Overview

This is a comprehensive trading strategy that combines institutional order flow analysis, trend following, and risk management. The strategy tracks institutional money movement by identifying order blocks in key price areas, utilizes dual Exponential Moving Averages (EMA) for trend confirmation, and includes a complete stop-loss and take-profit management system. Backtesting results show a 58.7% win rate in 2023 with a 1:2 risk-reward ratio.

Strategy Principles

The core logic is built on three main pillars: 1. Smart Money Tracking: Identifies order blocks through price action analysis, which typically represents institutional accumulation zones. When a sharp decline is followed by a strong reversal, the system marks that area as a potential trading opportunity. 2. Trend Confirmation System: Uses 50 and 200-period EMAs as trend filters. Long positions are only considered when the fast EMA is above the slow EMA, and vice versa for short positions. 3. Dynamic Risk Management: The system automatically calculates stop-loss levels based on recent volatility and sets take-profit targets according to a predetermined risk-reward ratio (1:2).

Strategy Advantages

- Fully Automated Operation: The strategy provides clear entry signals and complete trading parameters, reducing human judgment errors.

- Multi-dimensional Analysis: Combines order block analysis and trend following to improve signal reliability.

- Comprehensive Risk Control: Built-in dynamic stop-loss mechanism and fixed risk-reward ratio effectively control risk per trade.

- High Adaptability: Strategy can operate in different market environments, particularly excelling in trending markets.

Strategy Risks

- False Breakout Risk: In ranging markets, false trend signals may occur, leading to consecutive stops. Solution: Add additional trend confirmation filters.

- Slippage Risk: During high volatility, actual entry and exit prices may deviate from signal prices. Recommend allowing for slippage buffer in order execution.

- Over-reliance on Technical Indicators: Strategy is purely technical-based, potentially ignoring fundamental factors. Suggest incorporating key fundamental information in trading decisions.

Strategy Optimization Directions

- Dynamic Parameter Optimization: Automatically adjust EMA periods and order block identification parameters based on market volatility.

- Volume Analysis Integration: Incorporate volume data in order block identification to improve signal reliability.

- Market Environment Filtering: Add volatility indicators to adjust risk management parameters in high-volatility environments.

- Multiple Timeframe Confirmation: Add longer timeframe trend filters to improve trade success rate.

Summary

This is a quantitative trading strategy that combines multiple mature technical analysis methods, implementing smart money tracking and trend following through programmatic means. The strategy’s strengths lie in its fully automated nature and comprehensive risk management system, but users need to be mindful of market conditions’ impact on strategy performance and optimize parameters based on actual trading results. Successful implementation requires traders to have basic market knowledge and strictly adhere to risk management principles.

