Overview

The Multi-Timeframe Trend Recognition and Candlestick Pattern Trading Strategy is a quantitative trading approach that combines long and short-term market analysis. This strategy cleverly integrates multi-timeframe analysis techniques by confirming the overall market trend on a 15-minute timeframe while identifying specific candlestick patterns (such as bullish engulfing patterns) on a 1-minute timeframe to determine entry points. Additionally, the strategy incorporates strict time filtering mechanisms to avoid trading during highly volatile periods immediately after market open and before market close, while ensuring no positions are held overnight, effectively managing trading risk.

Strategy Principles

The core logic of this quantitative trading strategy is built on multi-timeframe analysis and strict trading time management. Specifically:

Trend Identification: The strategy obtains 15-minute timeframe price data through the

request.securityfunction to determine the medium to long-term trend direction. It confirms the existence of an uptrend by comparing the current closing price with the previous closing price (trend_15m > trend_15m[1]).Pattern Recognition: On the 1-minute timeframe, the strategy identifies bullish engulfing patterns, where the current candle’s closing price is higher than its opening price (bullish candle), the previous candle’s opening price is higher than its closing price (bearish candle), and the current candle’s closing price is higher than the previous candle’s opening price. This condition is implemented through

bullish_engulfing = close > open and open[1] > close[1] and close > open[1].Time Filtering: The strategy establishes two important time filters:

- Avoiding the first 45 minutes after market open (9:00-9:45) which is typically highly volatile

- Avoiding the last 60 minutes before market close (15:00-16:00) which often has high uncertainty

Risk Management: After confirming an entry signal, the strategy automatically sets a stop loss at the lowest point of the previous candle (

stop_loss := low[1]) and calculates a profit target based on a 2:1 risk-reward ratio (take_profit := close + 2 * (close - stop_loss)).Intraday Trading Restriction: The strategy forces the closure of all positions at the end of each trading day (16:00), ensuring no overnight positions, implemented through the

strategy.close_all()function.

Strategy Advantages

Multi-level Market Analysis: By combining 15-minute and 1-minute timeframe analyses, the strategy can simultaneously capture medium-term trends and short-term entry opportunities, significantly improving trading accuracy. The medium-term trend provides guidance on overall market direction, while short-term patterns provide precise entry timing.

Effective Time Filtering Mechanism: The strategy avoids high volatility and low liquidity periods around market open and close, which typically have more noise and lower quality signals that could lead to false breakouts or increased slippage.

Automated Risk Management: The strategy incorporates clear stop-loss and profit target settings, adopting a 2:1 risk-reward ratio, which is a risk control standard commonly used by professional traders and contributes to long-term profitability.

Intraday Trading Approach: By forcing position closure before market close, the strategy avoids overnight holding risks, including unexpected events and overnight gaps that could lead to uncontrollable losses.

Clean and Efficient Code: The strategy code has a clear structure and tight logic, utilizing PineScript language’s built-in functions such as

request.securityandstrategy.exit, which enhances execution efficiency.

Strategy Risks

Multi-Timeframe Lag: Using the

request.securityfunction to obtain data from larger timeframes may introduce some lag, potentially causing missed entry points or delayed exits in rapidly changing markets. A solution is to consider using dynamic timeframes or adding real-time trend confirmation indicators.Single Pattern Dependency: The strategy relies solely on bullish engulfing patterns as entry signals, which may cause it to miss other effective trading opportunities. Expanding to recognize other high-probability patterns (such as doji stars, hammer lines, etc.) could increase trading frequency.

Fixed Risk-Reward Settings: Using a fixed 2:1 risk-reward ratio may not be flexible enough in different volatility environments. A solution is to consider dynamically adjusting stop-loss and profit levels based on ATR (Average True Range).

Time Filter Limitations: While time filtering can avoid high-risk periods, it may also miss some high-quality trading opportunities, especially on strong trend days following opening gaps. Consider adding additional confirmation conditions rather than completely avoiding these periods.

Lack of Market State Adaptability: The strategy doesn’t differentiate between different market states (such as ranging or trending markets) and may perform poorly in certain market environments. Introducing market state recognition mechanisms could improve strategy adaptability.

