Overview

This is a day trading strategy designed for Nasdaq 100 micro futures. The strategy core utilizes a dual EMA system combined with Volume Weighted Average Price (VWAP) for trend confirmation, and dynamically adjusts stop-loss positions through Average True Range (ATR). While maintaining capital safety, the strategy captures market trends through strict risk control and dynamic position management.

Strategy Principles

The strategy is based on several core components: 1. The signal system uses crossovers of 9-period and 21-period Exponential Moving Averages (EMA) to identify trend direction. Long signals are generated when the short-term EMA crosses above the long-term EMA, and vice versa. 2. VWAP is used as a trend confirmation indicator, requiring price to be above VWAP for long positions and below VWAP for short positions. 3. The risk management system uses ATR-based dynamic stops, with stop-loss set at 2x ATR for longs and 1.5x ATR for shorts. 4. Profit targets employ asymmetric design, using a 3:1 reward-risk ratio for longs and 2:1 for shorts. 5. Implements trailing stops and break-even mechanisms, moving the stop-loss to entry when price reaches 50% of target profit.

Strategy Advantages

- Strong Dynamic Adaptability - Adjusts stops and trailing stops through ATR, automatically adapting to different market volatility environments.

- Comprehensive Risk Control - Limits risk to \(1,500 per trade with a \)7,500 weekly maximum loss limit.

- Asymmetric Return Design - Adopts different reward-risk ratios and position sizes for longs and shorts, better reflecting market characteristics.

- Multiple Confirmation Mechanism - Combines EMA crossovers with VWAP confirmation, effectively reducing false breakout signals.

- Complete Stop-Loss System - Includes fixed stops, trailing stops, and break-even stops for triple protection.

Strategy Risks

- Ranging Market Risk - EMA crossover signals may generate numerous false signals in sideways markets.

- Slippage Risk - Actual execution prices may significantly deviate from signal prices in fast markets.

- Systemic Risk - Stops may fail during major market events.

- Overtrading Risk - Frequent signals may increase transaction costs.

- Capital Management Risk - Small initial capital may prevent effective execution of the complete position management plan.

Strategy Optimization Directions

- Introduce Volume Filters - Add volume confirmation mechanisms, executing trades only when volume conditions are met.

- Optimize Time Filters - Consider adding specific trading time windows to avoid high-volatility opening and closing periods.

- Dynamic Parameter Adjustment - Automatically adjust EMA periods and ATR multipliers based on different market conditions.

- Add Market Sentiment Indicators - Incorporate volatility indicators like VIX to adjust trading frequency and position sizes.

- Enhance Trailing Stops - Design more flexible trailing stop algorithms to improve trend capture capability.

Summary

The strategy establishes a robust trend-following system through the combination of EMAs and VWAP, protecting capital through multi-layered risk control mechanisms. Its key features are adaptability and risk management capability, maintaining stability across different market environments through ATR-based dynamic parameter adjustment. The strategy is particularly suitable for day trading Nasdaq 100 micro futures, but requires traders to strictly execute risk control rules and adjust parameters according to market changes.

