Multi-Technical Indicator Gold Real-Time Movement Detection and Risk Management Strategy

MA EMA ATR STC HEIKIN ASHI CHANDELIER EXIT supertrend RMA VWMA WMA HMA

Strategy Overview

The Multi-Technical Indicator Gold Real-Time Movement Detection and Risk Management Strategy is a gold trading system based on 1-minute Heikin Ashi charts, combining multiple technical indicators as trading signals and confirmation tools. The strategy primarily uses Chandelier Exit as the leading indicator, with optional integration of EMA filter, SuperTrend, and Schaff Trend Cycle (STC) as confirmation tools. The strategy employs a flexible take-profit and stop-loss mechanism and provides an intuitive trading dashboard that allows traders to monitor trading status in real-time. This multi-dimensional technical analysis approach aims to quickly capture short-term fluctuations in gold prices while reducing the risk of false signals through an indicator confirmation system.

Strategy Principles

The strategy is based on a multi-level signal confirmation system, with core logic as follows:

Leading Indicator Signal Generation: The strategy uses Chandelier Exit as the leading indicator. Chandelier Exit is a trend-following indicator that uses ATR (Average True Range) multiplier to determine stop-loss positions and generates long and short signals.

Confirmation Indicator Filtering: The strategy allows traders to selectively enable multiple confirmation indicators:

- EMA Filter: Price needs to be above (long) or below (short) the specified EMA line

- SuperTrend: Needs to align with the leading signal direction

- Schaff Trend Cycle (STC): Needs to be above the upper boundary (long) or below the lower boundary (short)

Signal Expiry Mechanism: The strategy implements a signal expiry function, which can set the number of candles for which the signal remains valid, preventing trading on old signals.

Trade Execution Logic: When all selected conditions are met, the strategy generates entry signals and automatically sets take-profit and stop-loss at fixed points.

Data Processing Optimization: The strategy uses conditional sampling EMA and SMA functions, as well as dedicated range filters, improving the calculation efficiency of technical indicators.

Visualization System: Provides a trading dashboard displaying the status of various indicators, and marks trading signals and take-profit/stop-loss positions on the chart.

Strategy Advantages

Multiple Confirmation Mechanism: Significantly reduces false signals and improves trading accuracy through multiple indicator confirmations. When multiple indicators jointly confirm a direction, the trading signal becomes more reliable.

Flexible Indicator Combinations: Users can freely choose to enable or disable various confirmation indicators, customizing strategy performance according to different market conditions.

Precise Risk Management: The strategy allows users to set specific take-profit and stop-loss points, facilitating precise control of the risk-reward ratio for each trade.

Signal Expiry Control: By setting signal validity periods, the strategy avoids trading on outdated signals, reducing lag risk.

Highly Visualized Trading Interface: The trading dashboard intuitively displays the status of all indicators, helping traders quickly assess market conditions.

Optimized for Gold Markets: The strategy has been parameter-optimized for the characteristics of the gold market, with special consideration for point value conversion (1 point = $0.1).

High-Frequency Trading Adaptability: The 1-minute timeframe enables the strategy to capture short-term price movements, suitable for intraday traders.

Strategy Risks

Over-Trading Risk: The 1-minute timeframe may generate excessive trading signals, leading to increased trading costs and over-trading. The solution is to adjust the number of confirmation indicators or add signal filtering conditions.

Market Noise Impact: Lower timeframes are more susceptible to market noise interference, producing false signals. It is recommended to use with caution during high volatility periods, or combine with longer timeframe trend confirmations.

Indicator Stacking Lag: While multiple indicator confirmations reduce false signals, they also increase system lag, potentially causing missed profit opportunities. Consider reducing the number of confirmation indicators to improve response speed.

Limitations of Fixed Take-Profit/Stop-Loss: Fixed point take-profit/stop-loss does not account for changing market volatility; during high volatility periods, stop-loss may be too close, while during low volatility periods, take-profit may be too far. It is recommended to dynamically adjust take-profit/stop-loss values based on current ATR.

Gold Market Specific Risks: Gold markets are influenced by various macroeconomic factors, including inflation data, central bank policies, geopolitics, etc., which pure technical analysis may ignore. It is recommended to combine with fundamental analysis.

Leading Indicator Dependency: The strategy overly relies on Chandelier Exit as the leading indicator, which may not perform well in ranging markets. It is recommended to add options for selecting multiple leading indicators.

Strategy Optimization Directions

Diversification of Leading Indicators: Currently the strategy only supports Chandelier Exit as the leading indicator. It could be expanded to support multiple leading indicator options, such as Bollinger Bands, MACD, or Adaptive Moving Averages, to adapt to different market environments.

