Strategy Overview

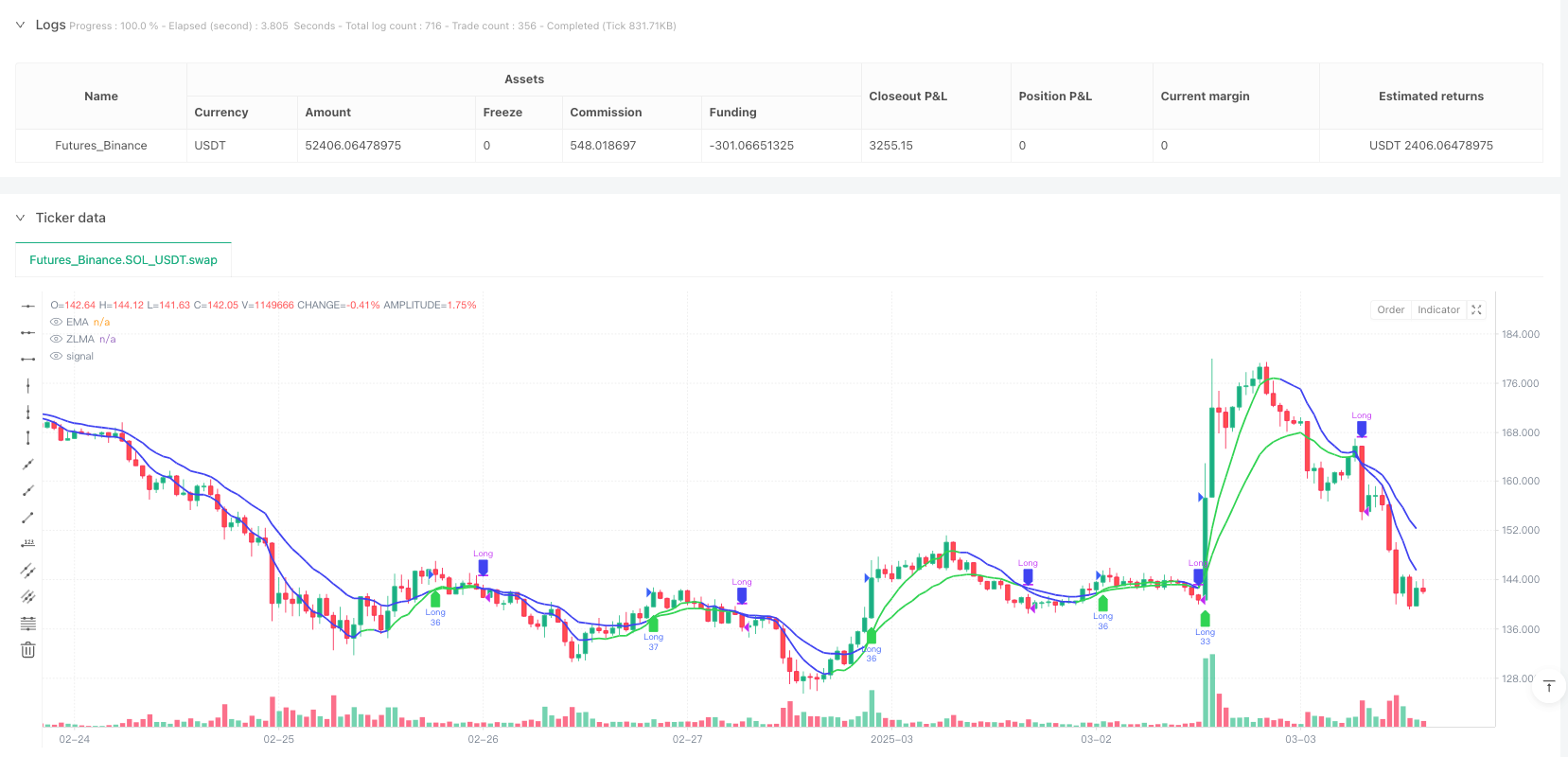

The Zero-Lag Moving Average Trend Crossover Strategy is a trend-following trading system based on improved moving averages. The core of this strategy is to identify market trend reversal points by utilizing the crossover relationship between the Zero-Lag Moving Average (ZLMA) and the traditional Exponential Moving Average (EMA), thereby capturing uptrends and avoiding downtrends. By eliminating the inherent lag of traditional moving averages, this strategy can respond more quickly to price changes, improving the accuracy of entry and exit timing.

