Overview

The Exponential Moving Average Breakout Reversal Trading System is a quantitative trading strategy based on short-term EMA (Exponential Moving Average) interactions, specifically designed for precise short-selling at market reversal points. The core of this strategy lies in identifying special relationship patterns with the 5-period EMA, capturing the beginning of short-term downtrends through the formation of an “Alert Candle” and subsequent price breakdowns. The system employs a dynamic position sizing calculation method, automatically adjusting trading quantities based on the Alert Candle’s range to ensure a fixed risk amount per trade, achieving precise capital management.

Strategy Principles

The operation of this strategy is based on several key technical components and precise execution logic:

EMA Interaction Detection Mechanism: The system monitors the relationship between price and the 5-period EMA, requiring the previous three candles to touch or be close to the EMA, while the current candle must be significantly above the EMA (not touching it). This separation from the EMA serves as the first signal of a potential reversal.

Alert Candle Identification: When the above EMA interaction conditions are met, the current candle is marked as an “Alert Candle,” and the system records its high and low points as reference points for subsequent trades.

Short Entry Condition: The system waits for the next candle to break below the low of the Alert Candle. When this breakthrough occurs, a short entry signal is triggered.

Dynamic Position Sizing Calculation:

- Alert Candle Range = High - Low

- Position Size = Fixed Risk ($2) / Alert Candle Range

- Capital Used = Position Size × Short Entry Price

Risk Management Parameters:

- Stop Loss: Set at the high of the Alert Candle

- Profit Target: Equal to the stop loss distance (1:1 risk-reward ratio)

Visual Aid Tools: The strategy provides intuitive visual markers on the chart, including the EMA line, Alert Candle marker, trade setup lines (entry, stop loss, take profit), and a capital used label.

The code implements a complete conditional logic set, ensuring trades are executed only when all conditions are met, while using persistent variables (varip) to store key price levels and trade status, maintaining strategy continuity and accuracy.

Strategy Advantages

Simple and Effective Reversal Capture: The strategy can effectively identify potential market reversal points through a clear combination of technical indicators, particularly suitable for capturing the beginning of short-term downtrends.

Precise Risk Control: By fixing the risk amount for each trade ($2), the strategy achieves consistent risk management, avoiding the excessive risk that might come from emotional decision-making.

Dynamic Position Adjustment: The strategy dynamically calculates position size based on actual market volatility (Alert Candle range), automatically adjusting under different volatility conditions, allowing the system to adapt to various market environments.

Clear Visual Feedback: Trading signals, entry points, stop losses, and profit targets are all visually displayed on the chart, making it easy for traders to understand and execute trading decisions.

Automated Execution: The strategy is fully programmable, allowing for automated execution of trades, reducing the impact of human intervention and emotional bias.

Transparent Capital Usage: The amount of capital used for each trade is clearly displayed on the chart, helping traders monitor capital usage in real-time.

Strategy Risks

False Breakout Risk: The market may produce false breakouts, causing the price to break below the Alert Candle’s low and then quickly rebound, triggering the stop loss. This risk can be reduced by adding confirmation indicators (such as volume confirmation) or waiting for a retest after the breakout.

1:1 Risk-Reward Ratio Limitation: The strategy uses a 1:1 risk-reward ratio to set profit targets, which may not be optimal under certain market conditions. Consider implementing dynamic profit targets or trailing stops to potentially improve overall performance.

Overtrading Risk: In sideways or low-volatility markets, the strategy may generate too many Alert Candle signals, leading to overtrading. Additional market environment filters, such as volatility indicators or trend strength filters, can be added.

Single Indicator Dependency: The strategy primarily relies on the relationship with the 5 EMA without using other technical indicators for confirmation. This may lead to decreased signal quality under certain market conditions. It is recommended to add auxiliary indicators such as RSI or MACD for signal confirmation.

Fixed Risk Amount Limitation: Although a fixed risk ($2) provides consistency, it may not be suitable for all account sizes. Larger accounts may need a larger risk amount, while smaller accounts may need a smaller risk amount. It is recommended to set the risk amount as a percentage of the total account.

