Overview

This strategy is a multi-indicator combination strategy based on Williams %R, Moving Average Convergence Divergence (MACD), and Exponential Moving Average (EMA). By assessing market overbought/oversold conditions, combined with momentum indicator trends and moving average support, it creates a complete trend-following trading system. The strategy includes both entry signal generation and comprehensive risk management mechanisms.

Strategy Principles

The strategy primarily relies on the coordination of three core indicators: 1. Williams %R is used to identify market overbought/oversold conditions, with a bullish reversal signal potentially occurring when the indicator breaks above the oversold zone (below -80) 2. MACD confirms momentum changes through crossovers of fast and slow lines, with additional confirmation when the MACD line crosses above the signal line 3. 55-period EMA serves as a trend filter, considering long positions only when price is above EMA, and vice versa

The strategy only opens positions when all three conditions are simultaneously met. Additionally, it incorporates a risk-reward based stop-loss and take-profit mechanism, controlling risk for each trade through fixed stop-loss percentages and risk-reward ratios.

Strategy Advantages

- Multi-indicator cross-validation: The combination of Williams %R, MACD, and EMA significantly reduces the probability of false signals

- Comprehensive risk control: Implements dynamic stop-loss and take-profit mechanisms based on risk-reward ratios, with clear risk control objectives for each trade

- Combines trend-following and reversal: Captures overbought/oversold reversal opportunities while ensuring alignment with the main trend through EMA

- Strong parameter adaptability: Period parameters for main indicators can be optimized for different market characteristics

Strategy Risks

- Choppy market risk: False breakout signals may occur frequently in sideways markets, leading to consecutive losses

- Slippage risk: Significant price differences between signal generation and actual execution may occur during high volatility

- Parameter sensitivity: Strategy performance is sensitive to parameter settings, requiring different combinations for various market environments

- Signal lag: The use of multiple indicators for confirmation may result in missing optimal entry points

Optimization Directions

- Dynamic parameter optimization: Automatically adjust indicator parameters based on market volatility to improve adaptability

- Market environment classification: Add market state recognition module to use different parameter combinations in different market conditions

- Entry timing optimization: Include additional indicators like volume to improve entry timing accuracy

- Risk management enhancement: Consider implementing dynamic stop-loss mechanisms that automatically adjust based on market volatility

Summary

The strategy constructs a relatively comprehensive trend-following trading system through the coordination of multiple technical indicators. Its main features are high signal reliability and clear risk control, though it faces some challenges with lag and parameter sensitivity. Through the suggested optimization directions, there is room for further improvement. For live trading implementation, it is recommended to thoroughly validate parameter combinations through backtesting and optimize specifically based on market characteristics.