Strategy Principles

The technical principle of this strategy is based on an innovative solution to the delay problem of traditional moving averages. The core calculation process is as follows:

- First, calculate the standard Exponential Moving Average (EMA) using a user-defined period parameter (default is 15)

- Calculate the correction factor: add the difference between the current closing price and the EMA to the closing price to form a corrected price data

- Calculate the Zero-Lag Moving Average (ZLMA): apply the EMA algorithm again to the corrected price data

The introduction of the correction factor is the key innovation of this strategy. It compensates for the delay characteristics of EMA, making the final ZLMA follow price movements more closely and reducing the lag reaction of traditional moving averages at trend turning points.

The trading signal generation logic is as follows: - Long entry signal: when ZLMA crosses above EMA (detected by the ta.crossover function) - Long exit signal: when ZLMA crosses below EMA (detected by the ta.crossunder function) - Additional exit mechanism: automatically close positions before market close (15:45) to avoid overnight risk

Strategy Advantages

Through in-depth analysis of the strategy code, the following significant advantages can be summarized:

- Reduced Latency - The zero-lag moving average technique effectively reduces the lag issue of traditional moving averages, allowing the strategy to identify trend changes earlier and enter or exit positions in advance

- Trend Confirmation Mechanism - Using the crossover relationship between two moving averages can filter out some price noise and reduce the probability of false signals

- Adaptive Visual Feedback - The visualization part of the strategy uses color changes to indicate trend direction, enhancing the intuitiveness of trend identification

- Integrated Risk Management - Built-in automatic position closing mechanism before market close effectively manages overnight risk

- Simple and Easy-to-Adjust Parameters - Only one period parameter (length) needs to be adjusted, lowering the operational threshold and facilitating use and optimization by beginners

- Flexible Capital Management - By default, it adopts the account equity percentage (10%) position management method, adapting to trading needs of different capital scales

Strategy Risks

Despite its many advantages, the strategy still has the following risks worth noting:

- Trend Oscillation Risk - In sideways markets, ZLMA and EMA may frequently cross, generating too many trading signals, increasing transaction costs and false breakout risks. Solution: Consider adding signal confirmation mechanisms, such as combining volume or volatility indicators to filter signals

- Parameter Sensitivity - The choice of moving average period (length) has a significant impact on strategy performance, and different markets and timeframes may require different parameters. Solution: Test parameter optimization for different markets and timeframes

- Single Technical Indicator Limitation - Relying solely on moving average crossovers may ignore changes in market structure and fundamentals. Solution: Consider integrating other complementary indicators or filtering conditions

- Fixed Closing Time Limitation - The hard-coded closing time (15:45) in the code may not be applicable to all markets. Solution: Modify to a configurable parameter or use the market time function of the trading platform

Strategy Optimization Directions

Based on an in-depth analysis of the code, the strategy can be optimized in the following directions:

- Add Trend Strength Filter - Introduce trend strength indicators such as ADX (Average Directional Index), execute trading signals only when the trend is clear, which can significantly reduce misleading signals in oscillating markets

- Dynamically Adjust Period Parameters - Introduce adaptive mechanisms to automatically adjust the moving average period according to market volatility, using shorter periods in high-volatility markets and longer periods in low-volatility markets

- Add Stop Loss Mechanism - The current strategy lacks a clear stop loss strategy, and dynamic stop losses based on ATR (Average True Range) can be added to improve risk management

- Optimize Capital Management - Introduce volatility-based position adjustment, increasing positions in low-volatility environments and reducing positions in high-volatility environments

- Add Multi-Timeframe Confirmation - Combine the trend direction of longer time periods as a trading filter condition to avoid trading against the major trend

- Market State Classification - Add market state judgment logic (trending market/oscillating market), using different trading strategy parameters in different market states

The core idea of optimization is to enhance the adaptability and robustness of the strategy, making it maintain relatively stable performance in different market environments.

