Overview

This strategy is a trend following system that combines Dynamic Reactor (DR) and Multi-Kernel Regression (MKR). It captures market trends by integrating ATR channels, SMA, and a combination of Gaussian and Epanechnikov kernel regressions, with RSI-based signal filtering. The strategy includes a comprehensive position management system featuring dynamic stop-loss, multiple take-profit targets, and trailing stops.

Strategy Principles

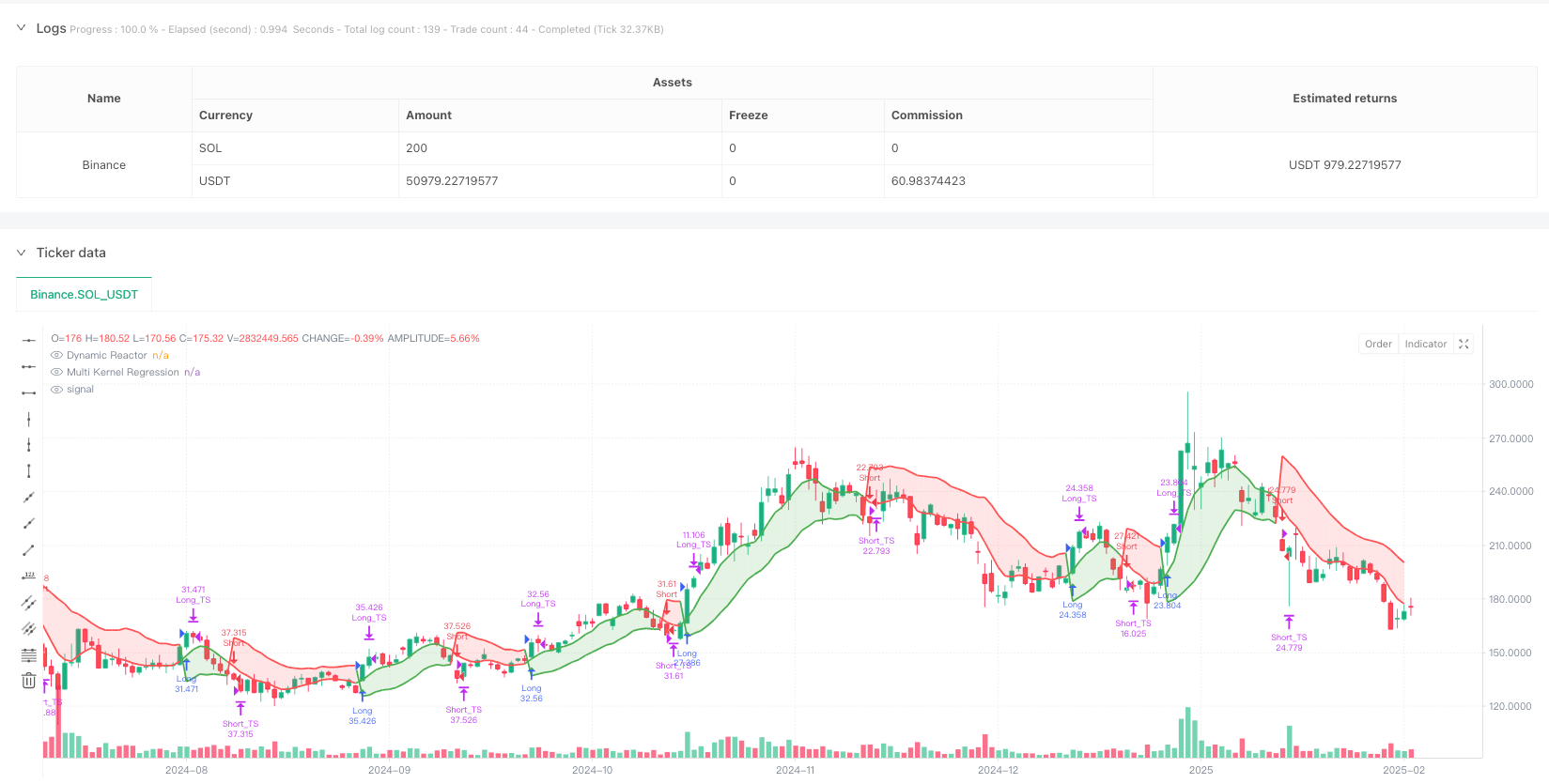

The strategy consists of two main components. The first is the Dynamic Reactor (DR), which constructs an adaptive price channel based on ATR and SMA. The channel width is determined by the ATR multiplier, while its position adjusts with the SMA movement. Trend direction updates when price breaks through the channel. The second component is the Multi-Kernel Regression (MKR), combining Gaussian and Epanechnikov kernel regressions. Through different bandwidth parameters and weights, the system better fits price movements. Trading signals are generated at MKR and DR line crossovers, filtered by RSI to avoid overbought and oversold areas.

Strategy Advantages

- High Adaptability: The combination of Dynamic Reactor and Multi-Kernel Regression allows the strategy to automatically adapt to different market environments and volatility conditions.

- Comprehensive Risk Management: Includes multiple risk control mechanisms such as dynamic stop-loss, partial profit-taking, and trailing stops.

- High Signal Quality: Effectively reduces false signals through RSI filtering and line crossover confirmation.

- High Computational Efficiency: Despite using complex kernel regression algorithms, optimized calculation methods ensure real-time performance.

Strategy Risks

- Parameter Sensitivity: Strategy effectiveness highly depends on proper setting of parameters like ATR multiplier and kernel bandwidth.

- Latency: Due to moving averages and regression algorithms, some lag may exist in fast-moving markets.

- Market Adaptability: Strategy performs well in trending markets but may generate false signals in ranging markets.

- Computational Complexity: Multi-kernel regression calculations are complex, requiring performance optimization for high-frequency trading.

Optimization Directions

- Parameter Adaptation: Introduce adaptive mechanisms to dynamically adjust ATR multiplier and kernel bandwidth based on market volatility.

- Signal Enhancement: Consider adding volume, price patterns, and other auxiliary indicators to improve signal reliability.

- Risk Control: Dynamically adjust stop-loss and take-profit ratios based on market volatility.

- Market Filtering: Add market environment recognition module to apply different trading strategies under different market conditions.