Dynamic Take-Profit/Stop-Loss: Replace fixed point take-profit/stop-loss with ATR-based dynamic take-profit/stop-loss for better adaptation to market volatility changes. For example,

sl_value = atr(14) * 1.5could be used instead of fixed points.Time Filter Integration: Add trading time filters to avoid low liquidity sessions or important news release periods, reducing the risk of slippage and unexpected price movements.

Volume Analysis Integration: Integrating volume indicators can verify the strength of price movements and improve signal quality. For example, only confirm breakout signals when volume increases.

Machine Learning Optimization: Introduce machine learning algorithms to dynamically adjust indicator weights based on recent market performance, making strategy parameters self-adaptive.

Partial Entry/Exit Mechanism: Implement partial entry/exit mechanisms to reduce timing risk of single entry/exit points, such as building positions in three phases and exiting in three phases.

Multi-Timeframe Confirmation: Add higher timeframe trend confirmation, only entering positions in the direction of higher timeframe trends, reducing counter-trend trading risk.

Indicator Correlation Analysis: Analyze correlations between selected indicators to avoid using highly correlated indicators as confirmation, which might lead to illusory multiple confirmations.

Conclusion

The Multi-Technical Indicator Gold Real-Time Movement Detection and Risk Management Strategy is a composite trading system for short-term traders that provides more reliable trading signals by integrating multiple technical indicators. The core advantages of the strategy lie in its flexible indicator confirmation mechanism and intuitive visualization interface, allowing traders to adjust strategy parameters according to market conditions. However, users need to be aware of the inherent risks of low timeframe trading, including over-trading and market noise impact.

By implementing the suggested optimization measures, particularly dynamic take-profit/stop-loss, multi-timeframe confirmation, and leading indicator diversification, the strategy can further improve its adaptability and robustness. For intraday traders and short-term gold trading enthusiasts, this strategy provides a technical analysis framework but should be used in conjunction with money management principles and market fundamental understanding to achieve optimal results.

Ultimately, trading success depends not only on the strategy itself but also on the trader’s understanding and correct execution of the strategy. Continuous strategy backtesting, optimization, and adaptation are key to achieving long-term stable trading results.

