Overview

The Multi-Fibonacci Optimal Time Entry Strategy is a quantitative trading system based on market structure and price retracement levels, integrating ICT (Inner Circle Trader) OTE (Optimal Time Entry) concepts with traditional Fibonacci retracement analysis. The core of the strategy is to identify key market swing highs and lows, calculate multiple Fibonacci retracement levels, and generate trading signals when price crosses a specific Fibonacci level (0.705) while simultaneously meeting other conditions. This approach aims to capture price rebounds or breakouts at significant support and resistance levels, thereby gaining advantageous entry points during trend continuation.

Strategy Principles

The strategy’s working principles can be divided into several key steps:

Swing Point Identification: The strategy first uses a specified length (default 20 periods) to identify swing highs and lows in the market. These points are defined as the highest and lowest prices within the given period.

Fibonacci Retracement Calculation: Once swing highs and lows are determined, the strategy calculates six key Fibonacci retracement levels: 0.272, 0.382, 0.5, 0.618, 0.705, and 0.786. These levels are derived from the price range between the swing high and low points.

Visual Assistance: The strategy draws these Fibonacci levels on the chart, using different colors for each level for easy differentiation. This provides traders with visual references to help identify key price areas.

Entry Conditions:

- Long entry: Triggered when price crosses above the 0.705 Fibonacci level and the closing price is higher than the 0.618 level.

- Short entry: Triggered when price crosses below the 0.705 Fibonacci level and the closing price is lower than the 0.618 level.

This entry logic combines price breakout (crossing the 0.705 level) and trend confirmation (position relative to the 0.618 level) conditions, aiming to reduce false signals and enhance strategy robustness.

Strategy Advantages

The Multi-Fibonacci Optimal Time Entry Strategy has several notable advantages:

Precise Entry Points: By combining Fibonacci retracement levels and price crossing conditions, the strategy can provide precise entry signals, reducing the risk of blind entries.

Visual Clarity: The strategy visually displays all key Fibonacci levels on the chart, allowing traders to clearly understand market structure and potential support/resistance areas.

Flexible Adaptability: The strategy allows adjustment of the swing length parameter, making it adaptable to different market conditions and timeframes.

Bidirectional Trading: The strategy supports both long and short trades, capable of capturing opportunities in different market environments.

Noise Reduction: By using the combination of 0.705 and 0.618 key levels as conditions, the strategy effectively filters market noise, reducing the possibility of false breakouts.

Market Structure Based: The strategy calculates entry zones based on actual market structure (swing highs and lows) rather than using arbitrary or fixed price levels.

Strategy Risks

Despite its advantages, the strategy also presents some potential risks:

Parameter Sensitivity: The choice of swing length parameter has a significant impact on strategy performance. Shorter lengths may lead to overtrading, while longer lengths may cause missed opportunities.

Market Environment Dependency: In highly volatile or ranging markets, the strategy may produce more false signals. The strategy performs best in markets with clear trends.

Drawdown Risk: Despite using multiple conditions to filter signals, the market may still experience significant drawdowns after entry, especially during major news or events.

Lack of Stop-Loss Mechanism: The current strategy code does not define stop-loss levels, which increases money management risk.

Over-reliance on Technical Indicators: The strategy is entirely based on technical analysis, ignoring fundamental factors and market sentiment, which may lead to undesirable results in certain market environments.

Risk mitigation measures can include: adding explicit stop-loss rules, incorporating other technical indicators for confirmation, pausing trading before major economic events, and dynamically adjusting parameters based on different market conditions.

Strategy Optimization Directions

There are several possible optimization directions for this strategy:

Dynamic Stop-Loss/Take-Profit: Implement dynamic stop-loss and take-profit mechanisms based on ATR or Fibonacci levels to protect profits and limit losses.

Multiple Timeframe Confirmation: Add trend confirmation conditions from higher timeframes to ensure trade direction aligns with the larger trend.

Volume Filter: Include volume confirmation in entry conditions to increase the reliability of price breakouts.

Dynamic Parameter Adjustment: Implement a mechanism to automatically adjust the swing length parameter based on market volatility, allowing the strategy to better adapt to different market environments.

Adding Market Sentiment Indicators: Incorporate additional technical indicators such as RSI, MACD, or Stochastic to provide more trade confirmations.

Entry Optimization: Implement a scaling-in strategy, building positions in multiple entries as price reaches specific Fibonacci levels to reduce entry timing risk.

Historical Pattern Recognition: Add logic to identify historically successful patterns and increase position size when current market conditions resemble past successful trades.

These optimizations can significantly improve the strategy’s robustness, profitability, and risk-adjusted returns. In particular, adding stop-loss mechanisms and multiple timeframe confirmation may be the most urgent and valuable improvements.

Summary

The Multi-Fibonacci Optimal Time Entry Strategy is a sophisticated quantitative trading system that combines ICT theory with Fibonacci retracement analysis. By identifying key market structures and price interactions, the strategy can provide precise entry signals applicable to various market environments. Its core advantages lie in its precise entry mechanism and clear visual feedback, but attention must be paid to changes in market environment and money management risks.

