Multi-Dimensional Technical Indicator Cross-Confirmation Buy Signal Optimization Strategy

MA RSI MACD STOCHASTIC FIBONACCI PARABOLIC SAR ADX VOLUME Candlestick Patterns SMA

Overview

This is a comprehensive buy signal optimization strategy that identifies buying opportunities in the market by combining multiple technical analysis indicators and candlestick patterns. The core feature of this strategy is its high customizability, allowing traders to set the minimum number of conditions (selected from 9 predefined conditions) required to trigger a buy signal. This flexible design enables the strategy to adapt to different market environments and individual trading preferences while maintaining objectivity and systematic decision-making.

Strategy Principles

The strategy is based on a multi-dimensional technical analysis framework, comprehensively evaluating the following 9 key conditions:

- Golden Cross Signal: 50-day simple moving average crosses above the 200-day simple moving average, indicating a potential long-term bullish trend shift.

- RSI Rebound Signal: Relative Strength Index (RSI) below 40 and rising, suggesting the asset may be in oversold territory and starting to rebound.

- MACD Cross Signal: MACD line crosses above the signal line, a classic bullish momentum indicator.

- Stochastic Low-Level Cross: Stochastic %K line crosses above the %D line from below 30, indicating price may be rebounding from oversold levels.

- Fibonacci Retracement Support: Price at key Fibonacci retracement levels (38.2%, 50%, or 61.8%) and showing reversal signs, confirmed by bullish candle patterns to validate potential support.

- Parabolic SAR Confirmation: SAR dots below price bars, indicating an upward trend.

- ADX Trend Strength Confirmation: Average Directional Index (ADX) above 15 and rising, with Positive Directional Indicator (+DI) greater than Negative Directional Indicator (-DI), confirming uptrend strength.

- Volume Confirmation: Volume increases during price rises, indicating strengthening buying pressure.

- Bullish Reversal Candlestick Patterns: Formation of Hammer, Inverted Hammer, or Morning Star classic bullish reversal candlestick patterns.

The strategy works by counting the number of satisfied conditions, triggering a buy signal when the count meets or exceeds the user-defined minimum threshold. The default setting requires at least 2 conditions to be met, but users can adjust this threshold according to their risk preference and market environment.

Strategy Advantages

This strategy offers several significant advantages:

- High Customizability: Traders can control the strategy’s sensitivity by adjusting the minimum number of conditions required, finding the balance between conservative and aggressive approaches.

- Multi-Dimensional Confirmation Mechanism: By combining different types of technical indicators (trend, momentum, volume, support/resistance, and pattern analysis), it reduces misleading signals that might occur with single indicators.

- Comprehensive Analytical Framework: The strategy simultaneously considers long-term trends (moving averages), medium-term momentum (MACD, RSI), and short-term price action (candlestick patterns), providing a comprehensive market perspective.

- Strong Adaptability: Due to its condition-counting mechanism rather than fixed condition combinations, the strategy can adapt to the characteristics of different market phases.

- Practical Risk Management: By requiring multiple conditions to be simultaneously met, it effectively reduces misjudgment risk.

- Easy Implementation and Backtesting: Developed on the TradingView platform using standard indicators, allowing for quick deployment and historical validation.

Strategy Risks

Despite its rational design, the strategy has the following potential risks:

- Over-Optimization Risk: The 9 conditions may have high correlation, such as using multiple momentum indicators simultaneously, which could lead to signal redundancy.

- Lagging Issues: Some indicators like moving averages inherently lag, potentially triggering signals after trends have already developed.

- Parameter Sensitivity: Standard parameters may not apply to all markets or timeframes, requiring optimization for different trading instruments.

- Market Environment Dependency: The strategy may perform well in trending markets but could generate excessive false signals in ranging markets.

- Exit Strategy Absence: The code only defines entry signals without clear exit mechanisms, which might result in profit loss despite good entries.

- Computational Complexity: Multi-condition evaluation increases computational complexity, potentially causing slight delays in real-time trading.

To mitigate these risks, traders are advised to: (1) adjust the minimum condition count based on different market cycles; (2) add appropriate stop-loss and profit-taking strategies; (3) test strategy performance in various market environments; (4) consider adding filter conditions to reduce false signals.

Strategy Optimization Directions

Based on in-depth analysis of the code, here are potential optimization directions for this strategy:

- Add Dynamic Condition Weighting: In different market environments, some indicators may be more reliable than others. Implementing a dynamic weighting system that automatically adjusts the importance of each condition based on current market characteristics.