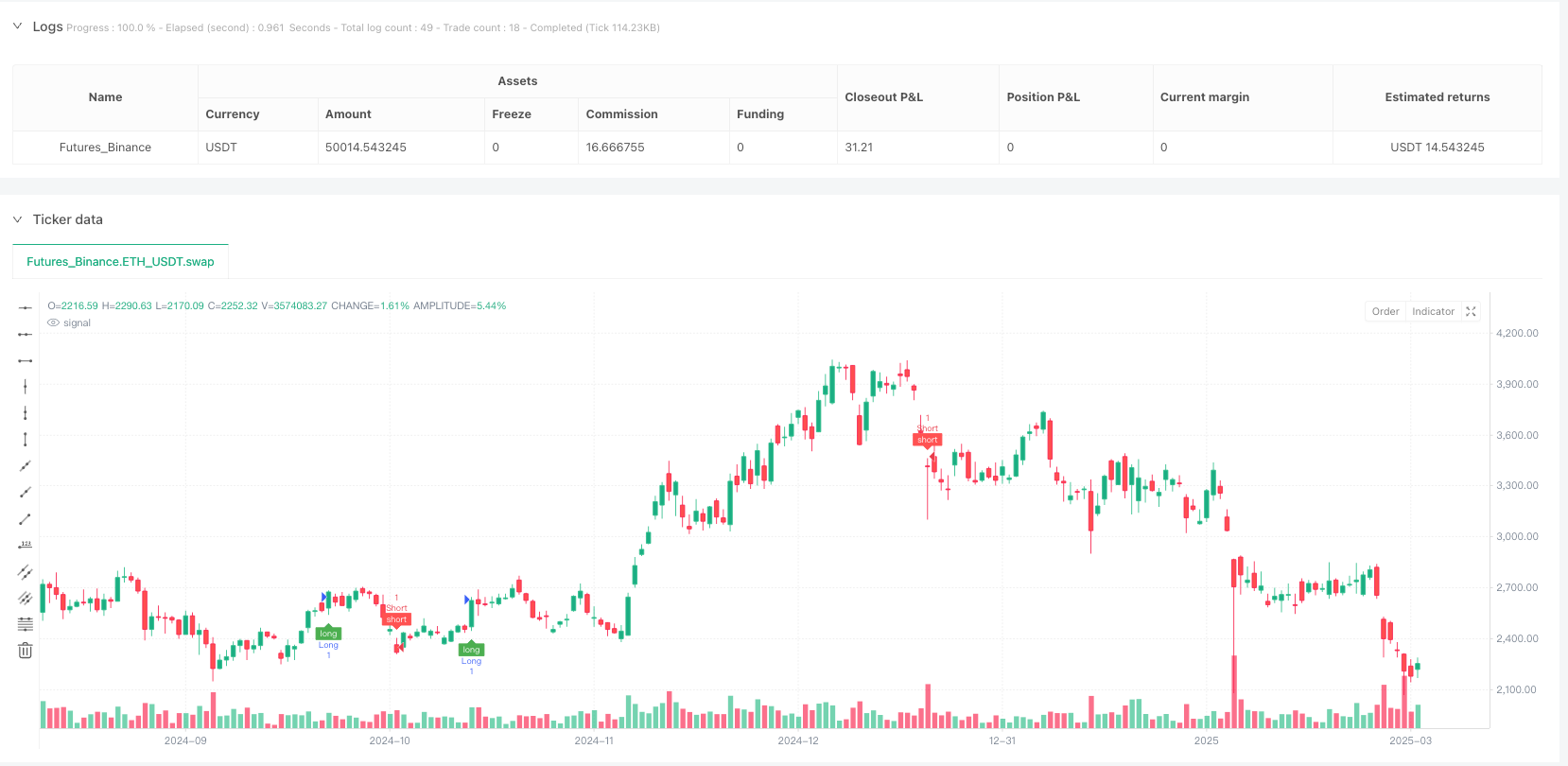

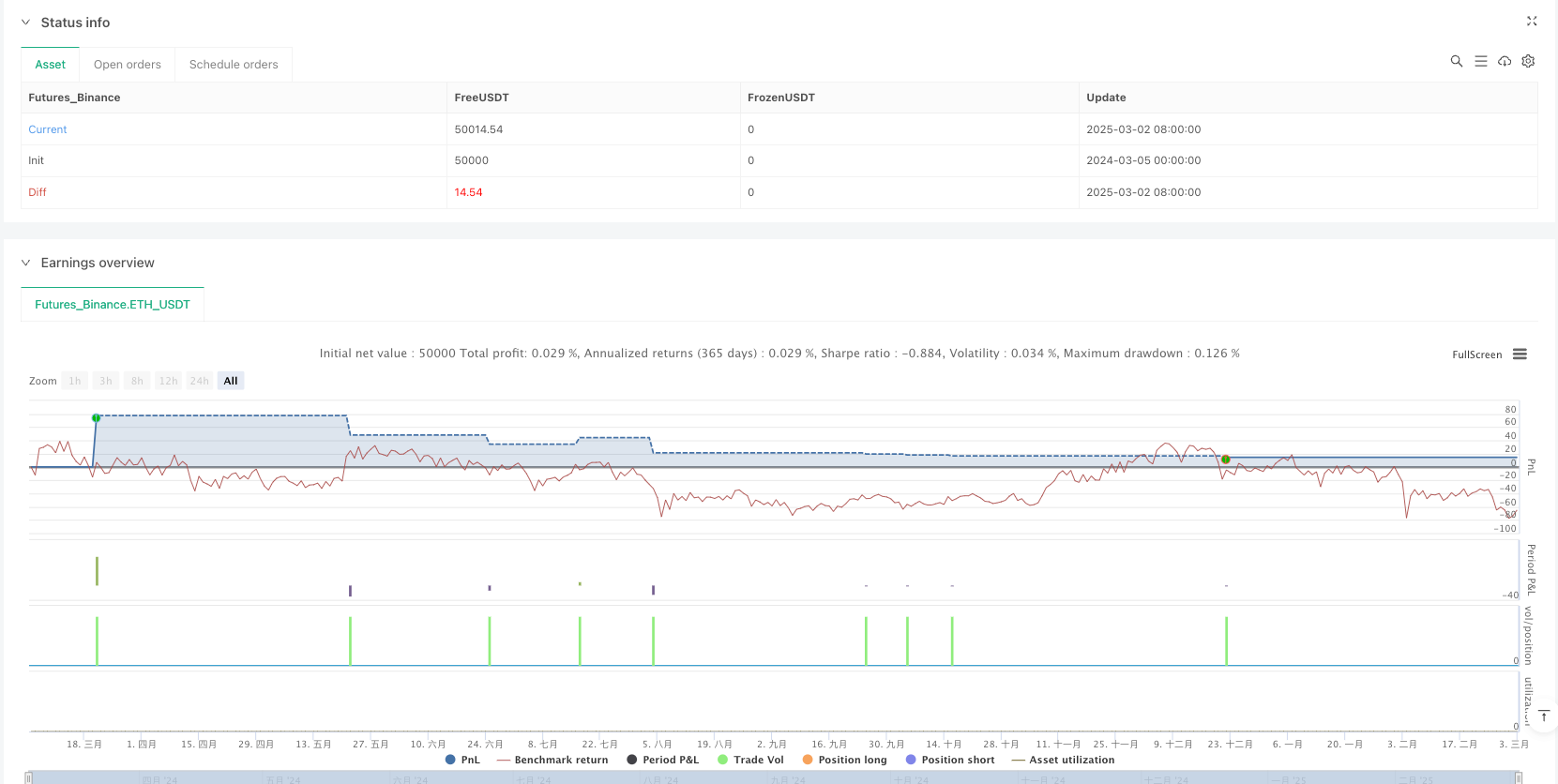

/*backtest

start: 2024-03-05 00:00:00

end: 2025-03-03 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT"}]