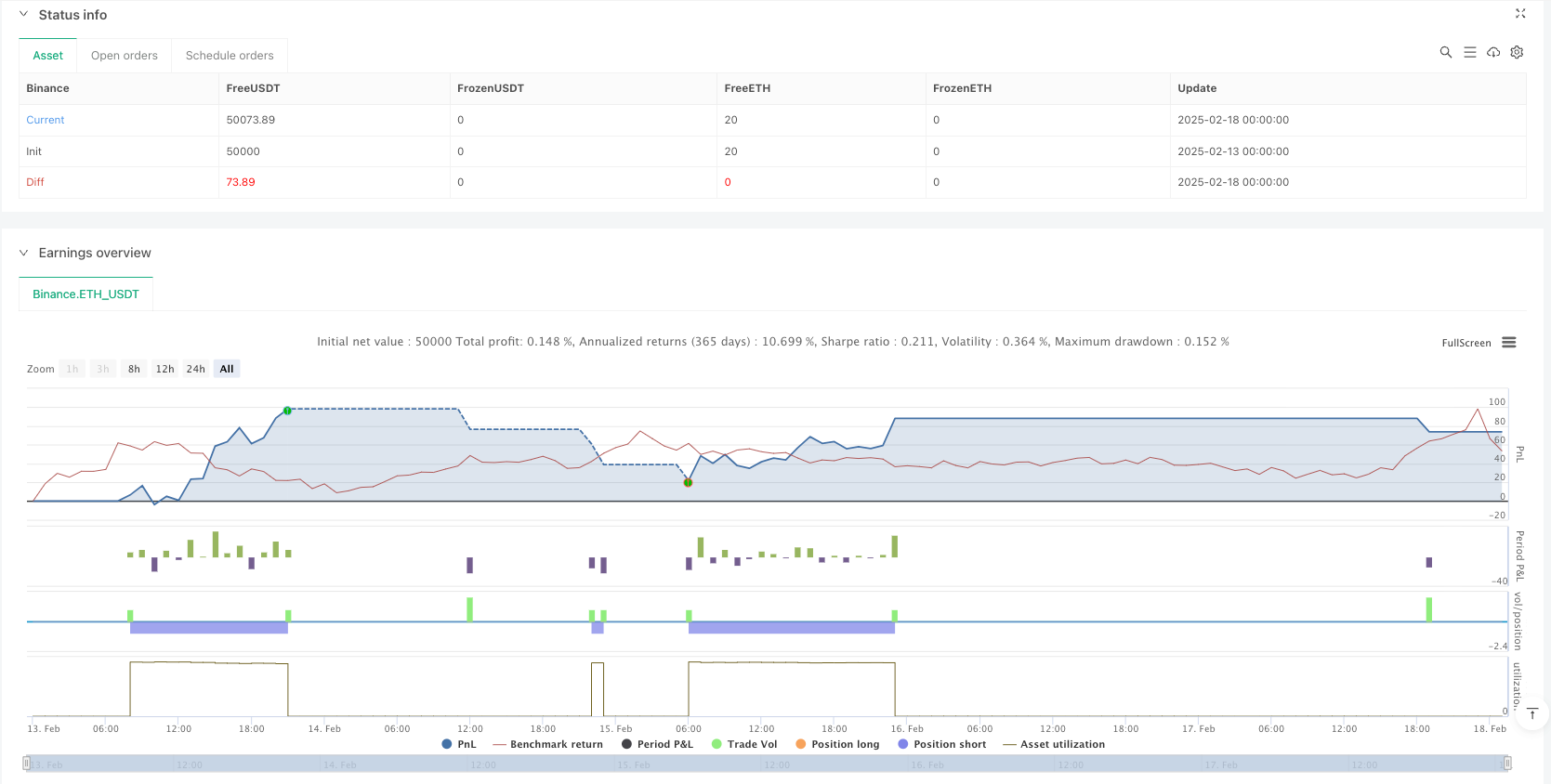

/*backtest

start: 2025-02-13 00:00:00

end: 2025-02-18 01:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Binance","currency":"ETH_USDT"}]

*/

//@version=5

strategy("XAU/EUR Beginner-Friendly Strategy", overlay=true, margin_long=100, margin_short=100)

// Input parameters with tooltips

ema_fast = input.int(50, "Fast EMA Length 📈")

ema_slow = input.int(200, "Slow EMA Length 📉")

risk_reward = input.float(2.0, "Risk/Reward Ratio ⚖️")

show_labels = input.bool(true, "Show Trading Labels 🏷️")

// Trend Following Components

fast_ema = ta.ema(close, ema_fast)

slow_ema = ta.ema(close, ema_slow)

trend_up = fast_ema > slow_ema

trend_down = fast_ema < slow_ema

// Smart Money Components

swing_high = ta.highest(high, 5)

swing_low = ta.lowest(low, 5)

order_block_bullish = (low[2] == swing_low[2]) and (close[2] > open[2])

order_block_bearish = (high[2] == swing_high[2]) and (close[2] < open[2])

// Entry Conditions

long_condition = trend_up and order_block_bullish

short_condition = trend_down and order_block_bearish

// Risk Management Calculations

stop_loss = long_condition ? swing_low : short_condition ? swing_high : na

take_profit = long_condition ? close + (close - stop_loss) * risk_reward : short_condition ? close - (stop_loss - close) * risk_reward : na

// Visual Elements

bgcolor(trend_up ? color.new(color.green, 90) : color.new(color.red, 90), title="Trend Background")

if show_labels

if long_condition

label.new(

bar_index, low,

text="BUY 🟢\nEntry: " + str.tostring(close, "#.##") +

"\nSL: " + str.tostring(stop_loss, "#.##") +

"\nTP: " + str.tostring(take_profit, "#.##"),

color=color.green, textcolor=color.white,

style=label.style_label_up, yloc=yloc.belowbar)

if short_condition

label.new(

bar_index, high,

text="SELL 🔴\nEntry: " + str.tostring(close, "#.##") +

"\nSL: " + str.tostring(stop_loss, "#.##") +

"\nTP: " + str.tostring(take_profit, "#.##"),

color=color.red, textcolor=color.white,

style=label.style_label_down, yloc=yloc.abovebar)

// Strategy Execution

if (long_condition)

strategy.entry("Long", strategy.long)

strategy.exit("Long Exit", "Long", stop=stop_loss, limit=take_profit)

if (short_condition)

strategy.entry("Short", strategy.short)

strategy.exit("Short Exit", "Short", stop=stop_loss, limit=take_profit)

// Simplified EMA Plotting

plot(fast_ema, "Fast EMA", color=color.new(color.blue, 0), linewidth=2)

plot(slow_ema, "Slow EMA", color=color.new(color.orange, 0), linewidth=2)