- Integrate Time Filters: Add trading time filtering functionality to avoid highly volatile periods such as market opening and closing.

- Improve Exit Logic: Develop exit strategies as comprehensive as the entry logic, considering reverse conditions or implementing trailing stops.

- Add Volatility Adjustment Mechanism: Increase the minimum condition requirement in high-volatility environments and decrease it in low-volatility environments.

- Introduce Machine Learning Optimization: Use machine learning algorithms to automatically identify which condition combinations work best in specific market environments.

- Integrate Fundamental Filters: Add simple fundamental filtering conditions on top of technical analysis, such as avoiding major economic data release periods.

- Improve Fibonacci Retracement Calculation: The current use of 260 periods for extremes may not be suitable for all markets; consider implementing adaptive period selection.

- Optimize Candlestick Pattern Recognition: The current pattern recognition is relatively simple; more complex and reliable pattern recognition algorithms can be added.

These optimization measures can significantly improve the strategy’s robustness and adaptability, especially during transitions between different market environments.

Summary

The “Multi-Dimensional Technical Indicator Cross-Confirmation Buy Signal Optimization Strategy” is a comprehensive and flexible trading system that identifies potential buying opportunities through integrated analysis of multiple technical indicators and price patterns. Its core strengths lie in customizability and multi-dimensional confirmation mechanisms, allowing traders to adjust strategy sensitivity according to personal risk preferences and market conditions.

Although the strategy has some inherent risks, such as parameter sensitivity and lack of a refined exit mechanism, these issues can be effectively addressed through the suggested optimization directions, particularly by adding dynamic weighting systems and improving exit logic. Overall, this is a well-structured, logically clear buy signal generation framework suitable for both experienced traders seeking advanced customization and beginners looking for objective market entry signals through simple parameter adjustments.

The true value of this strategy lies not only in its buy signal generation capability but also in providing an extensible framework that traders can continually iterate and improve upon to develop a complete trading system that better aligns with their personal trading style.