*/

//@version=5

strategy("1 Min Gold Heikin Ashi Strategy", overlay=true, max_bars_back=500)

// Adjustable TP & SL in Pips

tp_pips = input.int(50, title="Take Profit (Pips)")

sl_pips = input.int(30, title="Stop Loss (Pips)")

// Convert pips to price value for XAUUSD (1 pip = 0.1 in Gold)

tp_value = tp_pips * 0.1

sl_value = sl_pips * 0.1

// Fixed components

justcontinue = bool(true)

ma(_source, _length, _type) =>

switch _type

"SMA" => ta.sma (_source, _length)

"EMA" => ta.ema (_source, _length)

"RMA" => ta.rma (_source, _length)

"WMA" => ta.wma (_source, _length)

"VWMA" => ta.vwma(_source, _length)

alarm(_osc, _message) =>

alert(syminfo.ticker + ' ' + _osc + ' : ' + _message + ', price (' + str.tostring(close, format.mintick) + ')')

// Conditional Sampling EMA Function

Cond_EMA(x, cond, n) =>

var val = array.new_float(0)

var ema_val = array.new_float(1)

if cond

array.push(val, x)

if array.size(val) > 1

array.remove(val, 0)

if na(array.get(ema_val, 0))

array.fill(ema_val, array.get(val, 0))

array.set(ema_val, 0, (array.get(val, 0) - array.get(ema_val, 0)) * (2 / (n + 1)) + array.get(ema_val, 0))

EMA = array.get(ema_val, 0)

EMA

// Conditional Sampling SMA Function

Cond_SMA(x, cond, n) =>

var vals = array.new_float(0)

if cond

array.push(vals, x)

if array.size(vals) > n

array.remove(vals, 0)

SMA = array.avg(vals)

SMA

// Standard Deviation Function

Stdev(x, n) =>

math.sqrt(Cond_SMA(math.pow(x, 2), 1, n) - math.pow(Cond_SMA(x, 1, n), 2))

// Range Size Function

rng_size(x, scale, qty, n) =>

ATR = Cond_EMA(ta.tr(true), 1, n)

AC = Cond_EMA(math.abs(x - x[1]), 1, n)

SD = Stdev(x, n)

rng_size = scale == 'Pips' ? qty * 0.0001 : scale == 'Points' ? qty * syminfo.pointvalue : scale == '% of Price' ? close * qty / 100 : scale == 'ATR' ? qty * ATR : scale == 'Average Change' ? qty * AC : scale == 'Standard Deviation' ? qty * SD : scale == 'Ticks' ? qty * syminfo.mintick : qty

rng_size

// Two Type Range Filter Function

rng_filt(h, l, rng_, n, type, smooth, sn, av_rf, av_n) =>

rng_smooth = Cond_EMA(rng_, 1, sn)

r = smooth ? rng_smooth : rng_

var rfilt = array.new_float(2, (h + l) / 2)

array.set(rfilt, 1, array.get(rfilt, 0))

if type == 'Type 1'

if h - r > array.get(rfilt, 1)

array.set(rfilt, 0, h - r)

if l + r < array.get(rfilt, 1)

array.set(rfilt, 0, l + r)

if type == 'Type 2'

if h >= array.get(rfilt, 1) + r

array.set(rfilt, 0, array.get(rfilt, 1) + math.floor(math.abs(h - array.get(rfilt, 1)) / r) * r)

if l <= array.get(rfilt, 1) - r

array.set(rfilt, 0, array.get(rfilt, 1) - math.floor(math.abs(l - array.get(rfilt, 1)) / r) * r)

rng_filt1 = array.get(rfilt, 0)

hi_band1 = rng_filt1 + r

lo_band1 = rng_filt1 - r

rng_filt2 = Cond_EMA(rng_filt1, rng_filt1 != rng_filt1[1], av_n)

hi_band2 = Cond_EMA(hi_band1, rng_filt1 != rng_filt1[1], av_n)

lo_band2 = Cond_EMA(lo_band1, rng_filt1 != rng_filt1[1], av_n)

rng_filt = av_rf ? rng_filt2 : rng_filt1

hi_band = av_rf ? hi_band2 : hi_band1

lo_band = av_rf ? lo_band2 : lo_band1

[hi_band, lo_band, rng_filt]