Summary

The Zero-Lag Moving Average Trend Crossover Strategy provides a concise and effective framework for trend-following trading by innovatively solving the delay problem of traditional moving averages. The strategy captures trend turning points through the crossover relationship between ZLMA and EMA, combines automatic position closing mechanisms to manage risk, and is suitable for traders who seek trend-following advantages while wanting to reduce the lag of traditional moving averages.

Although the strategy is designed to be simple and easy to use, when applied in practice, factors such as market environment adaptability, parameter optimization, and risk management still need to be considered. Through the suggested optimization directions, the robustness and adaptability of the strategy can be further enhanced, allowing it to maintain relatively stable performance under different market conditions.

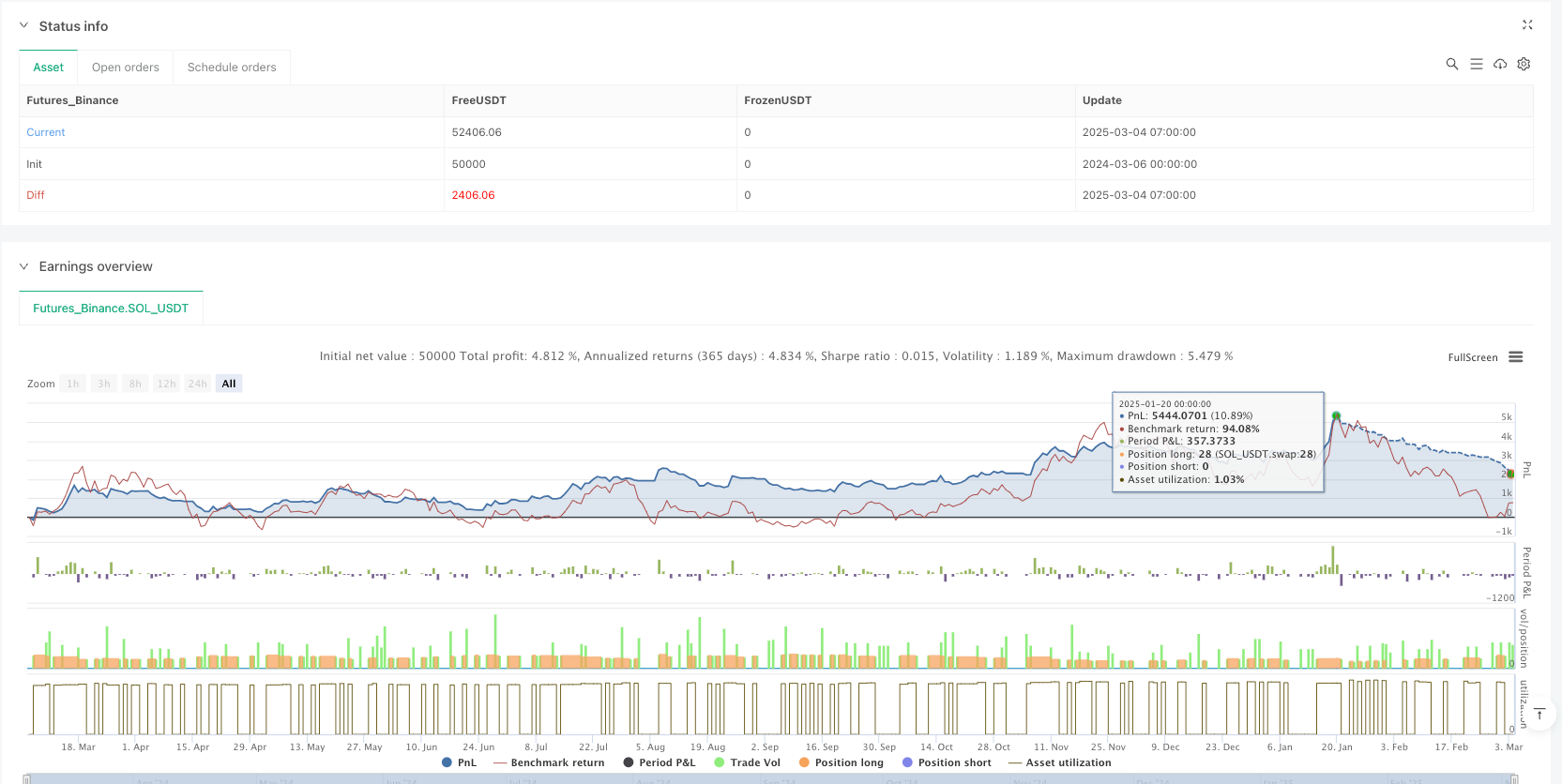

/*backtest

start: 2024-03-06 00:00:00

end: 2025-03-04 08:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"SOL_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © ChartPrime

//@version=5

strategy("Zero-Lag MA Trend Strategy", overlay = true, default_qty_type = strategy.percent_of_equity, default_qty_value = 10)

// --------------------------------------------------------------------------------------------------------------------}

// 𝙐𝙎𝙀𝙍 𝙄𝙉𝙋𝙐𝙏𝙎

// --------------------------------------------------------------------------------------------------------------------{

int length = input.int(15, title="Length") // Length for moving averages

// Colors for visualization

color up = input.color(#30d453, "+", group = "Colors", inline = "i")

color dn = input.color(#4043f1, "-", group = "Colors", inline = "i")

