#### Overview The Fixed Range Volume Profile And Anchored VWAP Trend Identification Strategy With Dynamic Stop-Loss is a comprehensive trading system that cleverly combines Fixed Range Volume Profile (FRVP) and Anchored Volume Weighted Average Price (AVWAP) with multiple momentum indicators including RSI, EMA, and MACD, along with ATR-based dynamic stop-loss management. This strategy aims to capture price trends while improving trade quality through multiple filtering conditions to reduce false signals. The system employs a combination of volume analysis and trend following methods, providing traders with a comprehensive and adaptive trading framework that is particularly suitable for markets with clear trending conditions.

Strategy Principles

The core principle of this strategy is to analyze market structure and momentum through multiple dimensions, combining volume and price behavior to make trading decisions. Specifically:

Anchored Volume Weighted Average Price (AVWAP): Acts as a dynamic support/resistance level by calculating the average price weighted by volume, providing important reference points for price breakouts. When price breaks through the AVWAP, it may indicate that a trend direction has been established.

Fixed Range Volume Profile (FRVP): Analyzes the highest and lowest prices within a specified period to calculate a midpoint price (frvpMid), helping to identify changes in market structure and key price levels.

Exponential Moving Average (EMA): The 200-period EMA serves as a trend filter to prevent counter-trend trades. Long positions are only considered when price is above the EMA, and vice versa.

Relative Strength Index (RSI): Avoids trading in overbought/oversold areas, providing additional confirmation for entries. For long positions, RSI must be above the oversold level; for short positions, RSI must be below the overbought level.

MACD Confirmation: Ensures that momentum direction aligns with trade direction, improving signal quality.

Volume Filter: Trades only when volume is above its 20-period average, avoiding false breakouts in low-liquidity environments.

ATR-Based Stop-Loss and Trailing Stop: Dynamically adjusts stop-loss positions based on market volatility, protecting capital while allowing sufficient price movement.

Entry conditions strictly require confirmation from all indicators, greatly improving the reliability of trading signals. For example, a long position requires price to break above AVWAP, be above the EMA, RSI above oversold level, MACD confirming upward momentum, and sufficient volume. The exit strategy employs stop-loss and trailing stop calculated as ATR multiples, allowing risk management to adapt to different market volatility environments.

Strategy Advantages

This strategy has multiple advantages:

Multi-dimensional Analysis: Combines price, volume, and momentum indicators for a comprehensive analysis, forming a more complete market perspective and reducing false signals that might come from using a single indicator.

Strong Adaptability: ATR-based stop-loss and trailing stop mechanisms automatically adjust according to market volatility, maintaining appropriate risk management in different market environments.

Trend and Volume Combination: AVWAP and FRVP provide volume-based support and resistance levels that are more convincing than pure price analysis, as they reflect actual market participation.

Strict Entry Conditions: Multiple confirmation mechanisms significantly reduce false signals and improve win rates. While this may reduce trading frequency, it ensures quality.

Dynamic Risk Management: ATR-based stop-loss strategy automatically adjusts stop distances based on market volatility, making risk control more precise and reasonable.

Low Volume Trade Filtering: Avoids trading in low liquidity environments, reducing the risk of slippage and false breakouts.

Visual Feedback: The strategy uses label functionality to visually display trading signals on the chart, helping traders better understand and evaluate system performance.

Strategy Risks

Despite its comprehensive design, the strategy still has some potential risks:

Parameter Sensitivity: The combination of multiple indicators and parameters may lead to over-optimization risk. Different markets and timeframes may require different parameter settings, necessitating thorough backtesting and validation.

Ranging Market Performance: In ranging markets without clear trends, the strategy may produce too many false breakout signals, leading to consecutive losses. Consider adding a volatility filter to pause trading in low-volatility environments.

Lag Issues: EMA and other indicators inherently have lag, which may lead to slightly delayed entries, missing part of the profit. Consider using faster indicators or adjusting existing indicator parameters to mitigate this issue.

Gap Risk for Stop-Loss: In fast markets or overnight gaps, ATR-based stops may not fully protect capital. Consider setting maximum loss limits or using options protection strategies.

Over-reliance on Technical Indicators: The strategy is completely based on technical analysis, ignoring factors such as fundamentals and market sentiment. Consider integrating market sentiment indicators or fundamental filters for a more comprehensive market view.

