Overview

This is a trend reversal trading strategy that combines the Relative Strength Index (RSI) and Stochastic RSI indicators. The strategy aims to capture potential reversal points by identifying overbought and oversold conditions along with momentum shifts in the market. The core concept involves using RSI as the base momentum indicator and calculating Stochastic RSI to further confirm momentum direction changes.

Strategy Principles

The main logic includes the following key steps: 1. Calculate RSI values based on closing prices to determine overall overbought/oversold conditions 2. Compute Stochastic RSI’s %K and %D lines using RSI values as the base 3. Generate long entry signals when RSI is in oversold territory (default below 30) and Stochastic RSI’s %K line crosses above %D line 4. Generate short entry signals when RSI is in overbought territory (default above 70) and Stochastic RSI’s %K line crosses below %D line 5. Exit positions when opposite RSI conditions occur or when Stochastic RSI shows reverse crossovers

Strategy Advantages

- Dual Confirmation Mechanism - The combination of RSI and Stochastic RSI effectively reduces false breakout risks

- Customizable Parameters - Key parameters like RSI period and overbought/oversold thresholds can be adjusted for different market conditions

- Dynamic Visualization - The strategy provides real-time charts of RSI and Stochastic RSI for monitoring

- Integrated Risk Management - Includes comprehensive stop-loss and profit-taking mechanisms

- High Adaptability - Applicable to different timeframes and market environments

Strategy Risks

- Sideways Market Risk - May generate frequent false signals in range-bound markets

- Lag Risk - Multiple moving average smoothing may cause some delay in signal generation

- Parameter Sensitivity - Different parameter settings may lead to significantly different trading results

- Market Environment Dependency - May miss some opportunities in strong trend markets

- Money Management Risk - Requires proper position sizing for risk control

Strategy Optimization Directions

- Add Trend Filter - Incorporate long-term moving averages as trend filters to trade only in trend direction

- Optimize Stop Loss - Implement dynamic stop-loss mechanisms like trailing stops or ATR-based stops

- Incorporate Volume Indicators - Combine volume analysis to improve signal reliability

- Add Time Filters - Avoid important news release times or low liquidity periods

- Develop Adaptive Parameters - Automatically adjust strategy parameters based on market volatility

Summary

This is a comprehensive strategy combining momentum and trend reversal concepts, using the synergy between RSI and Stochastic RSI to identify potential trading opportunities. The strategy is well-designed with good adjustability and adaptability. However, careful attention must be paid to market environment selection and risk control in practical applications, and thorough backtesting and parameter optimization are recommended before live trading.