Strategy Optimization Directions

Enhanced Trend Confirmation Indicators: Technical indicators such as MACD, RSI, or moving average systems could be added to the 15-minute timeframe to provide more reliable trend confirmation. For example, adding MACD crossovers or RSI directional confirmation could reduce false signals.

Dynamic Risk Management: Dynamically adjust stop-loss and profit targets based on market volatility (such as ATR) rather than using a fixed risk-reward ratio. Set wider stops in high-volatility markets and tighter stops in low-volatility markets.

Add More Entry Patterns: In addition to bullish engulfing patterns, recognize other high-probability candlestick formations, such as bullish star patterns or hammer lines, to increase trading frequency and diversity.

Incorporate Volume Confirmation: Integrate volume analysis into the strategy logic, confirming engulfing patterns only when accompanied by increased volume, which can improve signal quality.

Market Environment Adaptation: Add market environment recognition capabilities, for example, by using volatility indicators (such as ATR) or trend strength indicators (such as ADX) to distinguish between trending and ranging markets, and adjust strategy parameters accordingly.

Optimize Time Filters: Consider using more refined time filtering mechanisms, such as determining optimal trading periods based on historical data analysis, rather than simply excluding fixed time periods.

Conclusion

The Multi-Timeframe Trend Recognition and Candlestick Pattern Trading Strategy is a comprehensive trading system that combines medium to long-term trend analysis with short-term entry techniques. By confirming the overall market trend direction on a larger timeframe (15-minute) and identifying high-probability bullish engulfing patterns on a smaller timeframe (1-minute) to execute trades, the strategy can effectively improve entry accuracy.

Another major feature of this strategy is the integration of strict time filtering mechanisms and risk management systems, avoiding high volatility periods in the market, and controlling risk through fixed risk-reward ratios and forced position closure before market close. These features make the strategy particularly suitable for intraday traders seeking stable returns.

Although the strategy has clear logic and strict risk control, there are still multiple areas for optimization, including enhancing trend confirmation mechanisms, introducing dynamic risk management, adding more entry pattern recognition, integrating volume analysis, and developing market environment adaptation capabilities. Through these optimizations, the strategy has the potential to achieve more stable performance across different market environments.