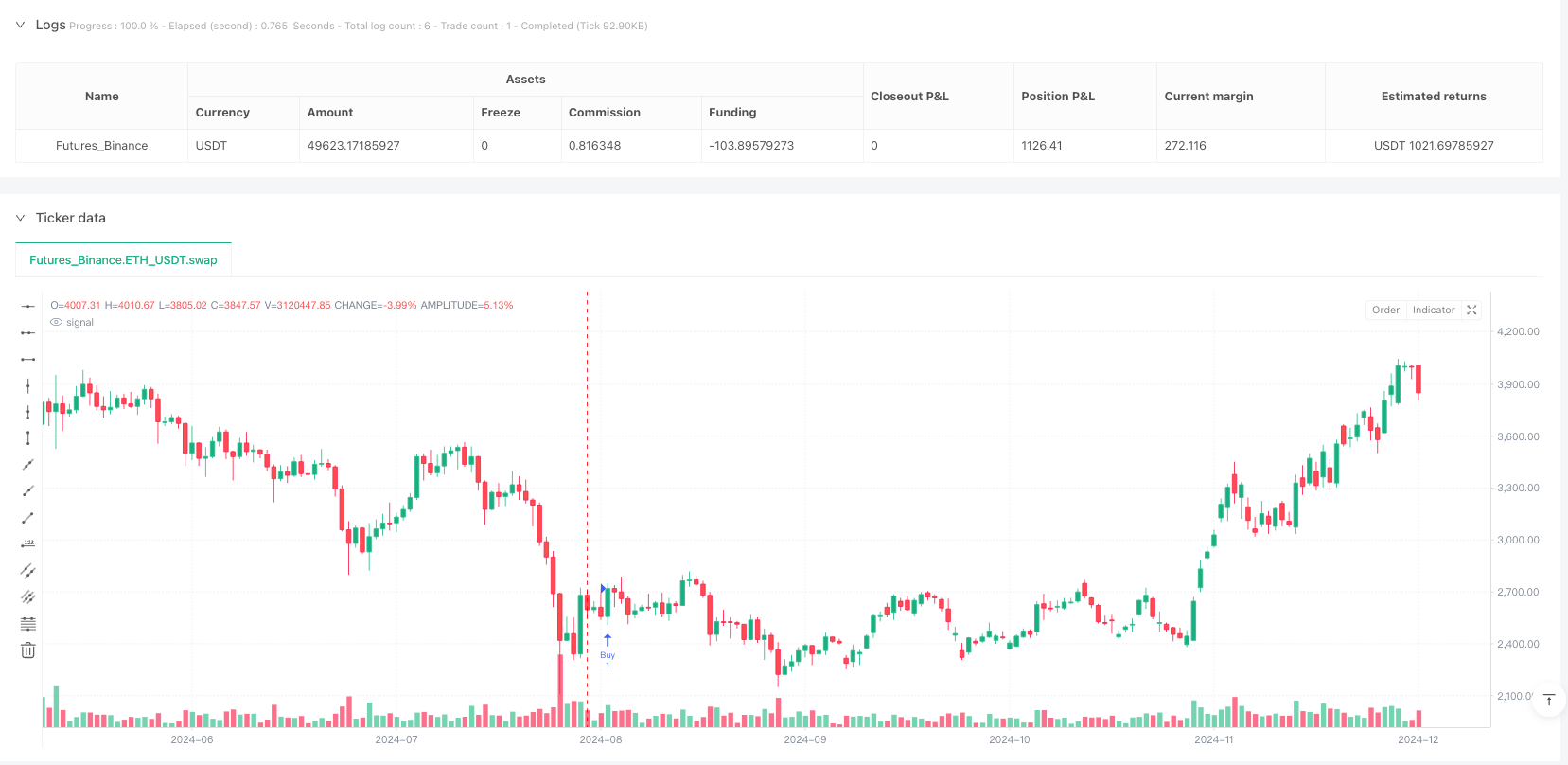

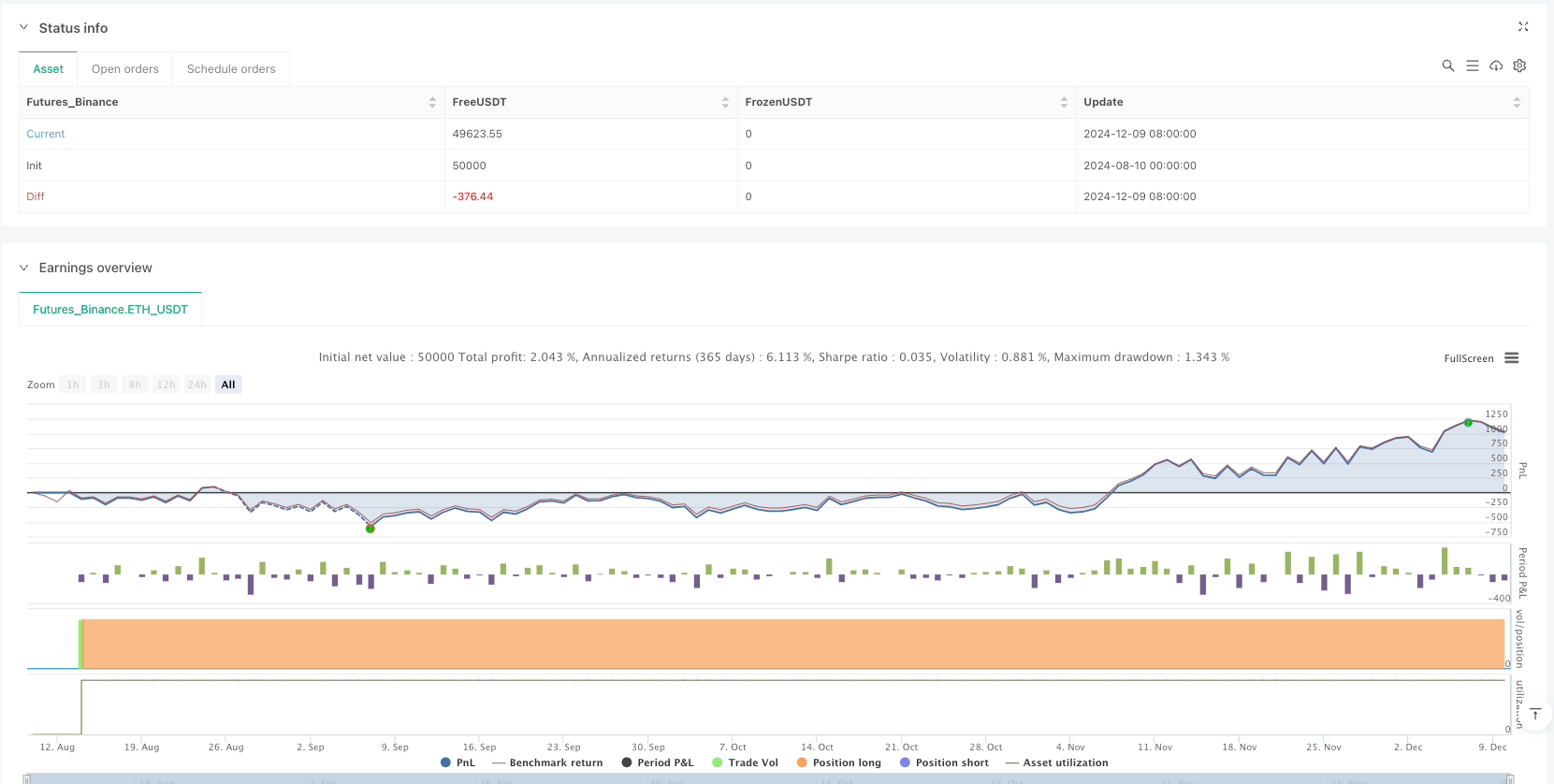

/*backtest

start: 2024-08-10 00:00:00

end: 2024-12-10 00:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT"}]

*/

//@version=5

strategy("My Buy Signal Strategy", overlay=true)

min_conditions = input.int(2, "Minimum Conditions", minval=1, maxval=9)

// Condition 1: 50-day MA crosses above 200-day MA

ma50 = ta.sma(close, 50)

ma200 = ta.sma(close, 200)

condition1 = ta.crossover(ma50, ma200)

// Condition 2: RSI < 40 and rising

rsi_value = ta.rsi(close, 14)

condition2 = rsi_value < 40 and rsi_value > rsi_value[1]

// Condition 3: MACD line crosses above signal line

[macd_line, signal_line, hist] = ta.macd(close, 12, 26, 9)

condition3 = ta.crossover(macd_line, signal_line)

// Condition 5: Stochastic %K crosses above %D from below 30

stoch_length = 14

smooth_k = 3

smooth_d = 3

stoch_raw = ta.stoch(high, low, close, stoch_length)

k = ta.sma(stoch_raw, smooth_k)

d = ta.sma(k, smooth_d)

condition5 = ta.crossover(k, d) and k[1] < 30

// Condition 6: Price at Fibonacci retracement levels and showing reversal signs

swing_low = ta.lowest(low, 260)

swing_high = ta.highest(high, 260)

fib382 = swing_high - 0.382 * (swing_high - swing_low)

fib50 = swing_high - 0.5 * (swing_high - swing_low)

fib618 = swing_high - 0.618 * (swing_high - swing_low)

close_within_fib382 = close >= fib382 - 0.01 * close and close <= fib382 + 0.01 * close

close_within_fib50 = close >= fib50 - 0.01 * close and close <= fib50 + 0.01 * close