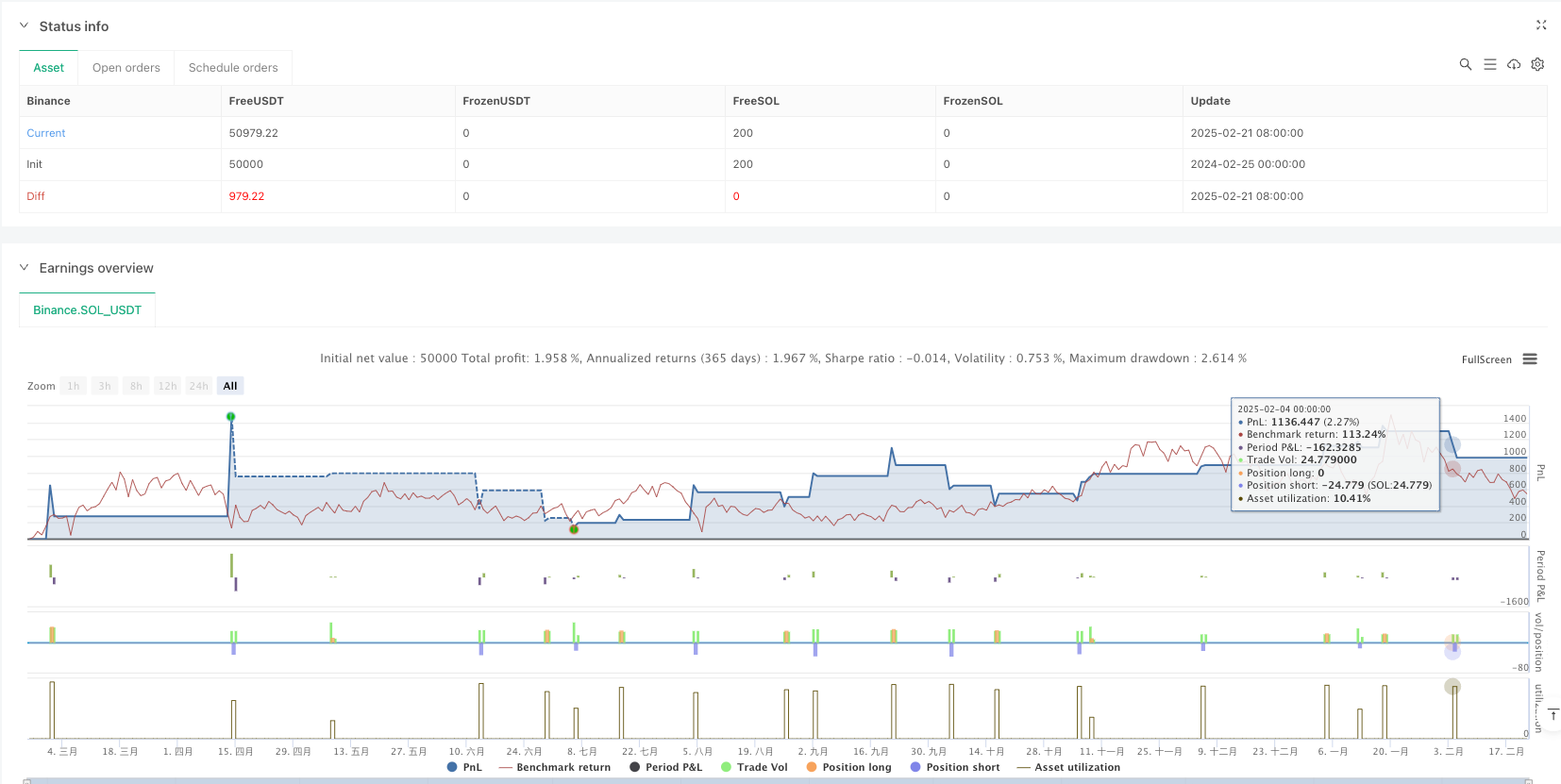

Summary

This is a complete trading system integrating modern statistical methods with traditional technical analysis. Through the innovative combination of Dynamic Reactor and Multi-Kernel Regression, along with comprehensive risk management mechanisms, the strategy demonstrates good adaptability and stability. While there are areas for optimization, continuous improvement and parameter optimization should help maintain stable performance across different market environments.

/*backtest

start: 2024-07-20 00:00:00

end: 2025-07-19 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Binance","currency":"ETH_USDT","balance":2000000}]

*/

//@version=5

strategy("DR+MKR Signals – Band SL, Multiple TP & Trailing Stop", overlay=true, default_qty_value=10)

// =====================================================================

// PART 1: Optimized Dynamic Reactor

// =====================================================================

atrLength = input.int(10, "ATR Length", minval=1) // Lower value for increased sensitivity

smaLength = input.int(10, "SMA Length", minval=1) // Lower value for a faster response

multiplier = input.float(1.2, "ATR Multiplier", minval=0.1, step=0.1) // Adjusted for tighter bands

atrValue = ta.atr(atrLength)

smaValue = ta.sma(close, smaLength)

basicUpper = smaValue + atrValue * multiplier

basicLower = smaValue - atrValue * multiplier

var float finalUpper = basicUpper

var float finalLower = basicLower

if bar_index > 0

finalUpper := close[1] > finalUpper[1] ? math.max(basicUpper, finalUpper[1]) : basicUpper

if bar_index > 0

finalLower := close[1] < finalLower[1] ? math.min(basicLower, finalLower[1]) : basicLower

var int trend = 1

if bar_index > 0

trend := close > finalUpper[1] ? 1 : close < finalLower[1] ? -1 : nz(trend[1], 1)

drLine = trend == 1 ? finalLower : finalUpper

p_dr = plot(drLine, color = trend == 1 ? color.green : color.red, title="Dynamic Reactor", linewidth=2)