By implementing the suggested optimization measures, especially adding stop-loss mechanisms, multiple timeframe confirmation, and dynamic parameter adjustment, the strategy has the potential to become a comprehensive and robust trading system. Ultimately, this strategy provides traders with a structured framework for identifying and capitalizing on optimal entry opportunities in the market.

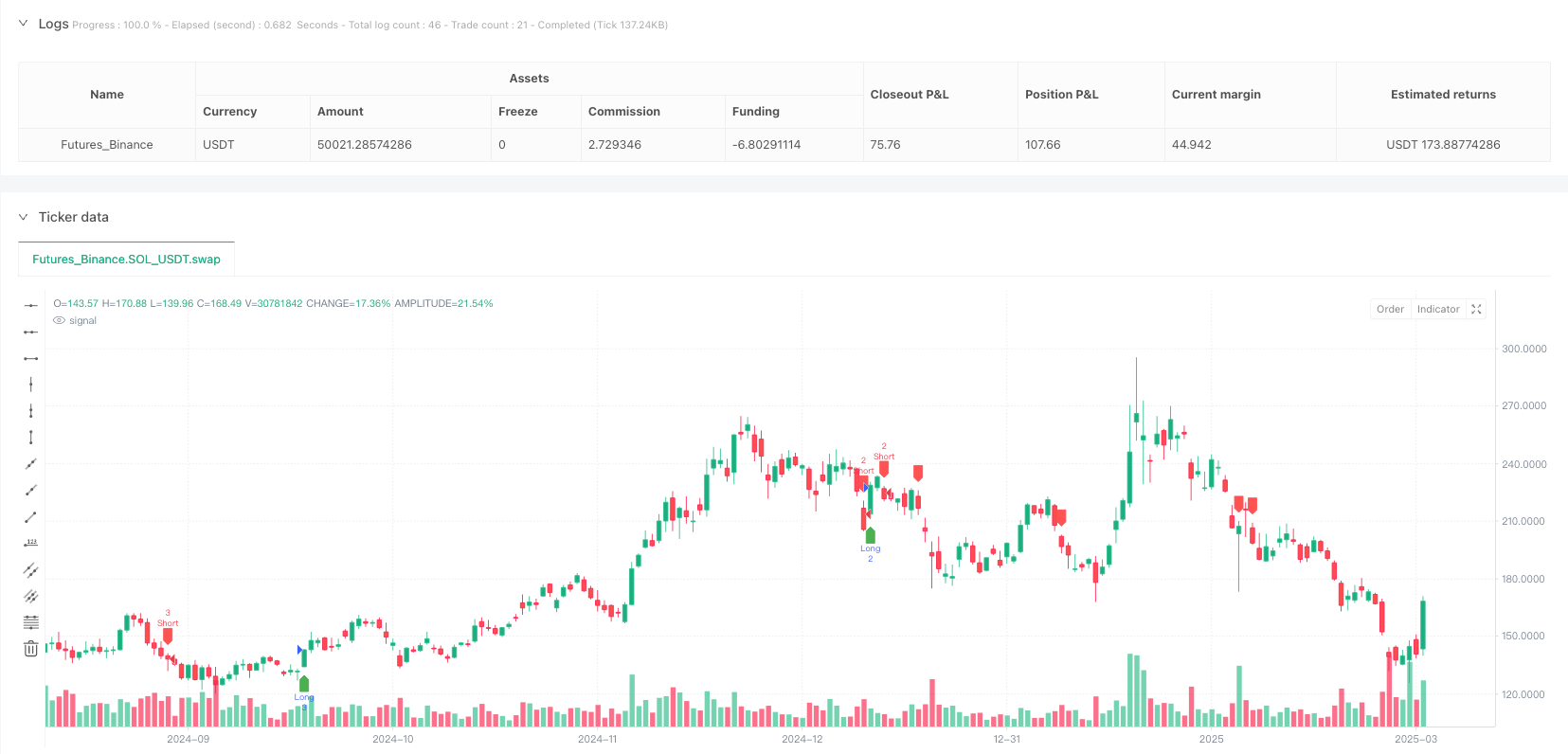

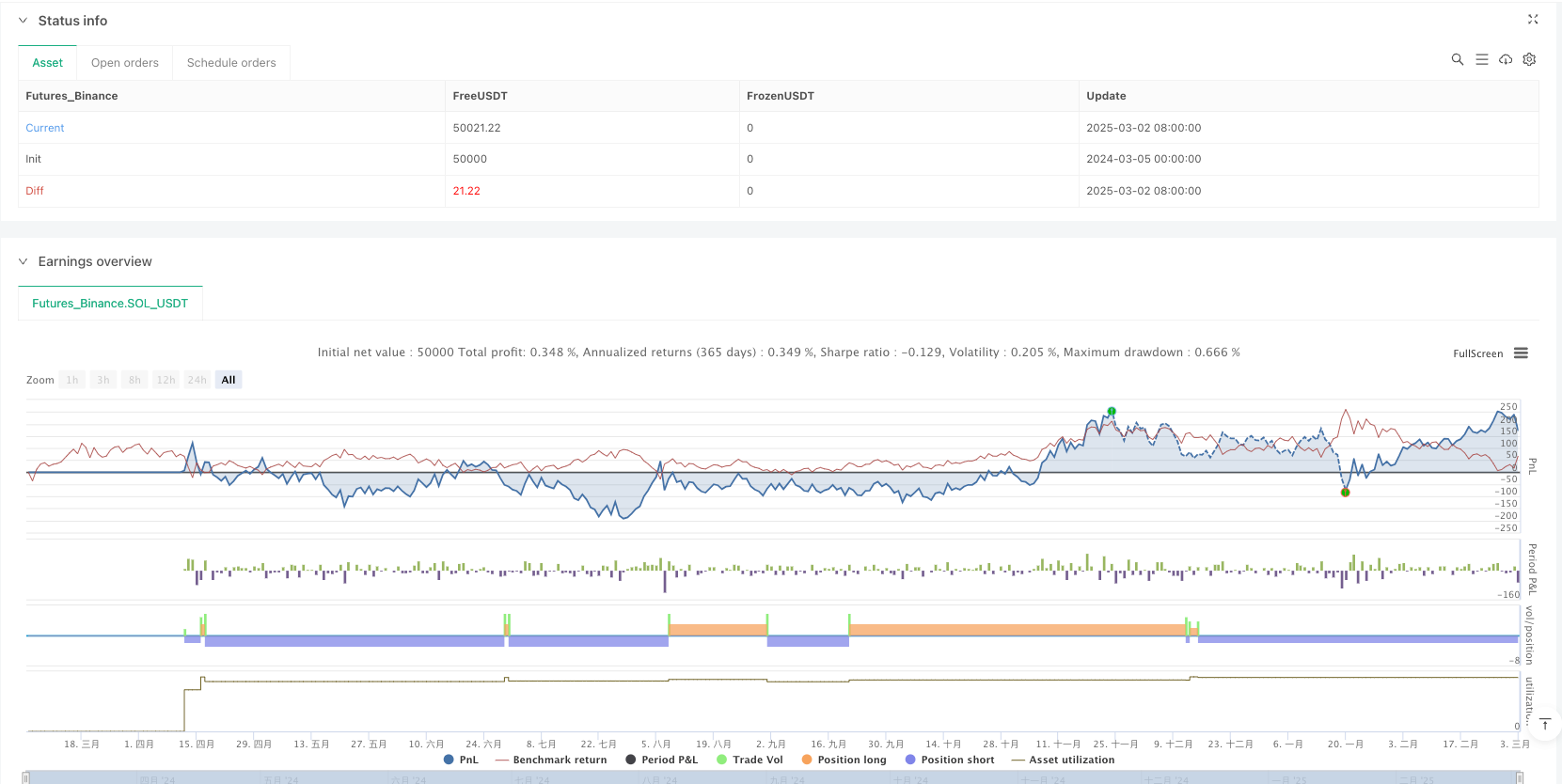

/*backtest

start: 2024-03-05 00:00:00

end: 2025-03-03 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"SOL_USDT"}]

*/

//@version=6

strategy("ICT OTE Strategy", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=1)

// Input settings

length = input.int(20, title="Swing Length")

showFibs = input.bool(true, title="Show Fibonacci Levels")

find_swing_high(len) =>

ta.highest(high, len) == high

find_swing_low(len) =>

ta.lowest(low, len) == low

// Identify swing high and low

var float swingHigh = na

var float swingLow = na

if find_swing_high(length)

swingHigh := high

if find_swing_low(length)

swingLow := low

// Define Fibonacci retracement levels

fibLow = swingLow

fibHigh = swingHigh

fib_level(start, end, level) =>

start - (start - end) * level

fib_0_705 = fib_level(fibHigh, fibLow, 0.705)

fib_0_786 = fib_level(fibHigh, fibLow, 0.786)

fib_0_618 = fib_level(fibHigh, fibLow, 0.618)

fib_0_5 = fib_level(fibHigh, fibLow, 0.5)

fib_0_382 = fib_level(fibHigh, fibLow, 0.382)

fib_0_272 = fib_level(fibHigh, fibLow, 0.272)

// Entry conditions based on OTE

longEntry = ta.crossover(close, fib_0_705) and close > fib_0_618

shortEntry = ta.crossunder(close, fib_0_705) and close < fib_0_618

// Strategy execution

if longEntry

strategy.entry("Long", strategy.long)

if shortEntry

strategy.entry("Short", strategy.short)

plotshape(series=longEntry, location=location.belowbar, color=color.green, style=shape.labelup, title="Long Entry")

plotshape(series=shortEntry, location=location.abovebar, color=color.red, style=shape.labeldown, title="Short Entry")