Overview

The Internal Bar Strength Trend Reversal Trading System is a daily timeframe trading strategy based on the Internal Bar Strength (IBS) indicator. The core concept of this strategy is to identify potential market reversal points by monitoring the relative position of the previous candle’s closing price within its high-low range to determine overbought and oversold market conditions. This strategy is particularly suitable for stocks and US indices trading, with default parameters optimized for major indices like SPY/SPX and NDQ/QQQ. By combining the Exponential Moving Average (EMA) as a trend filter, this strategy can capture short-term price fluctuations while adhering to long-term trends.

Strategy Principles

The core of this strategy lies in the calculation and application of the Internal Bar Strength (IBS) indicator. The IBS is calculated using the following formula:

IBS = (Previous Day's Close - Previous Day's Low) / (Previous Day's High - Previous Day's Low)

The IBS value always fluctuates between 0 and 1: - An IBS value below 0.2 is typically interpreted as an oversold condition, indicating a potential upward market movement - An IBS value above 0.9 suggests an overbought condition, signaling a possible market retracement

The trading rules of this strategy are as follows: 1. Long Entry Conditions: - Condition 1: IBS is below the user-defined entry threshold (default is 0.09) - Condition 2: Current price is above the N-period Exponential Moving Average (EMA) (default period is 220) - Note: Users can disable the EMA condition by setting the EMA period to 0

- Long Exit Conditions:

- Close the position when IBS rises above the user-defined exit threshold (default is 0.985)

- Or close the position when the trade duration reaches the maximum trading period (default is 14 days)

Additionally, the strategy introduces a “Minimum Distance for New Entry (%)” parameter, ensuring that new positions are only opened when the price has pulled back sufficiently, effectively reducing drawdown risk and optimizing capital management.

Strategy Advantages

Precise Market Timing: The use of the IBS indicator allows for accurate capture of market overbought and oversold conditions, providing an objective mathematical basis for entries and exits, reducing biases from subjective judgment.

Trend Filtering Mechanism: By using EMA as a trend filter, the strategy ensures that the trading direction aligns with the main trend, effectively avoiding the risks of counter-trend trading. The EMA period can be adjusted based on different market characteristics or completely disabled.

Flexible Position Management: The strategy supports pyramiding (up to 2 entries) and introduces the “Minimum Distance for New Entry (%)” parameter, implementing a more intelligent phased position building mechanism that can effectively lower the average position cost during price pullbacks.

Automatic Risk Control: The strategy sets a maximum holding time limit, automatically closing positions after a preset maximum trading period even if the market doesn’t trigger regular exit signals, effectively controlling the risk exposure time for each trade.

Parameter Optimization: Default parameters have been optimized for major market indices like SPY and QQQ/NDQ, with recommended settings that users can directly apply:

- QQQ recommended settings: Entry threshold 0.09, Exit threshold 0.985, EMA period 220, Minimum entry distance 0%, Maximum holding days 14

- SPY recommended settings: Entry threshold 0.11, Exit threshold 0.995, EMA period 200, Minimum entry distance 0%, Maximum holding days 12

Comprehensive Trading Modes: Supports long-only, short-only, or bidirectional trading modes, adapting to different market environments and trading styles.

Strategy Risks

Parameter Sensitivity: IBS entry and exit thresholds significantly impact strategy performance; improper parameter settings may lead to overtrading or missing important trading opportunities. It is recommended to conduct thorough historical data backtesting and parameter optimization for specific trading instruments before live implementation.

Oscillating Market Risk: In range-bound markets without clear trends, IBS signals may appear frequently, leading to overtrading and unnecessary transaction costs. The solution is to add filtering conditions, such as requiring confirmation from multiple consecutive IBS signals or combining with other indicators (like ATR) to assess market volatility.

Lag in Rapid Trend Changes: When markets experience quick trend shifts, the IBS indicator calculated from previous day’s data may react with a lag, resulting in less-than-ideal entry or exit timing. It is advisable to adjust IBS thresholds or shorten the maximum holding time during high volatility periods.

Capital Management Risk: By default, the strategy uses 50% of account funds for trading, which may lead to excessive risk exposure with multiple position additions. Users should adjust position size and pyramiding parameters according to their risk tolerance.

