RSI Reversal Fibonacci Bollinger Bands Quantitative Strategy

RSI VWMA FIBONACCI BOLLINGER BANDS STOP LOSS TAKE PROFIT OVERBOUGHT OVERSOLD

Overview

The RSI Reversal Fibonacci Bollinger Bands Quantitative Strategy is a technical analysis trading system that combines the Relative Strength Index (RSI) with custom Fibonacci Bollinger Bands. This strategy primarily identifies potential reversal points during market overbought and oversold conditions, using Fibonacci Bollinger Bands as additional support and resistance references. The strategy generates buy signals when the RSI indicator falls below 30 and sell signals when the RSI indicator rises above 70, while implementing fixed-ratio stop-loss and take-profit points to achieve risk control and profit locking.

Strategy Principles

The core principle of this strategy is to use the RSI indicator to identify potential market reversal points. The specific implementation principles are as follows:

- Use the standard 14-period RSI indicator to calculate market overbought and oversold conditions.

- When RSI drops from above 30 to below 30, a buy signal (long position) is triggered.

- When RSI rises from below 70 to above 70, a sell signal (short position) is triggered.

- Set fixed-ratio stop-loss (default at 1% of entry price) and take-profit points (default at 2% of entry price) for each trade.

- Incorporate Bollinger Bands based on Fibonacci levels (using VWMA as the middle band) to provide additional market structure reference.

The Fibonacci Bollinger Bands in the strategy represent an innovation, using the Volume Weighted Moving Average (VWMA) as the middle band, and applying Fibonacci levels of 0.236, 0.382, 0.5, 0.618, 0.764, and 1.0 multiplied by the standard deviation to calculate the upper and lower bands. The upper bands serve as potential resistance levels, while the lower bands act as potential support levels, helping to optimize entry and exit points.

Strategy Advantages

A deep analysis of the strategy’s code implementation reveals the following significant advantages:

Simple and Easy to Understand: The strategy logic is intuitive, mainly relying on RSI indicator’s overbought and oversold conditions, easy to understand and apply, suitable for trading beginners.

Clear Risk Management: Each trade has predefined stop-loss and take-profit points, set as percentages, making risk control more explicit and consistent.

Strong Adaptability: Can be adapted to different market environments through parameter adjustments, including RSI overbought/oversold levels, stop-loss and take-profit percentages, etc.

Fibonacci Bollinger Bands Enhancement: An innovative combination of traditional Bollinger Bands with Fibonacci levels provides a more detailed perspective of market structure, helping to identify key support and resistance areas.

Multi-timeframe Applicability: The strategy is suitable for both short-term (intraday) and medium-term (swing) trading styles, increasing its practicality.

Visual Intuitiveness: The strategy clearly marks buy and sell signals on the chart and displays the RSI indicator and Fibonacci Bollinger Bands, allowing traders to visually understand market conditions.

Strategy Risks

Despite its many advantages, the strategy also has some potential risks:

False Breakout Risk: In sideways or low-volatility markets, RSI may generate false signals, leading to unnecessary trades. The solution is to add additional filtering conditions, such as volume confirmation or trend filters.

Fixed Stop-Loss Risk: Using fixed percentage stop-losses may not be suitable for all market conditions, especially in highly volatile markets. Consider using dynamic stop-losses based on ATR (Average True Range) to adapt to market volatility.

Overtrading Risk: In rapidly changing markets, RSI may frequently cross overbought and oversold lines, leading to overtrading. It is recommended to add signal confirmation mechanisms or delayed entry to reduce false signals.

Counter-Trend Risk: This strategy is essentially a reversal strategy, which may lead to frequent losing trades in strong trending markets. It is advisable to assess the market trend environment before applying the strategy.

Parameter Sensitivity: Strategy performance is relatively sensitive to RSI threshold and Bollinger Bands parameter settings, with different parameters potentially leading to significantly different results. Backtesting and optimization are recommended to find parameters suitable for specific markets.

Strategy Optimization Directions

Based on the analysis of the code, here are several possible optimization directions:

Add Trend Filters: Incorporate trend identification components, such as moving average crossovers or the ADX indicator, executing trades only when aligned with the main trend direction to avoid counter-trend trading in strong trending markets.

Dynamic Stop-Loss and Take-Profit Points: Replace fixed percentage stop-loss and take-profit points with dynamic values based on ATR, better adapting to market volatility.

Signal Confirmation Mechanism: Require RSI signals to persist for a specific time or be confirmed by other indicators (such as increased volume or price patterns) before executing trades, reducing false signals.

Add Time Filters: Avoid trading during high-volatility periods at market open or close, or avoid important economic data release periods, reducing unnecessary market noise influence.

Optimize Fibonacci Bollinger Bands Parameters: Through backtesting analysis of different VWMA periods and standard deviation multipliers, find the parameter combination most suitable for the target market.