Strategy Optimization Directions

Multi-Timeframe Analysis Integration: Signal quality can be significantly improved by adding higher timeframe trend confirmation. For example, executing short signals on a 15-minute chart only when the daily trend is downward can reduce the risk of counter-trend trading.

Adaptive Risk-Reward Ratio: Adjust the risk-reward ratio based on market volatility or support/resistance levels, rather than using a fixed 1:1 ratio. In strong downtrends, larger profit targets (such as 1:2 or 1:3) can be set.

Dynamic EMA Period: The current strategy uses a fixed 5-period EMA. Implementing an adaptive EMA period that automatically adjusts according to market volatility (e.g., using a shorter EMA in low volatility environments and a longer EMA in high volatility environments) may improve strategy adaptability.

Adding Volume Confirmation: Volume is a key indicator for confirming the validity of price action. Requiring above-average volume when breaking below the Alert Candle’s low can reduce false breakout trades.

Integrating Market Environment Filters: Add market environment classification logic (such as trend, sideways, high volatility, low volatility) and adjust strategy parameters based on different environments or even completely avoid trading in unfavorable environments.

Stop Loss Optimization: Consider using smarter stop loss placement methods, such as ATR (Average True Range) based stops or the highest point of the last N candles, which may be more effective than using the Alert Candle’s high.

Summary

The Exponential Moving Average Breakout Reversal Trading System is a well-designed quantitative trading strategy, particularly suitable for short-term traders to capture market reversal points and short-term downtrends. Its core advantages lie in combining clear technical indicators (5 EMA), precise entry conditions (Alert Candle and breakout), and systematic capital management (dynamic position sizing).

The strategy’s risk management framework provides a disciplined trading approach by fixing the risk amount for each trade and dynamically adjusting positions based on actual market volatility. The strategy’s visual assistance system also enhances execution convenience and clarity.

However, to improve the strategy’s robustness and adaptability, it is recommended to consider integrating multi-timeframe analysis, adding auxiliary confirmation indicators, optimizing risk-reward settings, and adding market environment filters. These optimizations can reduce false signals, improve the proportion of profitable trades, and maintain good performance under different market conditions.

Overall, this is a clearly structured and logically rigorous trading system, suitable both for experienced traders as a primary strategy and for novice traders to learn the basic principles of quantitative trading. Through continuous backtesting and optimization, this strategy has the potential to become a reliable trading tool, bringing stable returns to the portfolio.

