Overview

This strategy is a trading system based on moving average crossovers, supporting both EMA and SMA types of moving averages and provides optimized preset parameters for multiple timeframes including 1-hour, 4-hour, daily, weekly, and bi-weekly. The system generates trading signals through the crossover of fast and slow moving averages and offers visualized price range filling effects.

Strategy Principle

The core of the strategy is to identify potential trend changes by monitoring crossovers between fast and slow moving averages. A long signal is generated when the fast moving average crosses above the slow moving average, while a short signal is generated when the fast moving average crosses below the slow moving average. The strategy offers three trading modes: long-only, short-only, and bi-directional trading. The optimal parameter combinations show that different timeframes require different moving average parameters and types.

Strategy Advantages

- Scientific Parameter Optimization: Parameters optimized through historical data analysis for different timeframes

- High Flexibility: Supports custom parameter settings, allowing adjustment of moving average lengths and types based on market conditions

- Visual Intuitiveness: Clear trend visualization through color-filled areas distinguishing bullish and bearish trends

- Multi-timeframe Applicability: Provides specially optimized parameters for different timeframes

- Complete Information Display: Real-time display of current strategy settings and parameters through an information panel

Strategy Risks

- Lag Risk: Moving averages are inherently lagging indicators, potentially causing delays in fast-moving markets

- Ineffective in Ranging Markets: Frequent crossover signals in sideways markets may lead to consecutive losses

- Parameter Dependency: Although optimized parameters are provided, adjustments may be needed based on specific market conditions

- Market Environment Changes: Parameters optimized based on historical data may become ineffective when future market conditions change

Strategy Optimization Directions

- Add Trend Filters: Incorporate trend indicators like ADX to execute trades only during strong trends

- Introduce Volatility Adjustment: Dynamically adjust moving average parameters based on market volatility

- Optimize Stop Loss Mechanism: Implement dynamic stop loss positions using ATR

- Add Volume Confirmation: Incorporate volume analysis when generating signals to improve reliability

- Develop Adaptive Parameters: Research and develop a parameter system that automatically adjusts based on market conditions

Summary

This is a rigorously optimized moving average crossover strategy applicable to multiple timeframes. Through scientific parameter optimization and flexible configuration options, the strategy provides traders with a reliable trend-following tool. While there are some inherent risks, the suggested optimization directions can further enhance the strategy’s stability and reliability. The strategy’s design philosophy combines classical technical analysis methods with modern quantitative analysis tools to provide traders with a trading system that is both simple to use and rigorously validated.

