY) / (mlLookback * sumX2 - sumX * sumX)

intercept = (sumY - slope * sumX) / mlLookback

predictedClose := slope * bar_index + intercept

// ———— 4. Strategy Logic ————

mlBullish = predictedClose > close

mlBearish = predictedClose < close

enterLong = ta.crossover(rsi, 30) and adx > 25 and mlBullish

enterShort = ta.crossunder(rsi, 70) and adx > 25 and mlBearish

// ———— 5. Execute Orders ————

strategy.entry("Long", strategy.long, when=enterLong)

strategy.entry("Short", strategy.short, when=enterShort)

// ———— 6. Plotting ————

plot(predictedClose, "Predicted Close", color=color.purple)

plotshape(enterLong, "Buy", shape.triangleup, location.belowbar, color=color.green)

plotshape(enterShort, "Sell", shape.triangledown, location.abovebar, color=color.red)