// Moving Average Function

ma_function(source, length, type) =>

if type == 'RMA'

ta.rma(source, length)

else if type == 'SMA'

ta.sma(source, length)

else if type == 'EMA'

ta.ema(source, length)

else if type == 'WMA'

ta.wma(source, length)

else if type == 'HMA'

if (length < 2)

ta.hma(source, 2)

else

ta.hma(source, length)

else

ta.vwma(source, length)

// Get Table Size

table_size(s) =>

switch s

"Auto" => size.auto

"Huge" => size.huge

"Large" => size.large

"Normal" => size.normal

"Small" => size.small

=> size.tiny

// Confirmation Setup

confirmation_counter = array.new_string(0)

confirmation_val = array.new_string(0)

confirmation_val_short = array.new_string(0)

pushConfirmation(respect, label, longCondition, shortCondition) =>

if respect

array.push(confirmation_counter, label)

array.push(confirmation_val, longCondition ? "✔️" : "❌")

array.push(confirmation_val_short, shortCondition ? "✔️" : "❌")

leadinglongcond = bool(na)

leadingshortcond = bool(na)

longCond = bool(na)

shortCond = bool(na)

longCondition = bool(na)

shortCondition = bool(na)

// Indicator Setup Inputs

setup_group = "████████ Indicator Setup ████████"

signalexpiry = input.int(defval=3, title='Signal Expiry Candle Count', group=setup_group, inline='expiry', tooltip="Number of candles to wait for all indicators to confirm a signal. Default is 3.")

alternatesignal = input.bool(true, "Alternate Signal", group=setup_group, inline='alternate')

showsignal = input.bool(true, "Show Long/Short Signal", group=setup_group, inline='showsignal', tooltip="Option to turn on/off the Long/Short signal shown on the chart.")

showdashboard = input.bool(true, "Show Dashboard", group=setup_group, inline='dashboard')

string i_tab1Ypos = input.string('bottom', 'Dashboard Position', group=setup_group, inline='dashboard2', options=['top', 'middle', 'bottom'])

string i_tab1Xpos = input.string('right', '', inline='dashboard2', group=setup_group, options=['left', 'center', 'right'])

in_dashboardtab_size = input.string(title="Dashboard Size", defval="Normal", options=["Auto", "Huge", "Large", "Normal", "Small", "Tiny"], group=setup_group, inline="dashboard3")

// Confirmation Indicator Settings

confirmation_group = "████████ Confirmation Indicators (filter) ████████"

respectce = input.bool(false, "Chandelier Exit", group=confirmation_group, inline='ce')

respectema = input.bool(false, "EMA Filter", group=confirmation_group, inline='respectema')

respectemaperiod = input.int(defval=200, minval=1, title='', group=confirmation_group, inline='respectema', tooltip="EMA filter for confirmation.")

respectst = input.bool(false, "SuperTrend", group=confirmation_group, inline='st')

respectstc = input.bool(false, "Schaff Trend Cycle (STC)", group=confirmation_group, inline='stc')

// Switchboard Indicators

switchboard_group = "████ Switch Board (Turn On/Off Overlay Indicators) ████"

switch_ema = input.bool(false, "EMA", group=switchboard_group, inline='Switch1')

switch_supertrend = input.bool(false, "Supertrend", group=switchboard_group, inline='Switch2')

switch_stc = input.bool(false, "STC", group=switchboard_group, inline='Switch3')

// ----------------------------------------

// 4. Indicator Code

// Chandelier Exit

////////////////////////////////////////////////

////// Chandelier Exit

///////////////////////////////////////////////

ChandelierE = "██████████ Chandelier Exit ██████████"

ce_length = input.int(title='ATR Period', defval=22, group=ChandelierE)

ce_mult = input.float(title='ATR Multiplier', step=0.1, defval=3.0, group=ChandelierE)

showLabels = input.bool(title='Show Buy/Sell Labels?', defval=true, group=ChandelierE)

useClose = input.bool(title='Use Close Price for Extremums?', defval=true, group=ChandelierE)

highlightState = input.bool(title='Highlight State?', defval=true, group=ChandelierE)

ce_atr = ce_mult * ta.atr(ce_length)

longStop = (useClose ? ta.highest(close, ce_length) : ta.highest(ce_length)) - ce_atr

longStopPrev = nz(longStop[1], longStop)

longStop := close[1] > longStopPrev ? math.max(longStop, longStopPrev) : longStop

shortStop = (useClose ? ta.lowest(close, ce_length) : ta.lowest(ce_length)) + ce_atr

shortStopPrev = nz(shortStop[1], shortStop)

shortStop := close[1] < shortStopPrev ? math.min(shortStop, shortStopPrev) : shortStop

var int dir = 1

dir := close > shortStopPrev ? 1 : close < longStopPrev ? -1 : dir

ce_long = dir == 1

ce_short = dir == -1

// EMA Filter

////////////////////////////////////////////////////////////////////////////

//////////// EMA Filter

////////////////////////////////////////////////////////////////////////////

respectemavalue = ta.ema(close, respectemaperiod)

isaboverespectema = close > respectemavalue

isbelowrespectema = close < respectemavalue

// SuperTrend Calculation

////////////////////////////////

///// SuperTrend

//////////////////////////////

sp_group = "██████████ SuperTrend ██████████"

