Overview

This strategy is a multi-timeframe trend following trading system that combines the 200 Exponential Moving Average (EMA) on the 1-hour chart for trend confirmation with the Supertrend indicator on the 15-minute chart for entry signals. This combination leverages the trend direction guidance from the higher timeframe and precise entry points from the lower timeframe, creating a complete trading system that can both capture major trends and optimize entry timing. The strategy also includes stop-loss settings based on the Supertrend indicator values and profit targets based on risk ratios, providing a clear risk management framework for each trade.

Strategy Principles

The core principle of this strategy is to filter trading signals through multi-timeframe analysis, ensuring that trading direction aligns with the primary trend. The specific implementation is as follows:

Trend Confirmation Mechanism (1-hour chart):

- Uses the 200-period Exponential Moving Average (EMA 200) to determine overall market trend

- When price is above EMA 200, confirms an uptrend

- When price is below EMA 200, confirms a downtrend

Entry Signals (15-minute chart):

- Uses the Supertrend indicator to generate precise entry signals

- When Supertrend is green (up), generates a buy signal

- When Supertrend is red (down), generates a sell signal

Risk Management:

- Stop-loss setting: Fixed at the Supertrend indicator value at entry

- Profit target: 1.5 times the distance between entry price and stop-loss (actually 2x in the code)

- Trade management: When a new signal is generated, the previous trade is closed, ensuring only one active trade at any time

Through code analysis, we can see that the strategy uses the request.security function to obtain EMA 200 data from the 1-hour timeframe and compares it with the current price to determine trend direction. At the same time, it calculates the Supertrend indicator value and its direction on the current 15-minute chart. Only when signals from both timeframes align (e.g., 1-hour uptrend + 15-minute Supertrend up) will a trade signal be triggered.

Strategy Advantages

After in-depth code analysis, this strategy demonstrates the following significant advantages:

More Reliable Trend Filtering: By combining trend confirmation from two timeframes, it significantly reduces the possibility of false breakouts and counter-trend trading. The higher timeframe (1-hour) EMA 200 provides more stable trend judgment, rather than relying solely on the more volatile short-term timeframe.

Precise Entry Timing: The Supertrend indicator on the short-term timeframe (15-minute) provides precise entry points, allowing traders to optimize entry prices while confirming the trend, improving the cost-effectiveness of trades.

Automated Risk Management: The strategy incorporates a dynamic stop-loss mechanism based on market volatility; the Supertrend indicator itself considers market volatility (calculated through ATR), so the stop-loss position automatically adjusts according to market conditions.

Proportional Profit Target Design: By setting a fixed risk-reward ratio (2:1) profit target, the strategy ensures the possibility of long-term profitability; even with a less-than-perfect win rate, the system can potentially achieve a positive expected value.

Avoids Trade Overlap: The strategy ensures that existing trades are closed when generating new signals, avoiding position stacking risk and simplifying fund management and risk control.

Strategy Risks

Despite its reasonable design, the strategy still has the following risks that need attention:

Delayed Reaction at Trend Turning Points: Due to the use of a long-period (200) moving average, the strategy’s reaction at trend turning points will be relatively delayed, potentially leading to continued trading in the original trend direction during the early stages of market reversal, causing certain losses.

Increased False Signals in Ranging Markets: In sideways or oscillating markets, prices may frequently cross the EMA 200 line, while the Supertrend indicator may also frequently change direction, producing multiple false signals and leading to consecutive stop-losses.

Limitations of Fixed Risk-Reward Ratio: Although the strategy sets a fixed 2:1 risk-reward ratio, the optimal risk-reward ratio may vary for different markets and different periods, making a fixed setting not always the optimal choice.

Parameter Sensitivity: The parameters of the Supertrend indicator (ATR period and factor) have a significant impact on strategy performance; different markets may require different parameter combinations, which increases the complexity of strategy optimization.

Liquidity Risk: In low liquidity markets or extreme market conditions, actual stop-losses may experience slippage, resulting in actual losses exceeding expectations.

Solutions include: adding trend filter conditions (such as trend strength indicators), adjusting Supertrend parameters to adapt to different market conditions, setting maximum consecutive loss limits, and dynamically adjusting risk-reward ratios based on market volatility.

Strategy Optimization Directions

Through in-depth code analysis, several potential optimization directions can be identified:

Introduce Trend Strength Filtering: The current strategy only uses price position relative to EMA 200 to judge trends; consider adding trend strength indicators (such as ADX or MACD), only trading when the trend is strong enough to avoid false signals in oscillating markets.