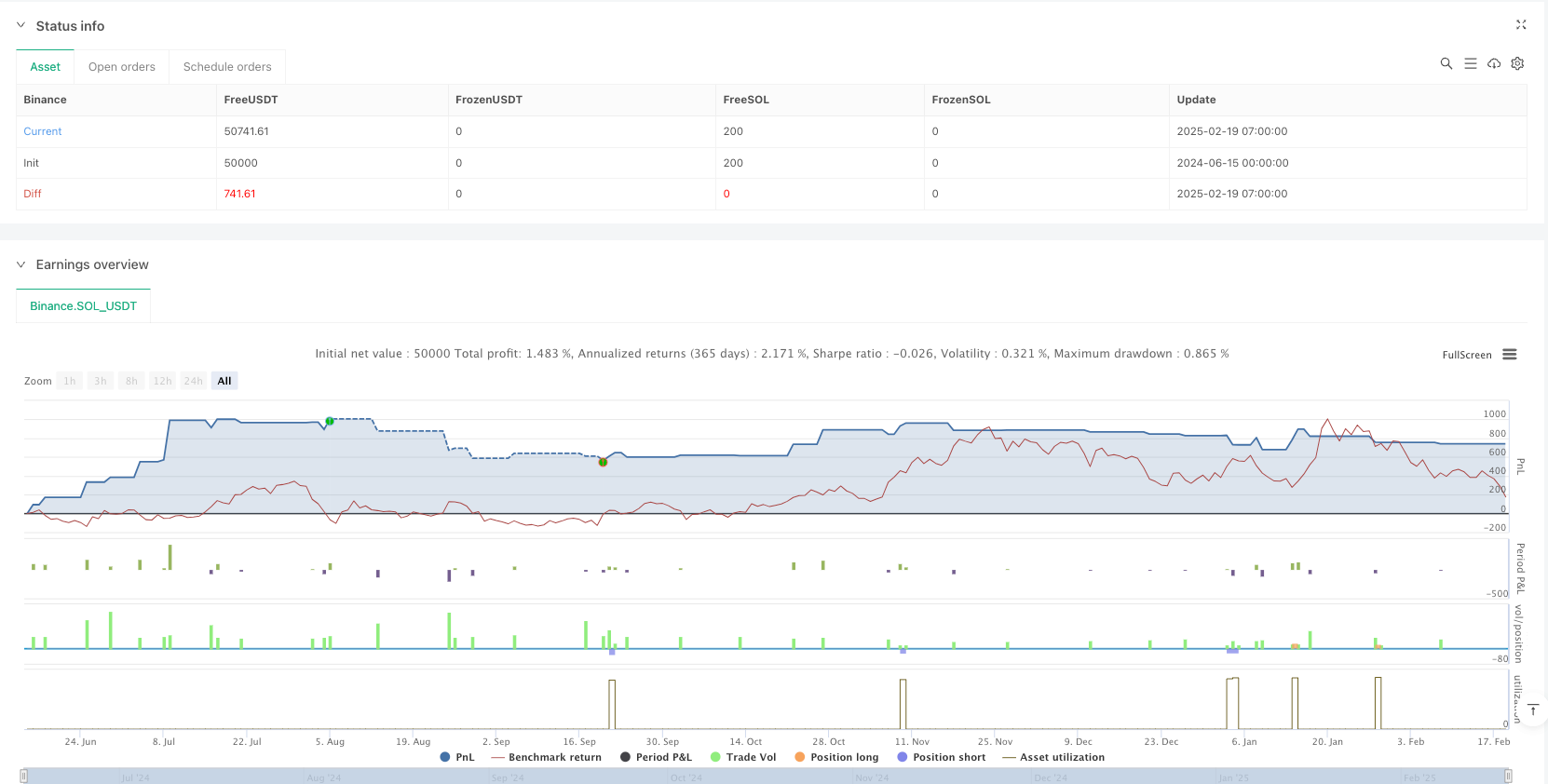

/*backtest

start: 2024-06-15 00:00:00

end: 2025-02-19 08:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Binance","currency":"SOL_USDT"}]

*/

//@version=5

strategy("RSI + Stochastic RSI Strategy", overlay=true, initial_capital=100000, default_qty_type=strategy.percent_of_equity, default_qty_value=10)

// INPUTS

// RSI settings

rsiLength = input.int(14, "RSI Length", minval=1)

rsiOverbought = input.int(70, "RSI Overbought Level")

rsiOversold = input.int(30, "RSI Oversold Level")

// Stochastic RSI settings

stochLength = input.int(14, "Stoch RSI Length", minval=1)

smoothK = input.int(3, "Stoch %K Smoothing", minval=1)

smoothD = input.int(3, "Stoch %D Smoothing", minval=1)

stochOverbought = input.int(80, "Stoch Overbought Level")

stochOversold = input.int(20, "Stoch Oversold Level")

// CALCULATIONS

// Compute RSI value on the closing price

rsiValue = ta.rsi(close, rsiLength)

// Calculate Stochastic RSI using the RSI value as source

rsiStoch = ta.stoch(rsiValue, rsiValue, rsiValue, stochLength)

kValue = ta.sma(rsiStoch, smoothK)

dValue = ta.sma(kValue, smoothD)

// PLOTTING

// Plot RSI and reference lines

plot(rsiValue, title="RSI", color=color.blue)

hline(rsiOverbought, "RSI Overbought", color=color.red)

hline(rsiOversold, "RSI Oversold", color=color.green)

// Plot Stochastic RSI %K and %D along with overbought/oversold levels

plot(kValue, title="Stoch %K", color=color.orange)

plot(dValue, title="Stoch %D", color=color.purple)

hline(stochOverbought, "Stoch Overbought", color=color.red, linestyle=hline.style_dotted)

hline(stochOversold, "Stoch Oversold", color=color.green, linestyle=hline.style_dotted)

// STRATEGY CONDITIONS

// Long Condition: RSI below oversold and Stoch RSI crosses upward while in oversold territory

longCondition = (rsiValue < rsiOversold) and (kValue < stochOversold) and ta.crossover(kValue, dValue)

// Long Exit: When RSI goes above overbought or a downward cross occurs on the Stoch RSI

longExit = (rsiValue > rsiOverbought) or ta.crossunder(kValue, dValue)

// Short Condition: RSI above overbought and Stoch RSI crosses downward while in overbought territory

shortCondition = (rsiValue > rsiOverbought) and (kValue > stochOverbought) and ta.crossunder(kValue, dValue)

// Short Exit: When RSI goes below oversold or an upward cross occurs on the Stoch RSI

shortExit = (rsiValue < rsiOversold) or ta.crossover(kValue, dValue)

// EXECUTE TRADES

if (longCondition)

strategy.entry("Long", strategy.long)

if (longExit)

strategy.close("Long")

if (shortCondition)

strategy.entry("Short", strategy.short)

if (shortExit)

strategy.close("Short")