Periods = input.int(title='ATR Period', defval=10, group=sp_group)

stsrc = input.source(hl2, title='Source', group=sp_group)

Multiplier = input.float(title='ATR Multiplier', step=0.1, defval=3.0, group=sp_group)

changeATR = input.bool(title='Change ATR Calculation Method?', defval=true, group=sp_group)

statr2 = ta.sma(ta.tr, Periods)

statr = changeATR ? ta.atr(Periods) : statr2

stup = stsrc - Multiplier * statr

up1 = nz(stup[1], stup)

stup := close[1] > up1 ? math.max(stup, up1) : stup

dn = stsrc + Multiplier * statr

dn1 = nz(dn[1], dn)

dn := close[1] < dn1 ? math.min(dn, dn1) : dn

sttrend = 1

sttrend := nz(sttrend[1], sttrend)

sttrend := sttrend == -1 and close > dn1 ? 1 : sttrend == 1 and close < up1 ? -1 : sttrend

stbuySignal = sttrend == 1 and sttrend[1] == -1

stsellSignal = sttrend == -1 and sttrend[1] == 1

isstup = bool(na)

isstdown = bool(na)

isstup := sttrend == 1

isstdown := sttrend != 1

// Schaff Trend Cycle (STC)

/////////////////////////

/// STC overlay signal

/////////////////////////

stc_group = "██████████ Schaff Trend Cycle (STC) ██████████"

fastLength = input.int(title='MACD Fast Length', defval=23, group=stc_group)

slowLength = input.int(title='MACD Slow Length', defval=50, group=stc_group)

cycleLength = input.int(title='Cycle Length', defval=10, group=stc_group)

d1Length = input.int(title='1st %D Length', defval=3, group=stc_group)

d2Length = input.int(title='2nd %D Length', defval=3, group=stc_group)

srcstc = input.source(title='Source', defval=close, group=stc_group)

upper = input.int(title='Upper Band', defval=75, group=stc_group)

lower = input.int(title='Lower Band', defval=25, group=stc_group)

v_show_last = input.int(2000, "Plotting Length", group=stc_group)

macd = ta.ema(srcstc, fastLength) - ta.ema(srcstc, slowLength)

k = nz(fixnan(ta.stoch(macd, macd, macd, cycleLength)))

d = ta.ema(k, d1Length)

kd = nz(fixnan(ta.stoch(d, d, d, cycleLength)))

stc = ta.ema(kd, d2Length)

stc := math.max(math.min(stc, 100), 0)

stcColor1 = stc > stc[1] ? color.green : color.red

stcColor2 = stc > upper ? color.green : stc <= lower ? color.red : color.orange

upperCrossover = ta.crossover(stc, upper)

upperCrossunder = ta.crossunder(stc, upper)

lowerCrossover = ta.crossover(stc, lower)

lowerCrossunder = ta.crossunder(stc, lower)

stcup = stc >= upper

stcdown = stc <= lower

// ----------------------------------------

// 5. Switchboard Code

// Additional code for EMA from Switchboard

/////////////////////////////////////////////////////////////////////////

// EMA Selection

/////////////////////////////////////////////////////////////////////////

ma_group= "██████████ MAs Line ██████████"

len1bool = input.bool(true, '', group=ma_group, inline='len1')

len1 = input.int(5, title='MA 1', group=ma_group, inline='len1')

string ma_1_type = input.string(defval='EMA', title='Type', options=['RMA', 'SMA', 'EMA', 'WMA', 'HMA', 'VWMA'], inline='len1', group=ma_group)

color ma_1_colour = input.color(color.rgb(254, 234, 74, 0), '', inline='len1', group=ma_group)

len2bool = input.bool(true, '', group=ma_group, inline='len2')

len2 = input.int(13, minval=1, title='MA 2', group=ma_group, inline='len2')

string ma_2_type = input.string(defval='EMA', title='Type', options=['RMA', 'SMA', 'EMA', 'WMA', 'HMA', 'VWMA'], inline='len2', group=ma_group)

color ma_2_colour = input.color(color.rgb(253, 84, 87, 0), '', inline='len2', group=ma_group)