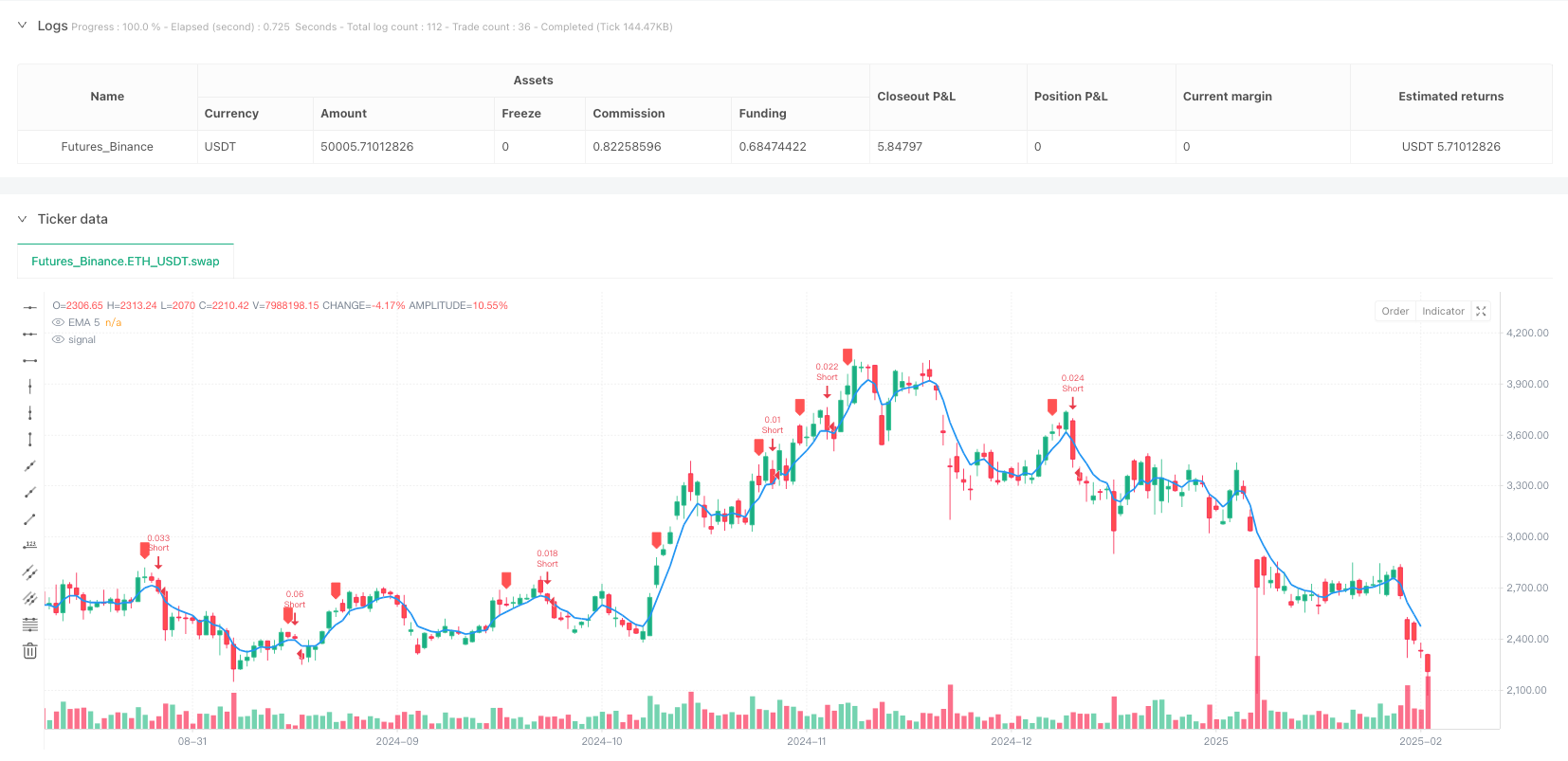

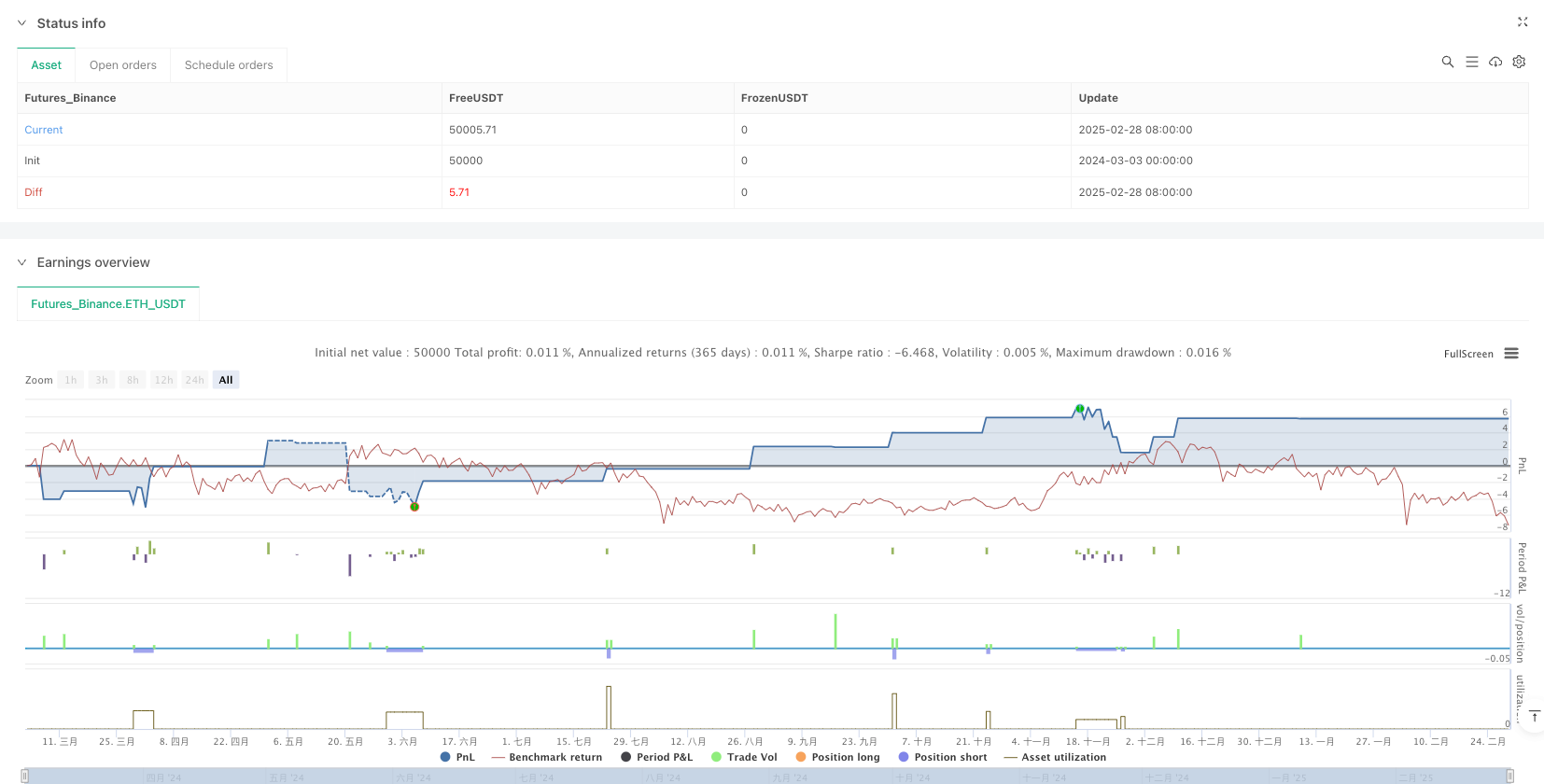

/*backtest

start: 2024-03-03 00:00:00

end: 2025-03-01 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT"}]

*/

//@version=5

strategy("EMA 5 Alert Candle Short", overlay=true)

// Define EMA

emaLength = 5

emaValue = ta.ema(close, emaLength)

// Risk Management Parameters

capital = 1000

riskPerTrade = 2 // Fixed risk per trade in dollars

// Check if previous candles touched EMA, but the current candle is far above EMA

candleTouchesEMA = low <= emaValue

alertCandle = not candleTouchesEMA[0] and candleTouchesEMA[1] and candleTouchesEMA[2] and candleTouchesEMA[3]

// Persistent Variables to Store Alert Levels

varip float validAlertLow = na

varip float validAlertHigh = na

varip bool isAlertActive = false

varip float positionSize = na

varip float capitalUsed = na

// When an alert candle is identified, store its high and low

if alertCandle

validAlertLow := low

validAlertHigh := high

isAlertActive := true

// Calculate Position Sizing

if isAlertActive

alertCandleRange = validAlertHigh - validAlertLow

positionSize := riskPerTrade / alertCandleRange // Shares or contracts

capitalUsed := positionSize * validAlertLow // Capital used in dollars

// Check if the next candle breaks the alert candle low (entry condition)

shortTrigger = isAlertActive and low < validAlertLow

if shortTrigger

shortEntry = validAlertLow

stopLoss = validAlertHigh

target = shortEntry - (stopLoss - shortEntry)

isAlertActive := false // Disable alert after trade execution

// Execute trade

strategy.entry("Short", strategy.short, qty=positionSize, stop=shortEntry)

strategy.exit("Take Profit", from_entry="Short", limit=target, stop=stopLoss)

// Reset alert candle if next candle does not break low but also does not touch 5EMA

if not shortTrigger and not candleTouchesEMA[0]

validAlertLow := low

validAlertHigh := high

isAlertActive := true

// Plot EMA

plot(emaValue, title="EMA 5", color=color.blue, linewidth=2)

// Mark alert candle

plotshape(alertCandle, location=location.abovebar, color=color.red, style=shape.labeldown, title="Alert Candle")