// =====================================================================

// PART 2: Optimized Multi Kernel Regression

// =====================================================================

regLength = input.int(30, "Regression Period", minval=1) // Lower value for increased sensitivity

h1 = input.float(5.0, "Gaussian Band (h1)", minval=0.1) // Adjusted for a better fit

h2 = input.float(5.0, "Epanechnikov Band (h2)", minval=0.1)

alpha = input.float(0.5, "Gaussian Kernel Weight", minval=0, maxval=1)

f_gaussian_regression(bw) =>

num = 0.0

den = 0.0

for i = 0 to regLength - 1

weight = math.exp(-0.5 * math.pow(i / bw, 2))

num += close[i] * weight

den += weight

num / (den == 0 ? 1 : den)

f_epanechnikov_regression(bw) =>

num = 0.0

den = 0.0

for i = 0 to regLength - 1

ratio = i / bw

weight = math.abs(ratio) <= 1 ? (1 - math.pow(ratio, 2)) : 0

num += close[i] * weight

den += weight

num / (den == 0 ? 1 : den)

regGauss = f_gaussian_regression(h1)

regEpan = f_epanechnikov_regression(h2)

multiKernelRegression = alpha * regGauss + (1 - alpha) * regEpan

p_mkr = plot(multiKernelRegression, color = trend == 1 ? color.green : color.red, title="Multi Kernel Regression", linewidth=2)

fill(p_dr, p_mkr, color = trend == 1 ? color.new(color.green, 80) : color.new(color.red, 80), title="Trend Fill")

// =====================================================================

// PART 3: Buy and Sell Signals + RSI Filter

// =====================================================================

rsi = ta.rsi(close, 14)

buySignal = ta.crossover(multiKernelRegression, drLine) and rsi < 70

sellSignal = ta.crossunder(multiKernelRegression, drLine) and rsi > 30

plotshape(buySignal, style=shape.triangleup, location=location.belowbar, color=color.green, size=size.tiny, title="Buy Signal")

plotshape(sellSignal, style=shape.triangledown, location=location.abovebar, color=color.red, size=size.tiny, title="Sell Signal")

alertcondition(buySignal, title="Buy Alert", message="Buy Signal generated")

alertcondition(sellSignal, title="Sell Alert", message="Sell Signal generated")

// =====================================================================

// PART 4: Trade Management – Dynamic Stop Loss & Adaptive Take Profit

// =====================================================================

var float riskValue = na

if strategy.position_size == 0

riskValue := na

enterLong() =>

strategy.entry("Long", strategy.long,comment='开多仓')

close - finalLower

enterShort() =>

strategy.entry("Short", strategy.short,comment='开空仓')

finalUpper - close

if (buySignal)

riskValue := enterLong()

if (sellSignal)

riskValue := enterShort()

exitLongOrders() =>

entryPrice = strategy.position_avg_price

TP1 = entryPrice + riskValue

strategy.exit("Long_TP1", from_entry="Long", limit=TP1, qty_percent=50, comment="平多仓TP 1:1")

strategy.exit("Long_TS", from_entry="Long", trail_offset=riskValue * 0.8, trail_points=riskValue * 0.8, comment="平多仓Trailing Stop")

if (strategy.position_size > 0)

exitLongOrders()

exitShortOrders() =>

entryPrice = strategy.position_avg_price

TP1 = entryPrice - riskValue

strategy.exit("Short_TP1", from_entry="Short", limit=TP1, qty_percent=50, comment="平空仓TP 1:1")

strategy.exit("Short_TS", from_entry="Short", trail_offset=riskValue * 0.8, trail_points=riskValue * 0.8, comment="平空仓Trailing Stop")

if (strategy.position_size < 0)

exitShortOrders()