// --------------------------------------------------------------------------------------------------------------------}

// 𝙄𝙉𝘿𝙄𝘾𝘼𝙏𝙊𝙍 𝘾𝘼𝙇𝘾𝙐𝙇𝘼𝙏𝙄𝙊𝙉𝙎

// --------------------------------------------------------------------------------------------------------------------{

emaValue = ta.ema(close, length) // EMA

correction = close + (close - emaValue) // Correction factor

zlma = ta.ema(correction, length) // Zero-Lag Moving Average (ZLMA)

// Entry signals

longSignal = ta.crossover(zlma, emaValue) // Bullish crossover

shortSignal = ta.crossunder(zlma, emaValue) // Bearish crossunder

// Close positions before the market closes

var int marketCloseHour = 15

var int marketCloseMinute = 45

timeToClose = hour == marketCloseHour and minute >= marketCloseMinute

// --------------------------------------------------------------------------------------------------------------------}

// 𝙏𝙍𝘼𝘿𝙀 𝙀𝙓𝙀𝘾𝙐𝙏𝙄𝙊𝙉

// --------------------------------------------------------------------------------------------------------------------{

if longSignal

strategy.entry("Long", strategy.long)

if shortSignal

strategy.close("Long")

if timeToClose

strategy.close_all("EOD Exit")

// --------------------------------------------------------------------------------------------------------------------}

// 𝙑𝙄𝙎𝙐𝘼𝙇𝙄𝙕𝘼𝙏𝙄𝙊𝙉

// --------------------------------------------------------------------------------------------------------------------{

// Plot the Zero-Lag Moving Average and EMA

plot(zlma, color = zlma > zlma[3] ? up : dn, linewidth = 2, title = "ZLMA")

plot(emaValue, color = emaValue < zlma ? up : dn, linewidth = 2, title = "EMA")

// Mark trade entries with shapes

plotshape(series=longSignal, location=location.belowbar, color=up, style=shape.labelup, title="Buy Signal")

plotshape(series=shortSignal, location=location.abovebar, color=dn, style=shape.labeldown, title="Sell Signal")