Add Partial Profit-Locking Mechanism: When price reaches a specific profit level, move stop-loss to breakeven or partially close positions, protecting realized profits.

The implementation of these optimization directions can improve the strategy’s robustness and adaptability, reduce unnecessary losses, and enhance overall performance while maintaining the strategy’s core advantages.

Summary

The RSI Reversal Fibonacci Bollinger Bands Quantitative Strategy is an innovative trading system that combines RSI reversal signals with Fibonacci Bollinger Bands. The core idea of the strategy is to capture potential reversal opportunities during market overbought and oversold conditions, using custom Fibonacci Bollinger Bands to provide additional market structure references.

The main advantages of the strategy lie in its straightforward logic and clear risk management settings, making it easy to understand and apply. The innovative application of Fibonacci Bollinger Bands provides more detailed support and resistance references for trading decisions, helping to optimize entry and exit points.

However, as a reversal strategy, it may face challenges in strong trending markets and is relatively sensitive to parameter settings. By adding trend filters, dynamic stop-loss mechanisms, and signal confirmation, the strategy’s robustness and adaptability can be significantly improved.

Whether for short-term traders or medium-term investors, this strategy provides a sound framework that can be customized and optimized according to individual trading styles and market conditions. In practical application, it is recommended to conduct thorough backtesting and forward validation to ensure the stability and effectiveness of the strategy in different market environments.

