Overview

This strategy is a high-frequency trading system based on opening range breakouts, focusing on the price range formed during the early trading session from 9:30-9:45. The strategy makes trading decisions by observing whether the price breaks through this 15-minute range, combining dynamic stop-loss and profit-taking settings to optimize the risk-reward ratio. The system also includes trading day selection functionality to selectively trade based on different time period market characteristics.

Strategy Principles

The core logic of the strategy is to establish a price range within the first 15 minutes after market opening (9:30-9:45 EST), recording the highest and lowest prices during this period. Once the range is formed, the strategy monitors price breakouts until noon: - When price breaks above the range, open a long position with stop-loss set at 0.5 times the range size and take-profit at 3 times the stop-loss - When price breaks below the range, open a short position with similar stop-loss and take-profit settings The strategy also includes mechanisms to prevent duplicate trades, ensuring only one trade per day, and closes all positions at market close.

Strategy Advantages

- Time Efficiency: Focuses on the most active trading period after market opening, capturing significant early session volatility

- Risk Control: Employs dynamic stop-loss and take-profit settings based on actual volatility

- Trading Flexibility: Provides weekly trading day selection to avoid unfavorable market conditions

- Clear Execution: Clear trading signals with definitive entry and exit conditions, minimizing subjective judgment

- High Automation: Fully automated execution reduces emotional interference

Strategy Risks

- False Breakout Risk: Initial breakouts after range formation may be false, leading to stop-loss exits

- Time Decay: Trading only during morning session may miss opportunities in other periods

- Volatility Dependence: Strategy may struggle to generate sufficient profits on low volatility days

- Slippage Impact: As a high-frequency strategy, may face significant slippage losses

- Market Environment Dependence: Strategy performance may be significantly affected by overall market conditions

Strategy Optimization Directions

- Incorporate Volume Indicators: Filter false breakouts by observing volume at breakout points

- Dynamic Trading Time Adjustment: Optimize trading windows based on different instrument characteristics

- Add Trend Filters: Combine larger timeframe trend analysis to improve directional accuracy

- Optimize Stop-Loss Settings: Consider using dynamic ATR indicators for stop-loss distances

- Add Volatility Filters: Evaluate volatility levels before market opening to determine daily trading execution

Summary

This is a well-designed and logically rigorous opening range breakout strategy that captures trading opportunities during the market’s most active period. The strategy’s strengths lie in its clear trading logic and comprehensive risk control mechanisms, while attention must be paid to potential risks such as false breakouts and market environment dependence. Through continuous optimization and improvement, this strategy has the potential to achieve stable returns in actual trading.