Technical Implementation Limitations: The strategy executes trades based on closing prices, which may face slippage and price discrepancies in actual operations. To reduce such risks, consider placing orders a certain time before market close or using limit orders instead of market orders.

Strategy Optimization Directions

Dynamic Threshold Adjustment: The current strategy uses fixed IBS entry and exit thresholds. Consider dynamically adjusting these thresholds based on market volatility. For example, increase entry thresholds and decrease exit thresholds during high volatility periods to reduce false signals; adopt more aggressive settings during low volatility periods. This can be implemented by linking IBS thresholds with ATR (Average True Range) or historical volatility.

Multi-Timeframe Confirmation: Introduce a multi-timeframe analysis framework, requiring simultaneous confirmation from short-term and medium-term IBS signals before executing trades. For example, in addition to daily IBS signals, calculate weekly or 4-hour IBS values, only entering when multiple timeframes show overbought or oversold conditions, which can significantly improve signal quality.

Intelligent Stop-Loss Mechanism: The current strategy relies only on IBS exit signals and maximum holding time to control risk. More intelligent stop-loss mechanisms can be introduced, such as ATR-based dynamic stop-losses, trailing stops, or support/resistance-based stop-loss strategies, to better protect profits and control single trade risk.

Market State Adaptation: Introduce market state recognition mechanisms to use different parameter settings in different market environments (trending markets, oscillating markets). Market states can be identified through ADX (Average Directional Index) or other trend strength indicators, relaxing IBS conditions in strong trend environments and adopting stricter IBS thresholds in oscillating markets.

Machine Learning Optimization: Utilize machine learning techniques to optimize and filter IBS signals. Train models to identify which IBS signals are more likely to generate profitable trades and automatically adjust parameters based on market characteristics, achieving adaptive strategy performance. This approach can significantly improve strategy stability and adaptability, especially when facing different market conditions and trading instruments.

Summary

The Internal Bar Strength Trend Reversal Trading System is a daily timeframe trading strategy that combines the Internal Bar Strength (IBS) indicator with the Exponential Moving Average (EMA). This strategy optimizes trading decisions by identifying potential market reversal points and following long-term trends, making it particularly suitable for stocks and US indices trading. Its core advantages lie in its objective mathematical model, flexible position management, and built-in risk control mechanisms.

The strategy has been parameter-optimized for major market indices like SPY/SPX and NDQ/QQQ, allowing users to directly apply recommended settings for trading. However, like any trading strategy, risks exist, including parameter sensitivity, oscillating market risk, and lag during rapid trend changes.

Future optimization directions include dynamic threshold adjustment, multi-timeframe confirmation, intelligent stop-loss mechanisms, market state adaptation, and machine learning optimization. These improvements can further enhance the strategy’s adaptability and robustness, maintaining good performance across different market environments.

As a quantitative trading strategy, the Internal Bar Strength Trend Reversal Trading System provides traders with a rule-based, objective trading method that reduces the impact of emotional factors on trading decisions, helping to achieve more consistent and predictable trading results.