close_within_fib618 = close >= fib618 - 0.01 * close and close <= fib618 + 0.01 * close

condition6 = (close_within_fib382 or close_within_fib50 or close_within_fib618) and close > open

// Condition 7: Parabolic SAR dots are below the price bars

psar = ta.sar(0.02, 0.02, 0.2)

condition7 = psar < close

// Condition 8: ADX > 15 and rising, with +DI > -DI

[di_plus, di_minus, _] = ta.dmi(14, 14)

dx = 100 * math.abs(di_plus - di_minus) / (di_plus + di_minus)

adx_val = ta.rma(dx, 14)

condition8 = adx_val > 15 and adx_val > adx_val[1] and di_plus > di_minus

// Condition 9: Volume increases during price rises

avg_volume = ta.sma(volume, 20)

condition9 = close > open and volume > avg_volume

// Condition 10: Price forms bull reversal patterns (Hammer, Inverted Hammer, Morning Star)

isHammer = close > open and (high - close) <= (close - open) and (open - low) >= 1.5 * (close - open)

isInvertedHammer = close > open and (high - close) >= 1.5 * (close - open) and (open - low) <= (close - open)

isMorningStar = close[2] < open[2] and math.abs(close[1] - open[1]) < (open[2] - close[2]) * 0.75 and close > open and close > close[1] and open[1] < close[2]

condition10 = isHammer or isInvertedHammer or isMorningStar

// Count the number of conditions met

count = (condition1 ? 1 : 0) + (condition2 ? 1 : 0) + (condition3 ? 1 : 0) + (condition5 ? 1 : 0) + (condition6 ? 1 : 0) + (condition7 ? 1 : 0) + (condition8 ? 1 : 0) + (condition9 ? 1 : 0) + (condition10 ? 1 : 0)

// Buy signal if count >= min_conditions

buy_signal = count >= min_conditions

if (buy_signal)

strategy.entry("Buy", strategy.long)