len3bool = input.bool(false, '', group=ma_group, inline='len3')

len3 = input.int(20, minval=1, title='MA 3', group=ma_group, inline='len3')

string ma_3_type = input.string(defval='EMA', title='Type', options=['RMA', 'SMA', 'EMA', 'WMA', 'HMA', 'VWMA'], inline='len3', group=ma_group)

color ma_3_colour = input.color(color.new(color.aqua, 0), '', inline='len3', group=ma_group)

len4bool = input.bool(true, '', group=ma_group, inline='len4')

len4 = input.int(50, minval=1, title='MA 4', group=ma_group, inline='len4')

string ma_4_type = input.string(defval='EMA', title='Type', options=['RMA', 'SMA', 'EMA', 'WMA', 'HMA', 'VWMA'], inline='len4', group=ma_group)

color ma_4_colour = input.color(color.new(color.blue, 0), '', inline='len4', group=ma_group)

len5bool = input.bool(true, '', group=ma_group, inline='len5')

len5 = input.int(200, minval=1, title='MA 5', group=ma_group, inline='len5')

string ma_5_type = input.string(defval='EMA', title='Type', options=['RMA', 'SMA', 'EMA', 'WMA', 'HMA', 'VWMA'], inline='len5', group=ma_group)

color ma_5_colour = input.color(color.new(color.white, 0), '', inline='len5', group=ma_group)

// Request Security for MA calculations

ema1 = request.security(syminfo.tickerid, timeframe.period, ma_function(close, len1, ma_1_type))

ema2 = request.security(syminfo.tickerid, timeframe.period, ma_function(close, len2, ma_2_type))

ema3 = request.security(syminfo.tickerid, timeframe.period, ma_function(close, len3, ma_3_type))

ema4 = request.security(syminfo.tickerid, timeframe.period, ma_function(close, len4, ma_4_type))

ema5 = request.security(syminfo.tickerid, timeframe.period, ma_function(close, len5, ma_5_type))

// Plot the Moving Averages

plot(len1bool and switch_ema ? ema1 : na, color=ma_1_colour, linewidth=2, title='MA 1')

plot(len2bool and switch_ema ? ema2 : na, color=ma_2_colour, linewidth=2, title='MA 2')

plot(len3bool and switch_ema ? ema3 : na, color=ma_3_colour, linewidth=2, title='MA 3')

plot(len4bool and switch_ema ? ema4 : na, color=ma_4_colour, linewidth=2, title='MA 4')

plot(len5bool and switch_ema ? ema5 : na, color=ma_5_colour, linewidth=2, title='MA 5')

// Additional code for SuperTrend from switchboard

///////////////////////////////////////////////////

// SuperTrend - Switchboard

///////////////////////////////////////////////////

upPlot = plot(sttrend == 1 and switch_supertrend ? stup : na, title='Up Trend', style=plot.style_linebr, linewidth=2, color=color.new(color.green, 0))

plotshape(stbuySignal and switch_supertrend ? stup : na, title='UpTrend Begins', location=location.absolute, style=shape.circle, size=size.tiny, color=color.new(color.green, 0))

dnPlot = plot(sttrend != 1 and switch_supertrend ? dn : na, title='Down Trend', style=plot.style_linebr, linewidth=2, color=color.new(color.red, 0))

plotshape(stsellSignal and switch_supertrend ? dn : na, title='DownTrend Begins', location=location.absolute, style=shape.circle, size=size.tiny, color=color.new(color.red, 0))

// Additional code for Schaff Trend Cycle (STC) from switchboard

/////////////////////////////////////////////

// Schaff Trend Cycle (STC) - Switchboard

/////////////////////////////////////////////

plotshape(stcdown and switch_stc ? true : na, style=shape.circle, location=location.top, show_last=v_show_last, color=color.new(color.red, 0), title='STC Sell')

plotshape(stcup and switch_stc ? true : na, style=shape.circle, location=location.top, show_last=v_show_last, color=color.new(color.green, 0), title='STC Buy')

// ----------------------------------------

// 6. Declare and Initialize 'leadingindicator'

leadingindicator = input.string(title="Leading Indicator", defval="Chandelier Exit",

options=["Chandelier Exit"], group="████████ Main Indicator (signal) ████████")

// 6. Leading Indicator Logic

if leadingindicator == 'Chandelier Exit'

leadinglongcond := ce_long

leadingshortcond := ce_short

// ----------------------------------------

// 7. Confirmation Indicator Logic

longCond := leadinglongcond

shortCond := leadingshortcond

longCond := longCond and (respectce ? ce_long : justcontinue)

shortCond := shortCond and (respectce ? ce_short : justcontinue)

longCond := longCond and (respectema ? isaboverespectema : justcontinue)

shortCond := shortCond and (respectema ? isbelowrespectema : justcontinue)

longCond := longCond and (respectst ? isstup : justcontinue)

shortCond := shortCond and (respectst ? isstdown : justcontinue)

longCond := longCond and (respectstc ? stcup : justcontinue)