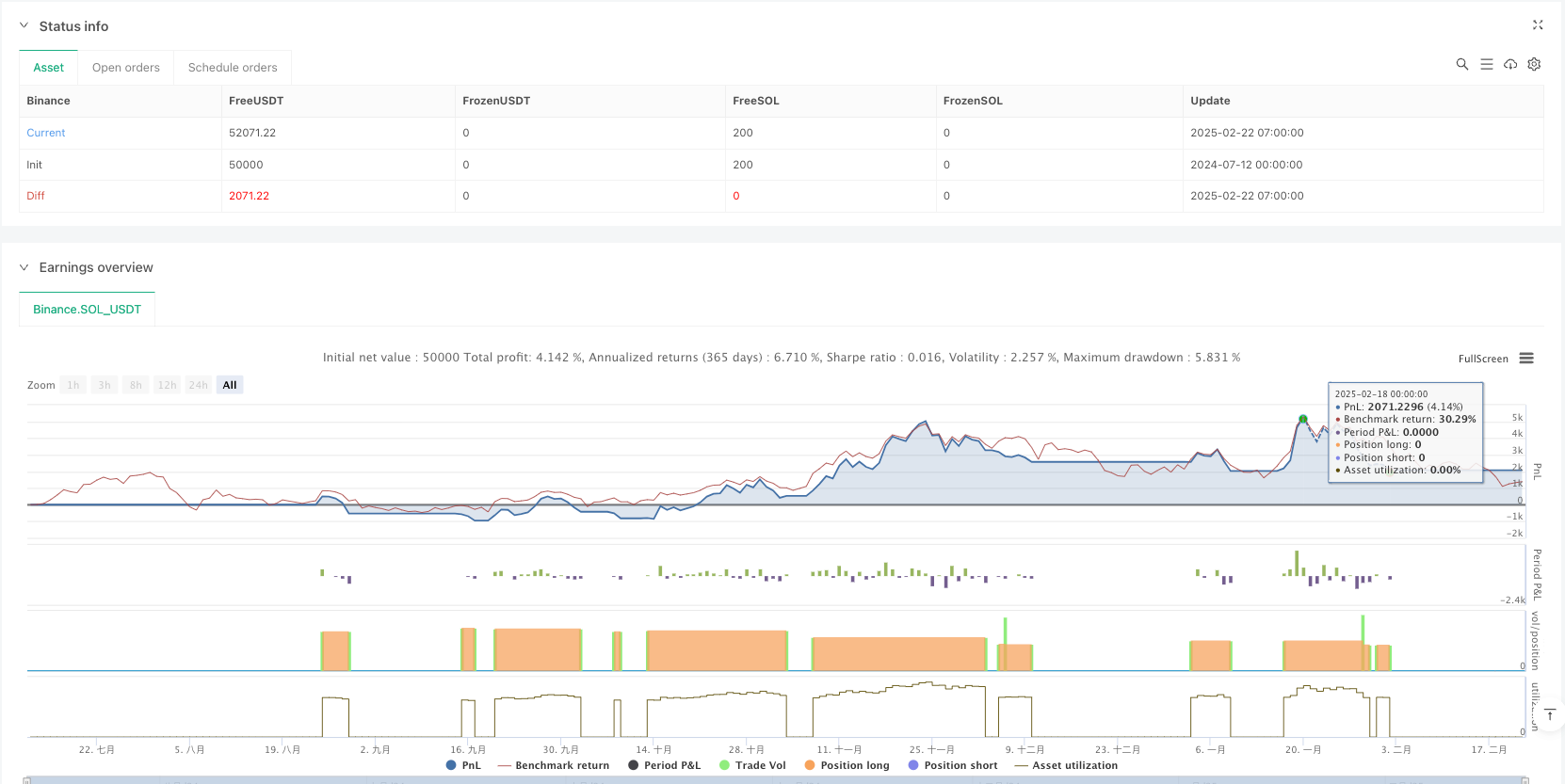

/*backtest

start: 2024-07-12 00:00:00

end: 2025-02-22 08:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Binance","currency":"SOL_USDT"}]

*/

//@version=5

strategy("MA Crossover [ClémentCrypto]", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=20, initial_capital=10000,process_orders_on_close=true)

// Groupe pour le choix entre preset et personnalisé

usePreset = input.bool(title="Utiliser Preset", defval=true, group="Mode Selection")

// Inputs pour la stratégie

timeframeChoice = input.string(title="Timeframe Preset", defval="1H", options=["1H", "4H", "1D", "1W", "2W"], group="Preset Settings")

tradeDirection = input.string(title="Trading Direction", defval="Long Only", options=["Long Only", "Short Only", "Both Directions"], group="Strategy Settings")

// Paramètres personnalisés MA

customFastLength = input.int(title="Custom Fast MA Length", defval=23, minval=1, group="Custom MA Settings")

customSlowLength = input.int(title="Custom Slow MA Length", defval=395, minval=1, group="Custom MA Settings")

customMAType = input.string(title="Custom MA Type", defval="EMA", options=["SMA", "EMA"], group="Custom MA Settings")

// Paramètres MA optimisés pour chaque timeframe

var int fastLength = 0

var int slowLength = 0

var string maType = ""

if usePreset

if timeframeChoice == "1H"

fastLength := 23

slowLength := 395

maType := "EMA"

else if timeframeChoice == "4H"

fastLength := 41

slowLength := 263

maType := "SMA"

else if timeframeChoice == "1D"

fastLength := 8

slowLength := 44

maType := "SMA"

else if timeframeChoice == "1W"

fastLength := 32

slowLength := 38

maType := "SMA"

else if timeframeChoice == "2W"

fastLength := 17

slowLength := 20

maType := "SMA"

else

fastLength := customFastLength

slowLength := customSlowLength

maType := customMAType

// Calcul des moyennes mobiles

fastMA = maType == "SMA" ? ta.sma(close, fastLength) : ta.ema(close, fastLength)

slowMA = maType == "SMA" ? ta.sma(close, slowLength) : ta.ema(close, slowLength)

// Conditions de trading simplifiées

longEntier = ta.crossover(fastMA, slowMA)

longExit = ta.crossunder(fastMA, slowMA)

shortEntier = ta.crossunder(fastMA, slowMA)

shortExit = ta.crossover(fastMA, slowMA)

// Définition des couleurs

var BULL_COLOR = color.new(#00ff9f, 20)

var BEAR_COLOR = color.new(#ff0062, 20)

var BULL_COLOR_LIGHT = color.new(#00ff9f, 90)

var BEAR_COLOR_LIGHT = color.new(#ff0062, 90)

// Couleurs des lignes MA

fastMAColor = fastMA > slowMA ? BULL_COLOR : BEAR_COLOR

slowMAColor = color.new(#FF6D00, 60)

// Gestion des positions

if tradeDirection == "Long Only"

if (longEntier)

strategy.entry("Long", strategy.long)

if (longExit)

strategy.close("Long")

else if tradeDirection == "Short Only"

if (shortEntier)

strategy.entry("Short", strategy.short)

if (shortExit)

strategy.close("Short")

else if tradeDirection == "Both Directions"

if (longEntier)

strategy.entry("Long", strategy.long)

if (longExit)

strategy.close("Long")

if (shortEntier)

strategy.entry("Short", strategy.short)

if (shortExit)

strategy.close("Short")

// Plots

var fastMAplot = plot(fastMA, "Fast MA", color=fastMAColor, linewidth=2)

var slowMAplot = plot(slowMA, "Slow MA", color=slowMAColor, linewidth=1)

fill(fastMAplot, slowMAplot, color=fastMA > slowMA ? BULL_COLOR_LIGHT : BEAR_COLOR_LIGHT)

// Barres colorées

barcolor(fastMA > slowMA ? color.new(BULL_COLOR, 90) : color.new(BEAR_COLOR, 90))