Frequent Trading Costs: Improper parameter settings may lead to frequent trading, increasing costs. Parameters should be optimized through backtesting to find the balance between trading frequency and profitability.

Strategy Optimization Directions

Based on code analysis, this strategy can be optimized in the following directions:

Dynamic Parameter Adaptation: Implement dynamic adjustment of parameters such as RSI and EMA based on market volatility, automatically optimizing parameters to make the strategy more adaptive. For example, use longer RSI periods in high-volatility markets and shorter periods in low-volatility markets.

Add Market Sentiment Indicators: Integrate VIX or other market sentiment indicators to adjust strategy behavior during periods of extreme fear or greed, avoiding trading in extreme market conditions.

Time Filters: Add time filtering functionality to avoid high-volatility periods around market open and close, or focus on specific trading sessions to improve win rates.

Multi-timeframe Analysis: Integrate confirmation signals from higher timeframes to ensure that trade direction aligns with larger trends, reducing the risk of counter-trend trading.

Improved Profit Target Setting: The current code does not explicitly define profit targets, mainly relying on trailing stops to lock in profits. Consider setting intelligent profit targets based on key resistance/support levels, risk-reward ratios, or price range.

Optimize Volume Analysis: Further refine volume analysis, such as using relative volume change rates rather than simple mean comparisons, to more accurately identify volume anomalies.

Add Strategy Pause Mechanism: Automatically pause trading after consecutive losses or under specific market conditions to protect capital from systemic risks, resuming trading when conditions improve.

Optimize Money Management: Currently, the strategy uses a fixed percentage (10%) for position sizing. Consider implementing volatility-based position sizing, increasing positions during low volatility and decreasing during high volatility.

Summary

The Fixed Range Volume Profile And Anchored VWAP Trend Identification Strategy With Dynamic Stop-Loss is a well-designed quantitative trading system that forms a comprehensive and adaptive trading framework by integrating multiple technical analysis tools and indicators. The core advantage of the strategy lies in combining volume-based price analysis (FRVP and AVWAP) with traditional trend and momentum indicators (EMA, RSI, MACD), supplemented by flexible risk management mechanisms, enabling it to maintain stable performance in different market environments.

While there are potential risks such as parameter sensitivity and poor performance in ranging markets, most of these issues can be effectively mitigated through the suggested optimization directions, including dynamic parameter adaptation, multi-timeframe analysis, and improved money management. In particular, the suggestions to add market sentiment indicators and a strategy pause mechanism are likely to further enhance the system’s robustness and long-term profitability.

For quantitative traders seeking a comprehensive trading strategy, this system provides a solid foundation that can be further customized and optimized according to individual risk preferences and instrument characteristics. Through rigorous backtesting and gradual improvement, this strategy has the potential to become an effective long-term trading tool.

