Overview

This strategy is a quantitative trading system that combines Exponential Moving Averages (EMA) and Moving Average Convergence Divergence (MACD) indicators. By integrating crossover signals from short-term and long-term EMAs with MACD momentum confirmation, it provides traders with a comprehensive trend-following solution. The strategy also includes dynamic stop-loss and take-profit mechanisms for effective risk control while maximizing potential returns.

Strategy Principles

The core logic is based on the synergy of two technical indicators. First, it uses 12-period and 26-period EMAs to identify market trends, generating long signals when the short-term EMA crosses above the long-term EMA, and short signals when it crosses below. Second, it uses the MACD indicator (12,26,9 settings) to confirm trend momentum, requiring the MACD line and Signal line relationship to support the EMA-generated trading signals. The system employs percentage-based dynamic stop-loss (default 2%) and take-profit (default 5%) levels, with additional exit signals triggered by EMA crossovers or MACD reversals.

Strategy Advantages

- Robust signal confirmation: Dual confirmation through EMA crossovers and MACD momentum significantly reduces false breakout risks

- Flexible risk management: Percentage-based stop-loss and take-profit levels easily adaptable to different market conditions and instruments

- Excellent visualization: Clear display of EMA lines, MACD indicator, and trade signal markers on charts

- Strong parameterization: Allows adjustment of EMA periods, MACD parameters, and risk control ratios to adapt to different trading strategies

Strategy Risks

- Trend reversal risk: May generate frequent crossovers in ranging markets, leading to false signals

- Lagging indicator issue: Both EMA and MACD are lagging indicators, potentially missing optimal entry points in fast-moving markets

- Money management risk: Fixed percentage stops may not be flexible enough in high-volatility environments

- Parameter optimization risk: Over-optimization may lead to poorer live trading performance compared to backtests

Optimization Directions

- Incorporate volatility indicators: Suggest adding ATR indicator for dynamic stop-loss and take-profit adjustments

- Add market environment filters: Consider using ADX or similar indicators to gauge trend strength and avoid ranging markets

- Enhance signal confirmation: Consider adding volume confirmation or other momentum indicators as auxiliary signals

- Improve money management: Implement dynamic position sizing based on account equity

Summary

This is a well-designed, logically sound trend-following strategy. By combining the strengths of EMA and MACD, it achieves a reliable trade signal generation mechanism while maintaining simplicity and clarity. The strategy offers strong customization options and robust risk management mechanisms, making it suitable as a foundation for medium to long-term trend trading. Traders are advised to thoroughly test parameter settings and optimize the strategy according to specific trading instruments and market conditions before live implementation.