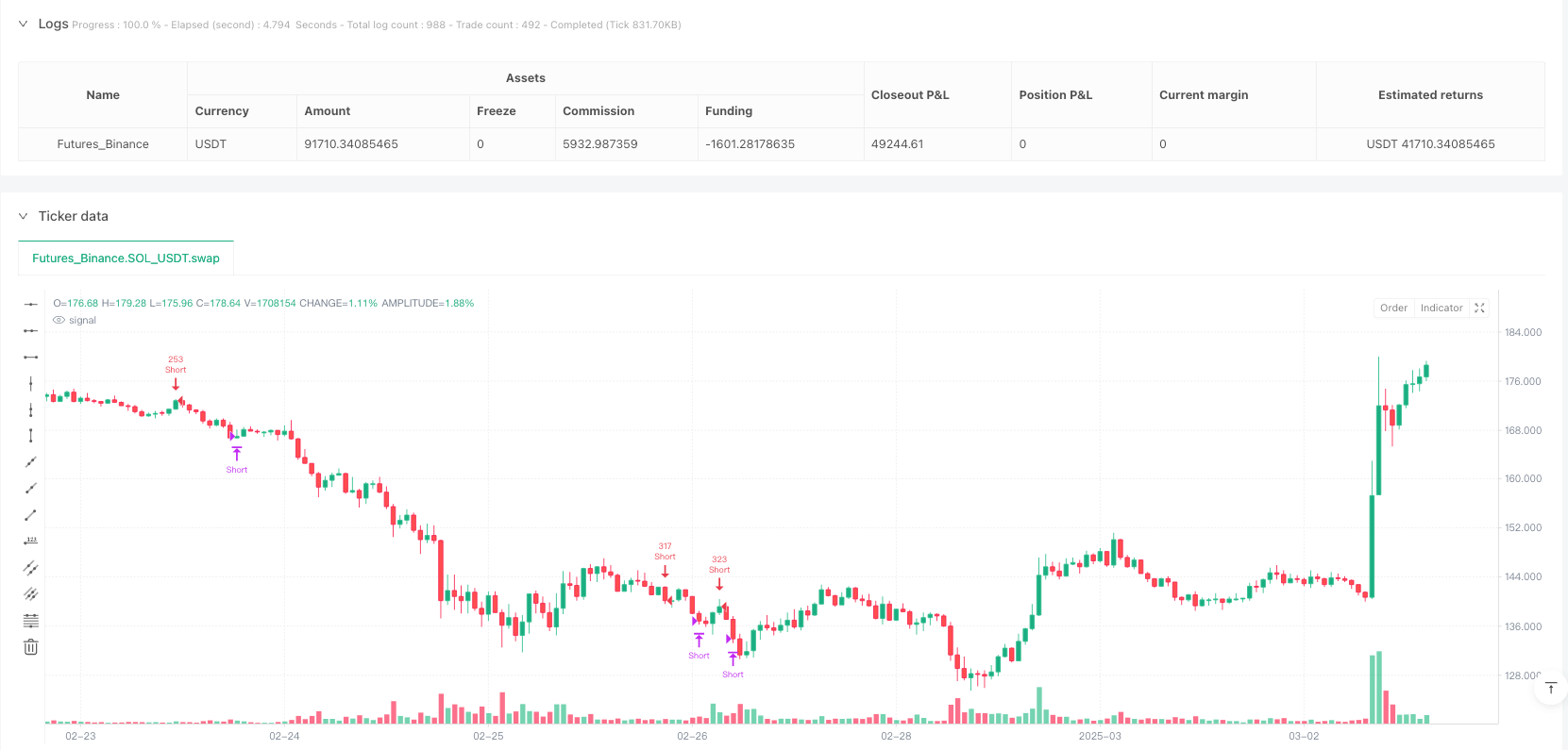

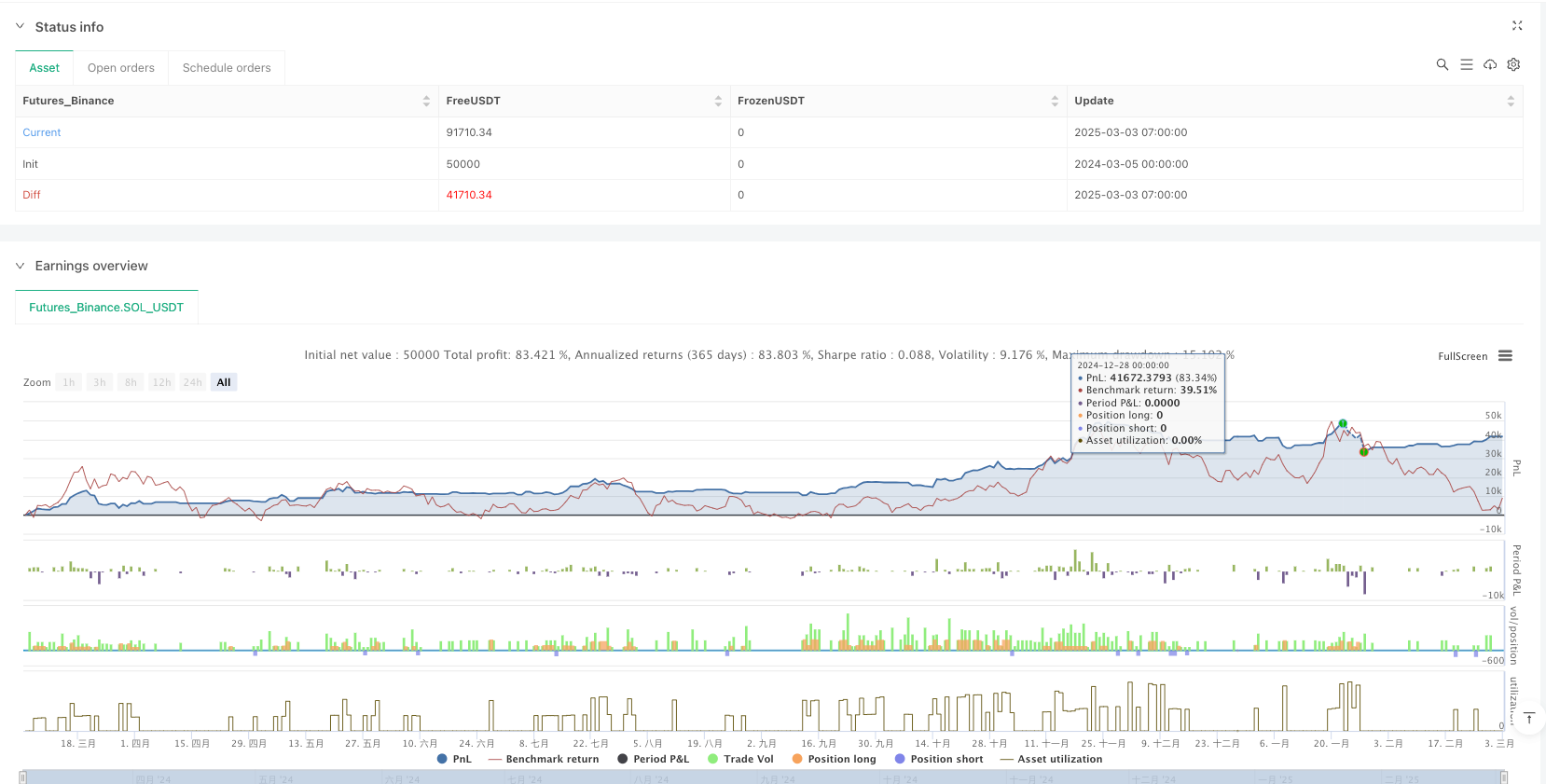

/*backtest

start: 2024-03-05 00:00:00

end: 2025-03-03 08:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"SOL_USDT"}]

*/

//Implementation by AlgoTradeKit

//v.0.5

//The IBS Trading Strategy is a daily bars long-only trading system, based on the concept of Internal Bar Strength (IBS).

//The strategy aims to identify potential reversals by monitoring how the previous bar’s close positions itself within its high-low range.

//It is suitable for stock and US indices. The default parameters are optimized for SPY/SPX and NDQ/QQQ

//Setting for QQQ: 0.09, 0.985, 220, 0, 14

//Setting for SPY: 0.11, 0.995, 200, 0, 12

//@version=6

strategy("IBS (Internal Bar Strength) Trading Strategy for SPY and NDQ", overlay=true, initial_capital=10000, default_qty_type=strategy.percent_of_equity, default_qty_value=50, pyramiding = 2, currency = currency.USD, process_orders_on_close=false)

// ***** INPUTS *****

// IBS thresholds

ibsEntryThreshold = input.float(0.09, title="IBS Entry Threshold", step=0.01, tooltip="IBS = (Previous Close - Previous Low) / (Previous High - Previous Low), and IBS value below 0.2 is typically interpreted as an oversold condition, while a value above 0.9 suggests an overbought state.")

ibsExitThreshold = input.float(0.985, title="IBS Exit Threshold", step=0.01, tooltip="IBS = (Previous Close - Previous Low) / (Previous High - Previous Low), and IBS value below 0.2 is typically interpreted as an oversold condition, while a value above 0.9 suggests an overbought state.")