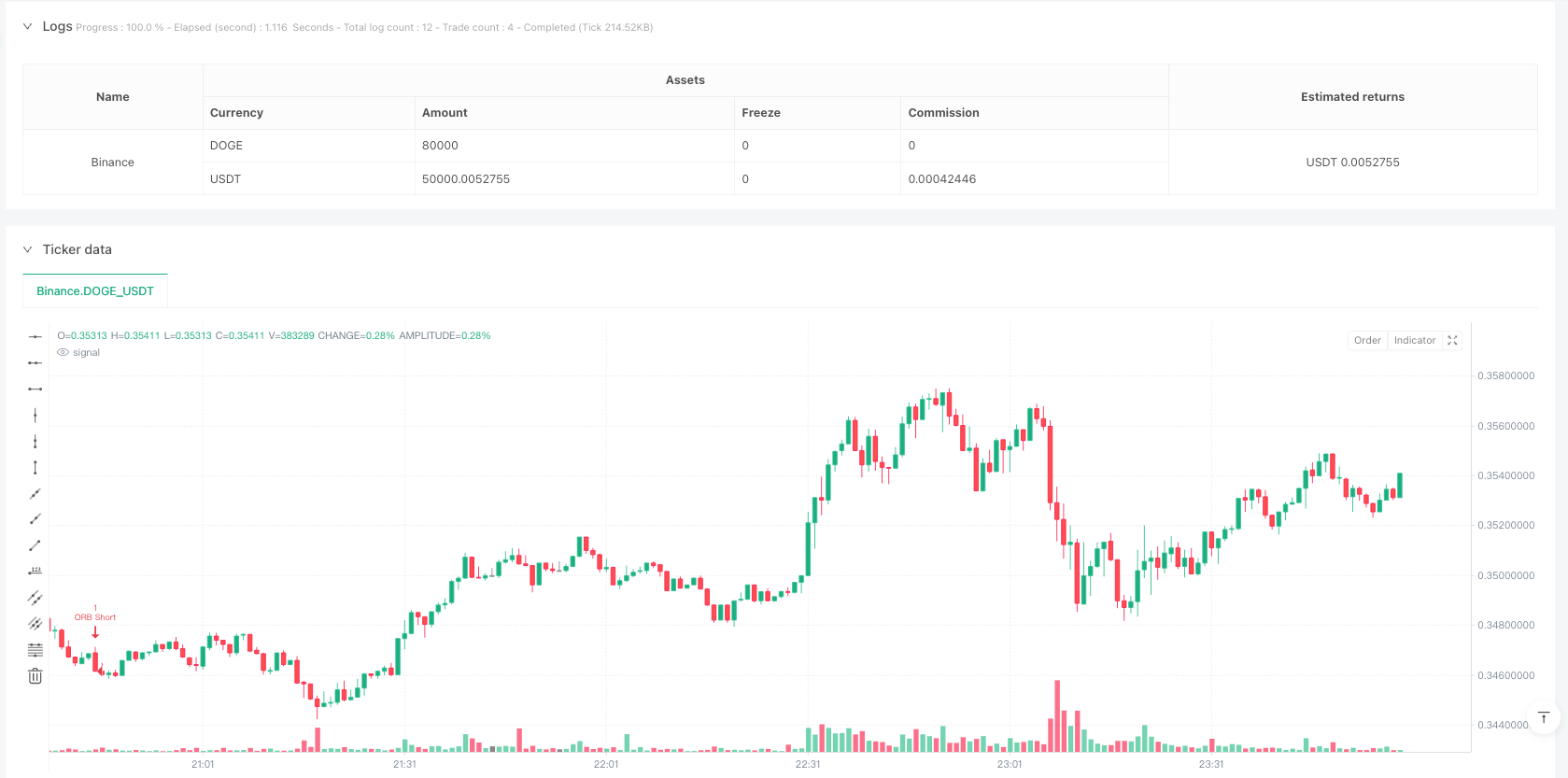

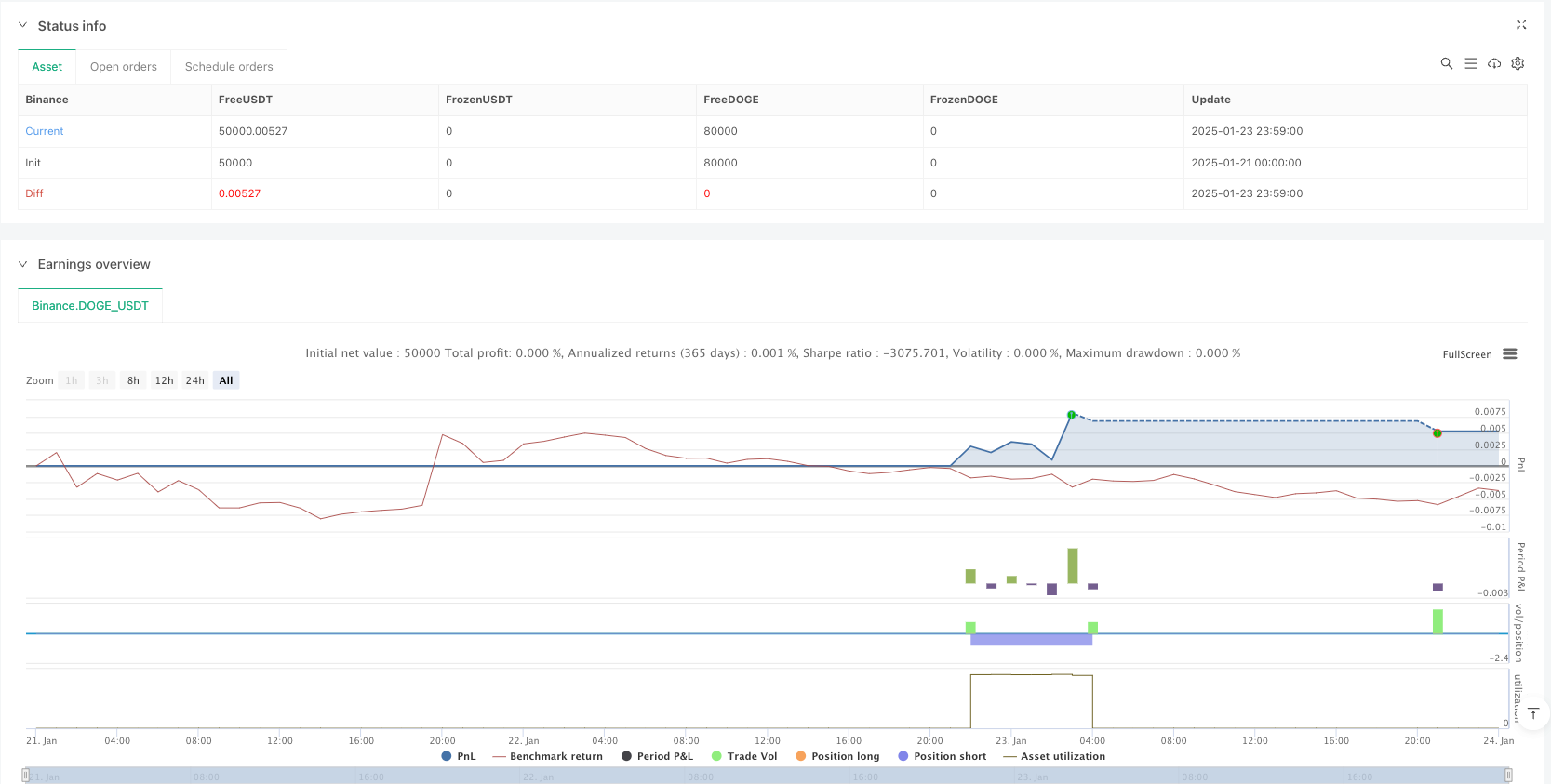

/*backtest

start: 2025-01-21 00:00:00

end: 2025-01-24 00:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Binance","currency":"DOGE_USDT"}]

args: [["MaxCacheLen",580,358374]]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © UKFLIPS69

//@version=6

strategy("ORB", overlay=true, fill_orders_on_standard_ohlc = true)

trade_on_monday = input(false, "Trade on Monday")

trade_on_tuesday = input(true, "Trade on Tuesday")

trade_on_wednesday = input(true, "Trade on Wednesday")

trade_on_thursday = input(false, "Trade on Thursday")

trade_on_friday = input(true, "Trade on Friday")

// Get the current day of the week (1=Monday, ..., 6=Saturday, 0=Sunday)

current_day = dayofweek(time)

current_price = request.security(syminfo.tickerid, "1", close)

// Define trading condition based on the day of the week

is_trading_day = (trade_on_monday and current_day == dayofweek.monday) or

(trade_on_tuesday and current_day == dayofweek.tuesday) or

(trade_on_wednesday and current_day == dayofweek.wednesday) or

(trade_on_thursday and current_day == dayofweek.thursday) or

(trade_on_friday and current_day == dayofweek.friday)

// ─── Persistent variables ─────────────────────────

var line orHighLine = na // reference to the drawn line for the OR high

var line orLowLine = na // reference to the drawn line for the OR low

var float orHigh = na // stores the open-range high

var float orLow = na // stores the open-range low

var int barIndex930 = na // remember the bar_index at 9:30

var bool rangeEstablished = false

var bool tradeTakenToday = false // track if we've opened a trade for the day

// ─── Detect times ────────────────────────────────

is930 = (hour(time, "America/New_York") == 9 and minute(time, "America/New_York") == 30)

is945 = (hour(time, "America/New_York") == 9 and minute(time, "America/New_York") == 45)

// Between 9:30 and 9:44 (inclusive of 9:30 bar, exclusive of 9:45)?

inSession = (hour(time, "America/New_York") == 9 and minute(time, "America/New_York") >= 30 and minute(time, "America/New_York") < 45)