Dynamic Risk-Reward Ratio: Replace the fixed risk-reward ratio with a dynamic calculation method based on market volatility or support/resistance levels. For example, set a more conservative risk-reward ratio during high volatility and use more aggressive settings in strong trends.

Add Partial Profit Mechanism: The current strategy uses a full position entry and exit approach; consider a partial profit mechanism, such as taking profit on a portion at a 1:1 risk-reward ratio, with the remaining portion set to trailing stop-loss to follow the trend.

Integrate Volume Confirmation: Integrate volume indicators into entry conditions, requiring signals to be accompanied by significant volume increases to improve signal reliability.

Time Filter: Add time filtering conditions to avoid known low liquidity periods or highly volatile market announcement periods.

Parameter Adaptive Mechanism: Implement adaptive adjustment of Supertrend parameters based on recent market volatility conditions, dynamically optimizing parameters to better adapt to different market phases.

The key to these optimization directions is to enhance the strategy’s robustness and adaptability while maintaining its core advantages—multi-timeframe trend confirmation and precise entry.

Summary

The Multi-Timeframe Trend Following with Supertrend Momentum Optimization Strategy is a complete trading system that combines basic principles of technical analysis with practical risk management. By integrating trend confirmation from the 1-hour timeframe and precise entry signals from the 15-minute timeframe, this strategy provides traders with a methodology that considers both the big picture and details.

While this method cannot guarantee profit on every trade, its design philosophy—following the main trend, optimizing entry points, fixed risk-reward ratio, and clear stop-loss strategy—reflects the key elements that a mature trading system should have. Through the implementation of the aforementioned optimization directions, this strategy has the potential to further enhance its stability and adaptability, allowing it to maintain competitiveness in different market environments.

Most importantly, the core ideas of this strategy reflect the basic principles of successful trading: trend confirmation, precise entry, risk management, and disciplined execution. These principles apply not only to this strategy but to almost all successful trading methods.