// EMA period (set to 0 to disable the EMA condition)

emaPeriod = input.int(220, title="EMA Period (0 to disable)", minval=0, maxval=5000, step=1, tooltip="Exponential Moving Average Filter Period (0 to disable)")

// Minimum percentage drop required for a new entry (for dollar-cost averaging)

minEntryPct = input.float(0, title="Minimum Distance for New Entry (%)", step=0.05, minval=0.0, maxval=100, tooltip = "Distance in Price from Last Opened Position, in Percentage Terms (%)")

maxTradeDuration = input.int(title="Maximum Trade Duration (days)", defval=14, minval=1, step=1, maxval=1000, tooltip = "Exit at close if maximum trade duration is reached.")

// Persistent variable to record the bar index when the trade is entered.

var int entryBarIndex = na

// ***** EMA CALCULATION *****

// Calculate the EMA globally if the period is greater than 0, otherwise leave as na.

emaValue = emaPeriod > 0 ? ta.ema(close, emaPeriod) : na

// ***** IBS CALCULATION *****

// Calculate IBS using the previous bar’s values.

// Guard against division by zero: if previous high equals previous low, default IBS to 0.5.

prevHigh = high[1]

prevLow = low[1]

prevClose = close[1]

ibs = (prevHigh != prevLow) ? (prevClose - prevLow) / (prevHigh - prevLow) : 0.5

// ***** ENTRY AND EXIT CONDITIONS *****

// Define the EMA condition: if emaPeriod is 0, bypass the EMA check.

emaConditionLong = emaPeriod == 0 or (close > emaValue)

emaConditionShort = emaPeriod == 0 or (close < emaValue)

// Entry: IBS is below the entry threshold and the EMA condition holds.

enterLong = (ibs < ibsEntryThreshold) and emaConditionLong

enterShort = (ibs > ibsExitThreshold) and emaConditionShort

// Exit: IBS is above the exit threshold.

exitLong = ibs > ibsExitThreshold

exitShort = ibs < ibsEntryThreshold

// ***** DOLLAR-COST AVERAGING CONDITION IN PERCENTAGE *****

// Track the last entry price. Reset when there is no open position.

var float lastEntryPrice = na

if strategy.position_size == 0

lastEntryPrice := na

// If there is no previous entry, the condition is met.

// Otherwise, allow a new entry only if the current price is lower than the last entry price

// by at least the predefined percentage (converted to a fraction).

dcaCondition = na(lastEntryPrice) or ((close < lastEntryPrice) and (((lastEntryPrice - close) / lastEntryPrice) >= (minEntryPct / 100)))

dcaConditionShort = na(lastEntryPrice) or ((close > lastEntryPrice) and (((close - lastEntryPrice) / lastEntryPrice) >= (minEntryPct / 100)))

// ***** STRATEGY ORDERS *****

// Enter a long position only if both the entry condition and the DCA condition are met.

if enterLong and dcaCondition

strategy.entry("Long", strategy.long)

lastEntryPrice := close // update the last entry price

entryBarIndex := bar_index

if enterShort and dcaConditionShort

strategy.entry("Short", strategy.short)

lastEntryPrice := close // update the last entry price

entryBarIndex := bar_index

// Compute trade duration in days using the absolute difference

tradeDuration = not na(entryBarIndex) ? math.abs(bar_index - entryBarIndex) : 0

// Exit the long position when the exit condition is met or if the trade duration reaches maxTradeDuration days.

if exitLong or (tradeDuration >= maxTradeDuration)

strategy.close("Long")

// Exit the long position when the exit condition is met or if the trade duration reaches maxTradeDuration days.

if exitShort or (tradeDuration >= maxTradeDuration)

strategy.close("Short")

// ***** PLOTTING *****

// Plot IBS for reference, along with horizontal lines for the entry and exit thresholds.

//plot(ibs, title="IBS", color=color.blue, linewidth=2)

//hline(ibsEntryThreshold, title="IBS Entry Threshold", color=color.green)

//hline(ibsExitThreshold, title="IBS Exit Threshold", color=color.red)