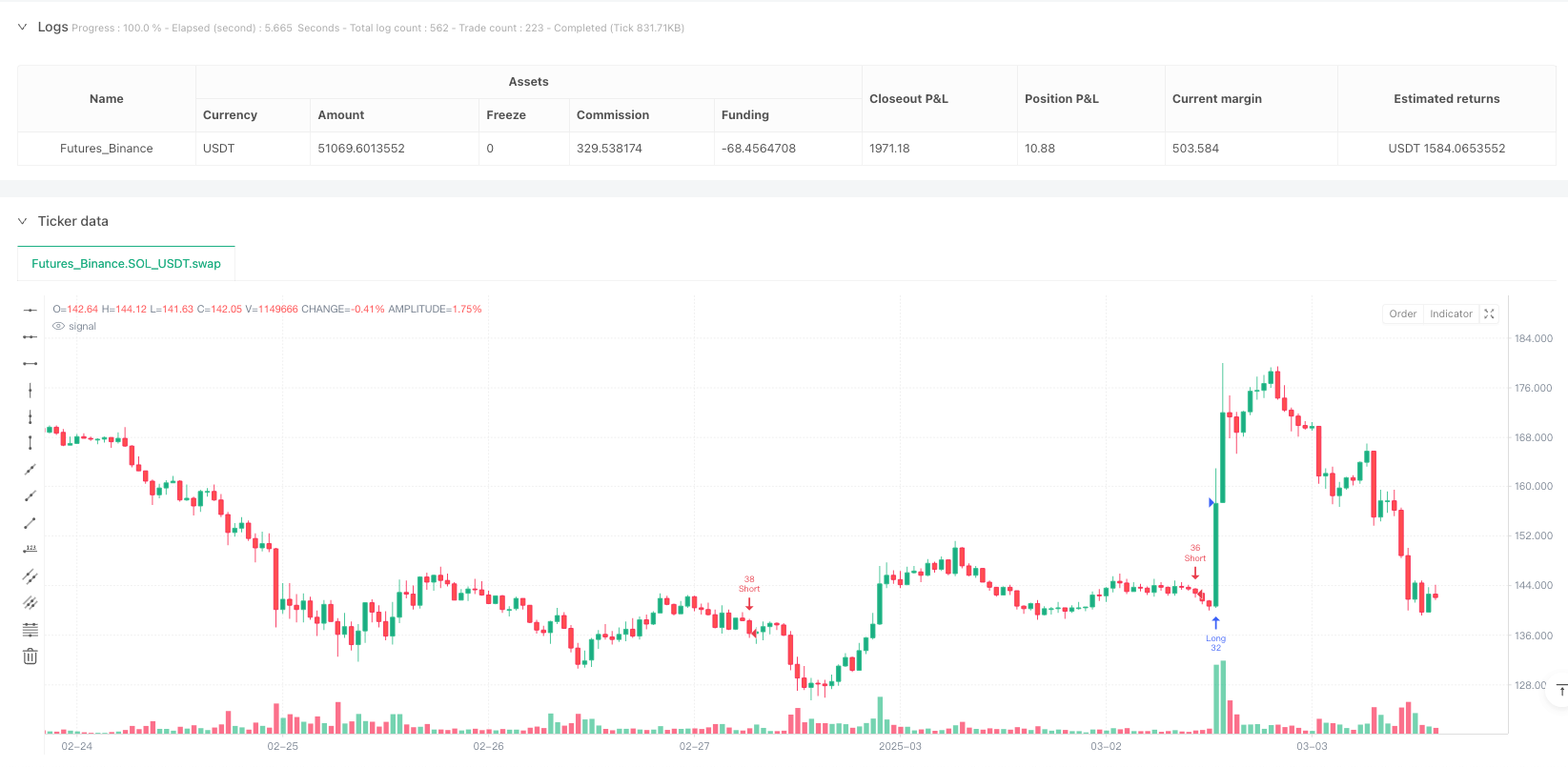

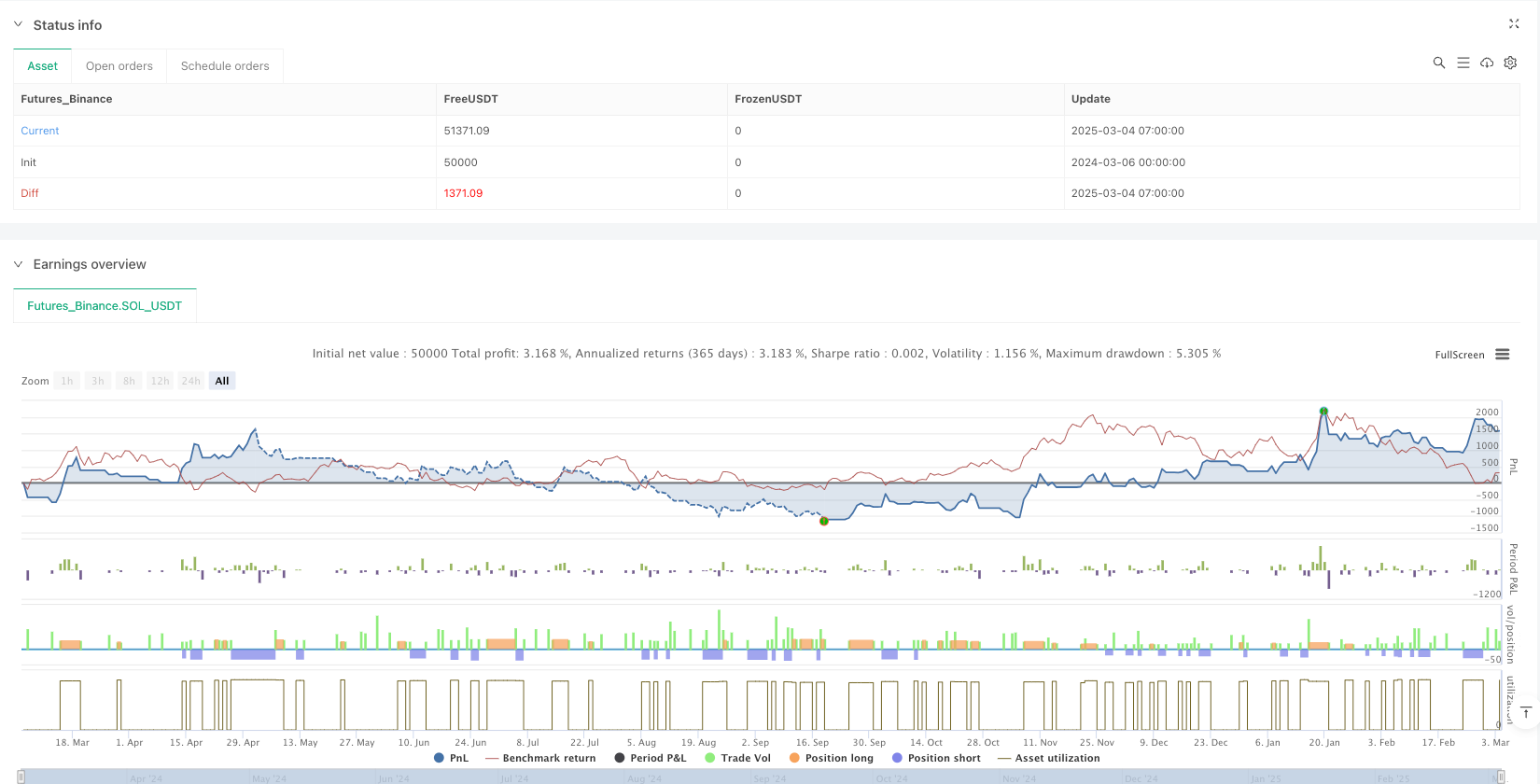

/*backtest

start: 2024-03-06 00:00:00

end: 2025-03-04 08:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"SOL_USDT"}]

*/

//@version=5

strategy("FRVP + AVWAP Improved By NgashCT", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=10)

// Inputs

length = input(50, title="AVWAP Length")

frvpLength = input(100, title="FRVP Length")

rsiLength = input(14, title="RSI Length")

rsiOverbought = input(70, title="RSI Overbought")

rsiOversold = input(30, title="RSI Oversold")

emaLength = input(200, title="EMA Length")

atrMultiplier = input(1.5, title="ATR Multiplier for Stop Loss")

trailStopMultiplier = input(2, title="ATR Multiplier for Trailing Stop")

// Indicators

avwap = ta.vwap(close)

ema = ta.ema(close, emaLength)

rsi = ta.rsi(close, rsiLength)

macdLine = ta.ema(close, 12) - ta.ema(close, 26)

signalLine = ta.ema(macdLine, 9)

atr = ta.atr(14)

// Volume Profile

highestHigh = ta.highest(high, frvpLength)

lowestLow = ta.lowest(low, frvpLength)

frvpMid = (highestHigh + lowestLow) / 2

// Entry Conditions

longCondition = ta.crossover(close, avwap) and close > ema and rsi > rsiOversold and macdLine > signalLine

shortCondition = ta.crossunder(close, avwap) and close < ema and rsi < rsiOverbought and macdLine < signalLine

// Volume Filter (Trade only when volume is above its moving average)

avgVolume = ta.sma(volume, 20)

volumeFilter = volume > avgVolume

longCondition := longCondition and volumeFilter

shortCondition := shortCondition and volumeFilter

// Debugging Prints

labelLong = longCondition ? "Long Signal" : ""

labelShort = shortCondition ? "Short Signal" : ""

label.new(bar_index, high, labelLong, color=color.green, textcolor=color.white)

label.new(bar_index, low, labelShort, color=color.red, textcolor=color.white)

// Strategy Orders

if longCondition

strategy.entry("Long", strategy.long)

strategy.exit("Exit Long", from_entry="Long", stop=close - atr * atrMultiplier, trail_points=atr * trailStopMultiplier)

if shortCondition

strategy.entry("Short", strategy.short)

strategy.exit("Exit Short", from_entry="Short", stop=close + atr * atrMultiplier, trail_points=atr * trailStopMultiplier)