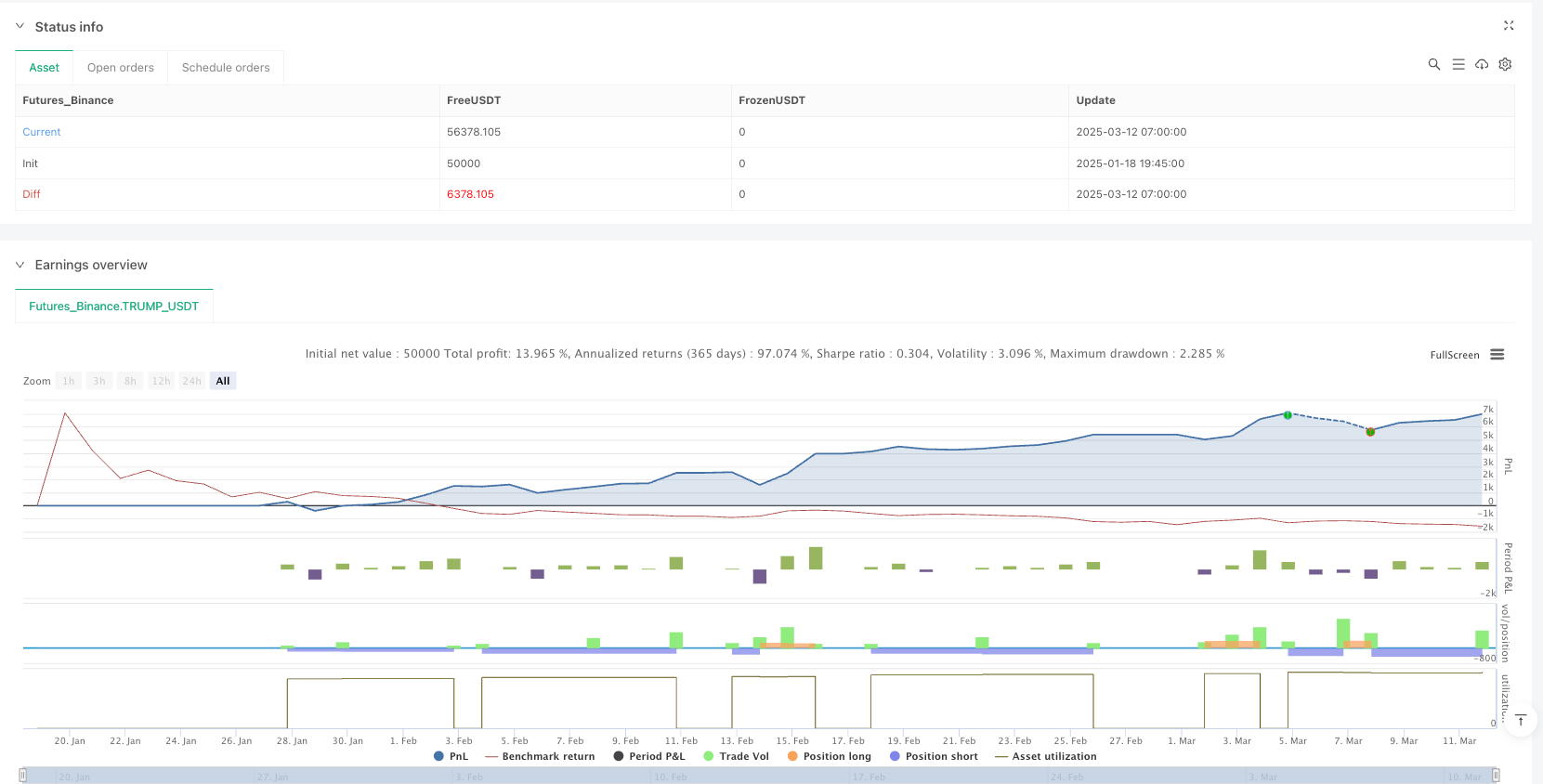

/*backtest

start: 2025-01-18 19:45:00

end: 2025-03-12 08:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"TRUMP_USDT"}]

*/

//@version=6

strategy("1H EMA 200 + 15M Supertrend Strategy ", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=10)

// === Inputs ===

atrPeriod = input.int(10, "ATR Length", minval=1)

factor = input.float(3.0, "Factor", minval=0.01, step=0.01)

// === 1-Hour EMA (Trend Confirmation) ===

ema200_1h = request.security(syminfo.tickerid, "60", ta.ema(close, 200), gaps=barmerge.gaps_off, lookahead=barmerge.lookahead_off)

isAboveEMA200 = request.security(syminfo.tickerid, "60", close > ema200_1h, gaps=barmerge.gaps_off, lookahead=barmerge.lookahead_off)

isBelowEMA200 = request.security(syminfo.tickerid, "60", close < ema200_1h, gaps=barmerge.gaps_off, lookahead=barmerge.lookahead_off)

// === 15-Minute Supertrend (Entry Signal) ===

[supertrend, direction] = ta.supertrend(factor, atrPeriod)

isUptrend = direction < 0

isDowntrend = direction > 0

// === Variables to Store SL and TP ===

var float stopLossPrice = na

var float takeProfitPrice = na

// === Buy Signal ===

buySignal = isAboveEMA200 and isUptrend

if (buySignal and not buySignal[1]) // Ensure signal is only shown once

if (strategy.position_size != 0) // Close previous trade if any

strategy.close_all()

stopLossPrice := supertrend // Set SL to Supertrend value at entry

takeProfitPrice := close + 2 * (close - stopLossPrice) // TP = 2x SL distance

strategy.entry("Buy", strategy.long)

// === Sell Signal ===

sellSignal = isBelowEMA200 and isDowntrend

if (sellSignal and not sellSignal[1]) // Ensure signal is only shown once

if (strategy.position_size != 0) // Close previous trade if any

strategy.close_all()

stopLossPrice := supertrend // Set SL to Supertrend value at entry

takeProfitPrice := close - 2 * (stopLossPrice - close) // TP = 2x SL distance

strategy.entry("Sell", strategy.short)

// === Exit Logic ===

if (strategy.position_size > 0) // For Buy Trades

strategy.exit("Take Profit/Stop Loss", from_entry="Buy", stop=stopLossPrice, limit=takeProfitPrice)

if (strategy.position_size < 0) // For Sell Trades

strategy.exit("Take Profit/Stop Loss", from_entry="Sell", stop=stopLossPrice, limit=takeProfitPrice)

// === Plotting ===

plot(ema200_1h, title="1H EMA 200", color=color.blue, linewidth=2)

plot(supertrend, title="Supertrend", color=color.red, linewidth=2)

plotshape(series=buySignal and not buySignal[1], title="Buy Signal", location=location.belowbar, color=color.green, style=shape.labelup, text="BUY")

plotshape(series=sellSignal and not sellSignal[1], title="Sell Signal", location=location.abovebar, color=color.red, style=shape.labeldown, text="SELL")