// ─── Reset each day at 9:30 ─────────────────────

if is930

// Reset orHigh / orLow

orHigh := na

orLow := na

rangeEstablished := false

tradeTakenToday := false

// Record the bar_index for 9:30

barIndex930 := bar_index

// ─── ONLY FORM OR / TRADE IF TODAY IS ALLOWED ─────────────────────

if is_trading_day

// ─── Accumulate the OR high/low from 9:30 to 9:44 ─

if inSession

orHigh := na(orHigh) ? high : math.max(orHigh, high)

orLow := na(orLow) ? low : math.min(orLow, low)

// ─── Exactly at 9:45, draw the lines & lock range ─

if is945 and not na(orHigh) and not na(orLow)

// Mark that the OR is established

rangeEstablished := true

// ─── TRADING LOGIC AFTER 9:45, but BEFORE NOON, and if NO trade taken ─

if rangeEstablished and not na(orHigh) and not na(orLow)

// Only trade if it's still BEFORE 12:00 (noon) EST and we haven't taken a trade today

if hour(time, "America/New_York") < 12 and (not tradeTakenToday)

// 1) Compute distances for stops & targets

float stopSize = 0.5 * (orHigh - orLow) // half the OR size

float targetSize = 3 * stopSize // 3x the stop => 1.5x the entire OR

// 2) Check if price breaks above OR => go long

if close > orHigh

// Only enter a new long if not already in a long position (optional)

if strategy.position_size <= 0

strategy.entry("ORB Long", strategy.long)

strategy.exit("Long Exit", from_entry = "ORB Long", stop = orHigh - stopSize, limit = strategy.position_avg_price + targetSize)

// Flag that we've taken a trade today

tradeTakenToday := true

// 3) Check if price breaks below OR => go short

if close < orLow

// Only enter a new short if not already in a short position (optional)

if strategy.position_size >= 0

strategy.entry("ORB Short", strategy.short)

strategy.exit("Short Exit", from_entry = "ORB Short", stop = orLow + stopSize, limit = strategy.position_avg_price - targetSize)

// Flag that we've taken a trade today

tradeTakenToday := true

if hour(time, "America/New_York") == 16 and minute(time, "America/New_York") == 0

strategy.close_all()