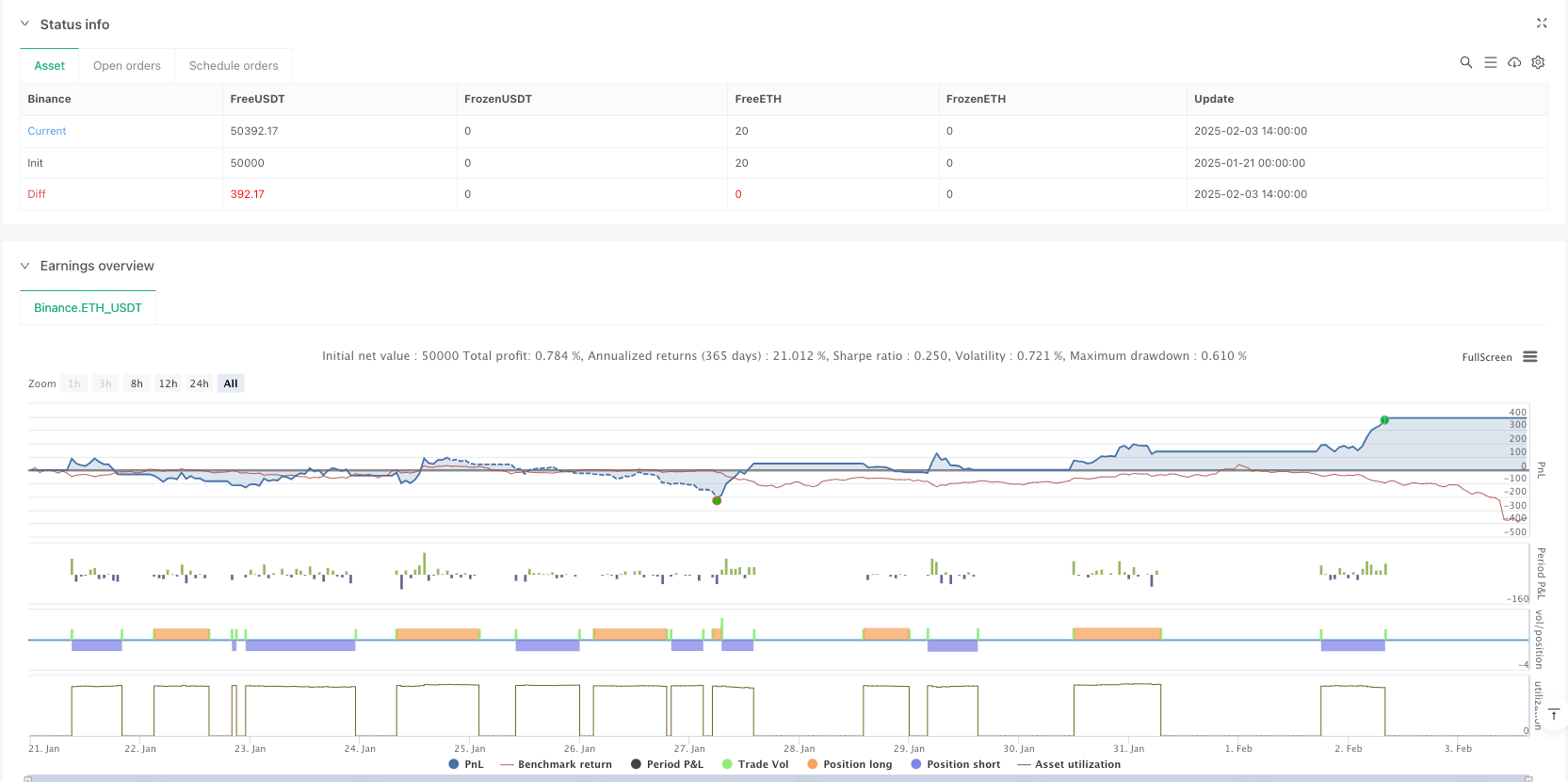

/*backtest

start: 2025-01-21 00:00:00

end: 2025-02-03 15:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Binance","currency":"ETH_USDT"}]

*/

//@version=5

strategy("EMA + MACD Strategy", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=10)

// === Inputs ===

shortEmaLength = input.int(12, title="Short EMA Period", minval=1)

longEmaLength = input.int(26, title="Long EMA Period", minval=1)

macdFastLength = input.int(12, title="MACD Fast EMA Period", minval=1)

macdSlowLength = input.int(26, title="MACD Slow EMA Period", minval=1)

macdSignalLength = input.int(9, title="MACD Signal Period", minval=1)

stopLossPerc = input.float(2.0, title="Stop-Loss (%)", minval=0.1, step=0.1)

takeProfitPerc = input.float(5.0, title="Take-Profit (%)", minval=0.1, step=0.1)

// === Indicator Calculations ===

// Exponential Moving Averages (EMA)

shortEMA = ta.ema(close, shortEmaLength)

longEMA = ta.ema(close, longEmaLength)

// MACD

[macdLine, signalLine, _] = ta.macd(close, macdFastLength, macdSlowLength, macdSignalLength)

// === Entry Conditions ===

// Buy signal: Short EMA crosses above Long EMA and MACD > Signal Line

longCondition = ta.crossover(shortEMA, longEMA) and (macdLine > signalLine)

// Sell signal: Short EMA crosses below Long EMA and MACD < Signal Line

shortCondition = ta.crossunder(shortEMA, longEMA) and (macdLine < signalLine)

// === Entry Signals with Stop-Loss and Take-Profit ===

if (longCondition)

strategy.entry("Long", strategy.long)

// Calculate Stop-Loss and Take-Profit

stopPrice = close * (1 - stopLossPerc / 100)

takePrice = close * (1 + takeProfitPerc / 100)

strategy.exit("Long Exit", from_entry="Long", stop=stopPrice, limit=takePrice)

if (shortCondition)

strategy.entry("Short", strategy.short)

// Calculate Stop-Loss and Take-Profit

stopPrice = close * (1 + stopLossPerc / 100)

takePrice = close * (1 - takeProfitPerc / 100)

strategy.exit("Short Exit", from_entry="Short", stop=stopPrice, limit=takePrice)

// === Exit Conditions ===

// Alternative exit conditions based on crossovers

exitLongCondition = ta.crossunder(shortEMA, longEMA) or (macdLine < signalLine)

exitShortCondition = ta.crossover(shortEMA, longEMA) or (macdLine > signalLine)

if (exitLongCondition)

strategy.close("Long")

if (exitShortCondition)

strategy.close("Short")

// === Indicator Plotting ===

// EMA

plot(shortEMA, color=color.blue, title="Short EMA")

plot(longEMA, color=color.red, title="Long EMA")

// MACD Indicator in separate window

hline(0, "Zero Line", color=color.gray, linestyle=hline.style_dotted)

plot(macdLine - signalLine, color=(macdLine - signalLine) >= 0 ? color.green : color.red, title="MACD Histogram", style=plot.style_histogram)

plot(macdLine, color=color.blue, title="MACD Line")

plot(signalLine, color=color.orange, title="Signal Line")

// === Signal Visualization ===

// Markers for Long and Short entries

plotshape(series=longCondition, title="Long Entry", location=location.belowbar, color=color.green, style=shape.labelup, text="Long")

plotshape(series=shortCondition, title="Short Entry", location=location.abovebar, color=color.red, style=shape.labeldown, text="Short")

// Markers for Long and Short exits

plotshape(series=exitLongCondition, title="Long Exit", location=location.abovebar, color=color.red, style=shape.labeldown, text="Exit Long")

plotshape(series=exitShortCondition, title="Short Exit", location=location.belowbar, color=color.green, style=shape.labelup, text="Exit Short")