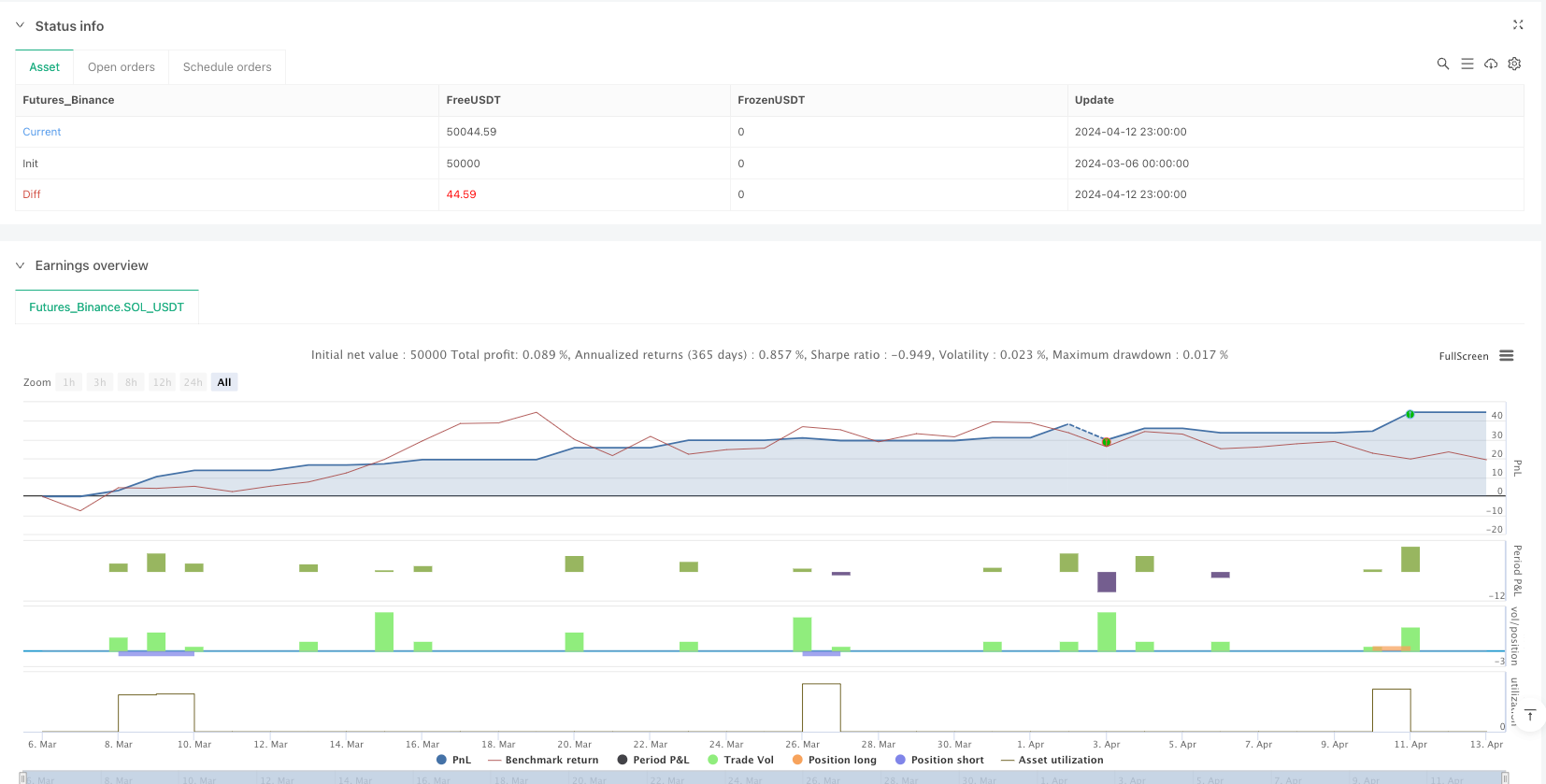

/*backtest

start: 2024-03-06 00:00:00

end: 2024-04-13 00:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"SOL_USDT"}]

*/

//@version=6

strategy("BRAHIM KHATTARA ", overlay=true)

// Input parameters

rsiOS = input.int(30, title="RSI Oversold Level", minval=0, maxval=100)

rsiOB = input.int(70, title="RSI Overbought Level", minval=0, maxval=100)

stopLossDistance = input.float(1.0, title="Stop Loss (%)", minval=0.1, maxval=10, step=0.1) // Stop loss as a percentage

takeProfitDistance = input.float(2.0, title="Take Profit (%)", minval=0.1, maxval=10, step=0.1) // Take profit as a percentage

// RSI Calculation

rsi = ta.rsi(close, 14)

// Custom Strategy Conditions

oversold = rsi <= rsiOS and rsi[1] > rsiOS

overbought = rsi >= rsiOB and rsi[1] < rsiOB

// Entry Conditions

longCondition = oversold

shortCondition = overbought

// Place Buy and Sell Orders

if (longCondition)

strategy.entry("Long", strategy.long)

if (shortCondition)

strategy.entry("Short", strategy.short)

// Exit Conditions with Take Profit and Stop Loss

if (strategy.position_size > 0)

strategy.exit("Take Profit/Stop Loss", from_entry="Long", limit=close * (1 + takeProfitDistance / 100), stop=close * (1 - stopLossDistance / 100))

if (strategy.position_size < 0)

strategy.exit("Take Profit/Stop Loss", from_entry="Short", limit=close * (1 - takeProfitDistance / 100), stop=close * (1 + stopLossDistance / 100))

// Plot Buy and Sell Signals

plotshape(longCondition, title="Buy Signal", location=location.belowbar, color=color.green, style=shape.labelup, text="BUY", size=size.small)

plotshape(shortCondition, title="Sell Signal", location=location.abovebar, color=color.red, style=shape.labeldown, text="SELL", size=size.small)

// Display RSI on Chart

hline(rsiOS, "Oversold", color=color.red, linestyle=hline.style_dotted)

hline(rsiOB, "Overbought", color=color.green, linestyle=hline.style_dotted)

plot(rsi, title="RSI", color=color.purple, linewidth=2)

// Fibonacci Bollinger Bands

length = input.int(200, title="Length", minval=1)

src = input(hlc3, title="Source")

mult = input.float(3.0, title="Multiplier", minval=0.001, maxval=50.0, step=0.1)

basis = ta.vwma(src, length)

dev = mult * ta.stdev(src, length)

upper_1 = basis + (0.236 * dev)

upper_2 = basis + (0.382 * dev)

upper_3 = basis + (0.5 * dev)

upper_4 = basis + (0.618 * dev)

upper_5 = basis + (0.764 * dev)

upper_6 = basis + dev

lower_1 = basis - (0.236 * dev)

lower_2 = basis - (0.382 * dev)

lower_3 = basis - (0.5 * dev)

lower_4 = basis - (0.618 * dev)

lower_5 = basis - (0.764 * dev)

lower_6 = basis - dev

// Plot Fibonacci Bollinger Bands

plot(basis, color=color.fuchsia, linewidth=2, title="Basis")

p1 = plot(upper_1, color=color.white, linewidth=1, title="0.236")

p2 = plot(upper_2, color=color.white, linewidth=1, title="0.382")

p3 = plot(upper_3, color=color.white, linewidth=1, title="0.5")

p4 = plot(upper_4, color=color.white, linewidth=1, title="0.618")

p5 = plot(upper_5, color=color.white, linewidth=1, title="0.764")

p6 = plot(upper_6, color=color.red, linewidth=2, title="1")

p13 = plot(lower_1, color=color.white, linewidth=1, title="0.236")

p14 = plot(lower_2, color=color.white, linewidth=1, title="0.382")

p15 = plot(lower_3, color=color.white, linewidth=1, title="0.5")

p16 = plot(lower_4, color=color.white, linewidth=1, title="0.618")

p17 = plot(lower_5, color=color.white, linewidth=1, title="0.764")

p18 = plot(lower_6, color=color.green, linewidth=2, title="1")