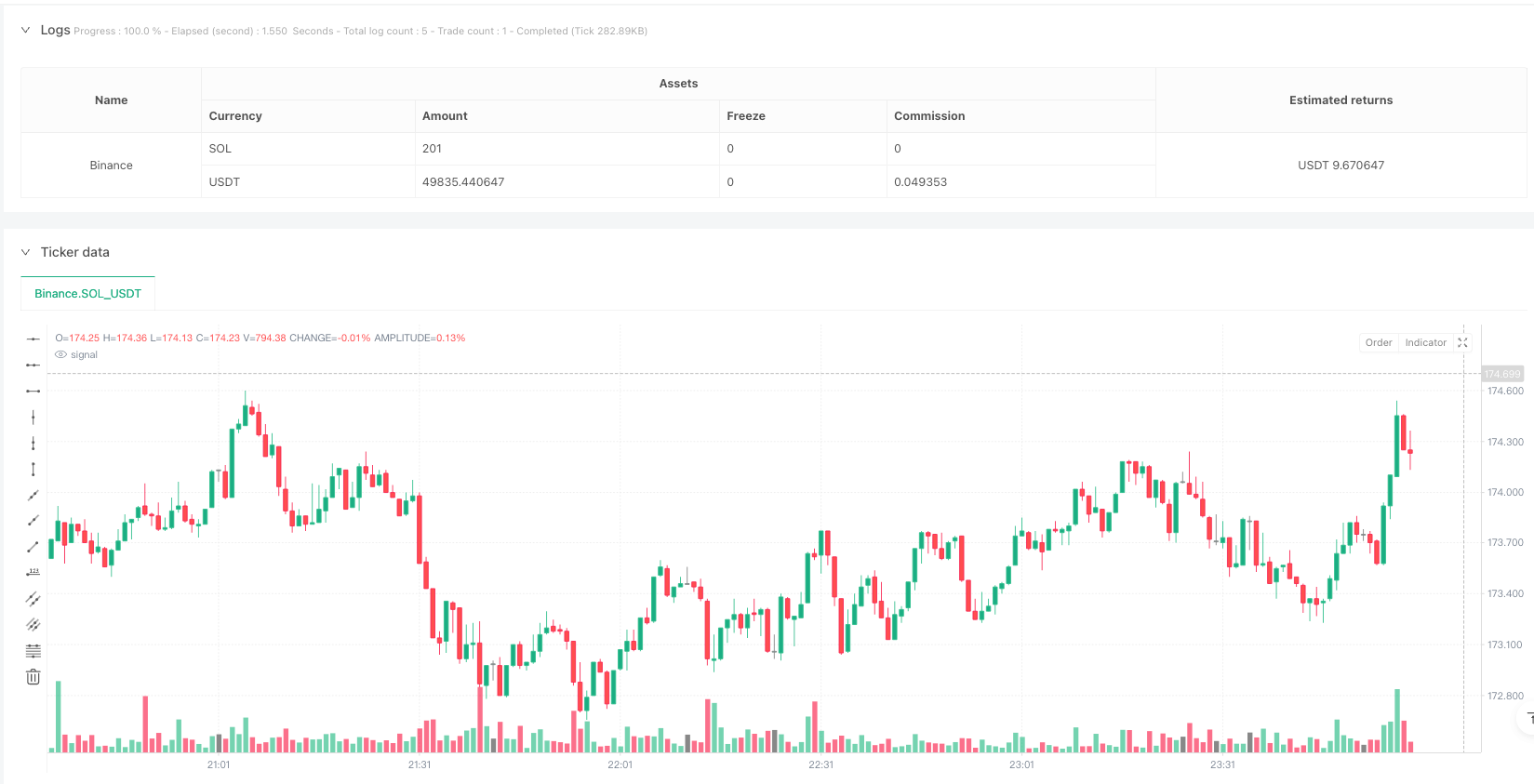

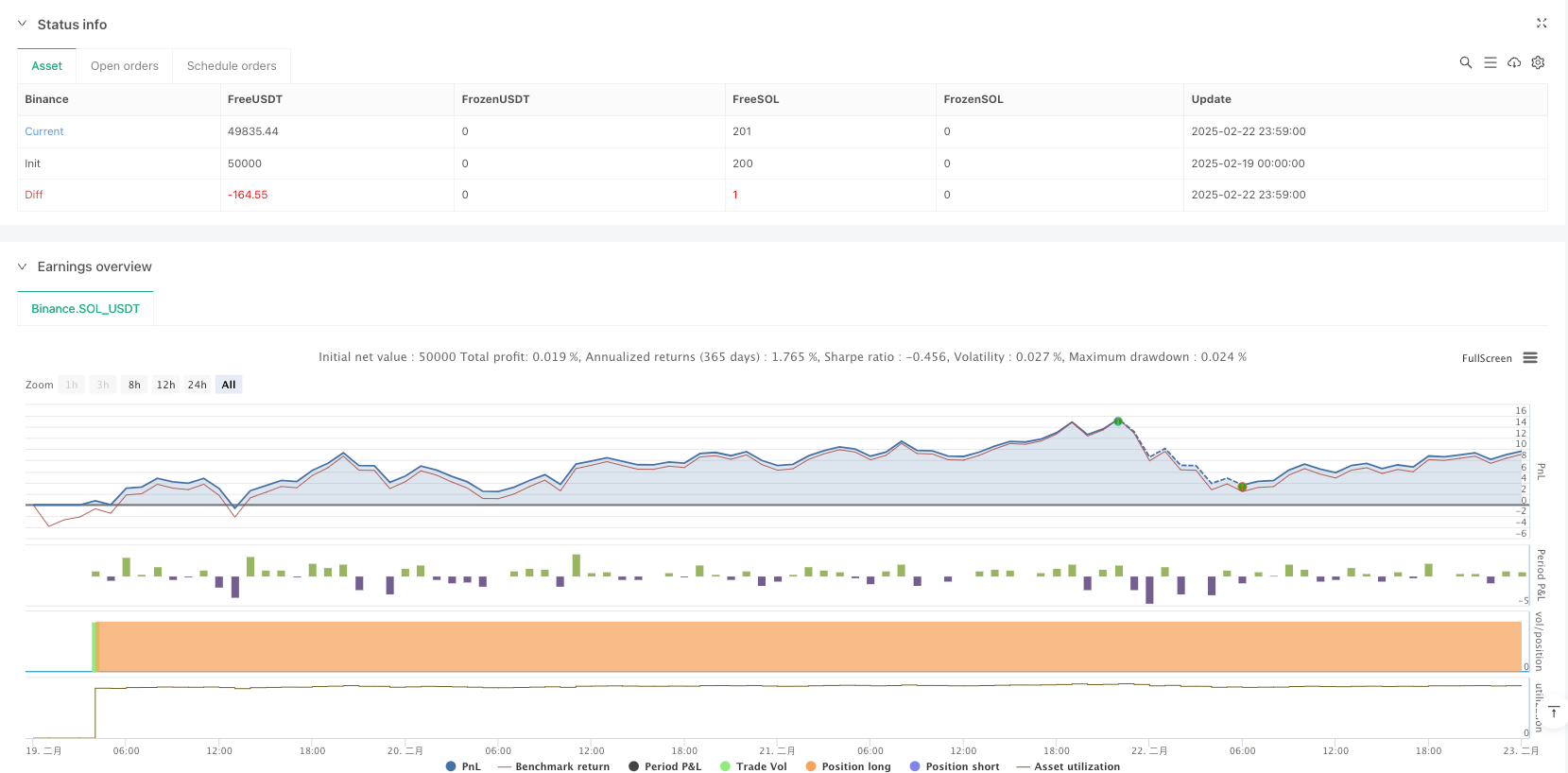

/*backtest

start: 2025-02-19 00:00:00

end: 2025-02-23 00:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Binance","currency":"SOL_USDT"}]

*/

//@version=5

strategy("Williams %R & MACD Swing Strategy", overlay=true)

// INPUTS

length_wpr = input(14, title="Williams %R Length")

overbought = input(-20, title="Overbought Level")

oversold = input(-80, title="Oversold Level")

// MACD Inputs

fastLength = input(12, title="MACD Fast Length")

slowLength = input(26, title="MACD Slow Length")

signalSmoothing = input(9, title="MACD Signal Smoothing")

// EMA for Trend Confirmation

ema_length = input(55, title="EMA Length")

ema55 = ta.ema(close, ema_length)

// INDICATORS

wpr = ta.wpr(length_wpr)

[macdLine, signalLine, _] = ta.macd(close, fastLength, slowLength, signalSmoothing)

// LONG ENTRY CONDITIONS

longCondition = ta.crossover(wpr, oversold) and ta.crossover(macdLine, signalLine) and close > ema55

if longCondition

strategy.entry("Long", strategy.long)

// SHORT ENTRY CONDITIONS

shortCondition = ta.crossunder(wpr, overbought) and ta.crossunder(macdLine, signalLine) and close < ema55

if shortCondition

strategy.entry("Short", strategy.short)

// RISK MANAGEMENT

riskRewardRatio = input(1.5, title="Risk-Reward Ratio")

stopLossPerc = input(2, title="Stop Loss %") / 100

takeProfitPerc = stopLossPerc * riskRewardRatio

longSL = strategy.position_avg_price * (1 - stopLossPerc)

longTP = strategy.position_avg_price * (1 + takeProfitPerc)

shortSL = strategy.position_avg_price * (1 + stopLossPerc)

shortTP = strategy.position_avg_price * (1 - takeProfitPerc)

strategy.exit("Take Profit / Stop Loss", from_entry="Long", loss=longSL, profit=longTP)

strategy.exit("Take Profit / Stop Loss", from_entry="Short", loss=shortSL, profit=shortTP)