// ----------------------------------------

// 7. Confirmation Indicator Logic

longCond := leadinglongcond

shortCond := leadingshortcond

longCond := longCond and (respectce ? ce_long : justcontinue)

shortCond := shortCond and (respectce ? ce_short : justcontinue)

longCond := longCond and (respectema ? isaboverespectema : justcontinue)

shortCond := shortCond and (respectema ? isbelowrespectema : justcontinue)

longCond := longCond and (respectst ? isstup : justcontinue)

shortCond := shortCond and (respectst ? isstdown : justcontinue)

longCond := longCond and (respectstc ? stcup : justcontinue)

shortCond := shortCond and (respectstc ? stcdown : justcontinue)

// ----------------------------------------

// 8. Function to Update Dashboard Label

pushConfirmation(respectce, "Chandelier Exit", ce_long, ce_short)

pushConfirmation(respectema, "EMA", isaboverespectema, isbelowrespectema)

pushConfirmation(respectst, "SuperTrend", isstup, isstdown)

pushConfirmation(respectstc, "Schaff Trend Cycle", stcup, stcdown)

// ----------------------------------------

// 9. Final Part (Dashboard Table and Signal Plotting)

leadingstatus = leadinglongcond ? "✔️" : "❌"

leadingstatus_short = leadingshortcond ? "✔️" : "❌"

rowcount = int(na)

if array.size(confirmation_counter) == 0

rowcount := 5

else

rowcount := array.size(confirmation_counter) + 4

// Signal Expiry Logic

var int leadinglong_count = 0

var int leadinglong_count2 = 0

var int leadingshort_count = 0

var int leadingshort_count2 = 0

if leadinglongcond

leadinglong_count := leadinglong_count + 1

leadinglong_count2 := leadinglong_count

for i = 1 to 100

if leadinglongcond[i]

leadinglong_count := leadinglong_count + 1

leadinglong_count2 := leadinglong_count

else

leadinglong_count := 0

break

if leadingshortcond

leadingshort_count := leadingshort_count + 1

leadingshort_count2 := leadingshort_count

for i = 1 to 100

if leadingshortcond[i]

leadingshort_count := leadingshort_count + 1

leadingshort_count2 := leadingshort_count

else

leadingshort_count := 0

break

// Expiry Condition

CondIni = 0

// If expiry option is used

longcond_withexpiry = longCond and leadinglong_count2 <= signalexpiry

shortcond_withexpiry = shortCond and leadingshort_count2 <= signalexpiry

// Without expiry

longCondition := longcond_withexpiry and CondIni[1] == -1

shortCondition := shortcond_withexpiry and CondIni[1] == 1

if alternatesignal

longCondition := longcond_withexpiry and CondIni[1] == -1

shortCondition := shortcond_withexpiry and CondIni[1] == 1

else

longCondition := longcond_withexpiry

shortCondition := shortcond_withexpiry

CondIni := longcond_withexpiry ? 1 : shortcond_withexpiry ? -1 : CondIni[1]

// Check if expiry count is crossed

is_expiry_count_crossed_long = leadinglong_count2 >= signalexpiry

is_expiry_count_crossed_short = leadingshort_count2 >= signalexpiry

// Plot signals on chart

plotshape(showsignal ? (longCondition[1] ? false : longCondition) : na, title='Buy Signal', text='long', textcolor=color.new(color.white, 0), style=shape.labelup, size=size.tiny, location=location.belowbar, color=color.new(color.green, 0))

plotshape(showsignal ? (shortCondition[1] ? false : shortCondition) : na, title='Sell Signal', text='short', textcolor=color.new(color.white, 0), style=shape.labeldown, size=size.tiny, location=location.abovebar, color=color.new(color.red, 0))

// Alerts

alertcondition(longCondition, title='Buy Alert', message='BUY')

alertcondition(shortCondition, title='Sell Alert', message='SELL')

alertcondition(longCondition or shortCondition, title='Buy or Sell Alert', message="Buy or Sell Alert")

/// ----------------------------------------

// 10. Strategy Execution - Entries & Exits

// Use already declared TP & SL values (from the start of the script)

// Long Entry Conditions

if longCondition

strategy.entry("Long", strategy.long)

strategy.exit("TakeProfit_Long", from_entry="Long", limit=close + tp_value, stop=close - sl_value)

// Short Entry Conditions

if shortCondition

strategy.entry("Short", strategy.short)

strategy.exit("TakeProfit_Short", from_entry="Short", limit=close - tp_value, stop=close + sl_value)