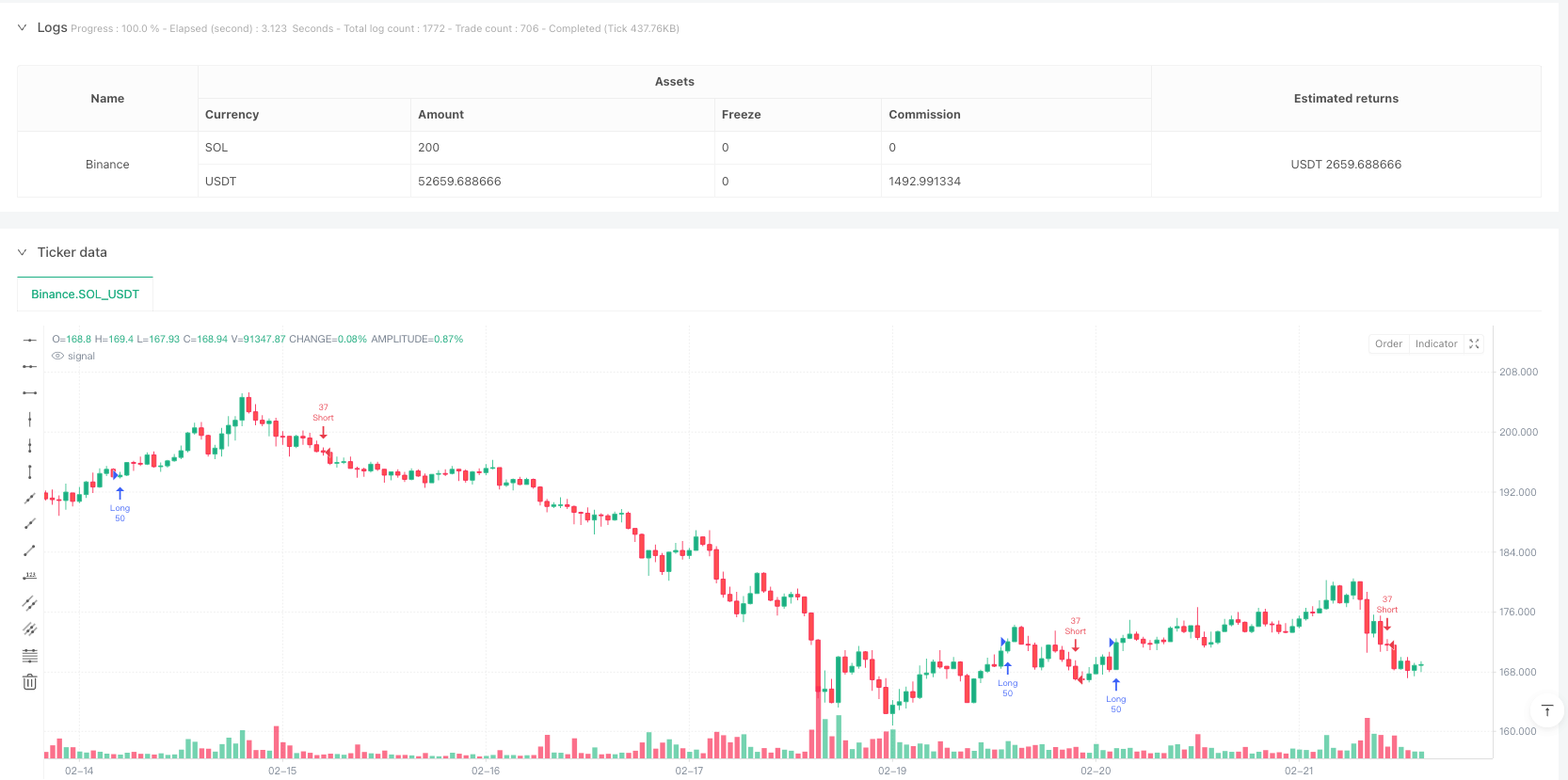

/*backtest

start: 2024-02-25 00:00:00

end: 2025-02-22 08:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Binance","currency":"SOL_USDT"}]

*/

//@version=5

strategy("Nasdaq 100 Micro - Optimized Risk Management", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=100)

// === INPUTS ===

riskPerTrade = input(1500, title="Max Risk Per Trade ($)")

profitTarget = input(3000, title="Target Profit Per Trade ($)")

maxWeeklyLoss = input(7500, title="Max Weekly Loss ($)")

emaShort = input(9, title="Short EMA Period")

emaLong = input(21, title="Long EMA Period")

vwapEnabled = input(true, title="Use VWAP?")

contractSizeMax = input(50, title="Max Micro Contracts per Trade")

atrLength = input(14, title="ATR Length")

// === INDICATORS ===

emaFast = ta.ema(close, emaShort)

emaSlow = ta.ema(close, emaLong)

vwapLine = ta.vwap(close)

atrValue = ta.atr(atrLength)

// === CONDITIONS ===

// Long Entry: EMA Crossover + Above VWAP

longCondition = ta.crossover(emaFast, emaSlow) and (not vwapEnabled or close > vwapLine)

// Short Entry: EMA Crossunder + Below VWAP

shortCondition = ta.crossunder(emaFast, emaSlow) and (not vwapEnabled or close < vwapLine)

// Position Size Calculation (Adjusted for Shorts)

riskPerPoint = 5 // MNQ Micro Futures = $5 per point per contract

stopLossPointsLong = atrValue * 2 // More room for longs

stopLossPointsShort = atrValue * 1.5 // Tighter for shorts

contractsLong = math.min(contractSizeMax, math.floor(riskPerTrade / (stopLossPointsLong * riskPerPoint)))

contractsShort = math.min(math.floor(contractsLong * 0.75), contractSizeMax) // Shorts use 75% of long size

// Stop Loss & Take Profit

longSL = close - stopLossPointsLong

longTP = close + (stopLossPointsLong * 3) // 1:3 Risk-Reward for longs

shortSL = close + stopLossPointsShort

shortTP = close - (stopLossPointsShort * 2) // 1:2 Risk-Reward for shorts

// === BREAK-EVEN STOP MECHANISM ===

longBE = close + (stopLossPointsLong * 1.5) // If price moves 50% to TP, move SL to entry

shortBE = close - (stopLossPointsShort * 1) // More aggressive on shorts

// === TRAILING STOP LOGIC ===

trailStopLong = close - (atrValue * 1.5)

trailStopShort = close + (atrValue * 1)

// === EXECUTION ===

// Check for weekly loss limit

weeklyLoss = strategy.netprofit < -maxWeeklyLoss

if (longCondition and not weeklyLoss)

strategy.entry("Long", strategy.long, contractsLong)

strategy.exit("TakeProfitLong", from_entry="Long", limit=longTP, stop=longSL, trail_points=atrValue * 1.5, trail_offset=atrValue * 0.5)

strategy.exit("BreakEvenLong", from_entry="Long", stop=longBE, when=close >= longBE)

if (shortCondition and not weeklyLoss)

strategy.entry("Short", strategy.short, contractsShort)

strategy.exit("TakeProfitShort", from_entry="Short", limit=shortTP, stop=shortSL, trail_points=atrValue * 1, trail_offset=atrValue * 0.5)

strategy.exit("BreakEvenShort", from_entry="Short", stop=shortBE, when=close <= shortBE)

// === STOP TRADING IF WEEKLY LOSS EXCEEDED ===

if (weeklyLoss)

strategy.close_all()