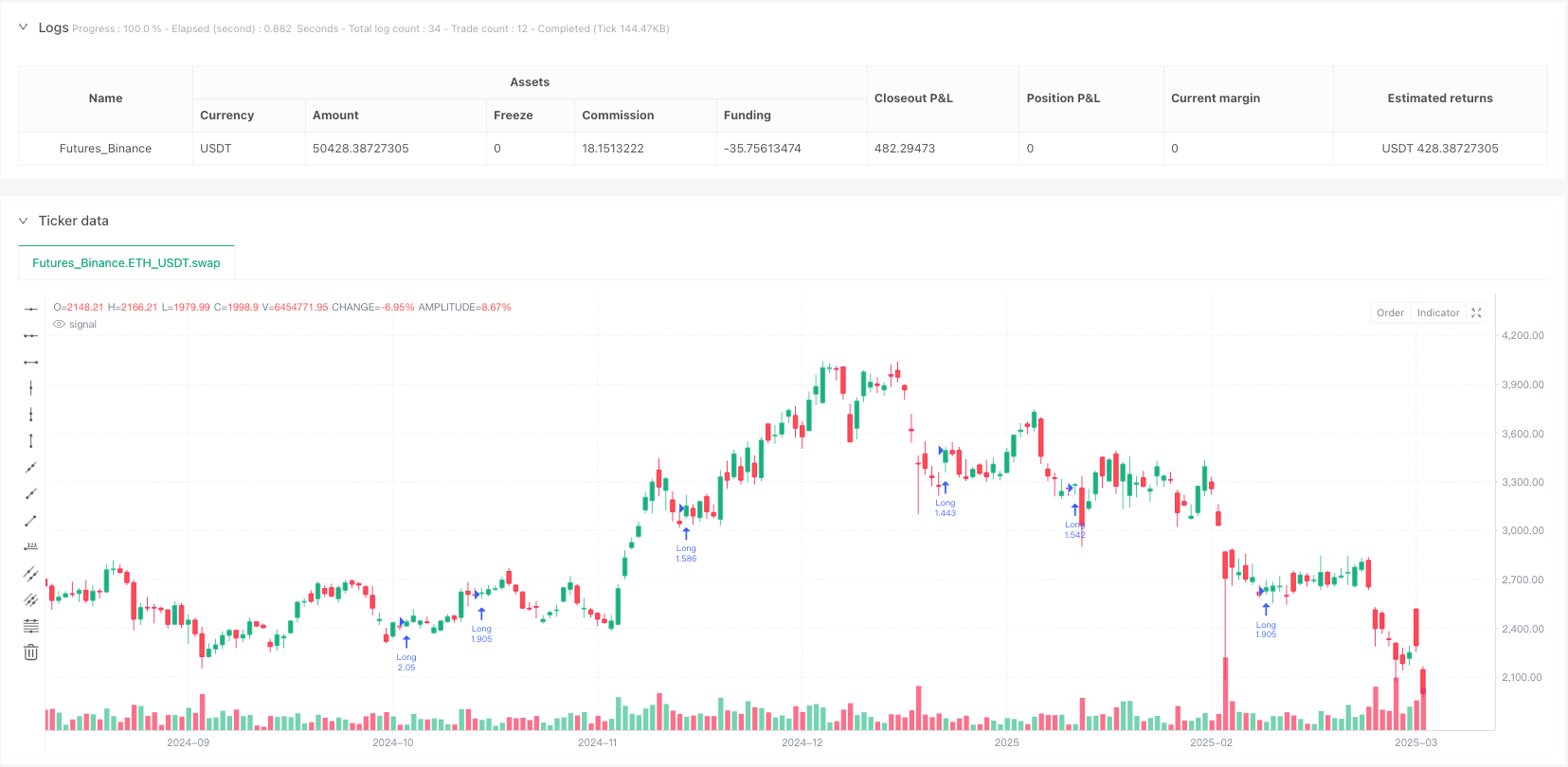

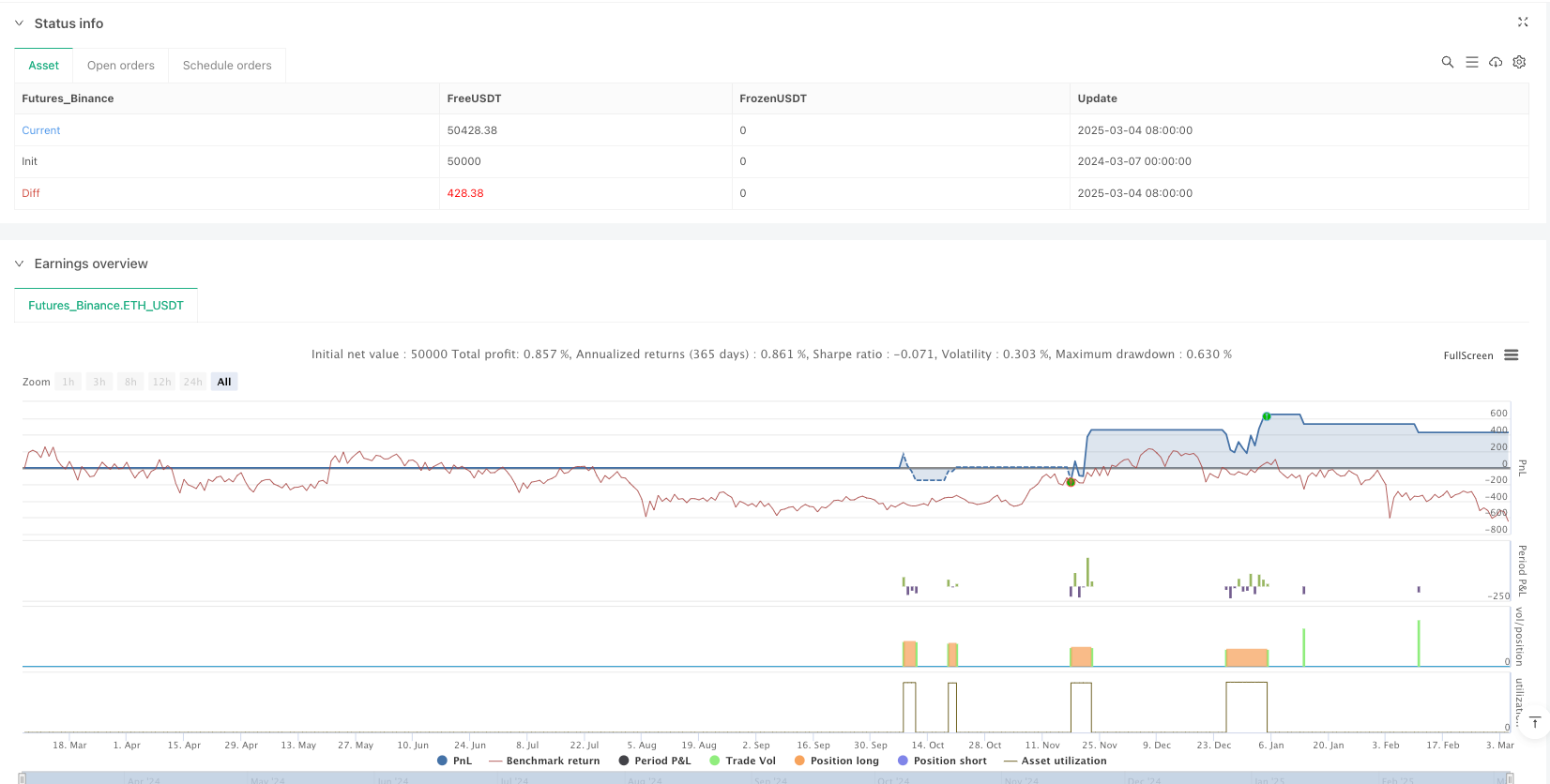

/*backtest

start: 2024-03-07 00:00:00

end: 2025-03-05 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT"}]

*/

//@version=5

strategy("Multi-Timeframe Strategy with Time Filters", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=10)

// Define the 15-minute trend (long-term trend)

trend_15m = request.security(syminfo.tickerid, "15", close)

// Identify Bullish Engulfing pattern on the 1-minute chart

bullish_engulfing = close > open and open[1] > close[1] and close > open[1]

// Define the entry condition: Bullish Engulfing on the 1-minute chart and uptrend on the 15-minute chart

long_condition = bullish_engulfing and trend_15m > trend_15m[1]

// Define the current time

current_hour = hour

current_minute = minute

// Check if it's within the first 45 minutes or last 60 minutes of the trading day

first_45_minutes = (current_hour == 9 and current_minute < 45) // First 45 minutes of the day (9:00 - 9:45 AM)

last_60_minutes = (current_hour == 15 and current_minute >= 0) or (current_hour == 16 and current_minute < 60) // Last 60 minutes (3:00 - 4:00 PM)

// Block trades if within the restricted time windows

time_restricted = first_45_minutes or last_60_minutes

// Execute the strategy logic for long entry only if not within restricted time window

if (long_condition and not time_restricted)

strategy.entry("Long", strategy.long)

// Initialize stop loss and take profit variables

var float stop_loss = na

var float take_profit = na

// Update stop loss and take profit values when a long entry is triggered

if (long_condition and not time_restricted)

stop_loss := low[1] // Set stop loss to the low of the previous candle

take_profit := close + 2 * (close - stop_loss) // Set take profit to 2:1 risk-to-reward ratio

// Set stop loss and take profit for the trade using strategy.exit

strategy.exit("Exit Long", "Long", stop=stop_loss, limit=take_profit)

// Close all positions at the end of the trading day (for example, at 16:00 EST)

end_of_day = (hour == 16 and minute == 0) // 16:00 EST is the end of the day for most US markets

if (end_of_day)

strategy.close_all() // Close all open positions at the end of the day